This year’s Survey reflects the status of the document imaging industry during the second year of the pandemic.

This is the second year we have been gauging the impact of the COVID-19 pandemic on the independent dealer channel. Last year’s Survey, particularly in the revenue portion, was pretty much what we expected based on our conversations throughout the year with dealers and OEMs. Annual revenue experienced the biggest year-over-year decline in the history of the Survey. This year, we examine how the channel has been recovering and inching toward pre-pandemic performance after weathering the darkest days of the pandemic when many customers’ businesses were temporarily, or permanently, closed or had significant numbers of employees working from home.

Creating a Dialog

When Frank G. Cannata launched that first Survey 37 years ago, his objective was to provide independent dealers with a venue to share views about their suppliers and competitors, and acknowledge the manufacturers that excel in supporting their channel partners. True to The Cannata Report’s original intent, these objectives are just as important today. These Survey results offer a deeper understanding of how dealers are performing and identify specific areas of concern, which are often of interest to their manufacturers. We believe most respondents are candid in their assessments. These comments and candid observations should be viewed as an asset to other dealers that can use them to improve their dealerships and to the manufacturers that can use them to improve their relationships with their dealer partners.

By the Numbers

Our Survey questions are designed to assess where dealers stand in 2022, based on their 2021 performance. When we reference numbers from the 2022 Survey, they represent our dealer respondents’ 2021 performance. When we refer to “last year’s Survey,” we are referring to our 36th Annual Dealer Survey, published consecutively in our October and November 2021 issues, which reference our dealer respondents’ 2020 performance.

This year, we provided four of the “Big Six” A3 manufacturers—Kyocera, Ricoh, Sharp, and Toshiba—with a link to the Survey. Each then sent the link to their dealers, encouraging them to respond.

The complete results of the Survey are featured in our October and November 2022 issues, as well as on www.thecannatareport.com. Results are also shared with non-subscriber dealers that completed the Survey in its entirety and provided their contact information.

Methodology

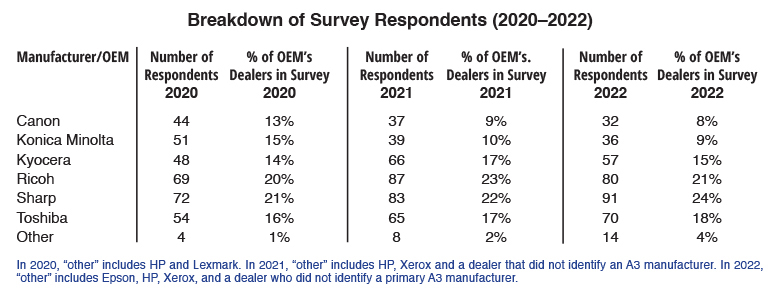

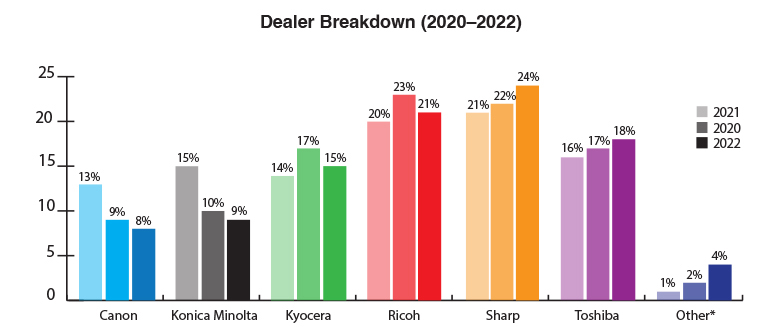

We conducted this year’s Survey online for the ninth consecutive year. This year, the Survey yielded 380 responses, five fewer than last year—after we deleted duplicates, those with corrupted data, and incomplete submissions. Across the history of the Survey, the numbers from dealers representing the “Big Six” OEMs—Canon U.S.A., Inc. (Canon), Konica Minolta Business Solutions U.S.A., Inc. (Konica Minolta), Kyocera Document Solutions America, Inc. (Kyocera), Ricoh USA, Inc. (Ricoh), Sharp Imaging and Information Company of America (Sharp), and Toshiba America Business Solutions, Inc. (Toshiba)—vary from year to year. As a result, some years are more balanced than others, with 2016 being one of the most balanced when accounting for OEM population in the history of the Survey. The past two years have not been as balanced as we would have liked. For example, this year, only 32 Canon and 36 Konica Minolta dealers participated. That’s a notable decline from our 2020 Survey where 44 Canon dealers and 48 Konica Minolta dealers participated.

For most of this Survey, we only used the responses from those dealers representing the Big Six, totaling 366. The group labeled “Other” comprises dealers representing Epson (2), HP (9), and Xerox (2), as well as one dealer who did not identify a primary A3 manufacturer. When we included responses from the “Other” group, it is noted. All respondents’ information was included in the Survey results related to total revenue, average percentage of revenue, acquisitions, production print, areas of concern, and the Frank Award selections that will appear in November in Part II of our Survey.

Response Rate

Although we did not receive as many responses to this year’s Survey compared to last year when we received the largest number of responses (385) in the Survey’s history, we were still satisfied by the number of dealers who participated. This year’s number of responses (380) ranks second in the history of the Survey.

The Survey continues to present a picture of an industry impacted by the biggest business disruption since its launch in 1985. Since its inception, the Survey has reflected the many technological changes, economic upheavals, new business models, and other transitions that have shaped and will continue to shape the channel. During the past two years, the channel was challenged by an unprecedented event of enormous proportions. Those two years were inflection points for the industry with the pandemic accelerating dealers’ adoption of new products and services to remain relevant for customers, no matter how and where those businesses are operating.

Acknowledgments

We deeply appreciate the efforts of Kyocera, Ricoh, Sharp, and Toshiba—all of which provided subscription incentives in support of this year’s Survey. In addition, we thank dealer groups BPCA, CDA, and SDG for encouraging their members to participate.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.