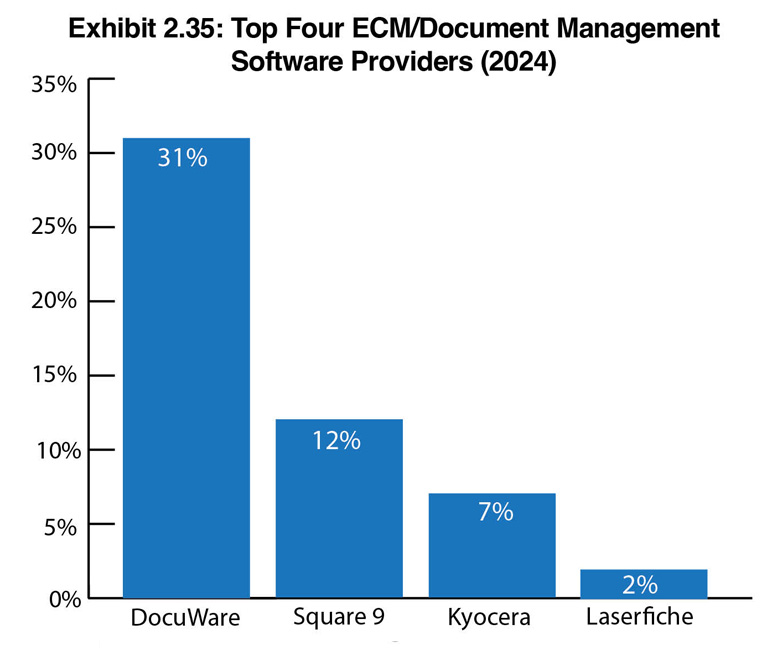

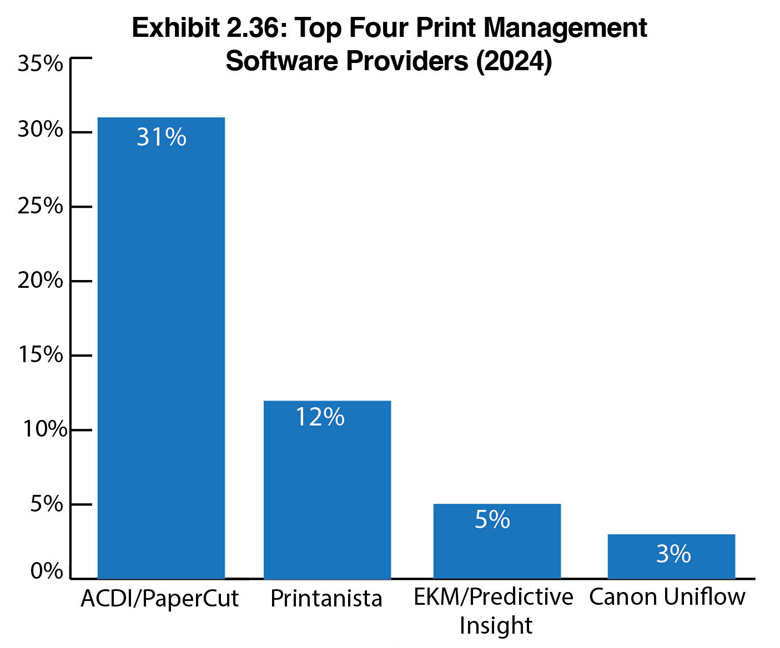

Exhibits 2.35-2.36

For six years, dealers have been rating their ECM/document and print management software providers. Unlike our A3, A4, and leasing company ratings, we keep it simple, only asking them to name the best provider in these two categories based on pre- and post-sales support and the product’s capabilities. We’re currently debating whether to go deeper with this question, perhaps asking dealers to share comments as to why they believe these providers’ solutions stand out from competitive solutions.

Unfortunately, fewer dealers offer an opinion in these two categories other than rating their A3 and A4 providers or their primary leasing partner. This year, 194 of the 401 dealers (48%), almost the same as last year (47%), rated their ECM/document management software provider. As we’ve seen in the past, some dealers filling out our Survey identified software companies that don’t offer an ECM/document management product. For print management, 215 of the 401 dealers (54%) participating in our Survey selected a print management provider versus 48% last year. The percentages in Exhibits 2.35 and 2.36 only reflect the dealers that responded to these two portions of the Survey rather than the entire universe of dealers participating.

The ECM/document management category results have been consistent for the past six years since we started focusing on these two software segments. Previously, we just asked dealers to identify the best software provider, leading to various disparate solutions competing in this category. DocuWare was selected by 31% of the dealers, 2% higher than last year. Compared to last year, when 49 of 96 Ricoh dealers (Ricoh owns DocuWare) selected DocuWare, only 40 of 92 dealers selected DocuWare this year. Forty-three dealers didn’t vote in this category. Only 20 dealers aligned with another manufacturer selected DocuWare.

Square 9, once highly regarded in this category, has consistently ranked second in the past six years. This year, 12% of dealers selected Square 9, compared to 13% last and 16% two years ago. DocuWare’s Ricoh connection seems to have had a distinct impact on Square 9’s standing in this category. As we’ve witnessed since we first started asking dealers to identify the best ECM/document management provider, no other company comes close to DocuWare or Square 9. In third place was Kyocera (7%), followed by Laserfiche at 2%. These ECM/document management software providers declined by 1% and 2%, respectively, from the previous year.

There seems to be no stopping ACDI/PaperCut in the print management category. Here, 31% of dealers selected them, a 3% decline from the previous year. However, this category has become more interesting in the past two years, with new players/rebranded solutions rising. Remember FMAudit, the much-maligned ECI solution that often finished in the second position in this category? It’s now part of ECI’s Printanista, which has taken over from FMAudit in second place at 12%. A new entry in this category is EKM/Predictive InSight at 5%. The company, which has been selling its meter reading solution in the United States since 2020, barely registered in the voting until this year. Rounding out the top four, as it usually does, is Canon Uniflow (3%). A company we began watching closely three years ago—MPS Monitor—was selected by 3% of dealers two years ago. However, only two dealers in our last two Surveys identified the company as the best print management provider. The company was acquired this past year, although we doubt that has anything to do with its lack of dealer support in our Survey. Perhaps a stronger marketing effort will return it to the top four in future Surveys.

Overall, 36 products were identified as dealers’ top print management software. We could debate which of those is truly print management software, but we won’t get into that in this year’s Survey. While 54% of dealers offer a print management solution, which is critical for those offering MPS, we surmise that percentage is slightly higher if we pool the entire dealer channel rather than just the 401 dealers in our Survey.