This year’s Survey reveals an industry undeterred by past obstacles and the latest challenges.

Don’t underestimate the perseverance of the office technology dealer channel. After being battered and bruised by the COVID-19 pandemic and supply chain issues, we can emphatically say that the channel continues to recover. That’s not to say some dealers aren’t facing financial challenges from the lingering effects of the pandemic and the supply chain, but many dealers in our 39th Annual Dealer Survey are meeting and exceeding their pre-COVID revenues, just as we witnessed in last year’s Survey.

Our 2021 Annual Dealer Survey found that revenue was severely impacted by the pandemic, with dealers experiencing the biggest year-over-year decline in the survey’s history. That was followed by a comeback year in 2022, with a few dealers reporting record revenues. That trend continued last year and again this year, with dealers strengthening their core businesses and ramping up their diversification initiatives.

Survey Objectives

When The Cannata Report launched the first Survey 39 years ago, we aimed to provide independent dealers with a place to share their views about their suppliers and competitors and acknowledge the manufacturers that stand out in supporting their channel partners. These objectives remain just as important today. Our Survey results provide a deeper understanding of how dealers are performing and identify specific areas of concern that frequently are of interest to their manufacturers.

We firmly believe that dealer comments and observations are an asset to other dealers who can use them to improve their businesses. Likewise, manufacturers find them helpful for improving their relationships with their dealer partners.

By the Numbers

Survey questions assess where dealers stand in 2024 based on their 2023 performance. When we reference numbers from the 2024 Survey, they represent our dealer respondents’ 2023 performance. When referring to “last year’s Survey,” we refer to our 38th Annual Dealer Survey, published consecutively in our October and November 2023 issues, which references our dealer respondents’ 2022 performance.

This year, we provided four of the “Big Six” A3 manufacturers—Kyocera, Ricoh, Sharp, and Toshiba—and LEAF Commercial Capital, ACDI, U.S. Bank, and Xerox with a link to the Survey. Each then sent the link to their dealers, encouraging them to respond.

We feature Survey results in our October and November 2024 issues and on thecannatareport.com. Results also are shared with non-subscriber dealers who completed the Survey and provided their contact information.

Methodology

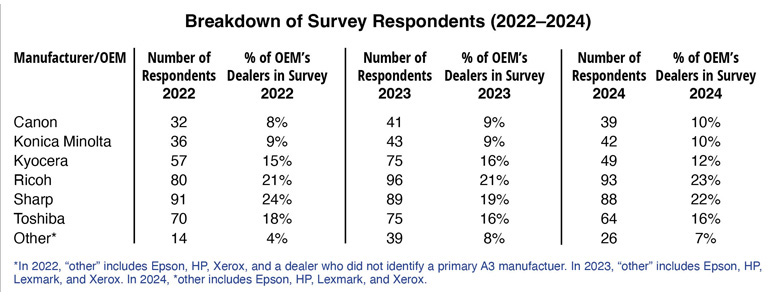

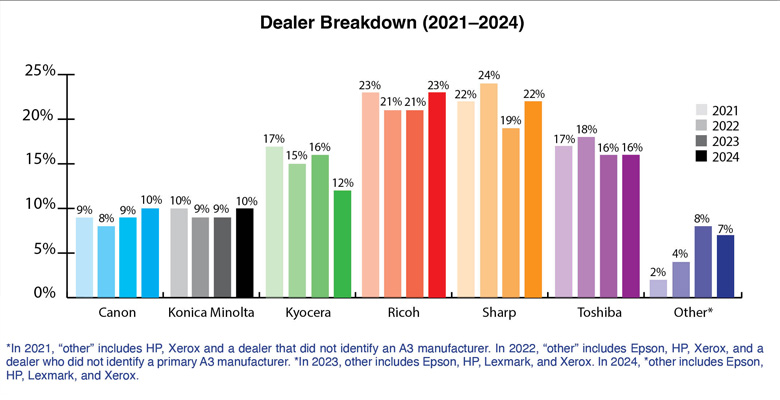

We conducted this year’s Survey online for the 11th consecutive year. This year, the Survey yielded 401 responses, 57 fewer than last year (after we deleted duplicates, those with corrupted data, and incomplete submissions). Across the history of the Survey, the numbers from dealers representing the “Big Six” OEMs—Canon, Konica Minolta Business Solutions U.S.A., Inc. (Konica Minolta), Kyocera Document Solutions America, Inc. (Kyocera), Ricoh USA, Inc. (Ricoh), Sharp Imaging and Information Company of America (Sharp), and Toshiba America Business Solutions, Inc. (Toshiba)—vary from year to year. As a result, some years are more balanced than others when accounting for the OEMs dealers identify as their primary A3 suppliers. The past few years haven’t been as balanced as we would have liked. For example, only 39 Canon, 42 Konica Minolta, and 49 Kyocera dealers participated this year. In contrast, Ricoh, Sharp, and Toshiba dealers dominated with 93, 88, and 64, respectively.

For most of this Survey, we used only the responses from those dealers representing the Big Six, totaling 375 compared to 419 in last year’s Survey. The “Other” group includes dealers representing Epson, HP, Lexmark, and Xerox. We note where we include responses from the “Other” group. All respondents’ information is included in the Survey results related to total revenue, average percentage of revenue, acquisitions, production print, areas of concern, and the Frank Award selections, which will be presented at our 39th Annual Awards & Charities Gala in November.

Response Rate

After receiving the most responses in the Survey’s history last year, we were initially disappointed to see the number of participants drop from 458 to 401 this year. However, upon further reflection, we still believe this is a strong showing (the second-highest number of participants in the Survey’s history), especially considering the many acquisitions, which have reduced the independent dealer population during the past 12 years. Another factor contributing to fewer responses may be that some of the private equity owned dealer organizations no longer participate in the Survey.

Acknowledgments

We appreciate the efforts of LEAF Commercial Capital, ACDI, U.S. Bank, Xerox, Kyocera, Ricoh, Sharp, and Toshiba, all of whom provided subscription incentives to support this year’s Survey.