Exhibits 1.41-1.45

For many dealers, diversifying their product offerings is critical to remain relevant with customers.

Since 2015, we have asked dealers to identify their greatest growth opportunities, allowing them to provide multiple responses to better reflect their visions for growth. This year, we asked dealers to rank their three greatest diversification opportunities from a list of eight in order of preference. Dealers were also allowed to identify opportunities not listed among these eight options. Dealers were asked to select three from the following:

- Managed IT

- Production Print

- Document Management/ECM

- Digital Signage/Whiteboards

- Cybersecurity

- Physical Security

- Smart Office/Managed Office

- Telephony/VoIP

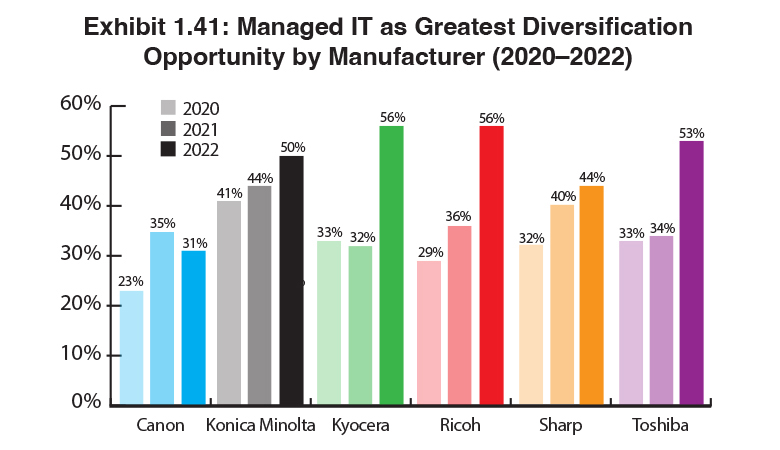

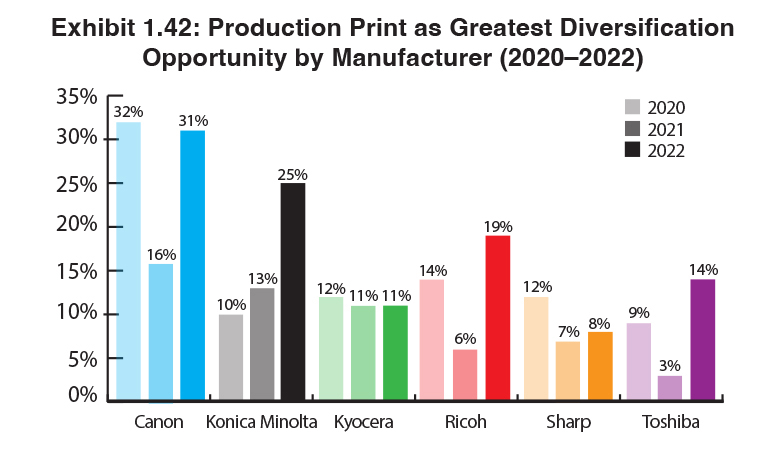

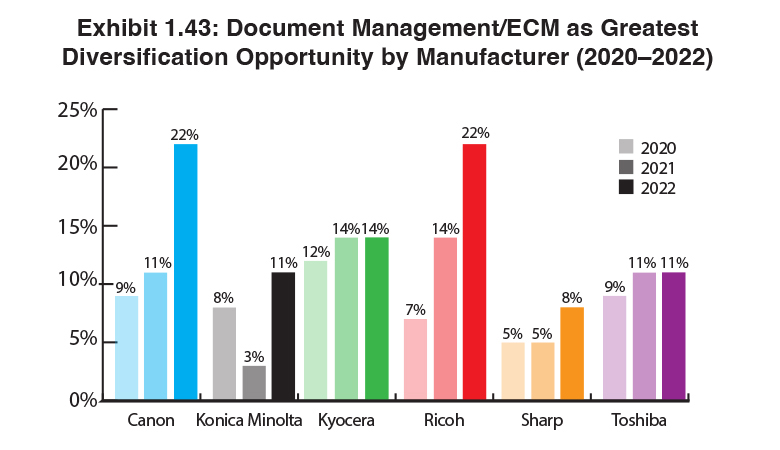

Exhibits 1.41 to 1.43 show the percentage of dealers, representing each of the Big Six OEMs, that identified managed IT, production print, and ECM/document management as their top growth opportunities.

In past Surveys, MPS ranked as the No. 1 growth opportunity for most dealers; however, because we felt that this was a service that most dealers offer, we erroneously deleted it from the list above. As a result, eight dealers identified MPS in the “Other” category. We will add MPS to the list in next year’s Survey. For the third straight year, managed IT was selected by dealers as the top opportunity (Exhibit 1.41). This year, we saw an increase in the percentage of dealers from five of the Big Six OEMs identifying managed IT as their No. 1 diversification opportunity. Dealers representing Kyocera (56%) and Toshiba (53%) seemed to have the biggest epiphanies around managed IT since last year when only 33% of Kyocera dealers and only 33% of Toshiba dealers cited this as a diversification opportunity.

We surmise that the pandemic continues to play a part in exposing dealers to opportunities in managed IT, particularly with employees still working from home who need to be securely connected to their organization’s network. As we observed in last year’s Survey, more than a few dealers told us during the pandemic that this segment of the business kept them afloat during the early months of the pandemic. And from the rising percentage of dealers that identified this area as a diversification opportunity, fear of managed IT, which has been an obstacle for many dealers in the past, seems to be dissipating.

After seeing the percentage of dealers that identified production print as their No. 1 diversification opportunity last year, there was an uptick in the percentages of dealers who identified it as their top growth opportunity in this year’s Survey (Exhibit 1.42). Surprisingly, 14% of Toshiba dealers, whose OEM doesn’t have a production print line, ranked production print No. 1 compared to only 3% a year ago. Among the dealers representing OEMs with strong production print lines, 25% of Konica Minolta dealers ranked production print as their top diversification opportunity compared to 13% last year. Ricoh dealers also saw the light about production print with 19% ranking it No. 1 in contrast to just 6% a year ago.

During our recent Access Japan interviews, we’ve been hearing a lot about a growing focus on solutions and software. One software segment where many OEMs see value is ECM/document management software. That was a big point of emphasis when we interviewed Toshiba and Kyocera executives, and the Ricoh acquisition of DocuWare in 2019 further underscores this trend.

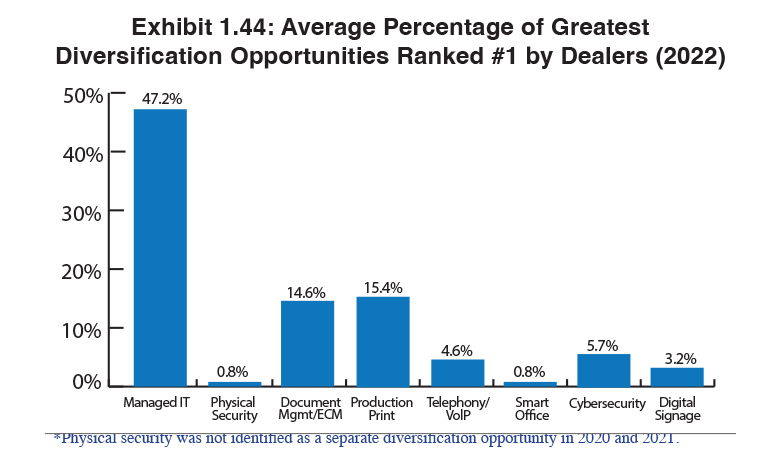

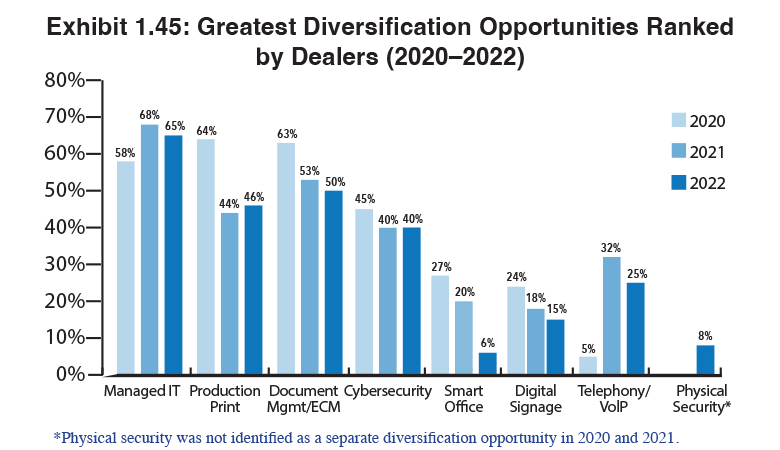

Dealers are catching on and for the second straight year, ECM/document management ranked second as a top diversification opportunity overall (Exhibit 1.45). ECM/document management doesn’t rate as highly, however, when dealers were asked to identify their No. 1 diversification opportunity. Here, it ranked far behind managed IT and just behind production print in third place (Exhibit 1.44). Examining how it ranked as a diversification opportunity by manufacturer (Exhibit 1.43), ECM/document management exhibited a strong showing among Canon (22%), Ricoh (22%), and Kyocera (14%) dealers. Sharp dealers (8%) seemed to have the least interest in this as a diversification opportunity. We can certainly attribute the interest of Kyocera and Ricoh dealers to Kyocera’s relationship with Hyland Software, and Ricoh’s with DocuWare.

Exhibit 1.44 also reveals how these three categories, as well as cybersecurity, physical security, smart office/managed office, digital signage/whiteboards, and telephony/VoIP, ranked in this year’s Survey as a No. 1 diversification opportunity. Managed IT, production print, ECM/document management have all experienced a strong uptick as a No. 1 ranked diversification opportunity. Although we believe each of those segments would have grown year over year, eliminating MPS as a diversification opportunity in this year’s Survey likely played a part in those increases. Also, this year, we created separate categories for cybersecurity and physical security rather than just labeling it security. We believe that breaking it out this way provides a more accurate read on what is taking place in the channel around security.

If we were only to examine the percentage of dealers that selected cybersecurity, physical security, digital signage, smart office/managed office, and VoIP as their No. 1 diversification opportunity, we would be missing out on what is really happening in the channel with those five opportunities. A more telling indicator is the percentage of dealers that identified one of these selections as one of their top three diversification opportunities (Exhibit 1.45). Cybersecurity rates at 40% among the entire dealer universe versus 5.7% who ranked it as their No. 1 diversification opportunity in Exhibit 1.44. It remains a key talking point and door opener for any dealer offering managed IT.

Another segment where we have seen strong interest is VoIP where 25% of dealers rank this as a top three diversification opportunity. This segment declined 7% from the previous year, which could mean interest has peaked or that dealers are shifting their focus to other high-growth areas such as cybersecurity.

In the smart office/managed office category, Konica Minolta, Ricoh, and Sharp are driving this initiative. However, only one dealer aligned with these OEMs identified smart office/managed office as their No. 1 diversification opportunity. Even among dealers’ top-three diversification opportunities, only one Konica Minolta dealer and one Ricoh dealer selected this segment. Sharp dealers, in contrast, were more interested, with 12 seeing opportunity in this segment. One of the issues that could be impeding interest is educating dealers about the concept behind smart office/managed office technology, and then, dealers having a strong enough understanding of it to be able to relay that to prospects. The pandemic and the transition to a hybrid workforce may also be impeding interest in this segment.

In the digital signage/whiteboard category, 31% of Sharp dealers identified this as one of their top-three diversification opportunities. Overall, among the dealer universe, this area was identified by 15% of dealers. Toshiba, with an extensive line of digital signage products, had 11% of its dealers rank this as one of their top three growth opportunities. We predict that this category will eventually pick up speed, especially as dealers selling these products find more opportunities beyond their traditional office customers. Directional signage, of which digital signage can potentially play a big part, is the wave of the future.

This year, the “Other” category yielded some not-so-surprising, as well as some interesting responses. Except for MPS, which was cited by eight dealers, most diversification opportunities in the “Other” category were only cited by one dealer. In alphabetical order, those include:

- Air Purifiers

- Acquisitions

- Bio Safety

- Business Process Optimization (BPO)

- Document Conversion Services

- Document Destruction

- E-Commerce

- Electric Vehicle Chargers

- Label Printers

- MPS

- Mailing Equipment

- Marketing Services

- Office as a Service

- Robotics

- Scanning Services

- Water

- Wide Format

- Workflow Solutions

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.