Exhibits 1.1-1.4

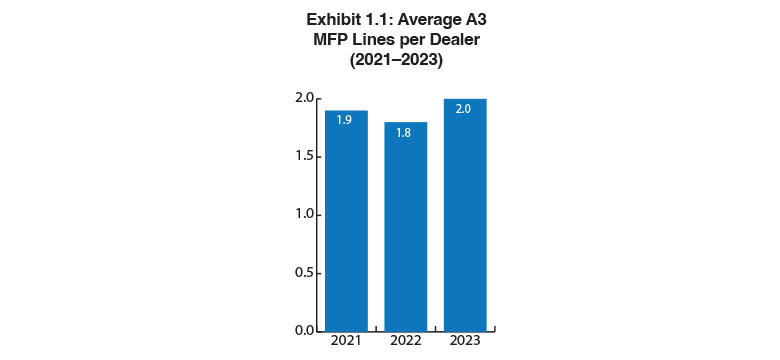

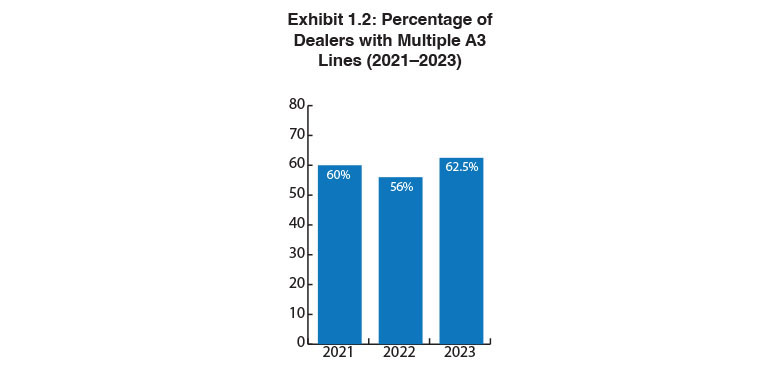

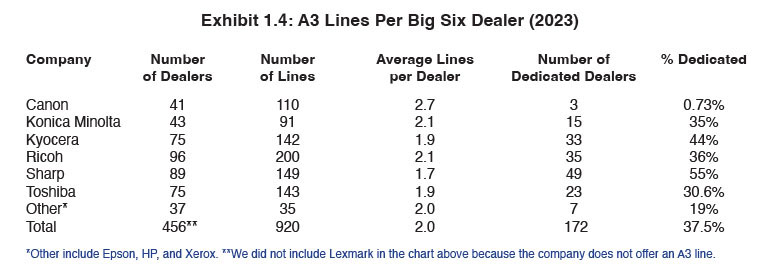

In this year’s Survey, 920 A3 MFP lines were reported across 456 respondents (This does not include two Lexmark dealers as Lexmark does not currently offer A3 products.). The average number of lines per dealer for the Big Six universe is 2.0, up from 1.8 a year ago (Exhibit 1.1). The increase can be attributed to a decline in single-line dealers participating in our Survey.

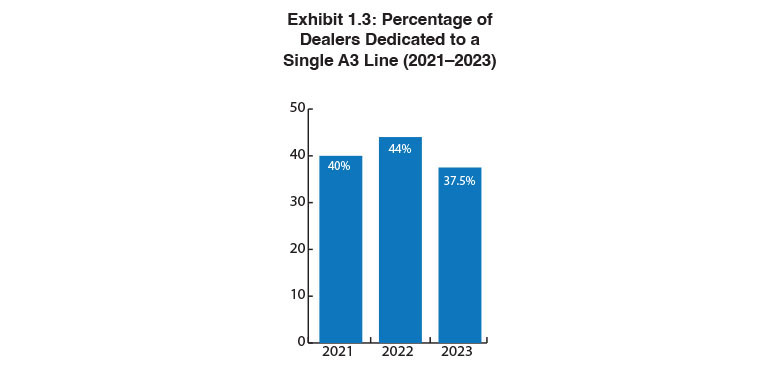

As you will see later in our Survey analysis under the “Dealer Dedication” heading, the number of single-line dealers declined by 6.5% since last year (Exhibit 1.3). This is a notable trend, especially since there were so many more respondents in this year’s Survey compared to previous years. If you consider that the independent dealer population has been on the decline for more than a decade, and that best estimates from industry thought leaders, including The Cannata Report, place it at less than 1,500, our Survey reflects nearly one-third of that population. As a result, we believe the data we are presenting in this year’s Survey offers an extremely accurate assessment of the state of the independent dealer channel.

Obviously, the Big Six OEMs comprising Canon, Konica Minolta, Kyocera, Ricoh, Sharp, and Toshiba maintain a significant share of the A3 market; however, we view Epson, HP, and Xerox as disruptors. This year, 18% of Survey respondents indicated they are selling HP A3 as their primary A3 product line, with 13% selling Xerox, and 9% selling Epson. In addition, Exhibit 1.10 reveals the percentages of manufacturers in a secondary position for A3 MFPs, which also includes the notable presence of HP, Xerox, and Epson. Please note that the percentages in Exhibit 1.10 do not account for the Survey respondent’s primary A3 product line.

What’s particularly notable in this year’s Survey is the number of dealers that identified Epson and Xerox as their primary A3 providers. In past years, those numbers were in the single digits. This year, there were 16 Epson dealers and 15 Xerox dealers participating in our Survey. This is a trend that is worth watching as both of those companies continue to aggressively recruit more dealers.

Where does that leave HP? It still ranks ahead of Epson and Xerox in the percentage of dealers in our Survey that are carrying its A3 line. But can it grow beyond that? That’s a tall order in a product segment with six well-established players. In order to add more dealers, HP will likely have to replace more of those Big Six vendors in secondary positions across the dealer channel, and that will be a challenge.