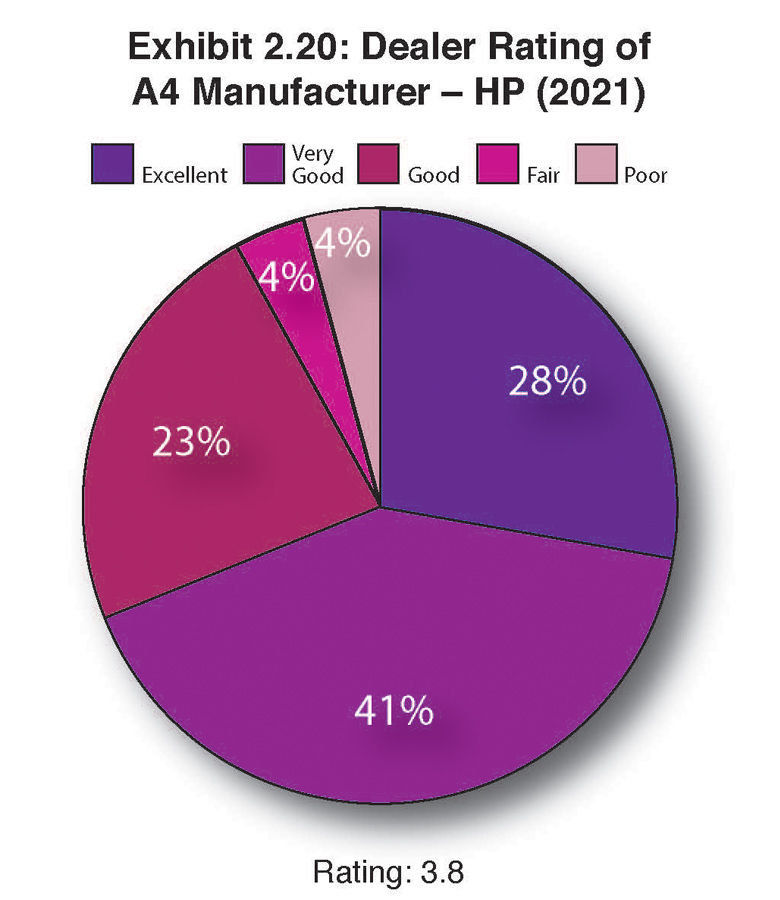

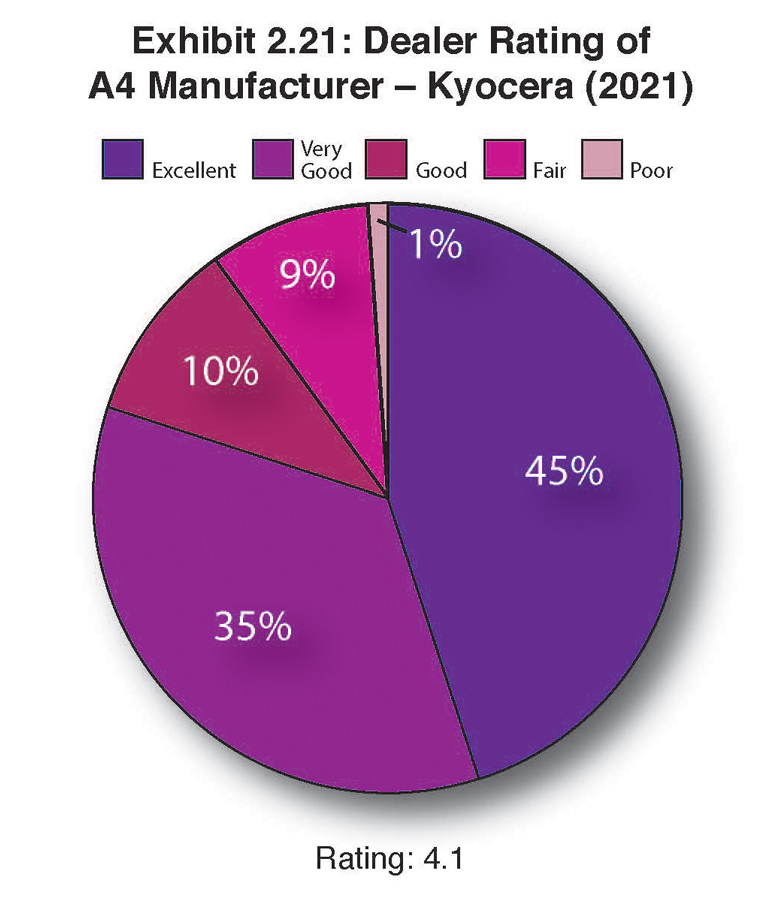

Exhibits 2.20-2.25

Because not all Big Six OEMs have a strong A4 offering, many dealers look beyond their primary A3 OEM to source A4 products. Companies such as Brother, Epson, HP, Lexmark, and Xerox are among the A4 providers that are helping dealers fill the A4 gap, as well as OKI Data, which exited the A4 business in North America last March. Thirty percent of respondents selected one of these companies as their primary A4 provider. Also notable is that 21% of dealers selected Kyocera as their primary A4 supplier, by far the strongest showing of all the Big Six OEMs.

- 780 Nov21 Ex2.20

- 780 Nov21 Ex2.21

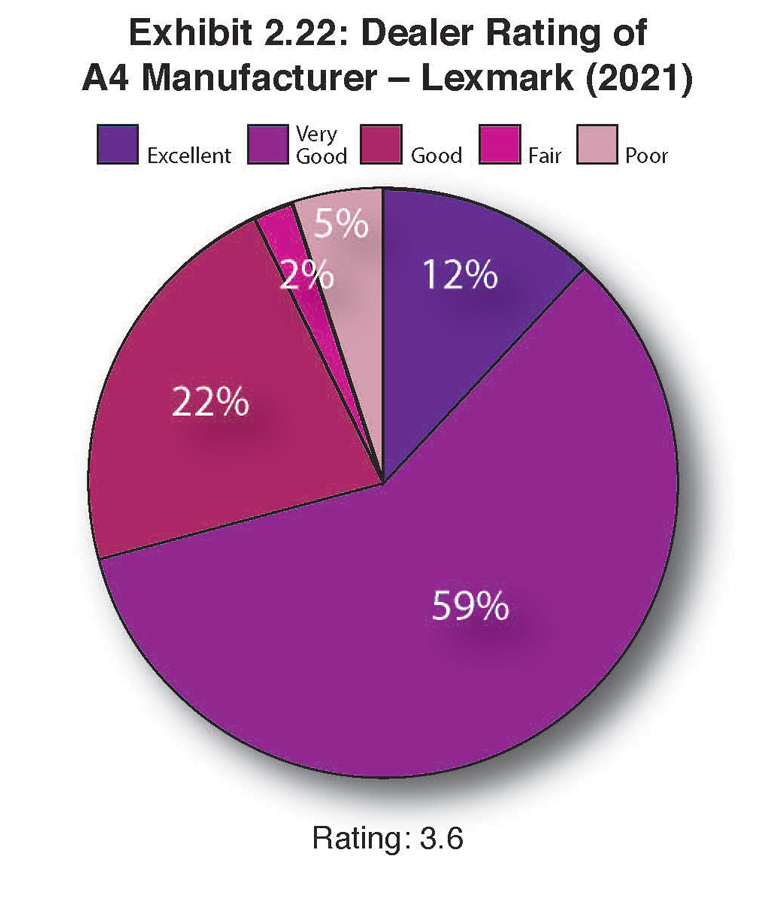

- 780 Nov21 Ex2.22

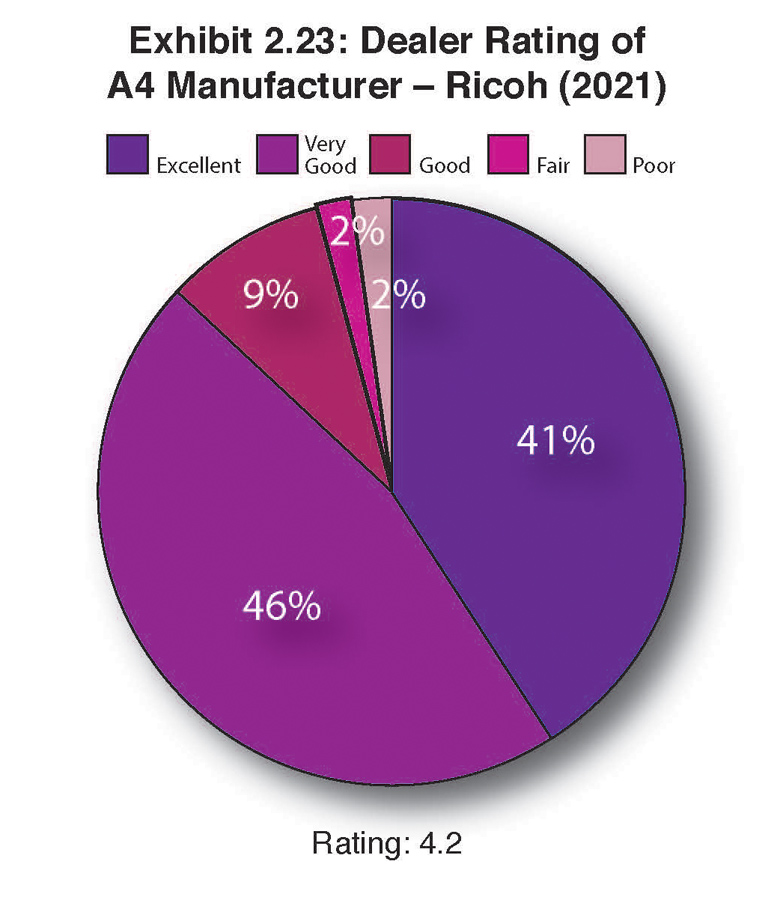

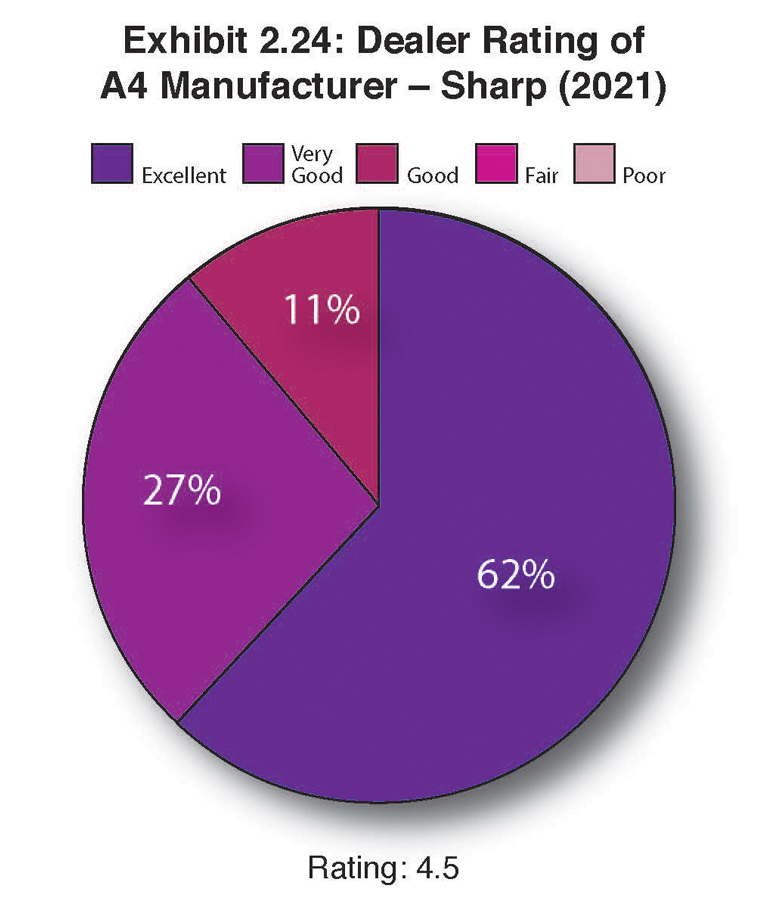

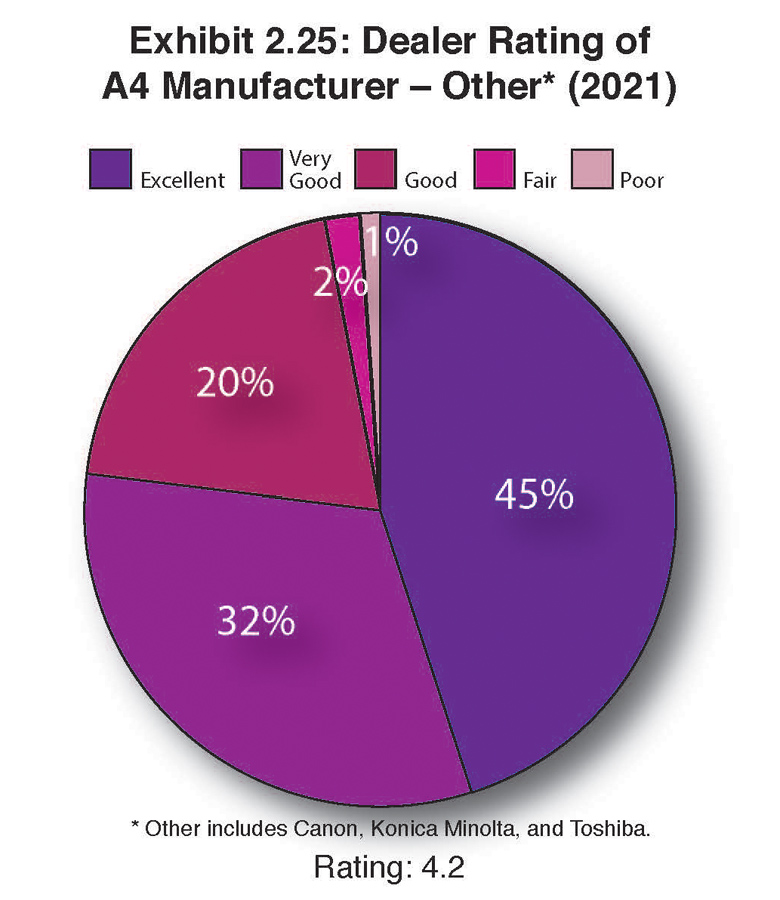

This year, we decided to provide charts (Exhibits 2.20-2.24) depicting the ratings of the A4 providers with 30 or more dealers selecting them as their primary A4 provider. The OEMs that met this criterion included HP, Lexmark, Kyocera, Ricoh, and Sharp. Combined, those five OEMs represent 76% of primary A4 suppliers. Exhibit 2.25 depicts the ratings of A4 providers cited by fewer than 30 dealers, including Canon, Konica Minolta, and Toshiba.

- 780 Nov21 Ex2.23

- 780 Nov21 Ex2.24

- 780 Nov21 Ex2.25

Ratings were down across the board for all A4 suppliers except for Sharp, which had the highest rating, improving from 4.4 last year to 4.5 this year. Despite not having a broad A4 line, Ricoh received a favorable A4 rating, finishing second overall with a 4.2, down from 4.3 a year ago. We attribute Ricoh’s favorable ratings to strength in numbers with 87 Ricoh dealers participating in the Survey and 56 selecting Ricoh as their primary A4 manufacturer. That said, only 41% rated the company as “Excellent,” down from 54% last year. However, 46% rated Ricoh as “Very Good,” up from 30% in last year’s Survey.

Although Kyocera and Lexmark have been selected by dealers as the best A4 provider in our Annual Awards for the past five years, their ratings in our Survey don’t seem to match that recognition. For example, this year, Kyocera had a 4.1 rating compared to 4.2 last year, while Lexmark’s rating dropped to 3.6 from 3.8 a year ago. Based on the comments that dealers provided to explain their ratings, most referred to supply chain issues. However, since we would prefer to focus on the equipment and the company—rather than the current backorder situation—the comments below primarily focus on the A4 products and programs. Please note that we included four comments for each of the OEMs identified by more than 30 dealers as their A4 supplier, and only three for those who were identified as the primary A4 supplier by fewer than 30 dealers, with the exception of Epson where only two dealers identified them as their primary A4 provider.

Brother

Excellent: “Brother puts out a solid product that we’ve put in some heavy-use environments, and they’ve held up well. The Brother warranty has been very prompt.”

Very Good: “Brother has some problems with reliability of lower-end MFPs.”

Very Good: “Reliable product, competitive cost per page.”

Canon

Excellent: “Phenomenal A4 product, which is unique and allows us to compete and win against the insane multitude of HP providers.”

Excellent: “Always seems to be ahead of everyone else when it comes to reliable A4 products.”

Fair: “Lack of support.”

Epson

Excellent: “Lowest cost and highest feature set of any of our manufacturers.”

Excellent: “Keeps us in the game.”

HP

Excellent: “They finally have an excellent dealer program.”

Excellent: “HP has really stepped up when it comes to competing in this area. Their programs for competing with non-OEM supplies has been a big factor for us.”

Fair: “They really don’t have a handle on what dealers need or want. Too one-sided—their way or the highway.”

Poor: “Terrible service, too corporate, no personal service.”

Konica Minolta

Excellent: “Konica Minolta has a strong line of products for us to sell.”

Very Good: “Konica Minolta is taking the lead in this segment of the market, focusing on producing their own product and leaving it in the line longer.”

Good: “Need better black & white printers and A4 MFPs.”

Kyocera

Excellent: “Reliability is excellent. Price is very competitive at our tier pricing.”

Excellent: “Kyocera is a top-notch partner. We love working with them. They are good to us and have great equipment.”

Very Good: “Good products, need to reduce aftermarket costs and make warranty claims simpler.”

Good: “Middle of the road quality.”

Lexmark

Excellent: “Full product line plus very reliable.”

Very Good: “A4 is growing and Lexmark with their BSD program has been a huge part of our success.”

Good: “Poor help desk support and unrealistic quotas.”

Poor: “Terrible sales representation.”

Ricoh

Excellent: “Product design, quality, feature sets, and support have been exceptional.”

Very Good: “Great equipment, price could be more competitive.”

Very Good: “They have a few holes in the product line in the smaller A4 device market, otherwise excellent.”

Poor: “The equipment for the most part is excellent. Pricing is not competitive with other manufacturers and is not an equal playing field between our manufacturer and independent dealers.”

Sharp

Excellent: “Excellent product, service, pricing, field performance. Good financial stability.”

Excellent: “They are willing to work with us in a very flexible manner to reach our goals whether it be through incentives or technological strategies.”

Very Good: “Sharp makes good A4, but I wish they had a full product line that was made by them only.”

Good: “Need more offerings.”

Toshiba

Excellent: “Great product and features, blends well with current A3 line.”

Very Good: “Products are strong, pricing is competitive.”

Good: “Training used to be excellent, now not so much.”

Xerox

Very Good: “Reliable products and great sales support.”

Good: “Too much email, difficult to work with, too many changes in direction and with personnel.”

Poor: “Xerox pulled the warranty reimbursement program and free parts for customer agreements already in place.”

Access Related Content