Exhibits 1.5-1.8

The last three years have been the best of times and the worst of times for A4 multifunction printers. Declining clicks, the COVID-19 pandemic, and the emergence of the hybrid workforce have had a positive impact on A4 placements in enterprises and small- to medium-size businesses (SMBs). Just as things were picking up, along come supply chain disruptions, which limited the availability of some of those products as some OEMs devoted their available resources, i.e., chips, to their higher-margin A3 products to keep that pipeline flowing as best as they could under the circumstances. Fortunately, most of those supply chain issues have been resolved.

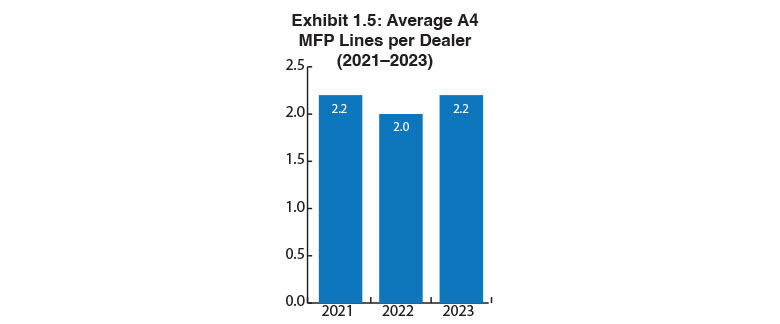

The average number of A4 lines carried per dealer (Exhibit 1.5) saw a modest increase from 2.0 to 2.2, likely driven by a greater number of Survey respondents, and some dealers adding new A4 suppliers that had products available during the height of the supply chain crisis. Eleven A4 brands were identified by dealers in our Survey—Brother, Canon, Epson, HP, Konica Minolta, Kyocera, Lexmark, Ricoh, Sharp, Toshiba, and Xerox.

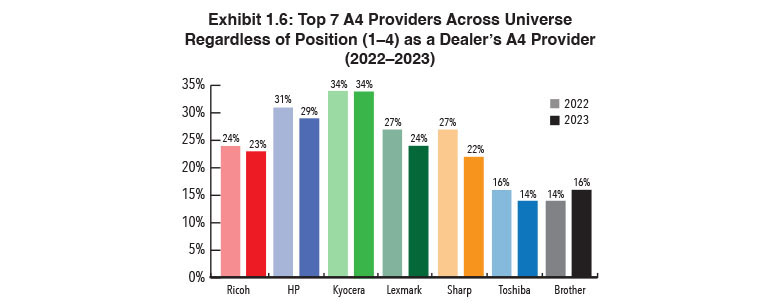

Five years ago, we began identifying the Top Five A4 brands regardless of whether they were a Big Six manufacturer or a secondary manufacturer and regardless of position as a dealer’s A4 provider. Three years ago, we increased that to the Top Seven A4 brands (Exhibit 1.6). For the second consecutive year, Kyocera holds the top position at 34%, the same percentage as a year ago. The percentage of dealers carrying HP A4 has declined from a high of 42% two years ago to 31% last year to 29% this year. The company did receive significant pushback from dealers when it introduced its Amplify partner program in 2020, which could be a reason for the decline, even though much of the concern around that program has dissipated. We are also seeing companies like Brother and Epson gain market share across the dealer channel in terms of A4.

Spots five through seven include Lexmark (24%), Ricoh (23%), Sharp (22%), Ricoh (24%), Brother (16%), and Toshiba (14%). Not included in Exhibit 1.6 were Canon (13%), Xerox and Epson (tied at 9%), and Konica Minolta (5%). Brother continues to grow its presence in the dealer channel, and after years in the single digits as an A4 provider, the company has been in the double digits in our past three Surveys. Epson has also seen its percentages grow, and much of that growth, including for its A3 products can be attributed to its PrecisionCore heat-free inkjet technology, which it heavily promotes as a differentiator.

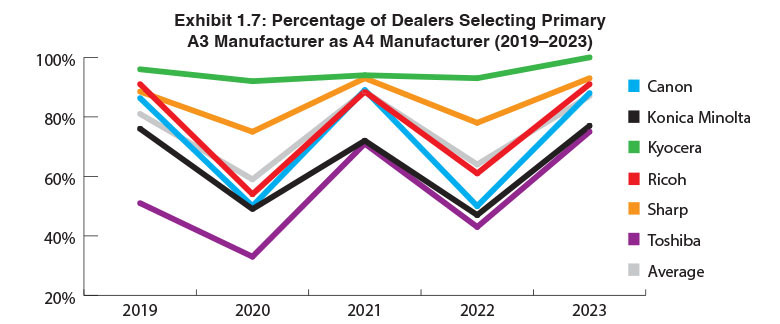

For the first time ever in our Survey, 100% of dealers selected their primary A3 manufacturer—Kyocera—as their number one A4 provider (Exhibit 1.7). Historically, Kyocera has always ranked highly here, and in the last two years, it garnered percentages of 94% and 93%. Sharp and Ricoh weren’t far behind with 93% and 91%, respectively.

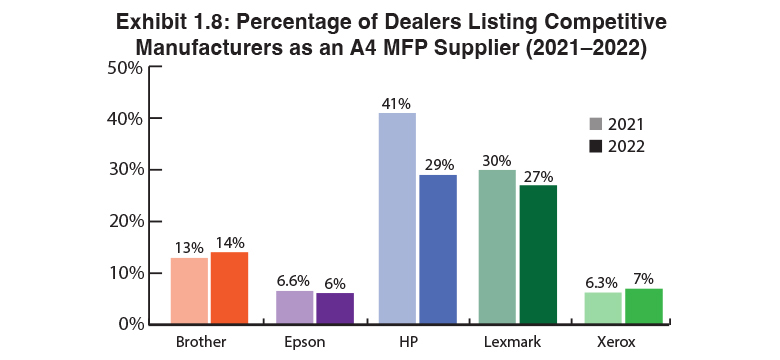

Exhibit 1.8 shows the performance of A4 suppliers not among the Big Six. HP is sold by 28% of dealers participating in our Survey. Please note that this percentage has been adjusted from the percentage shown in Exhibit 1.6 since we are not factoring in the six HP dealers who sell HP A4. Lexmark is still a significant player in the A4 space despite having its share of supply chain challenges last year. After attending the Lexmark Business Solutions Dealer Summit earlier this year, we can safely say that it still has an impressive array of dealers carrying its products, including some of the largest dealerships in the country, and many of those dealers remain extremely enthusiastic about the company’s A4 product line and what’s to come.