Exhibits 1.31-1.35

Since 2019, the percentage of dealers offering managed IT services has been fluctuating between 44% and 46%, not bad considering the number of smaller dealers with revenues under $5 million participating in the Survey. Those smaller dealers are not likely to offer managed IT.

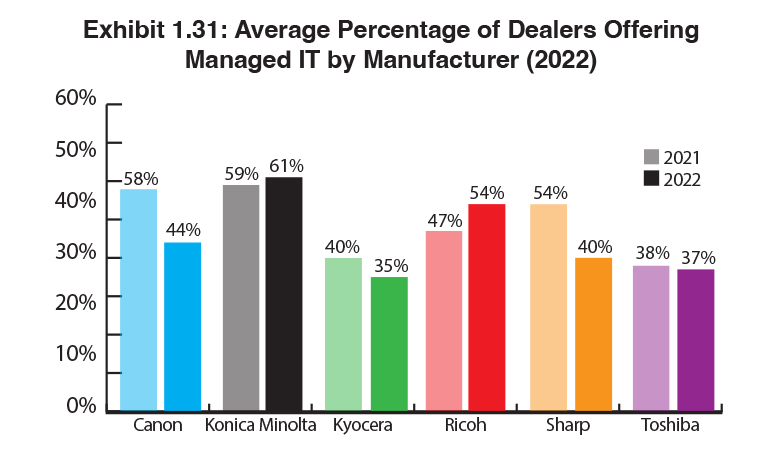

In 2019, the percentage of the 344 dealers offering managed IT was 46%. In 2020, with 385 dealers participating, the percentage of dealers offering managed IT declined to 44%. Last year, we saw an increase in the percentage of dealers offering managed IT (46%), while in this year’s Survey, the percentage of engagement fell back to 44%. Exhibit 1.31 shows the percentage of engagement among dealers representing the Big Six OEMs during the past two years. Please note there are two notable declines with Canon dealers and Sharp dealers participating in managed IT, each declining by 14%. When fluctuations such as this occur, it isn’t that dealers are pulling out of managed IT, even though that does happen—but rather we attribute this shift to a different pool of dealers representing those manufacturers participating in our survey. Meanwhile, the percentage of dealers representing Konica Minolta and Ricoh increased by 2% and 7%, respectively.

Managed IT remains a logical addition to a dealership’s services offerings, especially with so many devices connected to the network. Other factors impacting its growth are expanding the network beyond the traditional workplace as more employees work remotely and a growing awareness of cybersecurity. Security is a critical component of any managed IT offering and an excellent conversation starter with current customers and prospects.

It’s doubtful that any dealer offering managed IT services will say it’s been an easy business to get off the ground. Indeed, we’ve interviewed numerous dealers over the years, including some large ones, that stumbled out of the gate when entering this segment. Some tore it all down and started again, while some decided it wasn’t a good fit for their dealership or customer base.

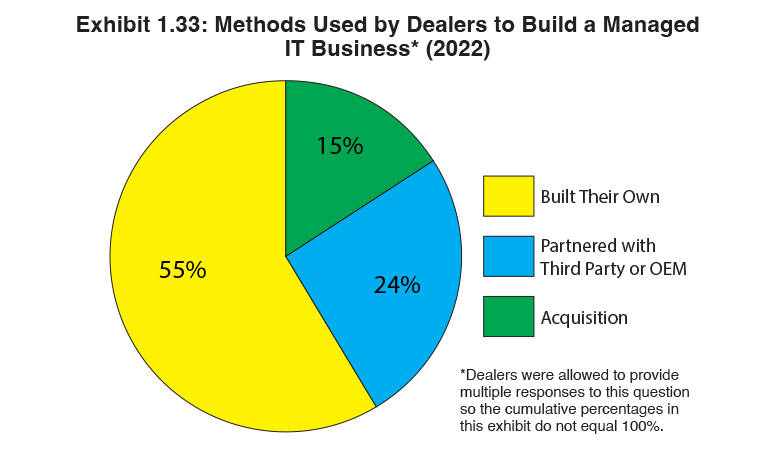

When we examine how dealers have established their managed IT businesses, we’ve found three primary methods. The least popular is acquisition (Exhibit 1.33), with 15% of respondents using this strategy. Last year, 12% used this strategy, and in our 2020 Survey, 19% did. The challenge that dealers interested in acquiring now face is a lack of suitable acquisition targets in the IT space. As representatives from organizations that assist dealers looking to acquire have told us in recent interviews, there are more buyers than sellers right now and not all of the IT companies on the market are worth buying.

The most popular method among dealers in establishing managed IT is building their own (55%), down from 61% in last year’s Survey. Considering the expanding profiles in the dealer channel of ConnectWise, All Covered, and GreatAmerica’s Collabrance, we would have expected partnering with a third party to receive higher percentages in our Survey. But no, this year, that percentage was 24%, down from 27% in the previous Survey. Some dealers use multiple strategies for building their managed IT business, so the cumulative percentages in Exhibit 1.36 do not equal 100%.

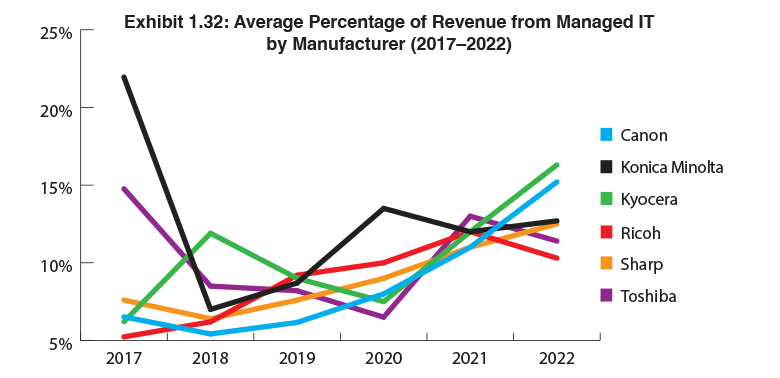

The average percentage of revenue from managed IT (Exhibit 1.32) rose to 13%, up from 11.8% last year. We’ve been seeing a steady increase in the average percentage of IT services revenue in our last four Surveys and for the last two years, it’s been in the double digits compared to 9% and 8% in 2020 and 2019, respectively. The dealers reporting the highest percentages of IT services revenue, were in the top spot—wait for it—Kyocera (16.3%) and Canon (15.2%). Kyocera is a surprise because most of its dealers that participated in the Survey are smaller. If you look at the average revenue per dealer in this year’s Survey, Kyocera dealers had an average annual revenue of $5 million placing them in sixth place among the Big Six OEMs. Rounding out the rest of the pack in percentage of revenue from managed IT were Konica Minolta (12.7%), Sharp (12.5%), Toshiba (11.4%), and Ricoh (10.3%). Comparing these percentages to our previous Survey, percentages were up from the previous year with Toshiba, followed by Konica Minolta, Kyocera, and Ricoh. Canon and Sharp dealers also posted increases from 2021. In last year’s Survey, we attributed those increases to dealers setting up customers’ employees remotely in 2020. This year, we are viewing the increase to providing customers with an expanded array of IT services offerings, including security.

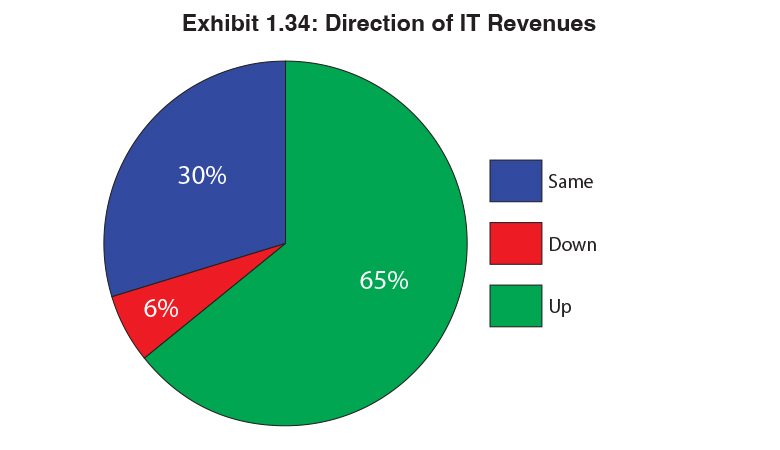

Two years ago, we started asking dealers if managed IT revenues were up, down, or the same compared to the previous year (Exhibit 1.35). This year, 65% reported revenues were up compared to 52% a year ago. Note that a year ago, our Survey reflected dealers’ performance during the first year of the pandemic. This year, 30% noted that revenues were the same compared to 36% last year. Only 6% of dealers participating in our 2022 Survey reported a decline in IT services revenue, down from 12% last year. In the year prior to the start of the pandemic, 62% of Survey respondents reported that their revenues were up, 35% said the same, and only 3% said revenues were down. So, yes, the channel is still in recovery mode.

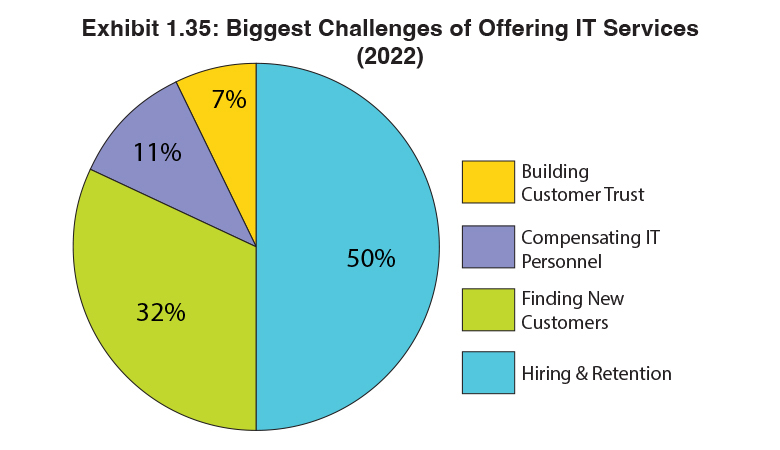

For the first time this year, we asked dealers to identify the biggest challenges they are facing in offering managed IT services (Exhibit 1.35). The top challenge identified was hiring and retention (50%), followed by finding new customers (32%), compensating IT personnel (11%), and building customer trust (7%). One dealer who responded to this question noted that onboarding of new IT personnel takes longer than onboarding traditional technical services staff and that growth must be planned. Good advice to end this section of the Survey.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.