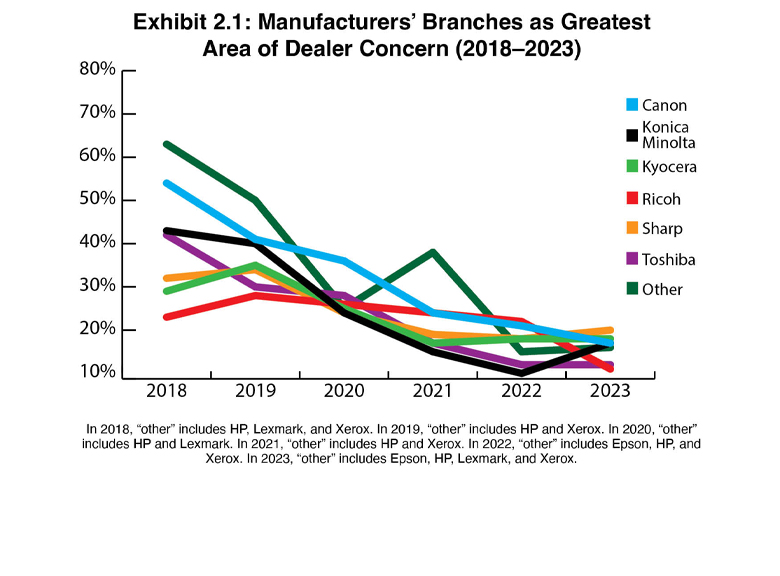

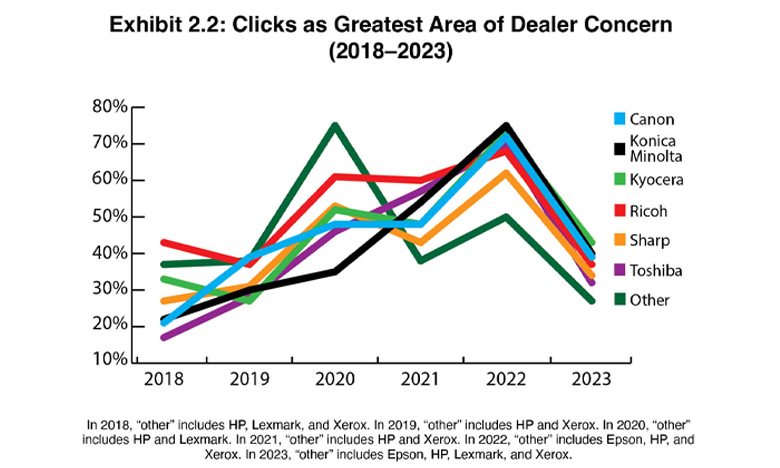

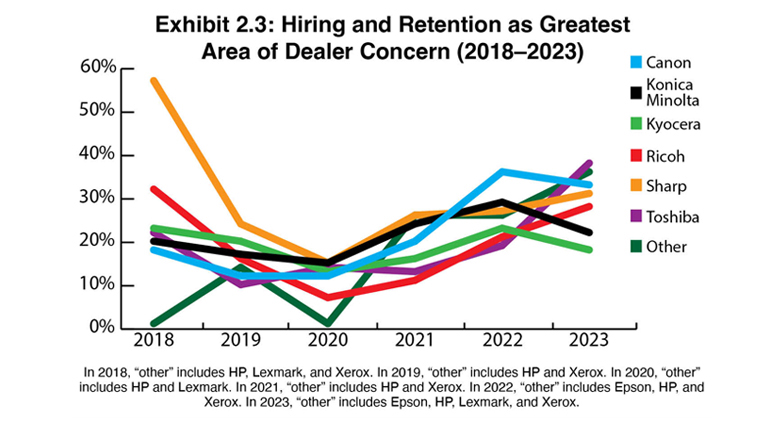

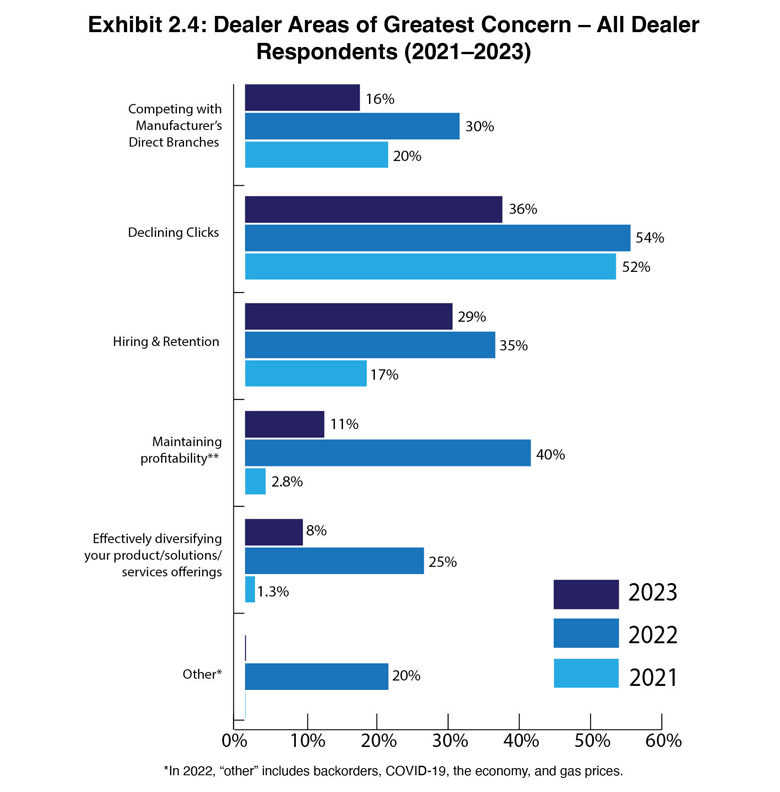

Exhibits 2.1-2.11

Concerns? Dealers have a few, and our Survey historically showcases those concerns. After expanding the number of concerns to 13 two years ago, we found that a handful of them stood out from the rest, with only a small percentage of dealers selecting some of the other options among the choices. Because of that, this year, we simplified this portion of our Survey by asking dealers to choose from five options. Dealers also had the option of identifying “other” concerns; however, surprisingly, no “other” concerns were identified by dealers in this year’s Survey.

The five options included:

- Competing against manufacturers’ branches

- Declining print clicks

- Hiring and retention

- Effectively diversifying your product/solutions/services offerings

- Maintaining profitability

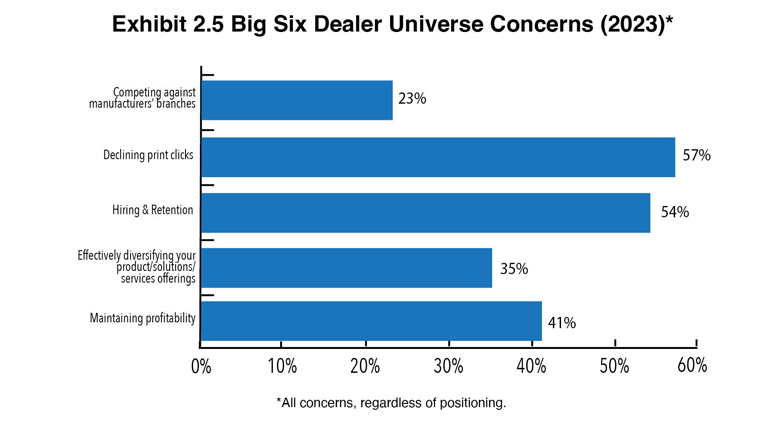

After narrowing down the options to five, we simplified this portion of the Survey even further, asking dealers to select three concerns from the list rather than identifying an unlimited number of concerns. The exhibits included in this section reflect the dealer concerns of each of the Big Six OEMs, as well as charts for the top three concerns (Exhibits 2.1–2.3) identified in the Survey, a chart that identifies those concerns listed by dealers as their top concern (Exhibit 2.4), and how each of the five concerns ranked across the dealer universe regardless of positioning (Exhibit 2.5).

Because we asked dealers to only identify three concerns rather than an unlimited number, the percentages reflected in this year’s Survey across most of these five categories declined from previous years. However, we still believe the results offer a more realistic depiction of office technology dealers’ biggest concerns.

Because we asked dealers to only identify three concerns rather than an unlimited number, the percentages reflected in this year’s Survey across most of these five categories declined from previous years. However, we still believe the results offer a more realistic depiction of office technology dealers’ biggest concerns.

For the fourth consecutive year, the No. 1 concern among all top three concerns (Exhibit 2.4) was declining clicks (36%), an 18% decrease from last year. Perhaps dealers are beginning to accept the inevitable. No doubt, the pandemic and the shift to hybrid work have been a factor for dealers identifying this as a concern prior to this year. However, focusing on other areas of the business beyond print may be another reason as to why more dealers are less concerned than in the past about declining clicks.

The No. 2 concern was hiring and retention (29%), a 6% decline from last year. Last year, we surmised that the so-called “Great Resignation” and staffing issues resulting from pandemic-related downsizing of staff in 2020 was the reason 35% of dealers selected hiring and retention as a top three concern compared to 17% in our 36th Annual Survey.

Competition from manufacturers’ direct branches, even though it was the No. 3 concern, declined to 16% from 30% last year. This concern fell out of the top three greatest concerns to fourth place in last year’s Survey but returned to the top three this year. Gone are the days when this was frequently cited as a dealer’s top concern. No doubt the OEMs have done a good job of alleviating some of the issues, mostly around pricing, that have been a source of contention in the channel. That doesn’t mean those situations still aren’t an issue, but not as frequently as in the past.

Rounding out the top five concerns were maintaining profitability (11%), down from 40% last year, and effectively diversifying your product/solutions/services offerings (8%). The latter continues to grow as a concern after only being selected by 1.4% of dealers in 2020 and 1.3% of dealers in 2021.

When examining all dealer concerns regardless of positioning (Exhibit 2.5), concerns about declining clicks rank No. 1 at 57% compared to 80% a year ago. It will be interesting to see if this concern continues to decline in future Surveys. Frankly, despite what we surmised earlier, we are surprised that fewer dealers are identifying this as a concern. With so many dealerships whose core business is still heavily focused on print technology, one would think they would be more concerned about this segment of the business even as they take steps to diversify into other areas.

Concern about hiring and retention declined from 65% last year to 54% this year. Of course, much of that concern centers around filling sales positions, a notoriously challenging position in any business.

The third leading concern for the fourth consecutive year was maintaining profitability at 41%, down from 56% a year ago. As reported in Part I of our Survey, 73% of dealers reported revenue increases and 18% held steady from the previous year. However, this information can be deceptive as we only track the direction of dealer revenues in our Survey. Even if a dealer reports revenues are up, that doesn’t mean the dealership was profitable. We plan to add a question in next year’s Survey about profitability in the revenue portion.

The number of dealers who identified “effectively diversifying your product/solutions/services offerings” as a concern remained the same as last year (35%). Based on our conversations with dealers across the country, more dealers are indeed diversifying, and as we noted in last year’s Survey analysis, perhaps more dealers are embracing this opportunity rather than fearing it.

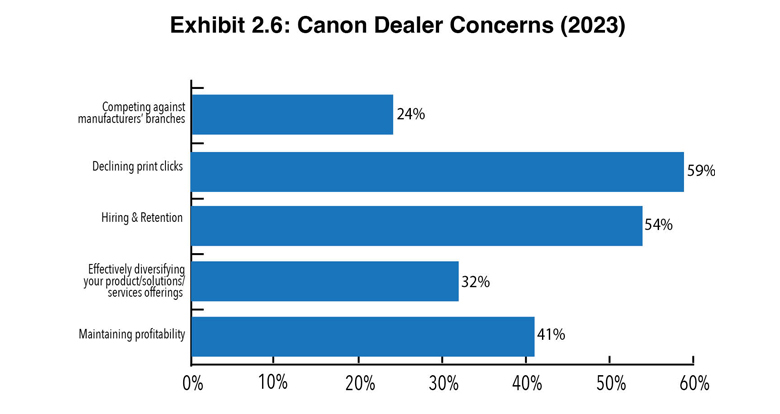

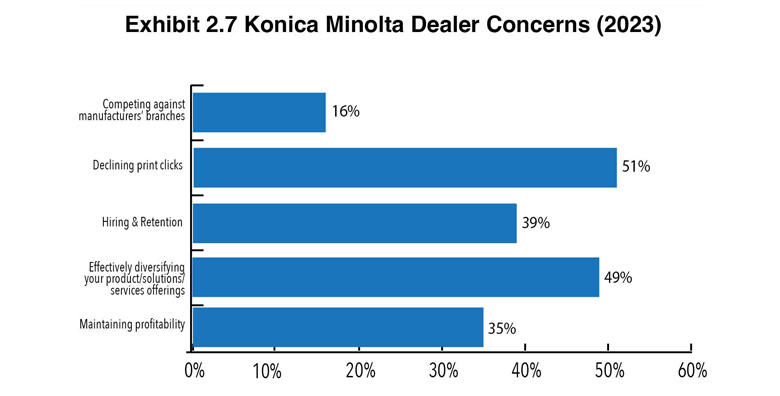

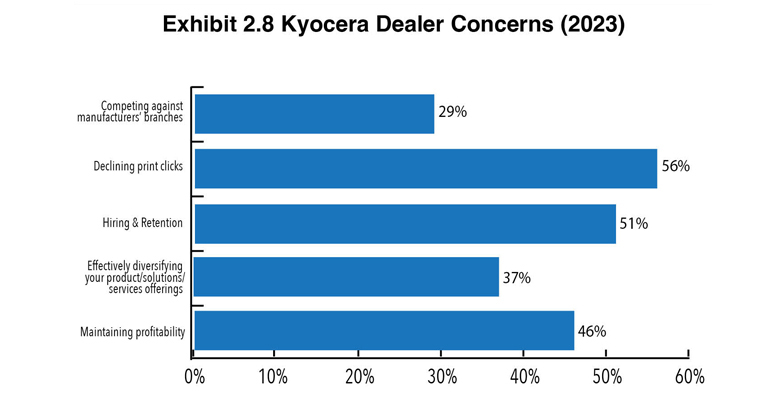

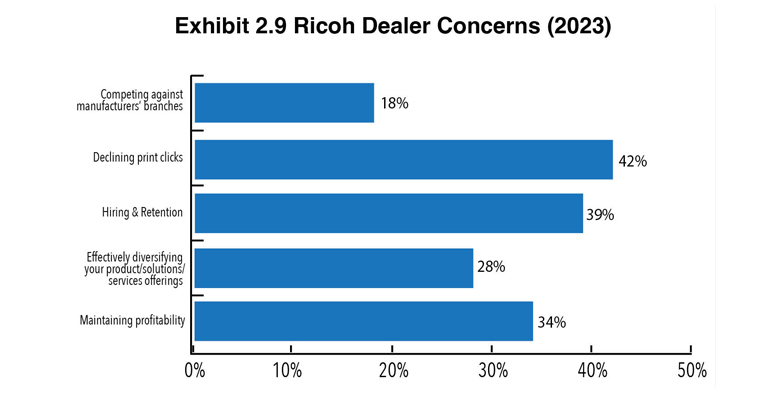

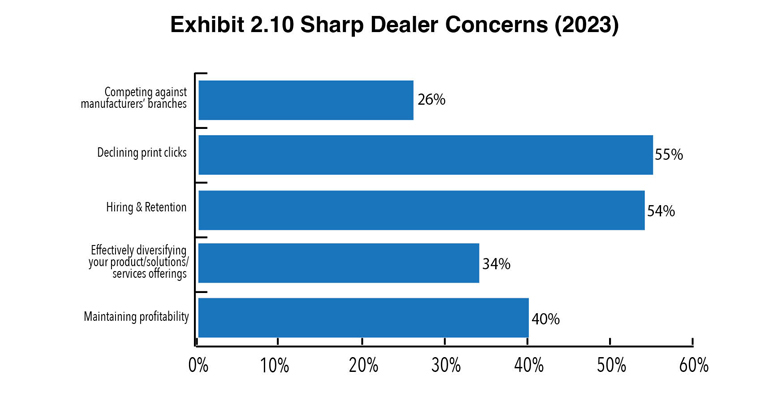

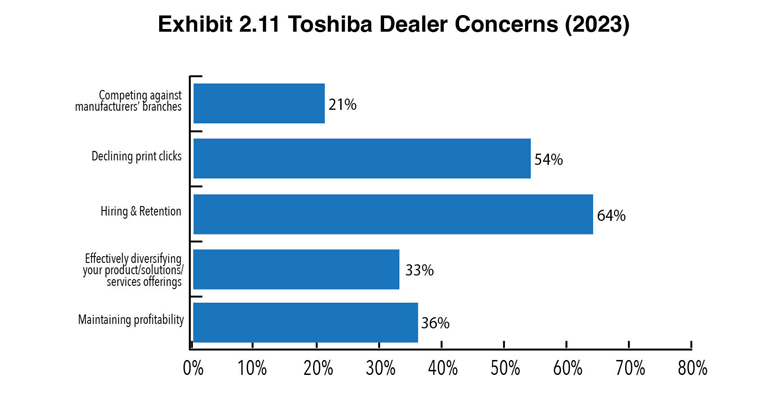

Exhibits 2.6 to 2.11 reflect the concerns, regardless of positioning, when listing those concerns of dealers affiliated with each of the Big Six OEMs. Ricoh dealers are the least concerned with declining clicks (42%). Dealers representing Canon are the most concerned (59%), followed by Kyocera (56%), Sharp (55%), Toshiba (54%), and Konica Minolta (51%). These results are in sharp contrast with the results from last year, when concerns around declining clicks among dealers representing the Big Six ranged from 80% to 90%.

Surprisingly, with the exception of Konica Minolta dealers, dealers representing the other Big Six OEMs were less concerned about diversifying their product and services offerings compared to last year. Only 30% of Konica Minolta dealers were concerned about diversifying in last year’s Survey, compared to 49% this year. Ricoh dealers were least concerned (28%), followed by Canon dealers (32%), Toshiba dealers (33%), Sharp (34%), and Kyocera (37%).

Diversification is an ongoing theme across the office technology industry, and dealers have more options than ever before to expand their offerings. One likely reason why dealers are less concerned is that more have determined that diversifying isn’t always that daunting and that their OEMs and other vendors are more than willing to assist them down that path.

Dealer concerns around diversifying often focus on the cost and the time to train sales reps and service technicians, particularly in the production print space. The reality is that some financial sacrifices are required at the beginning for most diversification opportunities. However, the rewards can sometimes be quite lucrative, and we are seeing a host of dealers who have diversified into managed IT, production print, and VoIP capitalize on their investments in those segments.

Always a top three concern, hiring and retention was not as big of a concern for dealers in this year’s Survey as in past Surveys. Regardless, it is still a topic that is frequently addressed at industry events and in the pages of The Cannata Report. Toshiba dealers (64%) were most concerned about hiring and retention compared to their peers. Fifty-four percent of Sharp dealers identified this as a concern, while only 39% of Ricoh dealers and Konica Minolta dealers, 37% of Kyocera dealers, and 32% of Canon dealers were concerned about hiring and retention.

780 Nov23Charts 2.11

Going forward, we fully expect hiring and retention to remain a top three concern across the independent dealer channel, especially as dealers diversify. Anecdotally, we are also hearing from more dealers who have made a concerted effort to recruit mature sales reps and service technicians from outside of the industry.

We are also hearing from more dealers who are taking part in job fairs at local colleges and high schools to raise awareness of opportunities in the office technology industry. We would be remiss not to mention the Mariano Rivera Foundation and its program to train young people for careers servicing production print equipment. This initiative is also being spurred by Atlantic Tomorrow’s Office which is working closely with the Mariano Rivera Foundation. Hiring and retention issues require creative solutions, and dealers and the industry overall are stepping up.