Connectivity among devices is paramount as the company expands its product offerings.

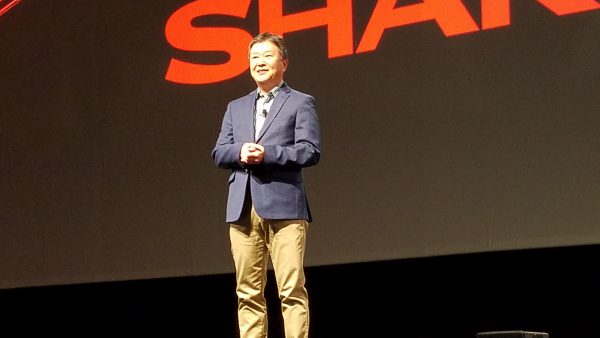

Above: Ted Kawamura speaks to dealers during Sharp’s 2019 dealer meeting. At the time, Kawamura was Chairman and CEO Americas, Sharp Corporation.

Sharp is on a mission to connect all its devices inside and outside an office while linking them with other IT services. That was the message from our virtual meeting on September 15 with 10 Sharp executives, including Ted Kawamura, executive officer, Sharp Corporation, who served as the primary presenter. Kawamura is also business unit president, Smart Business Solutions Business Unit, and chairman, Sharp NEC Display Solutions Ltd. Kawamura has been with Sharp for 38 years, including 19 years in the U.S. and 16 in Europe, working exclusively in the international B2B business.

This was an opportune time to speak with Sharp as the company celebrated its 110th anniversary on September 14 and is celebrating the 50th anniversary of the first Sharp copier this year.

Supply Chain Strategy

Sharp’s global initiatives to address backorders and the supply chain situation were the launch pad for our conversation. The company has done better than most OEMs in mitigating these problems. Kawamura presented 10 points illustrating Sharp’s strategies for alleviating supply chain issues. Those points centered around procurement, product design, production, logistic, and sales, as follows:

- Repeated negotiations with various vendors to source parts and chips

- Sourcing integrated circuit parts through online sources

- Redesigning products to better leverage currently available parts and chips

- Launching models with minor specification changes

- Adjusting production locations

- Prioritizing products by region/model

- Optimizing transportation (air/rail)

- Shortening delivery lead times, including direct delivery to customers

- Allocating parts and chips to in-stock models

- Leveraging its strong relationships with dealers

“We have faced big challenges over the past few years, but I am pleased we are handling this situation somewhat better than others,” noted Kawamura. “There is no magic; it’s just our diligent efforts.”

Communication with Sharp’s dealer community has also been essential for navigating supply chain issues. “I cannot emphasize enough how important that has been,” said Kawamura. “I’m proud that SIICA (Sharp Imaging and Information Company of America) people maintain a good relationship with our dealers.”

Despite a challenging 2020, Sharp’s Smart Business Solutions unit is projected to grow 25% from our last visit to Japan in 2018 to the end of this fiscal year. To achieve this growth, the company has expanded its focus to large enterprise customers such as Fortune 500 companies while not losing sight of its core SMB customers. Despite the COVID-19 pandemic, Kawamura reported that Sharp increased its global market share. One of Sharp’s most significant assets, he said, is Sharp’s diverse product offerings, which are vital to growth. “We are proud that we have a wide range of offerings compared to our peers in the MFP industry,” said Kawamura. “I am encouraged that we have room to grow in the MFP space. That space is still a major focus even as we transform our business into other categories and solutions.” He also revealed that Sharp plans to increase its focus on its business outside of Japan. For the B2B business, about 70% of Sharp’s global business is overseas.

Smart Business Solutions Strategy

Sharp’s Smart Business Solutions unit is responsible for solutions across all product categories, including smart office solutions and services. Sharp also has a Smart Enterprise Solutions group that focuses on logistic and retail solutions that aren’t directly related to Sharp’s office offerings. The NEC display business is also in this group. During our conversation, Kawamura spoke of “One SBS” and his mission to maximize the synergy of One SBS. The goal is to bring Sharp’s various product categories and functions, such as research and development, sales, and marketing together while creating new business opportunities driven by customer needs and market perspectives.

The breadth of Sharp’s products and solutions, and workstyle changes, most notably the proliferation of hybrid work, is driving the company’s smart office initiatives. The concept behind the smart office is to provide customers with a total office solution consisting of an array of products and services along with the capabilities to connect these products seamlessly. Kawamura described three pillars of service critical to the smart office concept—communication services, business process services, and security and IT services.

- Communication services focus on remote work, collaboration environments, and web meetings. The mission is to provide more flexible communication within these environments.

- Business process services focus on document management, ECM/content management, CRM, asset management, and integrating MFPs with the cloud. The goal is to grow business processes through these offerings.

- Security/IT services revolve around a full menu of IT services, including those provided by third parties such as ConnectWise, Perch, and ORIA. Sharp is also looking to grow security/IT services through mergers and acquisitions.

Sharp’s mission is to expand the Smart Office Business with these services, offered via a SaaS model that provides recurring revenue.

Smart MFPs

Sharp remains as committed as ever to the MFP business even though its vision of the MFP has changed. Three words describe this new vision—secure, connect, smart. And to celebrate its 50th year in the copier/MFP business, Sharp introduced seven CL series color A3 MFPs earlier this year. An additional five A3 black & white mid-range MFPs will be released later this year. These new models have a new light gray color design, improved energy savings, full flat-panel capacitive touch panels, high-productivity document feeders that allow for duplexing up to 280 pages per minute, smart scanning driven by artificial intelligence, and built-in folding units.

According to Kawamura, the initial dealer reaction to the CL series has been positive. “We keep investing in new product development, and our plans include a color light production series,” he added. Kawamura also sees potential for black & white light production, especially in the U.S., where there is more interest in this segment compared to other regions.

Even though the company shifted away from A4 to A3 during the supply chain crisis, that is not a permanent strategy. “A4 is one of our biggest focus points,” said Kawamura, who added that dealers can expect to see new products from Sharp in 2023 and 2024. Sharp is exploring various options for expanding its A4 offerings, including partnering with another OEM.

When queried if Sharp plans to introduce a “true” production print device in the future, Kawamura said he had nothing to share now. “But never say never,” he added while recalling the dealer visits he made while working in the U.S., where dealers frequently asked about Sharp’s plans for production and A4.

Synappx Synergy

Sharp’s Synappx platform was first introduced in the U.S. at its 2019 dealer conference. Since then, the platform has been evolving. “Synappx is a key ingredient of our Smart Office Business,” said Kawamura. “Through our Synappx solutions, we aim to connect all devices seamlessly, manage MNS services, and expand them to IT services. This will provide a huge benefit to our dealer community because it will create more dependence of the customer on our dealers.”

Two notable Synappx solutions discussed during our visit include:

- Synappx Smart Office Collaboration Hub is a mobile-device meeting assistant that launches a meeting on a display screen from a smartphone, allowing for the sharing of content and presentations wirelessly.

- Smart Office Manage allows corporate IT managers to remotely monitor MFPs, displays, and future Sharp office offerings. It can be used for firmware updates, changing device settings, and remote maintenance. It collects big data from servers, A3 and A4 MFPs, laptops and desktops, personal displays, information displays, and intelligent touch boards and stores it in the cloud.

Expect to hear much more about Synappx as Sharp introduces more products that leverage this platform.

Other Growth Segments

The NEC display business continues to grow. Sharp now offers NEC Direct View LED displays, increasing the demand for video-wall applications and creating more opportunities for the company. The Dynabook business is also strong, with Karamura emphasizing how the broad range of products in the Dynabook line help differentiate Sharp from its competitors. Dynabook sales have grown globally, especially in Europe and the U.S. “Notebook PCs are still a core piece of IT equipment and a door opener for our dealers and direct salespeople to talk to new customers,” said Kawamura.

Based on the content of Kawamura’s presentation and the responses to our questions, Sharp is executing on the strategies it shared during our 2018 visit to Japan. It is also fine-tuning its product and solutions initiatives to keep pace with current trends. We were also impressed by Kawamura’s deep appreciation for Sharp’s U.S. dealer channel, which is responsible for much of the company’s success. That appreciation extends to the Sharp team in the U.S., who have done a superior job communicating with dealers throughout the pandemic and the supply chain crisis.

Sidebar: Sharp Executives Attending Our Meeting

- A. Kawahara, vice president, Sharp Business Solutions Business Unit

- J. Ashida, vice president, Sharp Business Solutions Business Unit, president and CEO, Sharp Electronics Corporation

- M. Tokuyama, general manager, head of Smart Business Unit

- Y. Kobayashi, deputy general manager, digital imaging solutions

- K. Tanaka, deputy general manager, Digital Imaging Solutions Business Unit

- Y. Kashu, division manager, Smart Work Solutions Business Unit; Product Planning Division

- T. Yamane, division manager, Americas Marketing Center

- H. Kobata, senior manager, Americas Marketing Center

- M. Kawano, senior manager, Smart Work Solutions Business Unit, Product Planning Division

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.