Exhibits 1.14-1.20

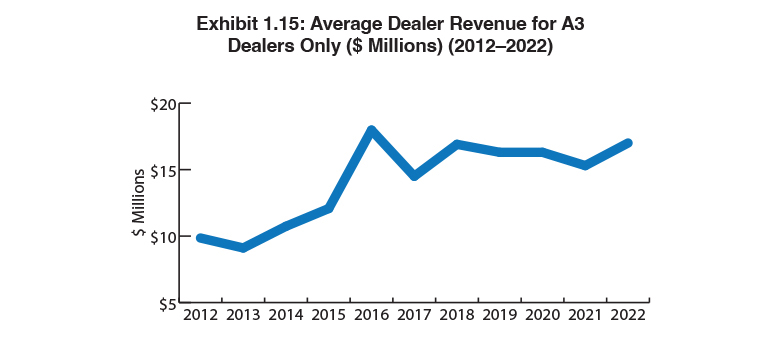

Despite the lingering effects of the COVID-19 pandemic, backorders, chip shortages, and hiring and retention challenges, the dealer channel seems to be recovering better than we would have predicted a year ago, based on 2021 revenue reported by our respondents. Indeed, dealer revenue was where we saw the most notable impact of the COVID-19 pandemic on the channel in last year’s Survey. The average dealer revenue reported in 2021 was $15.3 million, down from $16.3 million the year before the pandemic. To be honest, we were expecting a larger decline. And to be even more honest, we weren’t expecting to see what happened with dealer revenues in this year’s Survey either.

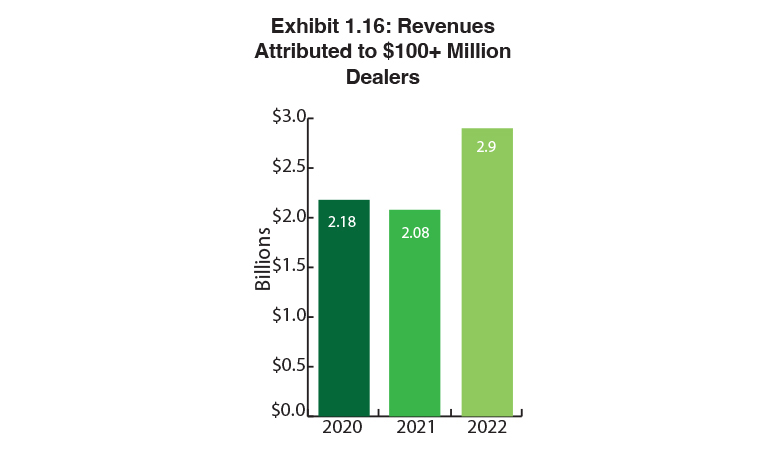

The average yearly revenue attributed to 380 dealers this year rose by nearly $2 million to $17,017,157 (Exhibit 1.15). That increase is the result of 13 dealers reporting more than $100 million in yearly revenues, including two dealers that did not participate in last year’s Survey. In that respect, we need to be careful about proclaiming that the independent dealer channel has fully recovered. If we were to subtract those 13 dealers from the equation, the average dealer revenue would be $9.6 million, not $17 million. In contrast with last year, where if we eliminated the revenue from the 11 $100-million-plus revenue dealers, the total revenue would have dropped to $3.8 billion for an average of $10.2 million.

We can’t minimize the impact of those 13 dealers on the average yearly dealer revenue and overall dealer revenue. Those 13 dealers are responsible for 45.4% of all dealer revenues reported in our Survey. Last year, with 11 dealers reporting revenues of more than $100 million, that percentage was 35.3%. This is an example of the big dealers getting bigger organically and through acquisition, a trend that shows no signs of abating.

Another big swing, that we can attribute to the participation of larger dealers is total dealer revenue, which climbed from $5.9 billion last year to 6.5 billion this year. Two years ago, that figure was $5.5 billion. When tabulating overall dealer revenue, we included all 380 respondents, not just the Big Six.

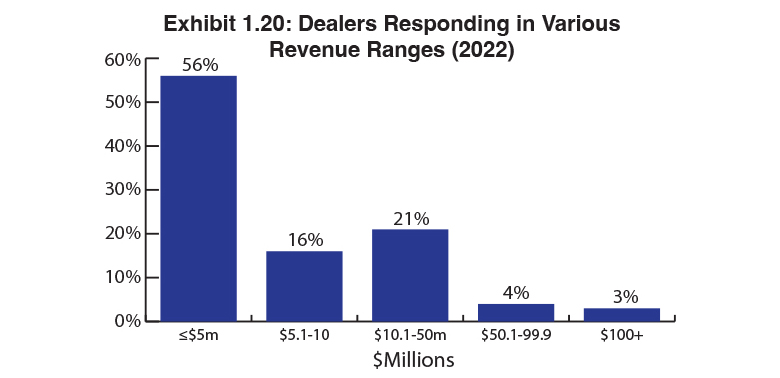

Although $100-million-plus dealers tend to get a lot of attention, the population of dealers with revenues of less than $10 million still dominates our Survey. Fully 56% of dealers who participated reported revenues of $5 million or less, a modest 1% increase from the year before. Another 16% have revenues between $5.1 and $9.9 million, down from 18% a year ago. Those numbers are holding steady despite the majority of acquisitions of dealers with revenues of under $5 million that have been occurring yearly. The reason the needle isn’t moving those percentages all that much in our Survey is because of a new population of dealers in those revenue ranges who respond to our Survey each year.

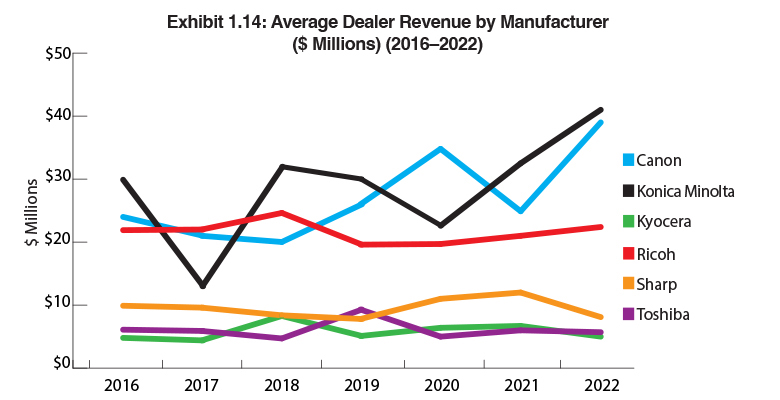

Konica Minolta and Canon dealers continue to represent the most profitable dealers in our Survey (Exhibit 1.14) in terms of average yearly revenue. Konica Minolta dealers lead with average yearly revenue of $41 million, followed by Canon at $39 million. Last year, Konica Minolta led with $32.5 million, with Canon trailing at $24.9 million. This year, a big factor in those average yearly revenues was the $100-million-plus dealers with two among the Canon dealer population and five among the Konica Minolta dealer population. Ricoh dealers had an average yearly revenue of $22 million, up from $21 million a year ago, buoyed by five dealers who reported revenues of more than $100 million in this year’s Survey. The remaining three Big Six dealers reported average yearly revenue of under $10 million.

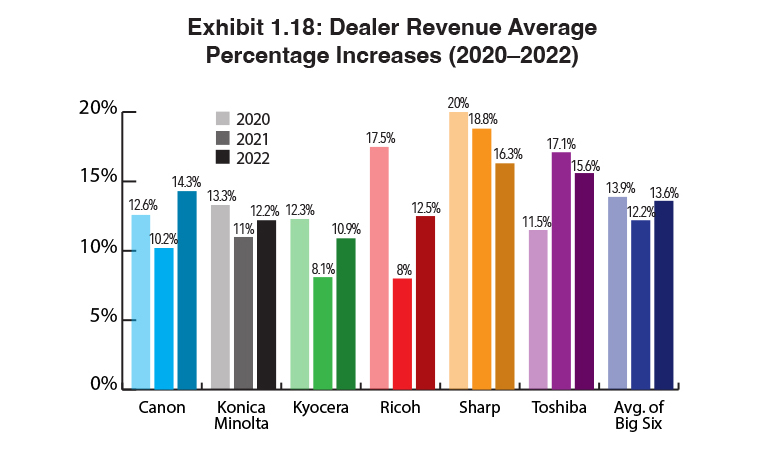

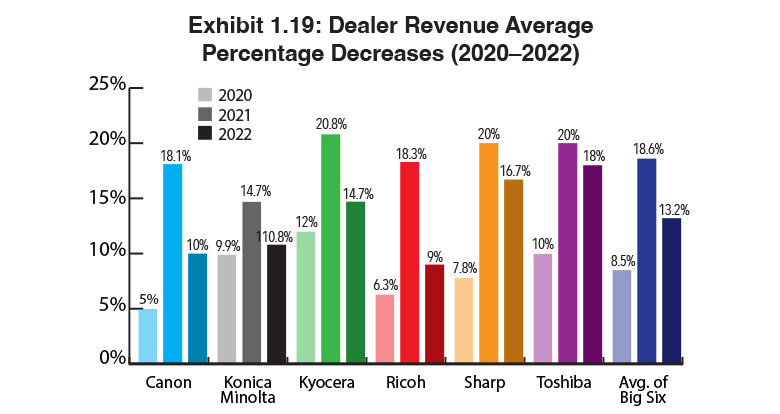

Exhibits 1.18 to 1.19 examine dealer revenue average percentage increases and decreases, as well as the percentages of those increases and decreases. Overall, the average revenue increase for dealers representing the Big Six was 13.6% up from 12.2% a year ago (Exhibit 1.18). The year prior to the pandemic (2020), the percentage was 13.9%.

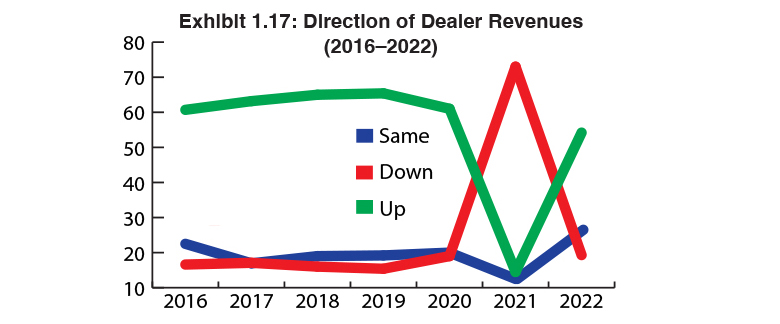

The biggest swing in this year’s Survey was in the percentage of dealers reporting revenue increases, which spiked from 14.5% a year ago to 54.2% this year (Exhibit 1.17). That percentage isn’t as high as what was reported for 2019 when 61% of dealers reported that revenues were up. The percentage of dealers that experienced flat revenues also was on the rise year-over-year from 12.5% in last year’s Survey to 26.5% this year. In 2019, 20% of dealers participating in our Survey reported flat revenues.

Last year in our Survey analysis, we predicted that we expected to see a significant decline in the number of dealers reporting that their revenues were down in our 2022 Survey. That prediction has come to fruition with only 19.3% reporting that their revenues were down compared to 73% last year. Looking at the pre-pandemic year, only 20% of dealers reported revenues were down, so if you judge the industry’s recovery on our Survey revenue numbers, the channel is speeding along on the road to recovery much faster than anticipated. We expected 73% to fall below 50% in this year’s Survey, but as you can see, it’s even better than that.

Examining the average percentage of revenue increases (Exhibit 1.18) by manufacturer, those ranged between 10.9% and 16.3% compared to 8% and 18.8% across dealers from the Big Six in last year’s Survey. For the third consecutive year, Sharp dealers reported the highest average percentage increase at 16.3%, down from 18.8% a year ago and 20% the previous year. Ricoh and Konica Minolta dealers had the smallest average revenue increases at 12.5 and 12.2%, respectively. Still, you can’t argue with double-digit percentage increases. This year, the dealer revenue average percentage increase for the Big Six was 13.6%, up from 12.2% a year ago. Two years ago, the average was 13.9%.

Among the dealers reporting decreases in revenue, the average percentage of revenue decreases (Exhibit 1.19) improved over last year, dropping from 18.6% to 13.2%, but nowhere near what it was two years ago when the average was 8.5%. All those reasons cited at the beginning of this section—COVID-19, backorders, chip shortages, and hiring and retention have all had an impact. Dealers representing Canon, Ricoh, and Kyocera improved the most in the revenue average percentage decreases. Canon dealers fell from 18.1% to 10%, Ricoh dealers from 18.3% to 9%, and Kyocera dealers from 20.8% to 14.7%.

The revenue results of our 37th Annual Dealer Survey paint a positive picture of how the channel is recovering from 2020; however, as we write this, all the aforementioned challenges we’ve cited, as well as concerns about a recession, have the potential to disrupt any forward progress we’re seeing, which is something that can’t be ignored.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.