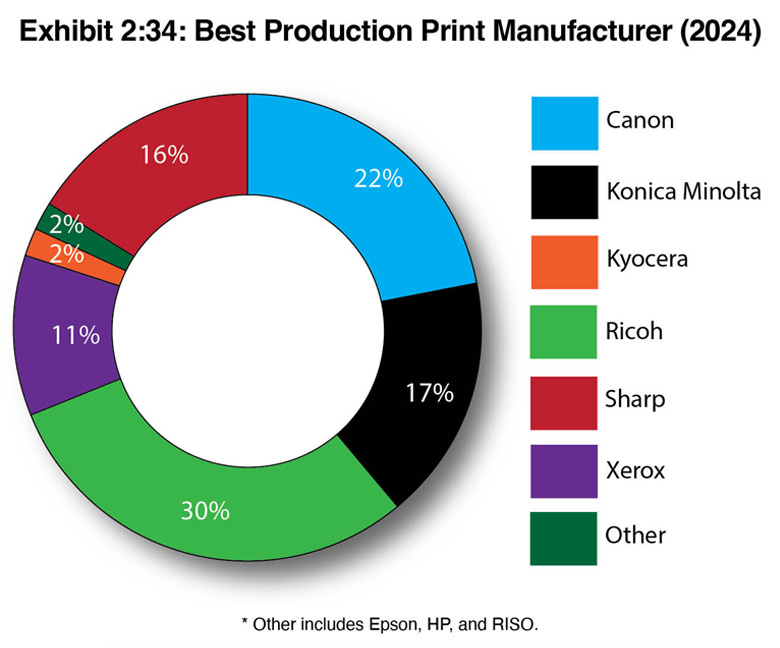

Exhibit 2.34

In case you haven’t noticed, The Cannata Report is a big advocate of production print as a diversification opportunity. Fifty-one percent of dealers agree, based on Part 1 of the Survey, in which we asked them to rank their greatest diversification opportunities in no particular order. That’s an increase of 6% over the previous year. When identified as a dealer’s No. 1 diversification opportunity, 17% of dealers selected production print, a 5% increase from the previous year. Clearly, production print is trending upwards in the hearts and minds of the independent dealer channel.

Every year, we ask dealers to identify the Best Production Print Manufacturer. After reviewing their input, we remove companies without a true production print line from consideration. Historically, companies such as Kyocera, Sharp, and Toshiba were eliminated using this criterion. However, now that Kyocera and Sharp are in the production print game, we include them in the voting.

Exhibit 2.34 includes six companies: Canon, Konica Minolta, Kyocera, Ricoh, Sharp, and Xerox, as well as “other.” The “other” category includes Epson, HP, and RISO, even though those companies cumulatively received only four votes as Best Production Print Manufacturer.

Ricoh was the clear winner in this category with 30%, followed by Canon (22%), Konica Minolta (17%), Sharp (16%), Xerox (11%), and Kyocera (2%). With Sharp’s addition to the production print category, the percentages of all the other production print OEMs declined between 1% and 4% from last year. However, we must offer a caveat regarding Sharp. Even though the company has introduced a formidable production print line, some dealers who voted for the company in this category aren’t yet selling Sharp production print products. As typically happens when asked to vote for “The Best” in any category, most dealers who selected the Best Production Print Manufacturer voted for their primary A3 provider. Kyocera and Xerox dealers led the way, with 100% of their votes going to their primary A3 provider. They were followed by Ricoh (82%), Canon (64%), and Konica Minolta (54%).

Unlike the other vendors who received votes in this category, Canon, Konica Minolta, Ricoh, and Xerox all have extensive production print lines. What impacts Xerox in our Survey is the scarcity of dealers participating (14). That’s partially true for Canon and Konica Minolta, with 39 and 42 dealers, respectively, participating. If those companies were on par with Ricoh (93 dealers) or Sharp (88), their percentages would be much higher.