Exhibits 1.27-1.30

Throughout the pandemic, including the current post-pandemic period, which in some ways is a misnomer, we heard from various dealers how their managed print programs helped them keep their heads above water during this time. Even if customers weren’t printing, some were still paying for the minimum number of prints under their MPS contracts. If anything, that underscores the continued viability of MPS.

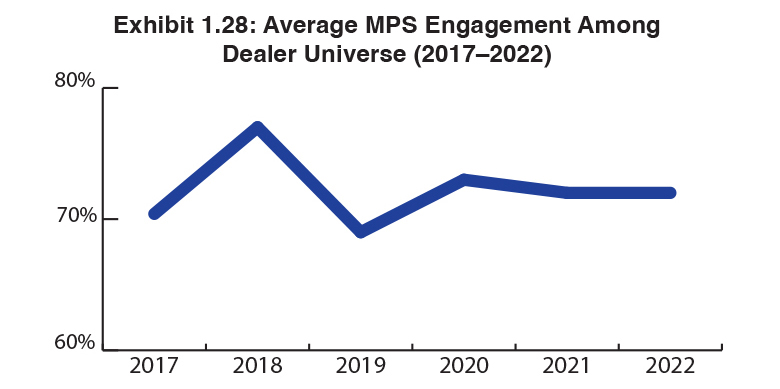

Our Survey reveals that the average percentage of dealers offering MPS remains the same as it was last year, 72% (Exhibit 1.28), down from a high of 77% in our 2018 Survey. We’ve been predicting that dealers that offer MPS will remain in the 70% to 75% range going forward, and we’re not seeing anything in our Survey results of the past few years to make us reconsider that forecast. If anything, the evolution of MPS with the advent of cloud-based MPS solutions is only making it more attractive to dealers and their end-customers, partly with the emergence of hybrid work.

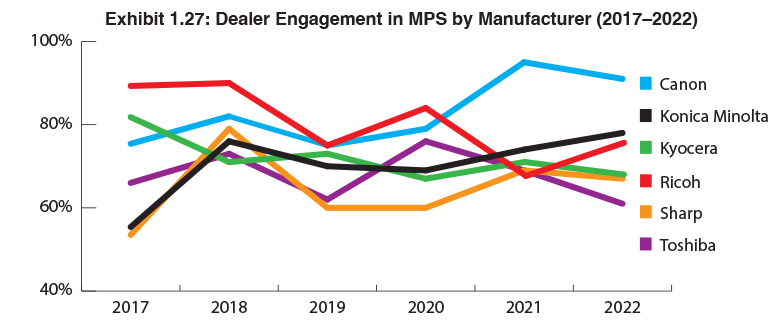

Dealer engagement in MPS (Exhibit 1.27) by manufacturer range from a high of 91% for Canon dealers to a low of 61% for Toshiba dealers. The rest of the Big Six OEMs fall squarely between those two percentages and cumulatively account for an average MPS engagement among the entire universe of 72%. Although not among the Big Six, notable for its dealer’s MPS engagement is HP, where all nine of its dealers that participated in the Survey offer MPS.

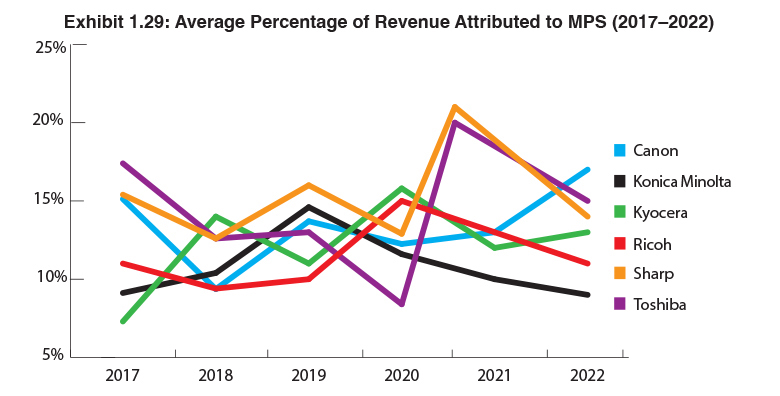

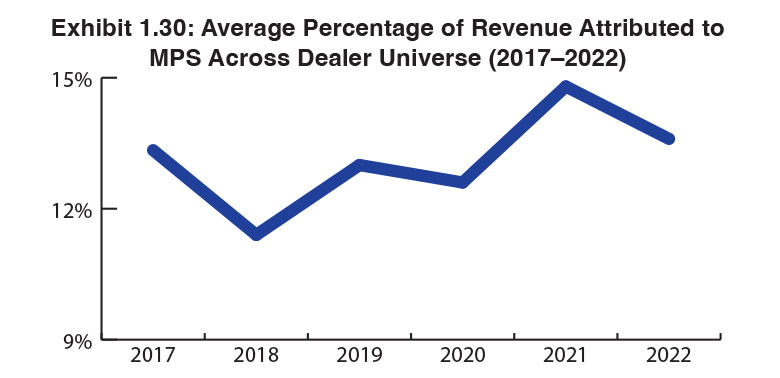

This year, the average percentage of revenues associated with MPS declined to 13.6% (Exhibit 1.30) from 14.8% a year ago. In our 2019 Survey, that percentage was 12.6%. In Exhibit 1.29, in 2022, you can see Canon led the pack at 17%, followed by Toshiba (15%), Sharp (14%), Kyocera (13%), Ricoh (11%), and Konica Minolta (9%). A total of 28 dealers (10%) offering MPS reported that it was responsible for 30% or more of their revenues, with three dealers stating percentages over 80%.

Dealers were also asked if their MPS revenues were up, down, or the same compared to the previous year. Here, we saw some interesting variations from the previous year. This year, 33% of dealers reported that their MPS revenues were up compared to 50% a year ago, while 54% said MPS revenues were the same, up from 45% in last year’s Survey. However, only 13% of respondents said that their MPS revenues were down last year compared to 72% a year ago. The percentage of MPS revenues that were up, down, or the same from the past two years might seem to contradict those dealers who claim that their MPS contracts kept them afloat during the darkest days of the pandemic and through what is still a recovery period. How we look at it is that even when MPS or even equipment revenues are down, that doesn’t mean that the dealer doesn’t have enough revenue coming in to still be profitable.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.