Exhibits 1.5-1.8

Despite generating lower margins than A3 devices, supply chain disruptions, and chip shortages, A4 multifunction printers have taken a licking but keep on clicking. Buoyed by declining clicks on A3 devices in the traditional office and the emergence of hybrid work, robust A4 devices have become more prevalent in the workplace and home offices—much to the consternation of office technology dealers who lament the loss of revenue as they sell fewer A3 products.

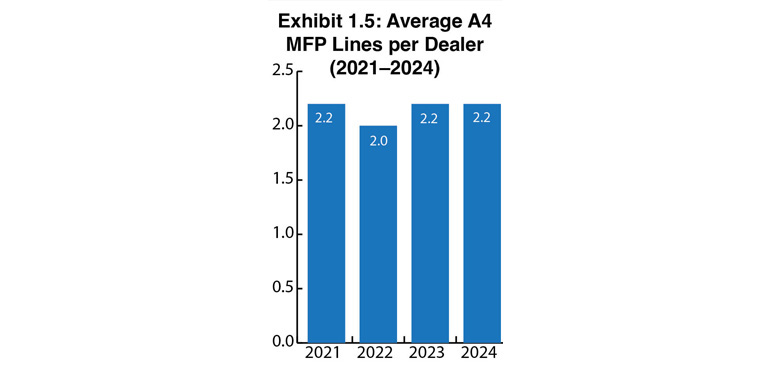

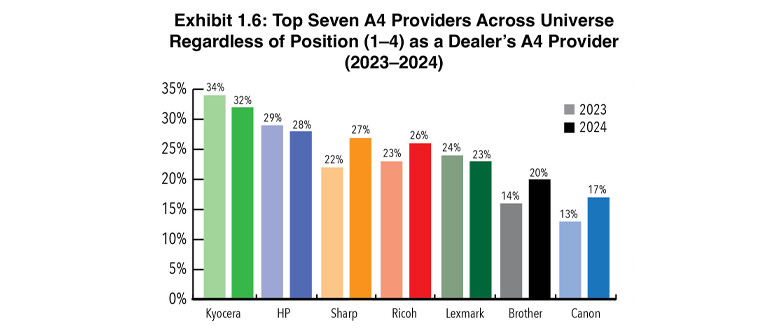

The average number of A4 lines carried per dealer (Exhibit 1.5) didn’t change year over year in our Survey and remains at 2.2. Dealers identified eleven A4 brands: Brother, Canon, Epson, HP, Konica Minolta, Kyocera, Lexmark, Ricoh, Sharp, Toshiba, and Xerox. Six years ago, we started identifying the Top Five A4 brands regardless of whether they were a Big Six manufacturer or a secondary manufacturer and regardless of position as a dealer’s A4 provider. Four years ago, we increased that to the Top Seven A4 brands (Exhibit 1.6), which gives us a clearer picture of what’s happening in the market, especially since some of the higher percentages for the Top A4 Providers reflected the number of dealers representing certain Big Six OEMs in our Survey even if they don’t have a strong A4 line.

For the third consecutive year, Kyocera holds the top position at 32%, a decline of 2% from a year ago. The percentage of dealers carrying HP A4 continues to fall—from 42% three years ago to 31% two years ago, 29% last year, and 28% this year. Despite that downward trend, HP remains dealers’ second most popular A4 line. HP’s decline in this segment could be the result of continued fallout from the HP Amplify partner program, introduced in 2020, even though dealers are less vocal about what they perceive as problems with the program than in previous years. In recent conversations with dealers, The Cannata Report continues to hear that the company is difficult to work with, which likely contributes to its declining percentages. Meanwhile, Brother and Epson are gaining A4 market share across the dealer channel.

Spots three through seven include Sharp (27%), Ricoh (26%), Lexmark (23%), Brother (20%), and Canon (17%), which supplanted Toshiba, who held the seventh spot last year. Not included in Exhibit 1.6 are Toshiba and Konica Minolta, tied at 13%, Epson (10%), and Xerox (8%). Sharp and Ricoh had 88 and 92 dealers, respectively, participating in the Survey, which impacted their standing considerably. It’s impossible not to be impressed by Brother’s upward momentum in the A4 category. After years in the single digits as an A4 provider, the company has been in the double digits in our past four Surveys. Epson also has been growing, although not as rapidly as Brother.

For the second consecutive year, 100% of dealers selected their primary A3 manufacturer—Kyocera—as their number one A4 provider (Exhibit 1.7). Kyocera continues to set the pace in this category, with percentages in the last four years of 93%, 91%, 100%, and 100%. However, Kyocera wasn’t the only Big Six OEM to exceed 90% in this category. Ricoh (99%), Canon (95%), and Sharp (93%) also were members of this elite group.

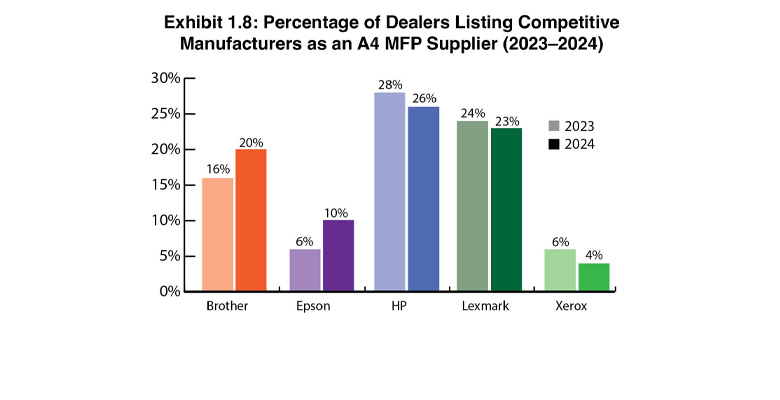

Exhibit 1.8 shows the performance of A4 suppliers not among the Big Six. Some of these percentages have been adjusted from the percentage shown in Exhibit 1.6 since we’re not factoring in Epson, HP, Lexmark, and Xerox dealers when determining those companies’ percentages. For example, we subtracted eight HP dealers from the 401 dealers participating in the Survey to determine HP’s percentage. Lexmark is still a significant player in the A4 space (23%), and Brother, as we noted earlier, remains a company to watch (20%).

Exhibit 1.8 shows the performance of A4 suppliers not among the Big Six. Some of these percentages have been adjusted from the percentage shown in Exhibit 1.6 since we’re not factoring in Epson, HP, Lexmark, and Xerox dealers when determining those companies’ percentages. For example, we subtracted eight HP dealers from the 401 dealers participating in the Survey to determine HP’s percentage. Lexmark is still a significant player in the A4 space (23%), and Brother, as we noted earlier, remains a company to watch (20%).