Exhibit 1.26

The pandemic and the hybrid workforce have accelerated the decline of office print. No matter who you speak with, no one believes that it will return to pre-pandemic levels. For some dealers—notably those with the appropriate financial resources and market opportunities—production print represents an opportunity to capture clicks outside of the traditional office.

This year, 35% of respondents offer production print, an almost identical percentage to the 35.6% last year. Please note that when tabulating the number of dealers that sell production print, we eliminated dealers that said they offered production print but are actually selling light production, which we do not categorize as production print. For example, there were nine dealers that identified Sharp as their primary production print brand; however, Sharp does not have a true production device in its line. That’s one of the challenges we encounter every year, dealers claiming that they are in production print, when the machines that they sell are light production. Our definition of production print is clearly stated in our Survey form as such:

We define production print as the marketing of a digital press with a digital front-end such as a Fiery controller that enables variable data printing, at minimum. We do not consider light production devices or devices sold for print-for-pay as production print.

By asking dealers to identify the primary production print product they sell, we were better able to provide a more realistic assessment of what dealers are actually doing in this segment.

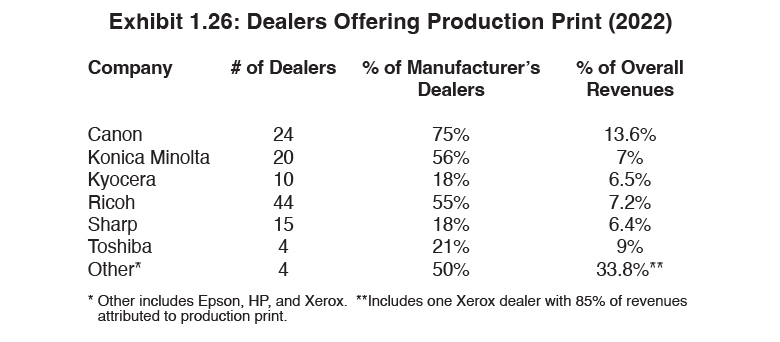

Canon, Konica Minolta, and Ricoh continue to set the industry standard among the Big Six OEMs in production print. Each of these three manufacturers has extensive production print lines, which accounts for their ranking in the top three OEMs whose dealers sell production print. Seventy-five percent of Canon dealers sell production print, followed by Konica Minolta (56%), and Ricoh (55%). Last year, Canon had 76%, Konica Minolta 69%, and Ricoh 44%. Rounding out this year’s list are Toshiba at 21%, and Kyocera and Sharp at 18% each. Even though Kyocera now offers a production device, only two of the 10 Kyocera dealers that sell production print identified Kyocera as their production print provider. We believe the reason for that is Kyocera’s late entry into the production space. As a result, Kyocera dealers had previously gone elsewhere to source production print products.

Our Survey also delved deeper into production print by tracking the percentage of revenues derived from this segment. Not all dealers separate their production print hardware sales from traditional A3 and A4 hardware sales. For those that do, the percentage of revenues associated with production print for each of the Big Six is included in the last column of Exhibit 1.26. The average percentage of yearly revenues for all Big Six dealers offering production print is 8.2%, up from 7.4% in 2020, and from 6.3% in 2019.

For those dealers that sell production print, 2021 was a very good year with 31.5% reporting that revenues in that segment were up over the previous year, when only 16% of dealers reported their revenues were up a year ago. We’re still not at 2019 levels when 46% of dealers selling production print said revenues were up, but we are getting there. For dealers that reported their revenues up, the average percentage increase was a healthy 29.4%. In last year’s Survey, 32% of dealers reported that their production print revenues were down, a 20-percentage point difference from 2019. On a positive note, only 10.5% of respondents reported production print revenues down in this year’s Survey. For those dealers, the average decline in production print revenue was 16%.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.