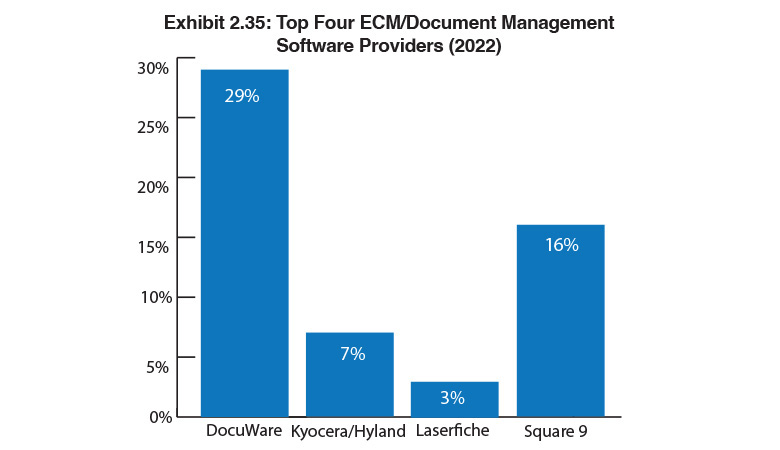

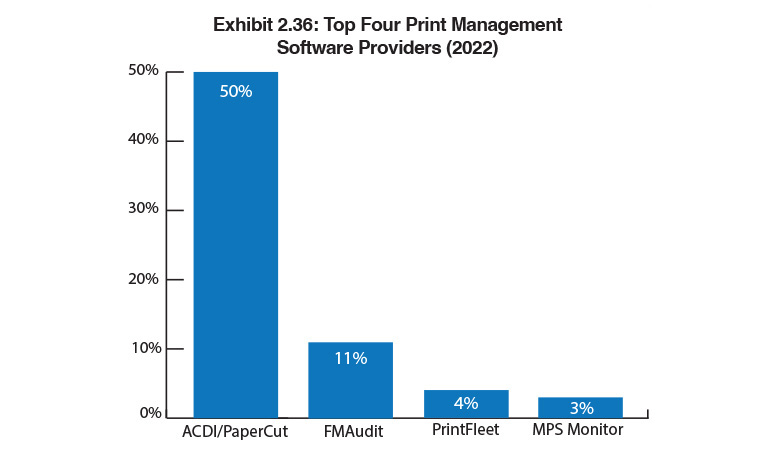

Exhibits 2.35-2.36

For the past nine years, we have asked dealers to identify the companies that provide them with the software and support that allows them to compete the most effectively. For the fourth year, we have asked dealers to identify the ECM/document management provider that provides the best pre- and post-sales support, as well as the print management provider that offers the same.

Prior to separating these ratings into those two categories, this category was a free for all, a hodgepodge of disparate solutions that we concluded did not offer a true representation of the primary software solutions that dealers were selling.

We did see some improvement in the number of dealers who selected an ECM/document management provider compared to a year ago. This year 213 of the 380 dealers (56%) are selling an ECM/document management solution compared to 187 of the 385 dealers (49%) participating in last year’s Survey. For print management, 211 of the 380 dealers (55%) participating in our Survey selected a print management provider. Last year, 192 of the 385 dealers (50%) identified a print management provider. Note that the percentages in Exhibits 2.35 and 2.36 only reflect the dealers that responded to these two portions of the Survey rather than the entire universe of dealers participating in the Survey.

Two companies continue to stand out in the ECM/document management category—DocuWare and Square 9. DocuWare was selected by 29% of the dealers, a 1% increase from last year, while Square 9 was identified by 16% of dealers responding to this question in our Survey, a 5% decline from the previous year. No other ECM/document management provider was even close to these two vendors. In third place was Kyocera, buoyed by its Hyland Software offering (7%), followed by Laserfiche at 3%. We keep expecting Laserfiche to gain more traction in our Survey as more dealers tell us that they are selling this solution, but that has yet to be reflected in our Survey results. As for DocuWare, its acquisition by Ricoh in 2019 has made a huge difference with 44 Ricoh dealers identifying it as their top ECM/document management provider. Only 18 dealers aligned with another manufacturer selected DocuWare. We surmise that the acquisition has made some dealers hesitant to partner with DocuWare because of the Ricoh connection, even though DocuWare is a separate organization.

In the print management category, it’s not even close, with PaperCut/ACDI identified by 50% of dealers that identified a print management provider, followed by FMAudit at 11%, PrintFleet at 4%, and MPS Monitor at 3%. This is the first year that MPS Monitor has received more than a single vote in our Survey, perhaps reflecting its recent efforts to raise its profile in the independent dealer channel.

We still believe that the penetration rate of print management software is much higher than the 55% of dealers that responded to this question in our Survey, especially because it is essential for any dealer offering MPS. As noted in Part 1 of our Survey, ECM/document management was cited by 50% of dealers as a viable diversification opportunity. With the decline of clicks and the growing emphasis on digital transformation (DX), ECM/document management should be in most dealers’ wheelhouses if it isn’t already.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.