Exhibits 1.1-1.4

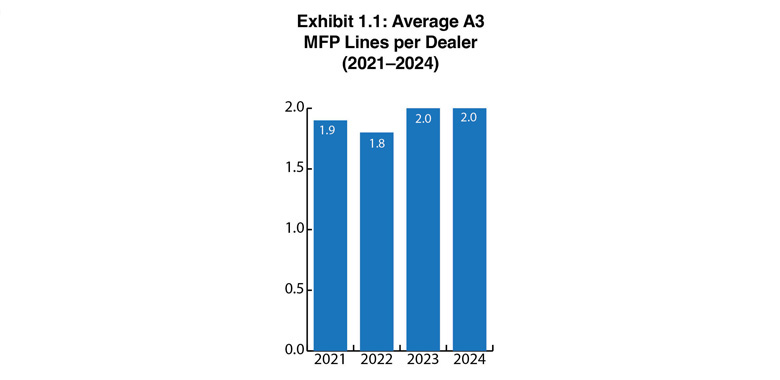

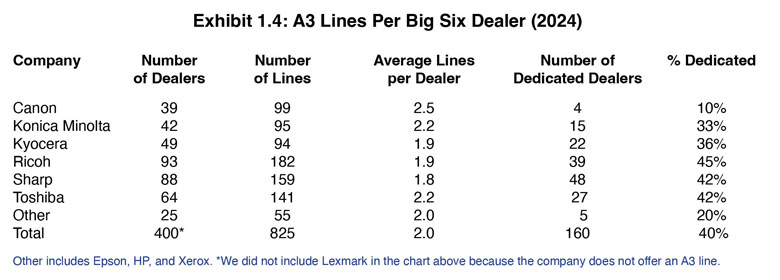

In this year’s Survey, 825 A3 MFP lines were reported across 400 respondents. (This doesn’t include the one Lexmark dealer participating in the Survey because Lexmark just introduced its first A3 product in April of this year, and the Survey reflects 2023 data.) The average number of lines per dealer for the Big Six universe is 2.0, identical to a year ago (Exhibit 1.1) and up from 1.8 two years ago.

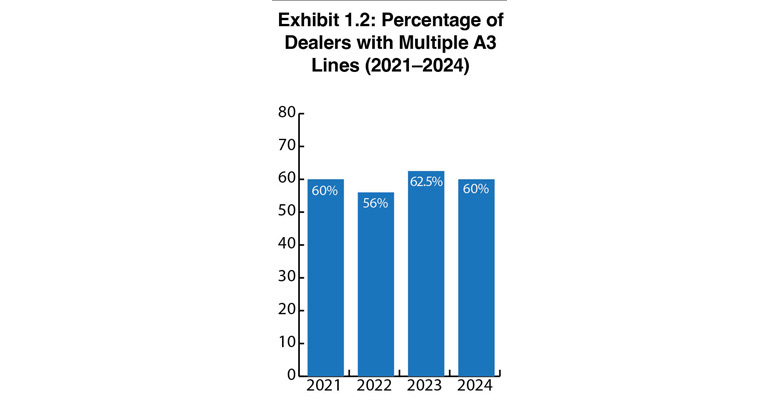

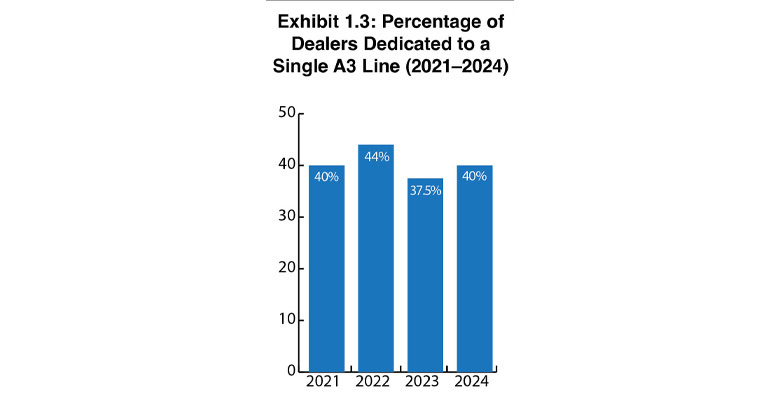

After seeing the number of single-line A3 dealers drop below 40% to 37.5% last year, the percentage grew to 40% this year (Exhibit 1.3). We attribute last year’s decline to the number of survey respondents, which was 458, the highest in the history of the Survey. Understanding that the independent dealer population has declined for more than a decade and that estimates from industry thought leaders, including The Cannata Report, place it at less than 1,400, our Survey reflects nearly one-third of that population. As a result, we believe our data offers an extremely accurate assessment of the state of the independent dealer channel.

Clearly, the Big Six OEMs, comprising Canon, Konica Minolta, Kyocera, Ricoh, Sharp, and Toshiba, maintain a significant share of the A3 market. Although Epson, HP, and Xerox also are players in the A3 space, none seem to be having much success in taking market share away from the Big Six. Only 6% of dealers participating in our Survey identified one of those three companies as their primary A3 product line. However, they fare better when viewed as a secondary A3 option for dealers. Exhibit 1.10 reveals the percentage of manufacturers in a secondary position for A3 MFPs, which also includes strong showings for Epson, HP, and Xerox. Note that the percentages in Exhibit 1.10 don’t account for the Survey respondent’s primary A3 product line.

With 57 fewer dealers responding to the Survey compared to last year, Epson, HP, and Xerox saw the number of dealers identifying them as their primary A3 vendor declining. Last year, some upward mobility occurred for Epson and Xerox as each was in the double digits as a dealer’s primary A3 vendor. For example, 16 Epson and 15 Xerox dealers participated in our 2023 Survey. This year, the number of Epson dealers fell to three, while Xerox had 14 dealers respond to the Survey. Meanwhile, HP, which had only six dealers respond to last year’s Survey, experienced a slight uptick to eight. Last year, we surmised that this trend was worth watching as Epson and Xerox have been aggressively recruiting dealers. However, some restructuring has occurred this year at Xerox, which could impact future dealer recruitment. In addition, a recent announcement from Epson in Japan that it would be cutting its global workforce could impact the momentum Epson has had over the past few years in the U.S. dealer channel. Although HP doesn’t rank high as a primary A3 line, it still ranks ahead of Epson and Xerox in the percentage of dealers carrying its A3 devices. Whether it grows beyond that will depend on how effectively it can replace more Big Six vendors in secondary positions across the dealer channel. We expect it to be a challenge. Next year, we’ll also look closely at Lexmark and whether it will have any presence as a dealer’s secondary A3 offering.