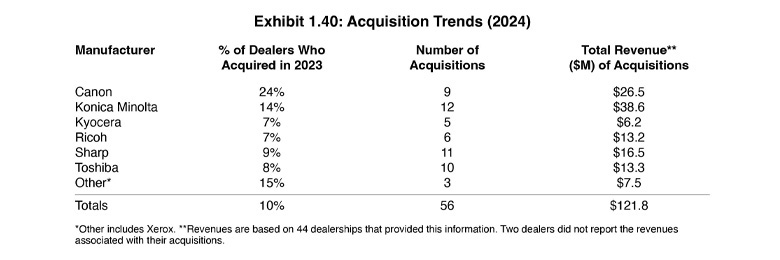

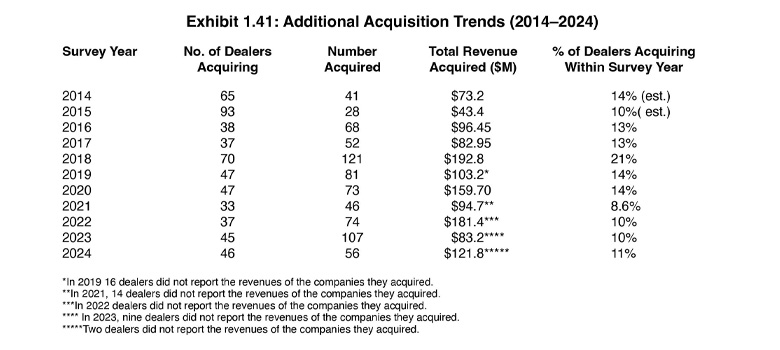

Exhibits 1.40-1.41

Since last year’s survey, we’ve seen a modest increase in the percentage of dealers making acquisitions. The big difference, however, was a decline in the number of companies acquired. Last year, 10% of dealers (45) participating in our Survey reported 107 acquisitions, whereas this year, 11% (46) of the dealers who responded to this question made just 56 acquisitions. Not every dealer publicizes their acquisitions or reports them in our Survey, so the number of acquisitions in the channel is actually higher than what our Survey reveals. We still believe that the acquisition data presented in our Survey provides a good indication of overall acquisition activity across the office technology industry.

Of the 56 companies acquired, 49 were office technology dealers, including four that also offered managed IT services; five were IT Companies, and two were supplies dealers. An ongoing trend in past surveys has been the acquisition of smaller companies, with the average value of those dealerships being less than $2 million. This year, the average revenue of 54 of the 56 acquisitions was $2.2 million thanks largely to two acquisitions—a $13 million and a $15 million dealer. Note that the average revenue shown in Exhibit 1.40 is based on the acquisitions where dealers provided us with the value of the acquired companies. This year, the value was based on 54 of the 56 companies acquired, with some companies valued at well under $1 million and most under $3 million.

The lingering effects of the pandemic remain a factor in many dealers selling, particularly among dealerships with owners over 65 years of age who don’t have a succession plan in place. Private equity owned dealer organizations and mega dealers continue to impact the office technology dealer channel, with DEX Imaging, Flex Technology Group, Marco Technologies, Novatech, Pacific Office Automation, UBEO, and Visual Edge IT responsible for most acquisitions during the past decade. There’s no reason to assume that any of these organizations will put the brakes on their acquisition strategies in the immediate future.

The biggest development this year on the private equity front was the announcement in April that Gamut Capital Management, L.P., had signed a definitive agreement to acquire DEX Imaging from Staples, Inc. Before then, it looked like all of the private equity firms had grown to sizes that made them too big for acquisition. Questions remain as to when the other private equity owned acquisitions will sell and to whom. However, the bigger these organizations get, the higher the price tag and the narrower the field of potential buyers. Could a merger or consolidation take place instead? It’s not like we haven’t seen consolidation on the OEM side of the business in the past. For that reason, we wouldn’t count that option out among the mega dealers or private equity owned dealers.

This year, 46% of respondents noted that they’re considering a future acquisition, up from 41% in last year’s Survey. The dealers that seem most interested in acquiring include Canon (69%), Kyocera (49%), and Toshiba (44%). Konica Minolta and Ricoh dealers round out the list, tied at 43%, followed by Sharp dealers at 39%. Only 35% of Kyocera dealers were interested in acquiring in last year’s Survey. Just because a dealer indicates interest in making acquisitions doesn’t mean it will. Considering the number of acquisitions made during the past decade and the proliferation of private equity backed dealer organizations, the number of viable acquisition targets continues to shrink. The question dealers must ask themselves is whether it is worth acquiring a distressed asset to acquire MIF.

Once again, we must ask a question we posed last year: How much more contraction can the dealer channel experience before no one is left to buy? We estimate the independent dealer population to be somewhere between 1,200 and 1,400. Although exceptions exist, this is a mature industry and not all that appealing to entrepreneurs who want to jump in and start a dealership from scratch as was common 20, 30, or 40 years ago. We believe it is safe to say that the independent dealer population will continue to shrink. Although smaller dealers with less than $5 million in revenues will continue to have their niche in certain markets and regions, many will disappear from the landscape via acquisition or simply shuttering their doors.