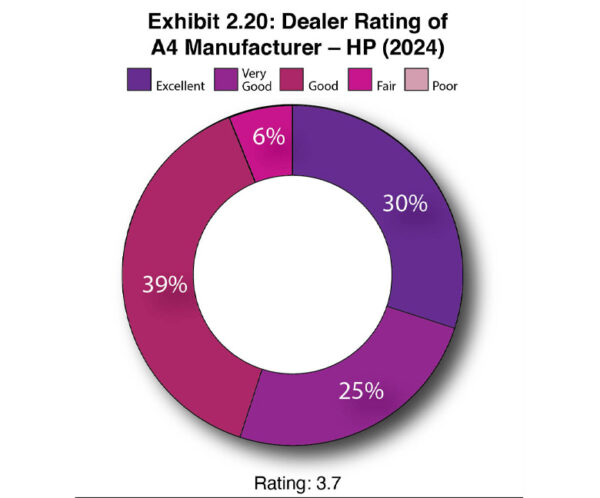

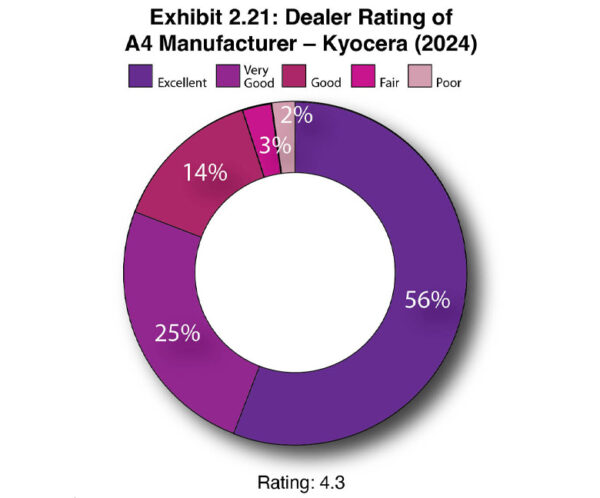

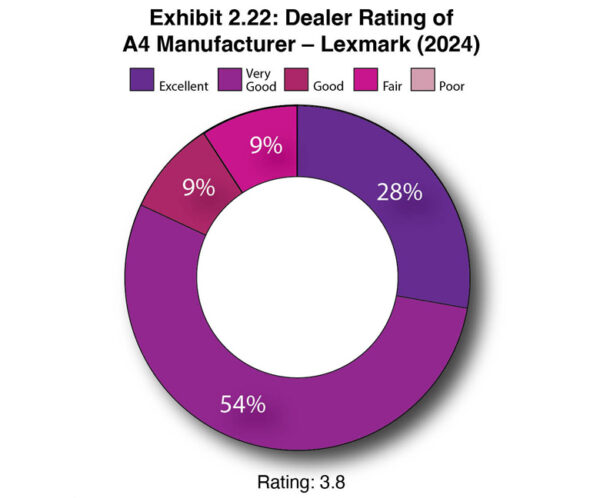

Exhibits 2.20-2.25

Historically, dealer ratings of their A4 OEMs tend to be lower than those of their A3 OEMs, with vendors outside the Big Six being judged more harshly (HP and Lexmark, for example). The other challenge that A4 has is that the margins of these products are lower compared to A3, which is one of the reasons many office technology dealers haven’t given the category much respect in years past. However, that’s changed with the emergence of hybrid work, which has made an A4 offering a must-have across the dealer channel.

Because not every Big Six OEM has a strong A4 offering, many dealers source A4 products from another vendor. Brother, Epson, HP, Lexmark, and Xerox are five manufacturers that dealers partner with to round out their A4 offerings. Thirty-one percent of respondents selected one of these other companies as an A4 provider, and 26% selected one of these as their primary A4 provider.

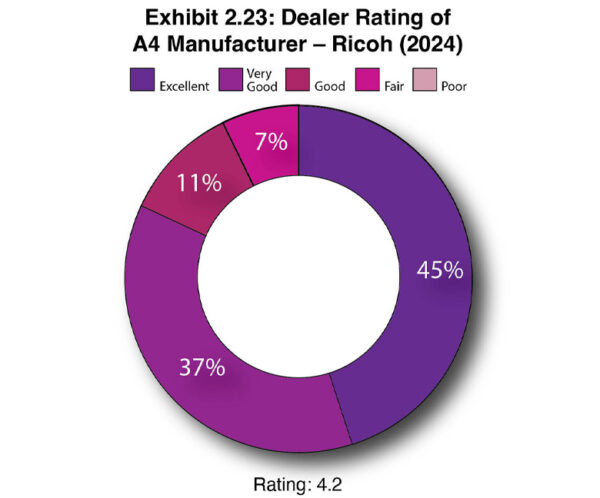

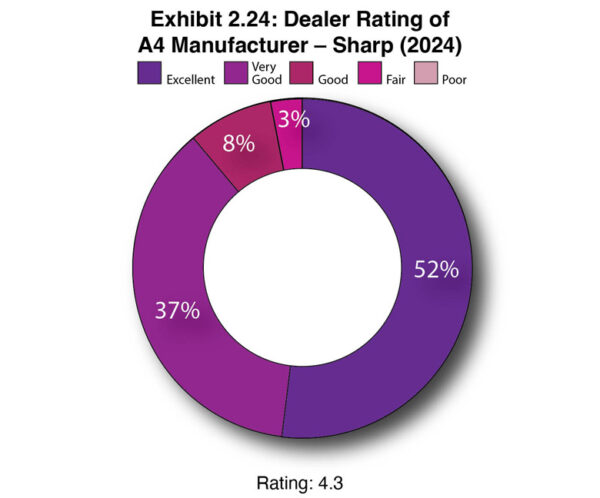

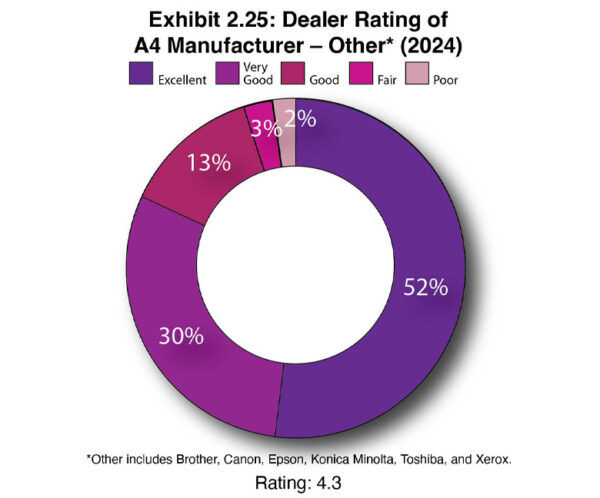

Exhibits 2.20 to 2.24 show the ratings of the A4 vendors with 30 or more dealers selecting them as their primary A4 provider. The OEMs that met this criterion included HP, Lexmark, Kyocera, Ricoh, and Sharp. Ricoh and Sharp are included primarily because of the large percentage of dealers associated with those two companies participating in the Survey and not necessarily because they offer a robust A4 line. Combined, those five OEMs represent 67% of primary A4 suppliers, the same percentage as last year. Exhibit 2.25 depicts the ratings of other A4 providers (Canon, Brother, Epson, Konica Minolta, Toshiba, Xerox) cited by fewer than 30 dealers.

Once again, the same two A4 providers as last year received ratings under 4.0: HP (3.7) and Lexmark (3.8). HP has received the lowest rating in the Survey in the past three years, although its rating is rising—from a low of 3.3 two years ago and 3.5 last year. Give the company credit; it’s tried to improve its programs and relationship with the independent dealer channel, but many dealers still aren’t won over. After watching Lexmark’s ratings decline in 2020 and 2021, it rebounded in 2022 to 4.1 before dropping to 3.8 last year. There was no change in its rating in this year’s Survey.

Kyocera and Sharp tied for the highest rating (4.3), followed by Ricoh at 4.2. Again, Ricoh and Sharp have limited A4 product lines, which, as you will see in the following comments, are a problem for dealers who use them as their primary A4 provider. That said, both companies are expanding their A4 offerings, and we expect that will alleviate some of the dealer criticism.

We’ve seen ratings improvements in the “Other” category over the past three years, from 3.9 two years ago to 4.2 last year and 4.3 this year. The ratings of the other OEMs in this category included Brother (4.4), Canon (4.2), Konica Minolta (4.0), Toshiba (4.5), and Xerox (3.7).

The following comments offer additional insights into the ratings for all A4 suppliers.

Brother

Excellent: “Great product line and willing to meet customers’ needs.”

Excellent: “Brother works hard at taking care of their dealers.”

Excellent: “Brother produces an affordable quality product, and their partnership with Toshiba helped to round out our offering.”

Very Good: “Brother has a great product, but sometimes it feels like they don’t know how to work with the dealer channel.”

Fair: “I am not a fan of the management style and product pricing.”

Canon

Excellent: “Excellent support and products. Management is fair and balanced, and programs contribute nicely to profitability and excellent aftermarket profitability.”

Excellent: “High quality for the price.”

Very Good: “Nice product selection, but also sold on Amazon and other places.”

Very Good: “Consistent.”

Good: “Products are getting better.”

Epson

Excellent: “Attention to our concerns.”

Very Good: “Great price point.”

Very Good: “Epson Inkjet is a solid alternative to laser, but not the same output quality.”

HP

Excellent: “HP has provided us the best technology with a great support system with the most profitable system for procuring MPS services from an A4 platform.”

Very Good: “Support is not very good, but the pricing is.”

Very Good: “HP doesn’t always seem to understand the dealer model. Also, requiring our client data is unacceptable.”

Good: “The quality of HP has declined in the past five years.”

Fair: “HP will never understand the dealer business.”

Konica Minolta

Excellent: “Great product and even better service.”

Excellent: “Good products, leadership, training.”

Very Good: “In my opinion, A4s are never as good as A3s, but Konica Minolta’s are very good compared to other brands I’ve seen.”

Fair: “Had lots of reliability problems with their A4s the last few years, and the response/support from them has been underwhelming.”

Poor: “Their A4 lines are weak and always have been. Brother does a better job in A4 in our opinion for the value.”

Kyocera

Excellent: “Kyocera is a reliable product with leading consumable life that pairs great with their warranty program and technical service.”

Excellent: “Kyocera does an amazing job in the A4 arena.”

Very Good: “Each new series keeps getting better.”

Good: “Good product, but difficult getting fax boards. Wi-Fi and DSDP are not standard.”

Good: “Kyocera is beginning to price themselves out of the business.”

Lexmark

Excellent: “Lexmark has some of the best people in the industry. They know how to treat their dealers. It’s been a tough year for them, but they still take great care of us.”

Very Good: “Inventory levels have been a pain point, but other than that, great products and pricing.”

Very Good: “Lexmark has been a great partnership for us. Our reps are on board big time, and we are confident in presenting their products to our customers. Their support is strong as well. There have been a few issues with supplies recently, but it seems we are past those.”

Fair: “The days of ‘Excellent’ and ‘Very Good’ are gone. Suppliers are only order-takers.”

Fair: “Need to get their act together.”

Ricoh

Excellent: “Best product they have produced, always assisting by any means necessary.”

Excellent: “Reliable and good price point.”

Very Good: “Ricoh’s product diversity and reliability drops slightly with A4 units.”

Good: “Just OK.”

Fair: “Supply and parts life do not always hit target yields being promoted.”

Sharp

Excellent: “Sharp’s A4 keeps improving with more options.”

Excellent: “I wish Sharp had more of its own OEM A4 products, but the A4 it does have is the best.”

Very Good: “The Sharp line doesn’t currently address all A4 needs competitively. They are working on rolling more out.”

Good: “Great products. Confusing and complicated programs. Arrogant.”

Fair: “Poor strategic plan for product evolution, repeated start/stop, which causes negativity among end users.”

Toshiba

Excellent: “Outstanding warranty, price point.”

Excellent: “Product has been excellent with great support on the sales and service side.”

Very Good: “Product variety.”

Good: “No differentiation.”

Good: “Pricing is terrible, and service isn’t much better.”

Xerox

Excellent: “Very dependable box.”

Good: “Inventory issues with supplies.”

Good: “Harder to work with and changing programs.”

Good: “Limited options, hard to compete with costs of HP and Lexmark.”

Good: “Most of the time, I can get the equipment on time, but not always.”