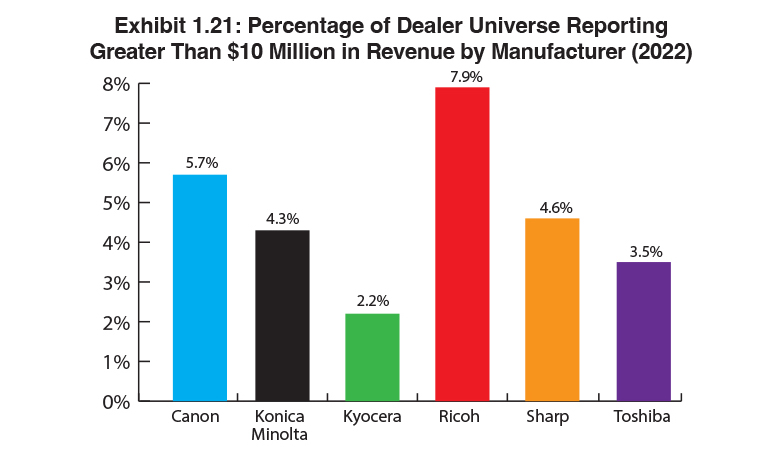

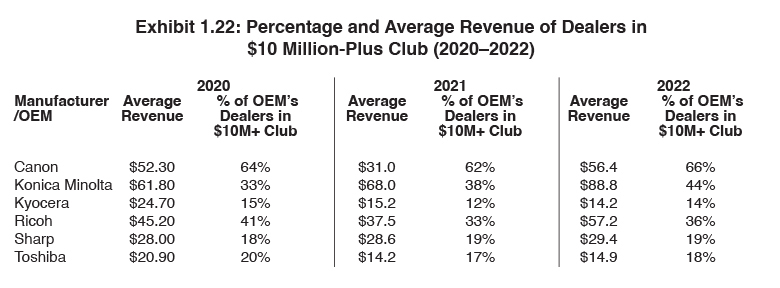

Exhibits 1.21-1.22

Since 2019 we’ve been tracking dealers with revenues of $10 million or greater, calling it the “$10 Million-Plus Club.” Prior to then, we focused on dealers with revenues of $7.5 million and higher, and before that, dealers with revenues of $5 million and higher. Our reasoning for tracking dealers in these various revenue ranges over the years was that we felt at the time that those dealers were large enough to invest in new products and services to grow the business and expand through acquisition. However, as the average dealer revenue has grown to $17 million since 2015, we decided to make the club even more exclusive, particularly as it has become more challenging for dealers with less than $10 million in revenue to grow their businesses in the same way as their more well-heeled peers. That’s not to say they can’t do it, but that $10 million threshold is much more realistic for driving future growth.

Smaller dealers with revenues under $10 million are prime targets for acquisition, even if most dealers currently being acquired have revenues of $5 million or less. As the market for suitable acquisition targets becomes more competitive and acquirers more discriminating, we expect to see their sights set on dealerships above $5 million with the MIF and reach to accelerate the acquirer’s growth targets.

Last year, we noted that the most surprising revelation in our summation of the $10 Million-Plus Club was how the percentage of dealers in this now-not-so-exclusive club had grown in the past year, even during the pandemic. We surmised that the reason for that was the higher number of dealers participating in our Survey. We maintained it had nothing to do with dealers growing their revenues during the pandemic, which was most definitely not a factor. Exhibit 1.21 identifies the percentage of our dealer universe reporting revenues greater than $10 million by manufacturer, while Exhibit 1.22 indicates the percentage and average revenue of dealers in the $10 Million-Plus Club by manufacturer. There was quite the deviation in the percentage of dealers reporting revenues of more than $10 million this year compared to last year. Last year, 45% (172 dealers) reported revenue of over $10 million, while this year, that percentage dropped to 33% (125 dealers). Whether this is due to acquisitions or a larger pool of participants in the lower revenue ranges, the $10 Million-Plus Club just became more exclusive.

Konica Minolta, Canon, and Ricoh dealers continue to rank in the top three, respectively, in terms of the highest average revenue (Exhibit 1.22). Despite only 36 Konica Minolta dealers participating in our Survey, the average percentage of revenue attributed to Konica Minolta was $88.8 million, the largest figure we’ve ever seen in this portion of our Survey. Driving those numbers upward were five Konica Minolta dealers reporting more than $100 million in revenue, including two with more than $380 million in annual revenues. The average revenue for dealers representing the Big Six in the $10 Million-Plus Club is $43.5 million, up from $32.4 million last year and $38.7 million two years ago. When only factoring in the average revenues of Canon, Konica Minolta, and Ricoh dealers, that average rises dramatically to $67.4 million compared to $45.4 million a year ago.

For the 20 dealers participating in our Survey that are hovering just below the $10-million revenue mark with revenues in the $8 million to $9.7 million range, diversifying outside of traditional office print may be the catalyst to bump them up to the $10 Million-Plus Club. Diversifying is more critical than ever before, with clicks on the decline and an expanding hybrid workforce. Each of the Big Six companies has been diversifying its product offerings beyond traditional office print, and as shown in the section on Greatest Growth Opportunities, dealers view some of these offerings as drivers for future growth and inclusion in the $10 Million-Plus Club.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.