Exhibits 1.11-1.13

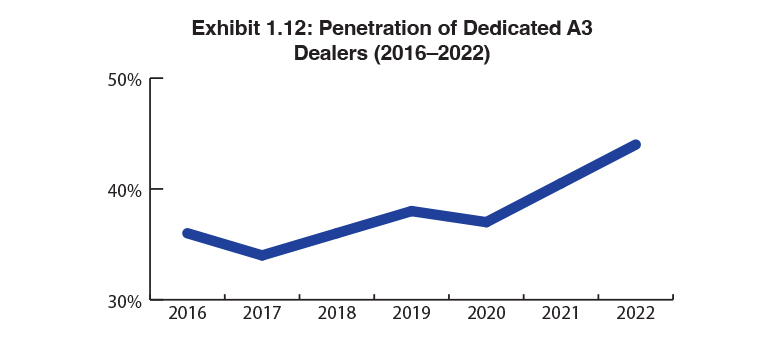

The percentage of dedicated dealers is on the rise (Exhibit 1.12). Two years ago, 37% of dealers participating in our Survey were dedicated to a single A3 supplier. Last year, that percentage rose to 40.5%, and this year, it’s up to 44%, the highest in the history of our Survey. Those percentages are moving in the opposite direction of what we would have expected as acquisitions accelerate and the industry consolidates. As we’ve seen over the years, it’s not unusual for a dealer to add another line when he or she acquires another dealer that carries a line the acquiring dealer currently doesn’t sell.

We also would have thought that supply chain issues would have caused more dealers to take on additional lines, but that doesn’t seem to be happening to any great extent.

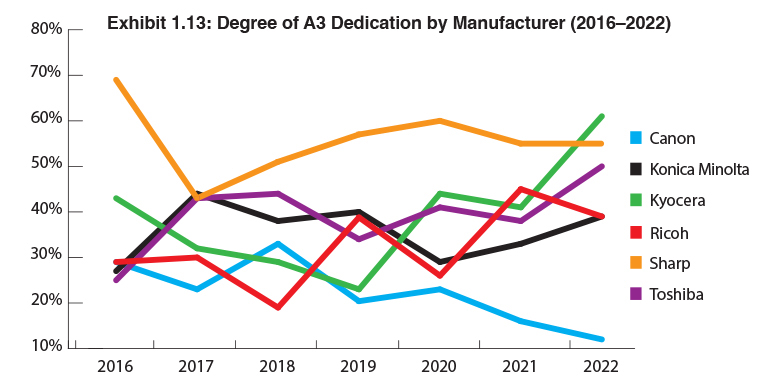

Historically, our Survey has revealed that the lower the revenues, the more likely the dealer will be dedicated. This year 56% of dealers recorded revenues of $5 million or less compared to 55% in our previous Survey. With a larger number of dealers in this revenue range, it’s no wonder we are seeing a higher level of dedication. This year, as you will see in the revenue section of the Survey (Exhibits 1.14-1.20), revenues are rebounding. This year, 48% of dedicated Sharp dealers participating in our Survey had revenues of $5 million or less, followed by Kyocera at 42% and Toshiba at 37%.

The big surprise in this year’s Survey is Sharp being supplanted as the OEM with the highest percentage of dedicated dealers. This year, Kyocera has the highest percentage (61%), followed by Sharp (55%), and Toshiba (50%). Sharp did have the most dedicated dealers overall with 50, compared to Kyocera and Toshiba, each with 35. Once again, Canon had the fewest percentage of dedicated dealers in this year’s Survey (12%), a 4% decline from last year.

Cumulatively, there were 167 dedicated dealers participating in our survey, 10 more than last year and 37 more than in our 2020 Survey. It’s unclear how much longer that trend can continue, especially when there are certain OEMs experiencing more severe supply-chain issues than others, which is resulting in some long-time dedicated dealers taking on another line. That dynamic could potentially reverse the upward trend we’re seeing in the percentage of dedicated dealers.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.