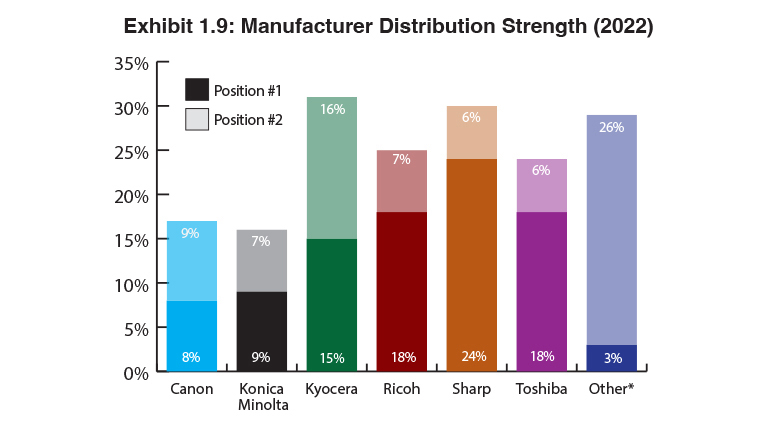

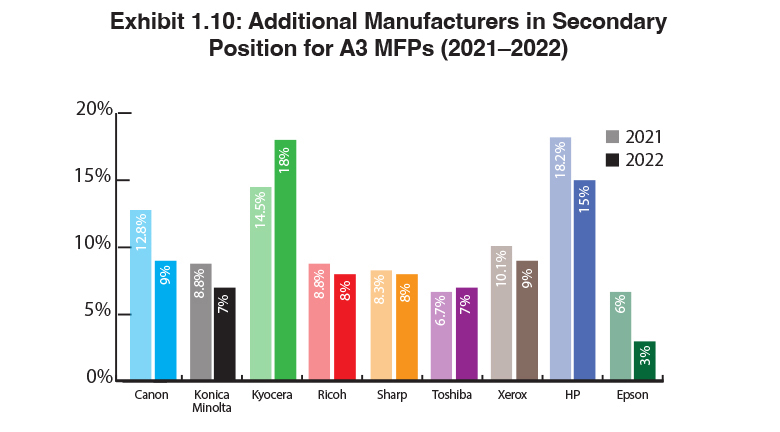

Exhibits 1.9-1.10

To identify the manufacturers with the strongest distribution, we tracked how they ranked as a dealer’s primary and secondary equipment supplier (Exhibit 1.9). Even as the number of dedicated dealers trends upward in our Survey, there are still a significant number of dealers (56%) carrying two, three, and four A3 lines. That’s down 3.5% from last year’s Survey. Some of those lines have historically filled in gaps in their primary manufacturer’s A3 product lines, while others were added through acquisitions. As we’ve heard from conversations with dealers during the past year, supply chain issues with their primary A3 manufacturer have also encouraged dealers to take on an additional line.

The exhibit for Additional Manufacturers in Secondary Position for A3 MFPs (Exhibit 1.10) identifies the percentages of manufacturers identified as a dealer’s second, third, or fourth line. This order (second, third, fourth) is sometimes arbitrary. Positioning can be the result of the performance of an additional line in terms of sales during the Survey year, or a manufacturer’s incentives could determine the order of placement, which is why there isn’t always consistency from year to year when we identify the manufacturers in a secondary position.

HP and Xerox remain companies to watch as secondary A3 suppliers. Eighteen dealers selected HP as their No. 2 manufacturer, and 28 dealers selected Xerox. Both companies have been aggressively recruiting dealers, and those efforts have been reflected in our past three Surveys. Increased dealer participation in this year’s Survey is another factor. When we examine how those companies were represented as secondary A3 suppliers overall (Exhibit 1.10), not just as the No. 2 option, HP and Xerox remain viable suppliers among dealers across the channel. Although HP’s percentage declined from 18.2% to 15% this year, that doesn’t negate the fact that HP has made inroads into the channel. Similarly, Xerox’s percentage fell to 9% from 10.1% a year ago. Another vendor, relatively new to the A3 space in our Survey, is Epson. This OEM and its inkjet products, which seemed to be gaining traction in the channel, were carried by 3% of dealers in this year’s Survey, down from 6.7% a year ago.

The percentages of the Big Six in the No. 2 position and in subsequent positions (Exhibit 1.10) tend to experience modest fluctuations year over year. The leading three lines in the second position this year were Kyocera (18%), Canon (9%), Ricoh and Sharp tied at 8%, and Konica Minolta and Toshiba tied at 6%. If we had included HP in this group, that would have been even a stronger indication of the company’s traction in the channel as 54 dealers (15%) carry the HP A3 line.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.