Exhibits 1.23-1.25

Despite the emergence of A4 in the MPS world, standalone printers are still as relevant as ever for MPS and still demanded by customers, even if they are not taking advantage of a dealer’s MPS offering. Twelve different printer brands were cited by Survey respondents, including two dealers that are still selling the discontinued OKI product line.

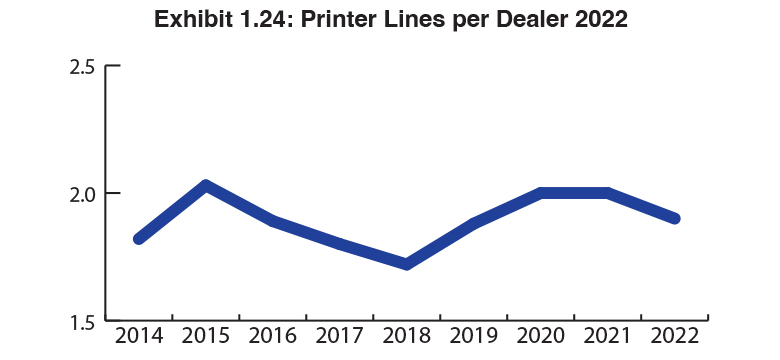

The number of printer lines carried by dealers is still significant—719—even though it is down from 752 a year ago. In our 2019 Survey, the total number of printer lines was 612. The decline from 752 to 719 printer lines finds the average number of printer lines declining to 1.9 compared to 2.0 a year ago.

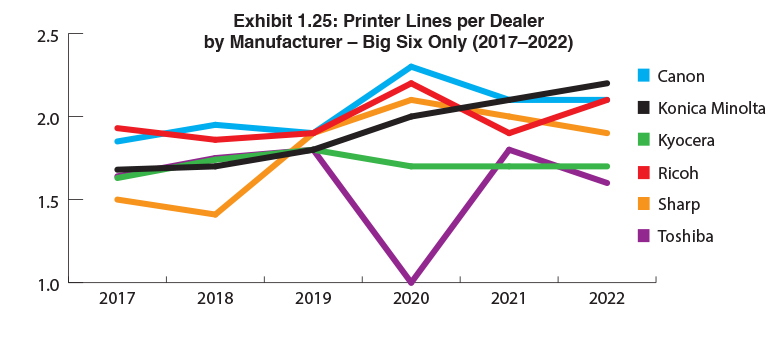

Exhibit 1.25 reveals the average number of printer lines per dealer by manufacturer for the Big Six. Konica Minolta (2.2), Canon (2.1), and Ricoh (2.1) dealers ranked just ahead of Sharp (1.9), with Kyocera (1.7) and Toshiba (1.6) in the final two positions, respectively. Kyocera’s positioning can be attributed to the satisfaction of more than half of its dealers (29) that only carry the Kyocera printer line. That dedication, we believe, is a testament to the quality of Kyocera’s line.

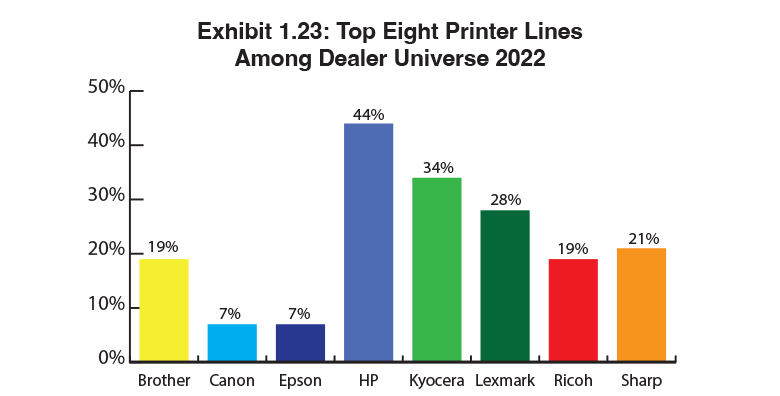

Exhibit 1.23 identifies the top eight printer lines in the dealer universe. HP (44%) has consistently been the No. 1 brand and although dropping 2 percentage points from last year, still leads by a significant margin over the other six vendors. Kyocera (34%) dropped 3 percentage points from last year, but still held on to the second spot among the top seven. Lexmark, which has been taking a licking in the A4 space, saw its percentage rise from 27% last year to 28% this year. Rounding out the top six were Sharp (21%), thanks to the growing number of Sharp dealers participating in our Survey, and Brother and Ricoh tied at 19% each. Please note that these percentages represent the percentage of dealers that identified these companies as either their first, second, third, or fourth printer line.

Other manufacturers identified in the Survey that do not appear in Exhibit 1.25 include Konica Minolta (8%), Canon (7%), Epson (7%), Xerox (5%), Toshiba (2%), and OKI (0.5%). As we’ve noted in our previous two Survey analyses, keep an eye on Epson as the percentage of dealers selling the line has been increasing from 4% in our 2020 Survey to 6% last year, and up to 7% this year. We wouldn’t be surprised to see the company grow into double-digit percentages within the next two years.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.