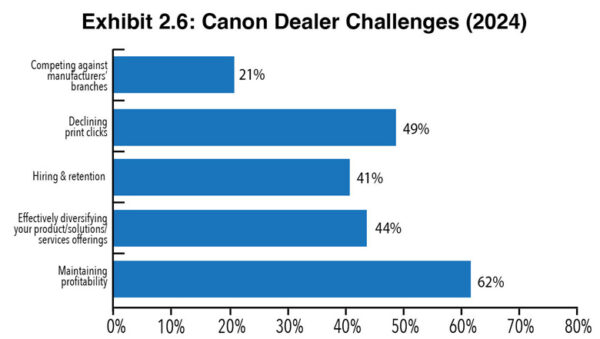

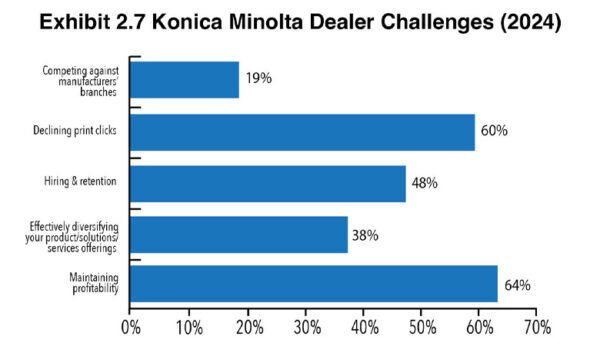

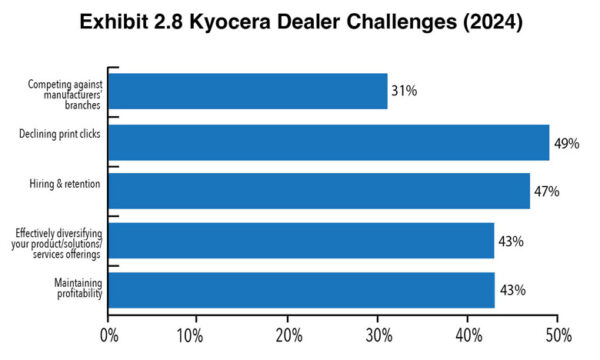

Exhibits 2.1-2.11

Until this year, we began Part II of our Annual Dealer Survey examining “Areas of Greatest Concern.” This year, we’re changing the heading to “Top Challenges.” Sure, it’s a matter of semantics, but we feel that “challenges” more accurately describe how dealers view this factor.

After expanding the number of challenges (concerns) to 13 two years ago, we found that five stood out from the rest by a wide margin, with only a small percentage of dealers selecting the other eight options among the choices. Because of that, last year, we simplified this portion of our Survey by asking dealers to choose from five options. Dealers also had the option of identifying “other” challenges.

The five options included the following:

- Competing against manufacturers’ branches

- Declining print clicks

- Hiring and retention

- Effectively diversifying your product/solutions/services offerings

- Maintaining profitability

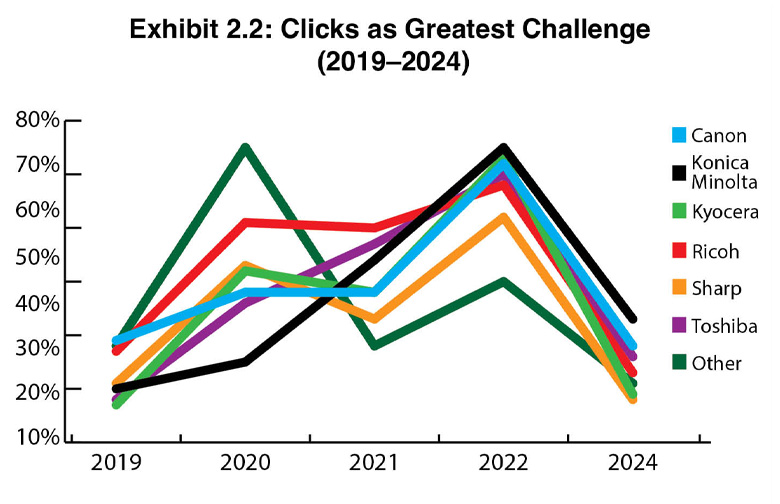

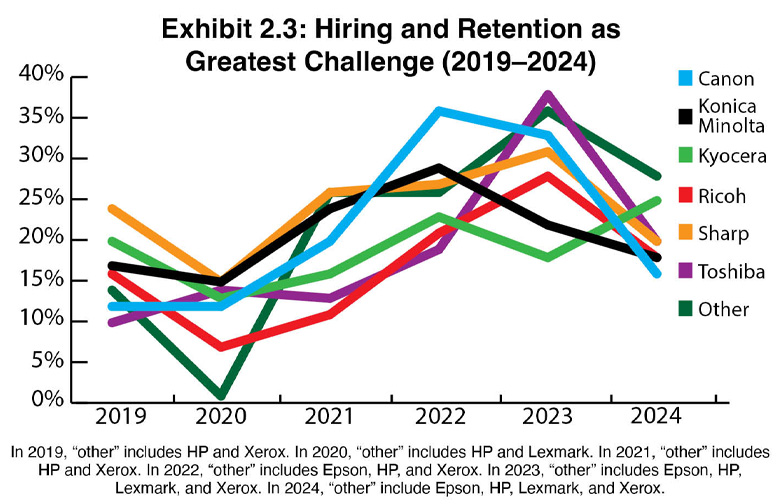

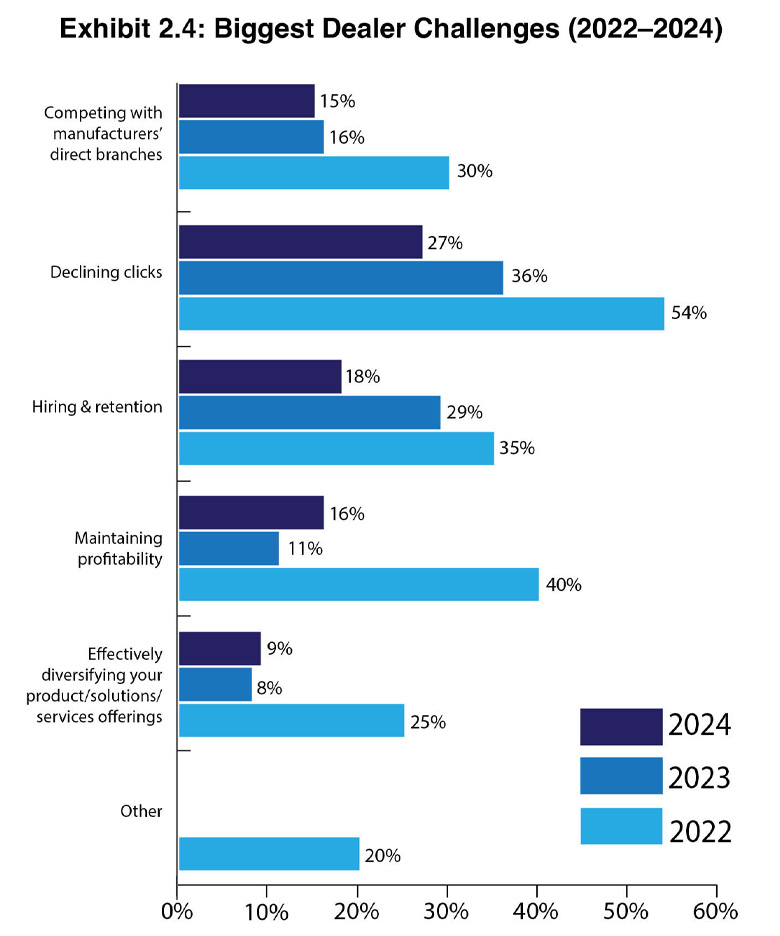

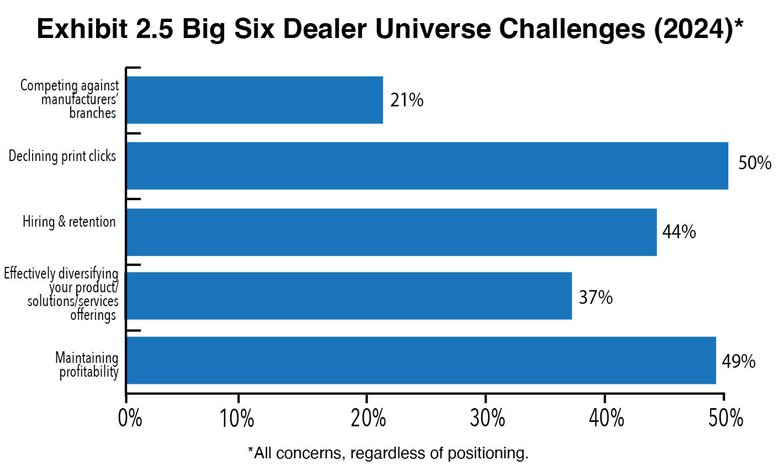

We then asked dealers to select three challenges from the list rather than identifying an unlimited number as they had in the past. The exhibits included in this section reflect the dealer challenges of each of the Big Six OEMs, as well as charts for the top three challenges (Exhibits 2.1–2.3) identified in the Survey, a chart that identifies those challenges listed by dealers as their top challenge (Exhibit 2.4), and how each of the five challenges ranked across the dealer universe regardless of positioning (Exhibit 2.5).

For the fifth consecutive year, the No. 1 challenge (Exhibit 2.4) was declining clicks (27%), a 9% decrease from last year and half of what it was two years ago (54%). We surmise that dealers are beginning to accept the inevitable. Undoubtedly, the pandemic and the shift to hybrid work have been factors for dealers identifying this as their biggest challenge before last year. However, focusing on other areas of the business beyond print may be another reason more dealers view declining clicks as less of a challenge than in the past. The No. 2 challenge, hiring and retention (18%), declined by 11% from last year. Two years ago, hiring and retention was identified as the leading challenge by 35% of dealers, driven by the so-called “Great Resignation” and staffing issues resulting from pandemic-related staff downsizing in 2020. Today, hiring and retention as a dealer’s biggest challenge has fallen to almost where it was before 2020 (17%). The third most significant challenge we’ve included for the past five years in our Survey is maintaining profitability. After reaching a high of 40% in our 2022 Survey, it dropped to 11% last year before climbing into third place this year at 18%.

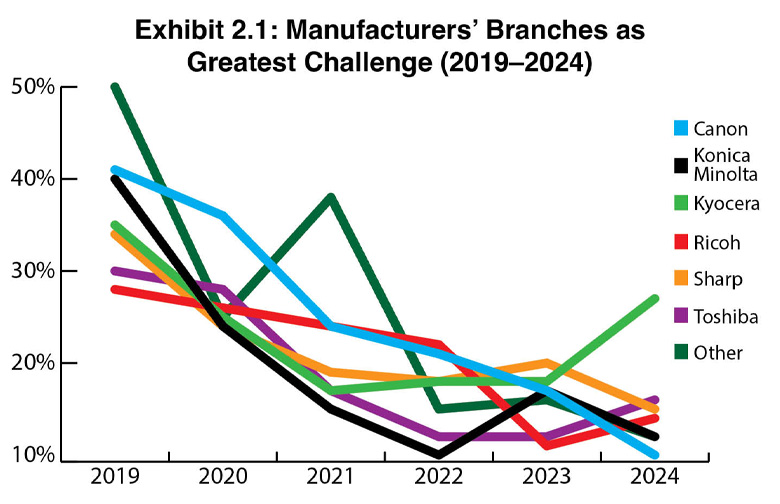

Competition from manufacturers’ direct branches frequently was identified as dealers’ No. 1 challenge in past Surveys. However, as OEMs took notice and adjusted to level the playing field, this challenge has declined for the past few years. For example, it declined to 16% from 30% two years ago and declined by 1% to 15% this year. The OEMs have done an excellent job of alleviating some of the issues, mainly around pricing, that have been a source of contention in the channel. That doesn’t mean problems don’t still exist, but we’re not hearing about them as much as we had in the past.

The final challenge was diversifying your product/solutions/services offerings (9%). This challenge has been growing, and we expect it to move into the double digits in future Surveys as the pressure to compensate for declining clicks increases. In 2020, only 1.4% of dealers selected this as their top challenge, and only 1.3% of dealers in 2021. Last year, this was the No. 1 challenge for 8% of dealers.

When examining all dealer challenges regardless of positioning (Exhibit 2.5) among the Big Six Dealer Universe, the percentage of dealers concerned about declining clicks is falling even though it still ranks as the leading challenge with 50% of respondents. Last year, 57% of dealers participating in our Survey identified this as a challenge compared to 80% two years ago. This trend is still surprising, especially with many dealerships whose core business is still heavily focused on print technology. One might think they would be more concerned about declining clicks even as they diversify into other areas.

Hiring and retention has dropped from second to third place among dealers’ overall challenges, from 65% two years ago to 54% last year to 44% this year. Based on conversations with dealers and recruiting firms like Copier Careers, challenges around hiring and retention were primarily related to filling sales positions. However, with an aging service staff, that position has become equally critical to dealers across the country.

- 780 Nov24 Ex2.11

After four consecutive years as the third leading challenge, dealers identified maintaining profitability as their No. 2 challenge (49%). Last year, 41% of respondents noted this challenge, down from 56% two years ago. As we reported in Part I of our Survey, 65% of dealers reported revenue increases, while 26% were the same as the previous year. However, this information can be deceptive as we only track the direction of dealer revenues in our Survey. Even if a dealer reports revenues are up, that doesn’t mean the dealership was profitable.

The percentage of dealers who identified effectively diversifying your product/solutions/services offerings as a challenge increased slightly from 35% the year before to 37% this year. The evidence is clear at dealer events and in articles in The Cannata Report and other office technology industry trade publications that dealers are diversifying. It seems that more dealers are embracing this opportunity rather than fearing it.

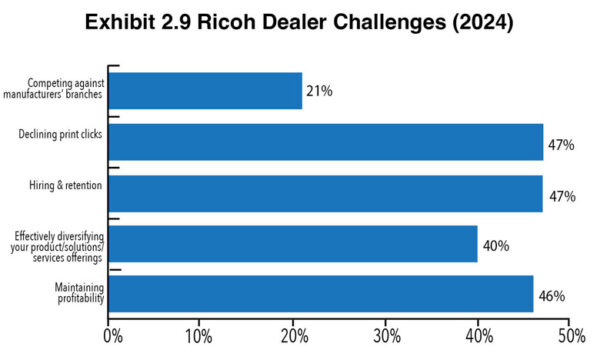

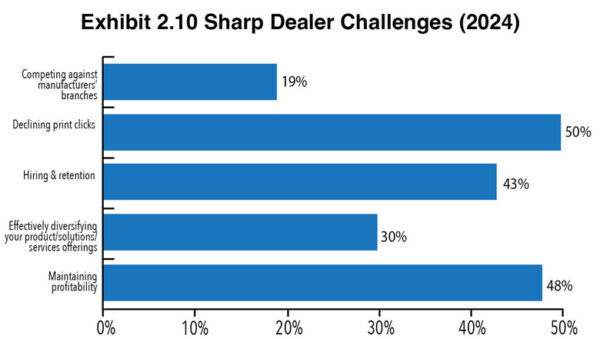

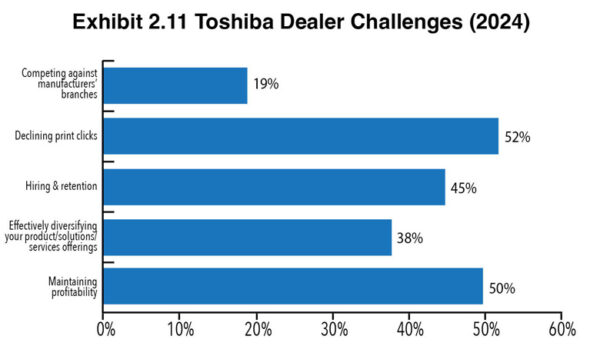

Exhibits 2.6 to 2.11 identify the challenges, regardless of positioning, of dealers affiliated with each of the Big Six OEMs. Konica Minolta dealers (60%) are most concerned with declining clicks, followed by Toshiba dealers (52%), and Sharp dealers (50%). Kyocera dealers (49%) and Ricoh dealers (47%)—still significant percentages—are the least concerned about declining clicks. The percentage of dealers concerned about declining clicks has dropped dramatically from two years ago, when challenges ranged from 80% to 90%. It’s safe to say that more dealers have accepted the inevitability of declining clicks and must focus on diversifying to compensate for that decline.

Dealers representing four Big Six OEMs are more challenged with effectively diversifying their product/solutions/services offerings than a year ago, with Canon dealer’s percentages growing from 32% to 44%, Kyocera dealers from 37% to 43%, Ricoh dealers from 28% to 40%, and Toshiba dealers from 33% to 38%. Meanwhile, only 38% of Konica Minolta dealers and 30% of Sharp dealers view this as a challenge compared to 49% and 34% a year ago. We don’t believe the higher or lower percentages should be viewed as negatives because many dealers who express this as a challenge are actively diversifying with varying degrees of success. These percentages include many dealers that are finding some diversification opportunities aren’t as daunting as they might have assumed before taking on these products, solutions, or services, whether it’s managed IT, production print, VoIP, or some other opportunity.

Hiring and retention challenges among dealers representing the Big Six OEMs ranged from a low of 41% (Canon dealers) to a high of 48% (Konica Minolta dealers). We expect hiring and retention to remain a top three challenge across the independent dealer channel for the foreseeable future, especially since this tends to be the nature of a sales-driven business. Hiring and retention issues require creative solutions, and we’re talking with more dealers than ever that are taking steps to find the best available talent for their organizations. Whether that’s hiring from outside the industry, identifying talent while still in college before they enter the workforce, or recruiting mature talent with industry experience, dealers aren’t being complacent.

Dealers also expressed a variety of “other” challenges, including:

- Private equity owned dealers

- Training sales reps to sell “diversified” products

- Finding and hiring techs

- Existing team capabilities

- Cash flow while experiencing high growth

- Replacing tenured sales reps who are getting ready to retire

- Backorder issues

- Interest rates

- Cybersecurity liability

- New laws and regulations