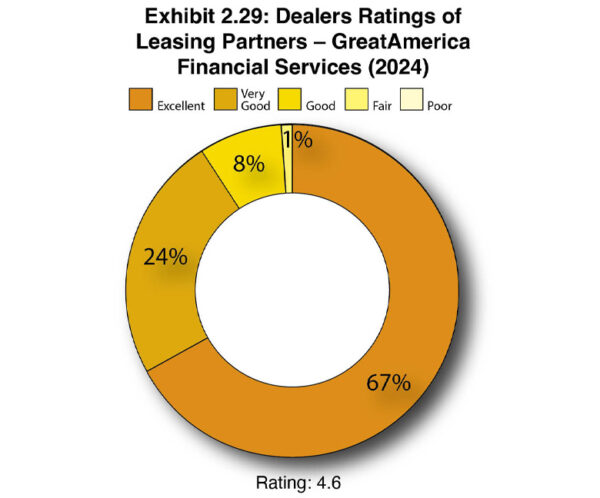

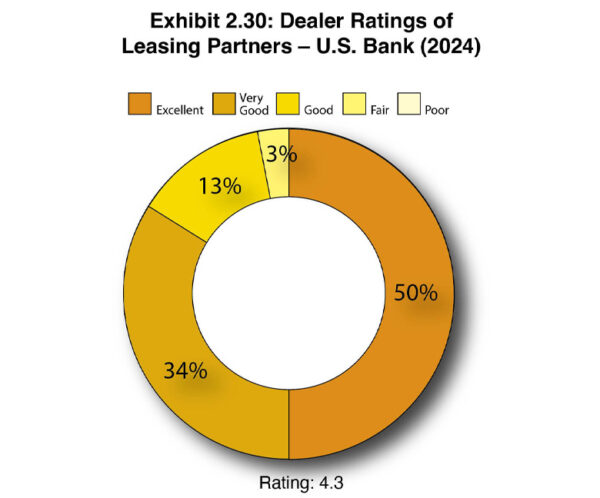

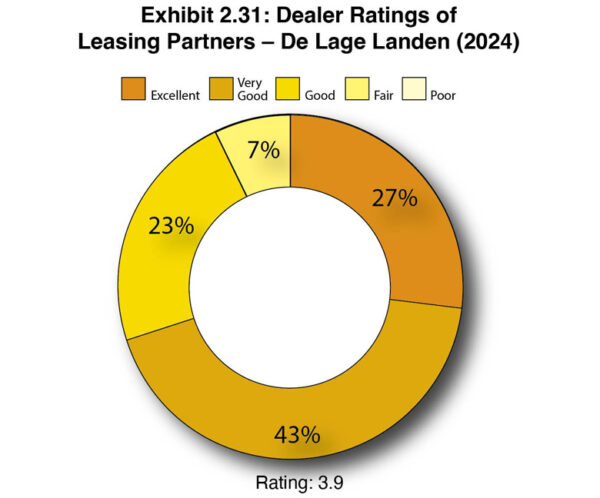

Exhibits 2.26-2.33

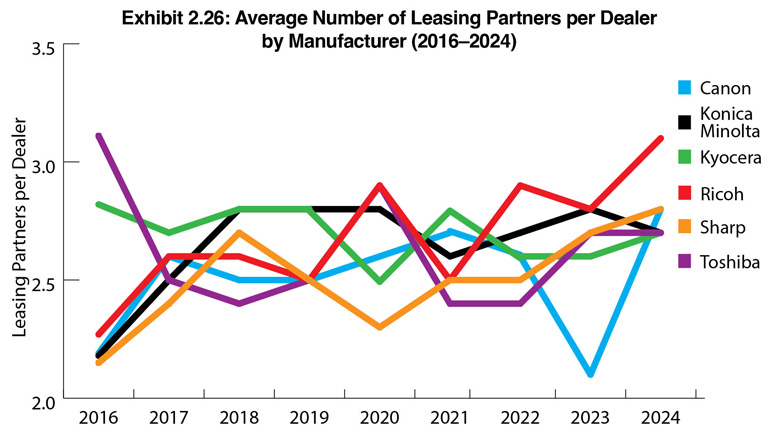

Where would office technology dealers and their customers be without their leasing partners? The dealers’ world and financial standing would be dramatically different without these valuable partners. The average number of leasing partners among the dealers aligned with the Big Six OEMs is one indication of just how vital the leasing companies are. After holding steady for the past four years at 2.6, the average number of leasing partners grew to 2.8 in this year’s Survey. Dealers identified 28 different leasing options (dealers could identify up to four leasing partners), including leasing from their OEM. That figure doesn’t include the 44 dealers that provide their own leasing.

When tabulating dealers’ ratings of their leasing partners, we only include those companies identified by 25 or more dealers as their primary leasing partner. For the fourth consecutive year, five leasing companies reached that figure: De Lage Landen (DLL) (44), GreatAmerica Financial Services (101), LEAF Commercial Capital (75), Wells Fargo (39), and U.S. Bank (32).

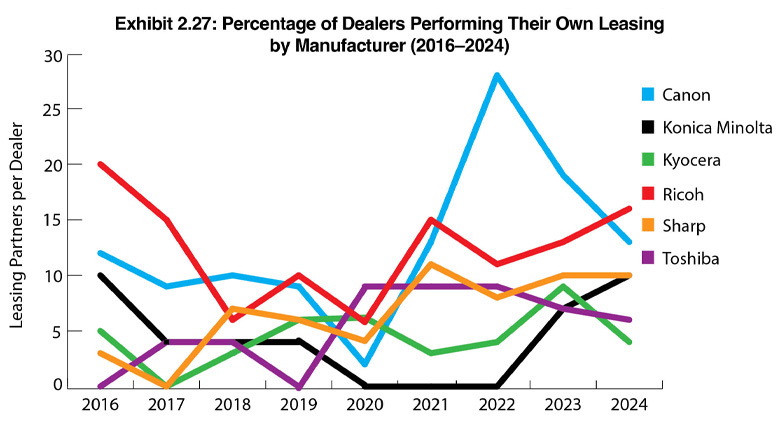

The number of dealers providing their own leasing decreased from 10% last year to 9.8% this year, not a difference of any magnitude. Most dealers that offer in-house leasing also partner with at least one other leasing company, providing customers with multiple options.

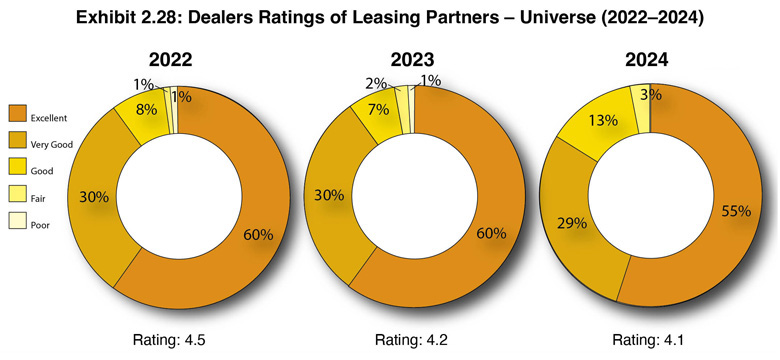

Dealers were asked to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” or “Poor.” In our current Survey, 55% were ranked as “Excellent,” a 5% decline from last year. No leasing companies received a “Poor” rating in this year’s survey, which indicates that dealers are satisfied with their leasing partners overall, although 3% received “Fair” ratings. Check out the comments section for some of the reasons for the ratings. Using a five-point rating system (with 5.0 being the highest rating), four of the five leasing companies that 25 or more dealers identified as their primary leasing partners received scores above 4.0, averaging 4.1, a decline from 4.2 last year. An asset for many of the leasing companies that have received high ratings is the variety of programs offered to meet the needs of dealers that are expanding their product and service offerings, the quality of their communications and customer service, and, as always, their rates.

GreatAmerica Financial Services and LEAF Commercial Capital received the most favorable ratings in our Survey, 4.6 and 4.5, respectively. A year ago, GreatAmerica received a 4.7 while LEAF received a 4.6 rating. The top two were followed by U.S. Bank (4.3) and Wells Fargo (4.2). U.S. Bank received the same rating as a year ago while Wells Fargo improved, albeit modestly, over last year, improving from 4.0 to 4.2. DLL, the only leasing company with a rating below 4.0 (3.9), also improved its rating from 3.4 a year ago.

The following comments offer additional details on dealers’ ranking of their leasing partners. As you’ll see in these comments and the earlier comments for the A3 and A4 providers, there are plenty of contrary views among dealers working with the same vendors.

De Lage Landen

Excellent: “My rep is wonderful, quick approvals, and when issues arise, able to resolve.”

Very Good: “Quick to fund, straight forward with the exception of an assignment issue in fine print, that said, ‘Client still responsible after assigned.’ I found that sleazy.”

Very Good: “We have the highest credit approvals with them than with any other leasing companies, and they especially work with us on tough accounts and provide great programs for the salespeople to earn extra money.”

Very Good: “Good communication, competitive rates; high staff turnover is a downside.”

Fair: “DLL’s funding speed is good, but sales vendor staff is poor with high turnover and hard-to-reach sales reps.”

GreatAmerica Financial Services

Excellent: “True partner in all areas. Thinks outside the box.”

Excellent: “GreatAmerica makes everything simple, efficient, and easy.”

Excellent: “They are responsive to all questions and concerns for customers and our dealership.”

Very Good: “GreatAmerica provides great service, but the rates are high and continue to increase.”

Good: “Rates could be better, support could improve.”

LEAF Commercial Capital

Excellent: “LEAF has proven to be a great partner with excellent sales support, timely responses for approval, and a back-office system that makes it simple for reporting info.”

Excellent: “LEAF always tries the best to help my customers. Libby Hess has been the best rep I’ve worked with from any leasing company!”

Excellent: “The LEAF team is outstanding. Quick response time. Works hard to get approvals. Extremely easy to work with.”

Very Good: “We have great trust in LEAF, and they are easy to deal with. Our only gripe is the occasional delay in funding after a sale is complete.”

Very Good: “I think they are great but need to be a little easier to work with on the end of leases or customer service to our customers.”

U.S. Bank

Excellent: “Great support and programs.”

Excellent: “Easy to work with, no backend surprises, and helpful with billing and problems.”

Very Good: “Easy to do business with and a clean-run organization.”

Good: “It’s getting harder to get approvals.”

Fair: “Just moved to U.S. Bank as primary. Still ironing out relationship.”

Wells Fargo

Excellent: “Excellent online portal, fast turnaround times, can always talk to a rep.”

Excellent: “It all falls into the service we get, and we are very happy with Wells Fargo and the wonderful team we work with.”

Very Good: “Wells Fargo has the most competitive lease rates and has made significant strides in technology and customer service.”

Good: “Internal support is questionable.”

Fair: “Not great support and not very flexible.”