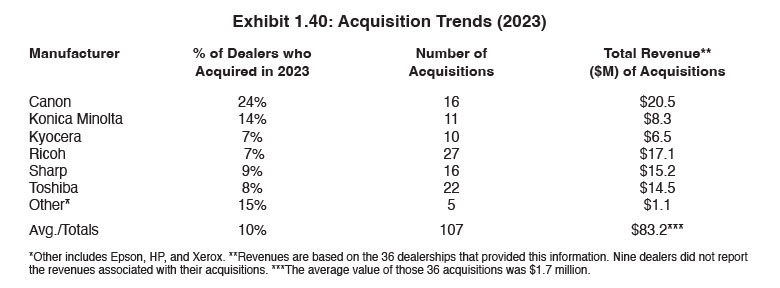

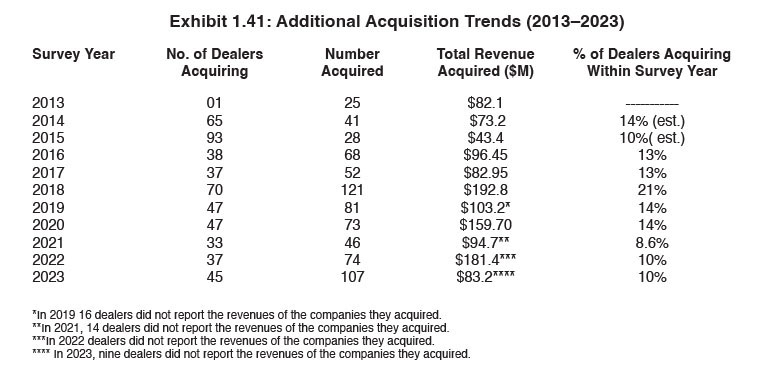

Exhibits 1.40-1.41

Between last year and this year, we saw a 2% dip in the percentage of dealers making acquisitions. However, there was a significant uptick in the number of acquisitions. In last year’s Survey, 12% of dealers (37) participating in our Survey reported 74 acquisitions, whereas this year, 45 (10%) of the dealers who responded made 107 acquisitions. As we’ve noted in the past, not every dealer publicizes their acquisitions or reports them in our Survey. Still, what is reported in our Survey gives us a good indication of overall acquisition activity across the office technology industry.

Of the 107 companies acquired, 72 were office technology dealers, 32 were IT companies, and three were identified as “Other.” The “other” category included a printing company, a sign company, and a finishing and binding company, each of which is an example of diversification.

As has been an ongoing trend, most acquisitions have been of smaller companies, with the average value of the acquired companies at $1.7 million, a decrease from the $3.7 million (2022) and $3.5 million (2021) reported in our previous two Surveys. Note that the average revenue shown in Exhibit 1.40 is based on the acquisitions where dealers provided us with the value of the acquired companies. For example, this year, the value was based on 49 of the 106 companies acquired, and six of those were valued at less than $1 million.

We surmise, based on some of the acquisitions that were made last year, that the average value of the 104 acquisitions made this year would be more than $2 million if every dealer reported the value of the companies that they acquired.

We believe the pandemic continues to be a factor in many dealers selling, particularly among dealerships with leaders over 65 years of age who don’t have a succession plan in place. Just because a dealer is aging out or a business is not as lucrative as it was in the past, doesn’t mean it will be easy to find a buyer. As some acquirers have told us, “We don’t buy distressed assets.” Others, however, are more interested in the MIF and are confident that they can fix whatever is broken or absorb the acquired dealer’s MIF into their existing MIF.

Private equity money continues to reshape the office technology dealer channel with DEX Imaging, Flex Technology Group, Marco Technologies, Novatech, and UBEO setting the pace. Less of a factor of late has been Visual Edge IT, but we wouldn’t count them out as a player in the acquisition game.

High-profile dealerships making acquisitions include Applied Innovation, Gordon Flesch Company, Kelley Connect, Pacific Office Automation, and RJ Young. The biggest acquisitions of 2022 were UBEO’s acquisition of Centric Business Systems in January and Flex Technology Group’s acquisition of Standard Office Systems in June. This year’s big acquisition, which will be reflected in next year’s Survey, was Novatech’s acquisition of Carolina Business Equipment.

This year, 41% of respondents reported they are considering a future acquisition, down 1% from last year’s Survey. The dealers that seem most interested in acquiring represent Canon (66%) and Ricoh (45%) with Konica Minolta and Sharp tied at 42%. Kyocera dealers, as they were last year, were least interested in acquiring (35%). But just because a dealer is interested in making acquisitions doesn’t mean it will happen. So many factors, some of which were previously noted, play into that decision, including competing against well-heeled private equity owned mega dealers.

How much more contraction can the dealer channel experience before there is no one left to buy? Industry estimates place the independent dealer population at less than 1,500. This is a mature industry that doesn’t attract entrepreneurs like it did decades ago. There are exceptions, or at least one that we found when we profiled Epic Office Solutions earlier this year. Epic Office Solutions is an Epson dealer that is growing the business from the ground up. The secret to starting a new dealership in 2023 is aligning with an OEM that has something different to offer such as Epson’s inkjet multifunction printers and printers.

Meanwhile, the big question that comes up every year about the private equity owned mega dealers is when will they sell? Usually, private equity firms purchase an entity and then flip it within five years or so. For many of these companies, the five-year expiration date has long since expired. Many have become so big that they are not so easy to flip anymore. That said, we would not be surprised if a future acquirer happens to be another private equity-owned entity within the office technology industry.