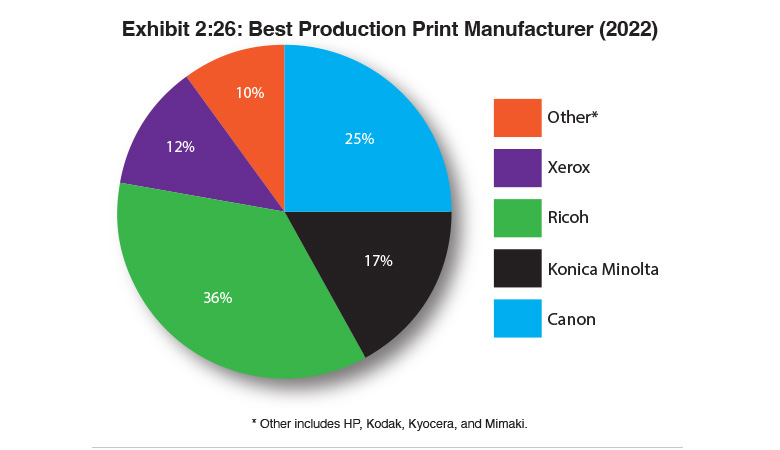

Exhibit 2.26

In Part 1 of our Survey in the October issue, production print was identified by 46% of dealers as a growth opportunity, although only 15% identified it as their No. 1 growth opportunity, a 7% increase from last year. Because we do not consider light production as production print when compiling the manufacturers that dealers identify as their leading production print suppliers, we exclude Sharp and Toshiba, two companies that do not offer production print products. As a result, four companies make the cut in Exhibit 2.26—Canon, Konica Minolta, Ricoh, and Xerox. All four carry full production print lines. Collectively, these companies received recognition from 135 (of 143 who voted in this category) dealers that said these manufacturers were the best. We did not factor in the 37 dealers that selected either Sharp or Toshiba. The “other” category in Exhibit 2.26 includes HP, Kodak, Kyocerya, Mimaki.

Ricoh ranked in the No. 1 position among production print manufacturers with 36%, ahead of Canon (25%), Konica Minolta (17%), Xerox (12%), and Kyocera (5%). Of the 59 dealers that selected Ricoh, eight (14%) identified another OEM as their primary A3 provider. That is in sharp contrast with Canon, Konica Minolta, Kyocera, and Xerox where most of their support came from their own dealers.

We are confident that Canon, Konica Minolta, and Ricoh will continue to dominate this category in future Surveys. However, until we see participation from Canon and Konica Minolta dealers in our Survey rise, supplanting Ricoh here will be a significant challenge. Although Kyocera and Xerox are receiving more appreciation from dealers for their efforts in production print, those two companies are equally challenged albeit for different reasons in our Survey rankings. For Kyocera, it’s only having a single production-print device, and for Xerox, it’s the modest number of dealers contributing to our Survey that carry the line. Only 20 dealers among the 135 dealers selling production print sell Xerox production.