Exhibits 2.27-2.34

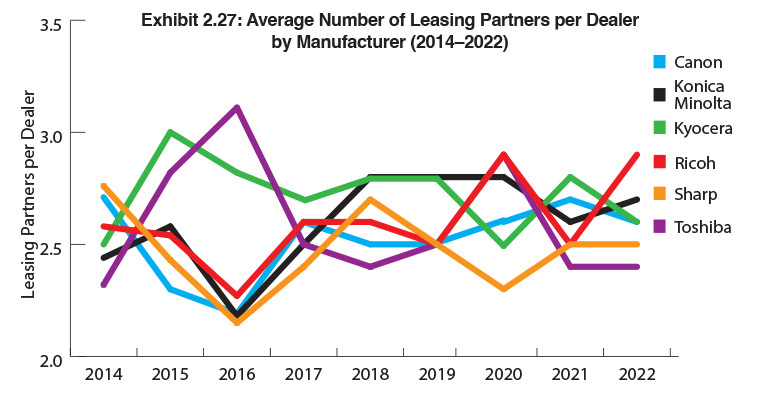

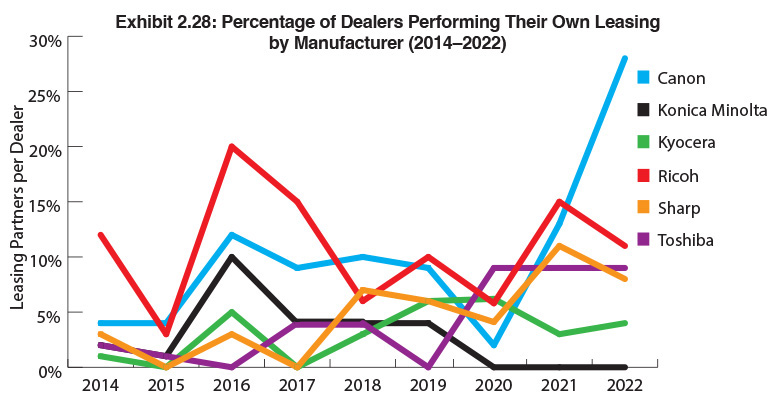

If there is one thing you can consistently count on in our Annual Dealer Survey for the past five years, it’s the average number of leasing partners among the Big Six dealer universe. Once again it is 2.6. A total of 70 different leasing options were identified by dealers (dealers could identify up to four leasing partners), including leasing from their OEM. That figure does not include the 35 dealers, the same number as last year, that provide their own leasing.

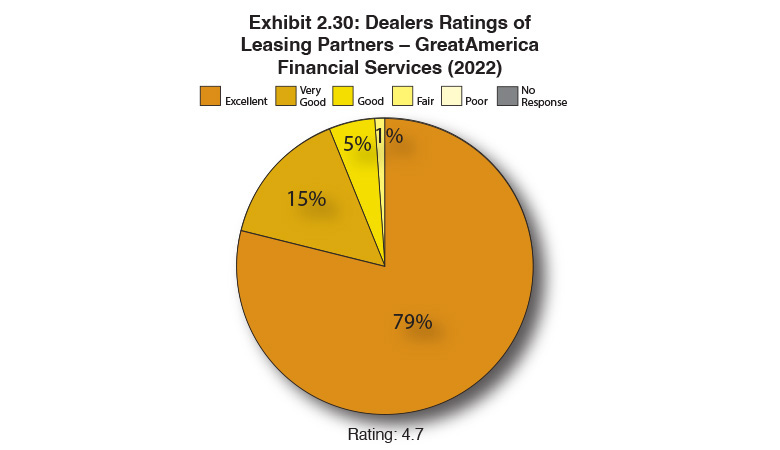

When tabulating dealers’ ratings of their leasing partners, we only include those companies that have been identified by 25 or more dealers as their primary leasing partner. For the second consecutive year, only five leasing companies reached that figure—DLL, GreatAmerica Financial Services, LEAF Commercial Capital, U.S. Bank, and Wells Fargo.

The number of dealers providing their own leasing remained the same as last year (9%). Please note that most dealers that offer in-house leasing also partner with another leasing company as well, providing customers with multiple leasing options. In-house leasing is a likely alternative when it is difficult to get approval from a third-party leasing partner. When that fails, it’s more than likely that the in-house leasing group will assume the risk and approve the lease.

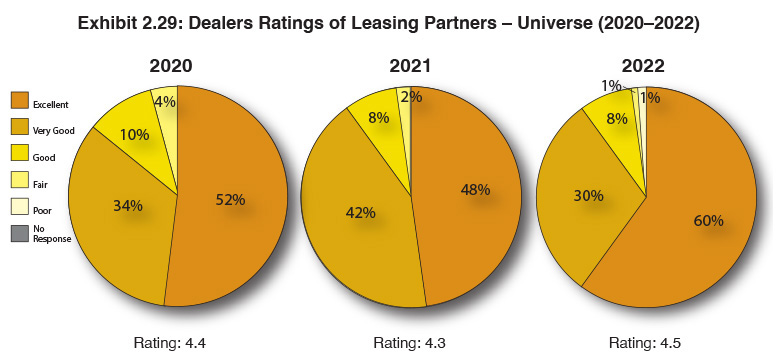

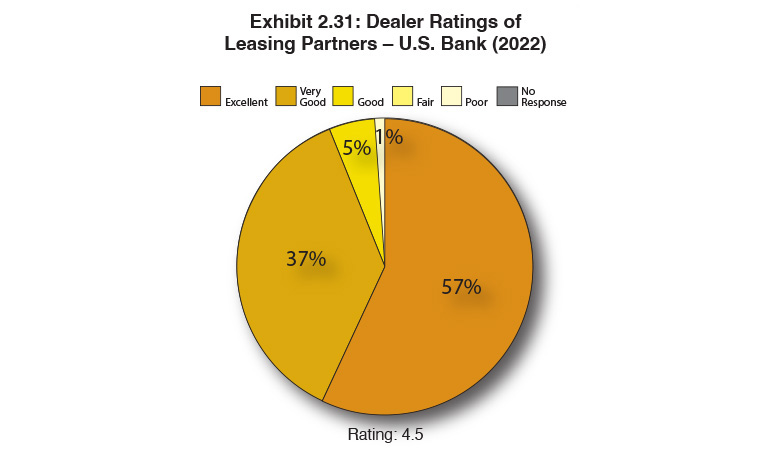

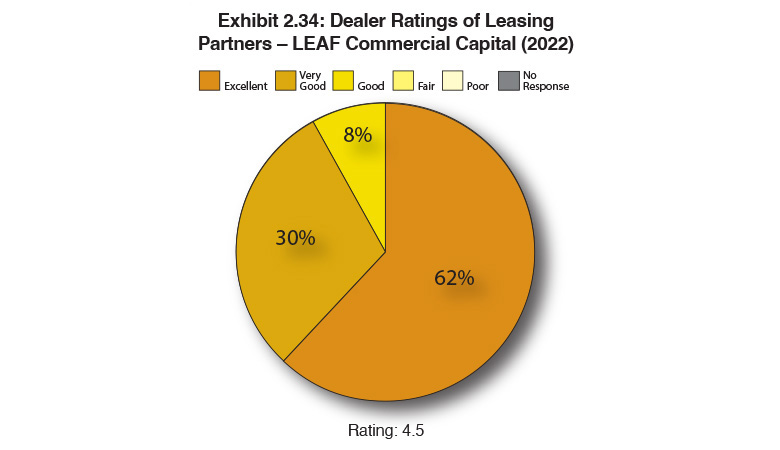

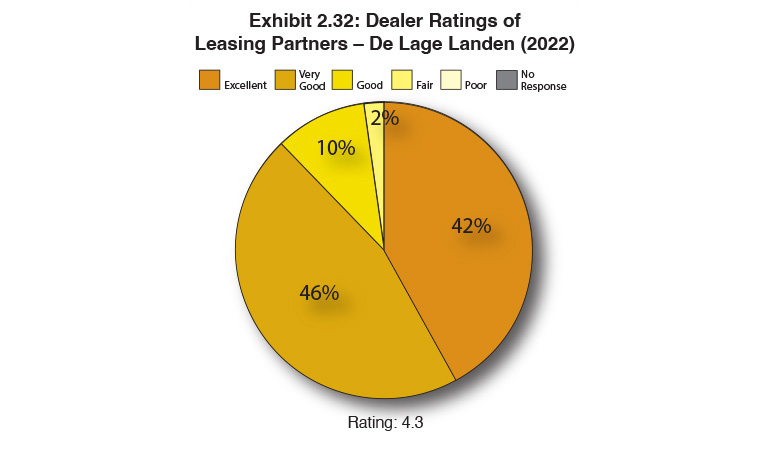

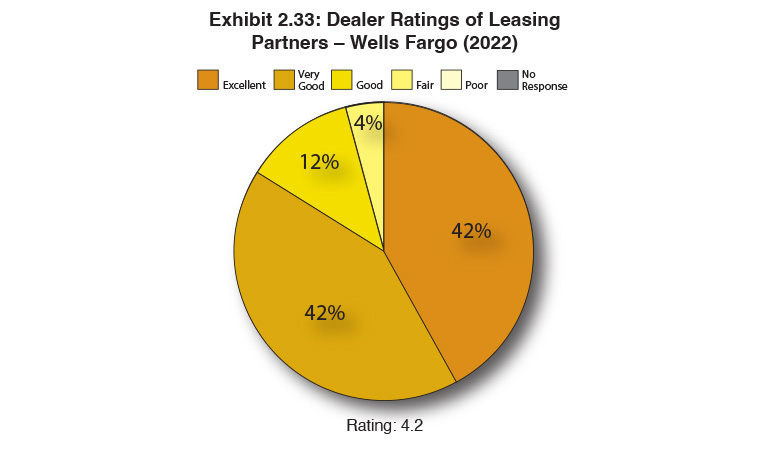

We asked dealers to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” and “Poor.” In our current Survey, 60% were ranked as “Excellent,” a 12% increase from last year. Only one leasing company received a “Poor” rating in this year’s Survey, which indicates that dealers are generally satisfied across the board with their leasing partners. The comments section supports this observation. Using a five-point rating system (with 5.0 being the highest rating), all five leasing companies that were identified by 25 or more dealers as their primary leasing partners, received scores above 4.00, averaging 4.4. We credit the high ratings to the way the leasing companies have stepped up during the pandemic and during the backorder crisis by being more flexible and providing dealers with access to end-of-lease equipment to fill the gaps while waiting for new products to arrive.

GreatAmerica Financial Services received the most favorable ratings in our Survey, averaging out at 4.7, up from 4.6 a year ago. The ratings for U.S. Bank (4.5) and DLL (4.3) were the same as last year while Wells Fargo’s rating declined from 4.3 to 4.2. The biggest increase was by LEAF Commercial Capital, which rose from 4.0 to 4.5, the highest rating it has ever received in our Survey.

The following representative comments shed light on dealers’ ranking of their leasing partners.

DLL

Excellent: “Hands down, the best.”

Excellent: “I really like the ability to have extended payback financing options, especially their six-month payment plan.”

Very Good: “Works well with the customer and provides quick approvals.”

Very Good: “Easy to work with. Willing to go the extra mile to get the deal done.”

Good: “Has had too many personnel and process changes.”

GreatAmerica Financial Services

Excellent: “They help improve our profitability.”

Excellent: “Great America is the most engaged partner that is committed to the success of the dealer. They are forward thinking and first to market with automation tools benefiting the dealer.”

Excellent: “The best is simply the BEST!”

Very Good: “Easy to work with at the beginning of the lease and the end of the lease.”

Very Good: “The people at GreatAmerica are incredible.”

LEAF Commercial Capital

Excellent: “Competitive rates, good process, good approval rate. Creative and flexible programs to help during the backorder crisis.”

Excellent: “Fast to get us approvals, fast to get funding, few client issues.”

Excellent: “They work with us to get done any kind of financing we need.”

Very Good: “Good rates and great support.”

Very Good: “LEAF is a pleasure to work with. Only problem is getting funding on time.”

U.S. Bank

Excellent: “Fantastic communication, very professional, and great backroom support.”

Excellent: “Strong admin capabilities, reliable, and competitive.”

Very Good: “Custom programs, responsive to issues.”

Very Good: “Not always perfect but effective programs to help us get new business.”

Good: “Lease processing has slowed a little in the past year.”

Wells Fargo

Excellent: “Easy to navigate website, easy to process leases, easy to track portfolio, easy to upgrade, and good rates.”

Excellent: “Helpful with delays in receiving equipment.”

Excellent: “Never any issues doing business with them.”

Very Good: “Their online tools make it easy [to do business with them] and their rates are competitive.

Good: “We can still get answers, but not that smooth anymore. That is why we use our financing in some cases. Times are tough.”

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.