Exhibits 2.1-2.11

Dealers have many concerns, and our Survey historically illuminates those concerns. After expanding the number of concerns to 13 last year, we found that a handful of them stood out from the rest with only a small percentage of dealers selecting some of the others among the choices. As a result, we have simplified this portion of our Survey by asking dealers to choose from five options, as well as “other.”

These include:

- Competing against manufacturers’ direct branches

- Declining print clicks

- Hiring and retention

- Effectively diversifying your product/solutions/services offerings

- Maintaining profitability

- Other

The following concerns were deleted from this year’s Survey to keep things simple:

- Keeping up with new technology

- Keeping up with the growing number of solutions on the market

- Maximizing revenue and profits from MPS

- Maximizing revenue and profits from Managed IT

- Succeeding in production and/or industrial print

- A clear vision for where the industry is heading

- The ongoing impact of the COVID-19 pandemic

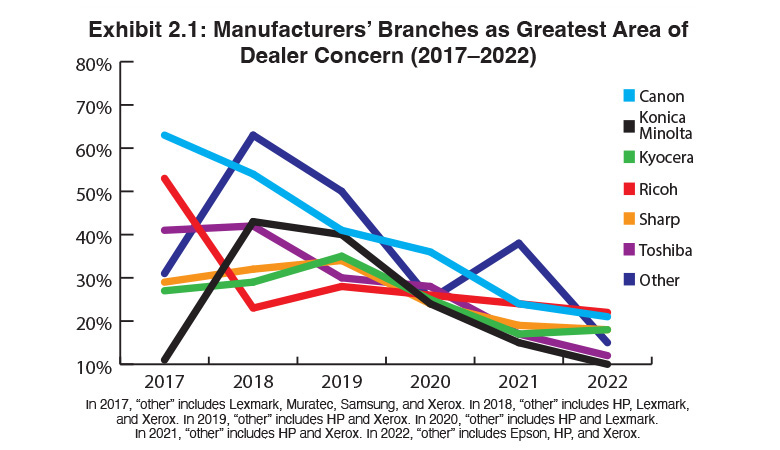

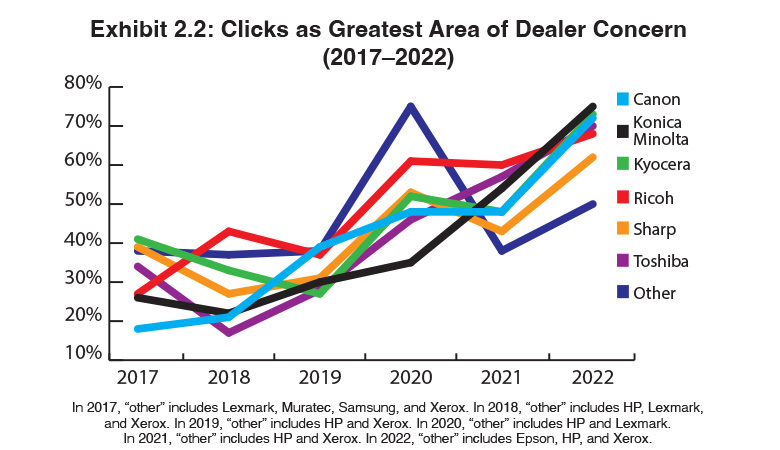

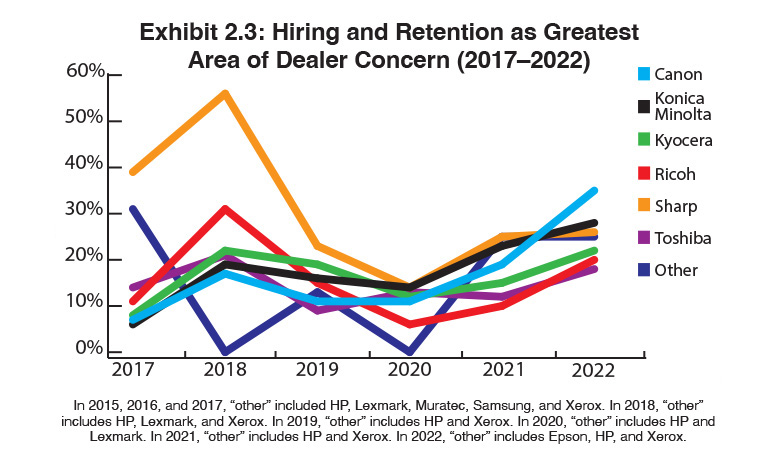

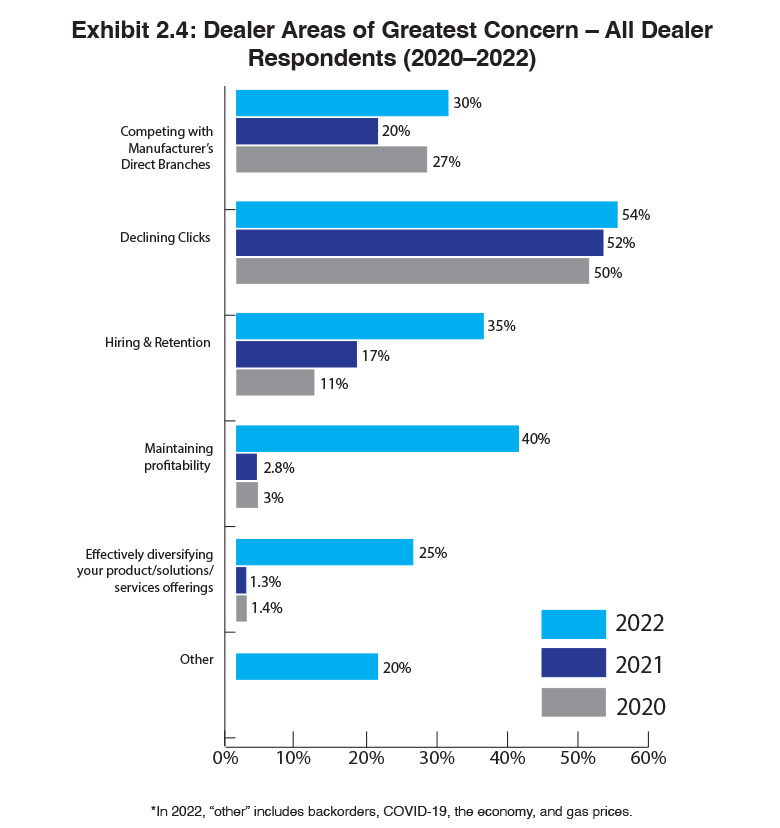

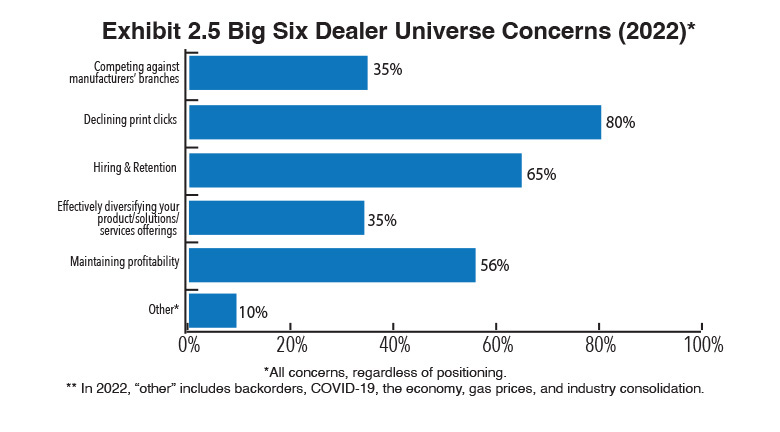

We then simplified this portion of the Survey even further, asking dealers to select three concerns from the list rather than identifying an unlimited number of concerns. The exhibits included in this section reflect the dealer concerns of each of the Big Six OEMs, as well as charts for the top three concerns (Exhibits 2.1–2.3) identified in the Survey, a chart that identifies those concerns listed by dealers as their top concern (Exhibit 2.4), and how each of the five concerns ranked across the dealer universe regardless of positioning (Exhibit 2.5).

There has not been a change in the top three concerns since we began asking this question until this year. For the third consecutive year, the No. 1 concern (Exhibit 2.4) was declining clicks (54%), a 2% increase from last year, and up 20% from three years ago. No doubt, the pandemic and the shift to hybrid work have been a factor for dealers identifying this as a concern. The No. 2 concern was maintaining profitability, identified by 40% of respondents. With the “Great Resignation” and staffing issues resulting from pandemic-related downsizing of staff in 2020, hiring and retention (recruiting) ranked as the No. 3 concern at 35%, more than double last year’s percentage (17%).

Competition from manufacturer direct branches has become less of an issue for dealers as some OEMs have taken the initiative to resolve some of the issues (mostly pricing) that were creating angst in the independent dealer channel. This concern fell out of the top three greatest concerns to fourth place in this year’s Survey. Selling SMB MIF to select dealers as Ricoh and Konica Minolta have done has also alleviated tensions. Still, competition from manufacturers’ direct branches was cited as a concern by 30% of respondents, up 10% from a year ago (Exhibit 2.4). We attribute this increase to fewer concerns for dealers to choose from, as well as renewed concerns about favoritism toward direct branches around product availability. Effectively diversifying your product/solutions/services offerings round out the top five at 25%. In the past three years, this ranged from 1.3% to 2% as a dealer’s single greatest concern.

The increase in dealers concerned about declining clicks is even more dramatic when we examining all dealer concerns regardless of positioning (Exhibit 2.5). This year, 80% of dealers identified it as a concern, up 2% from a year ago. Three years ago, this was a concern of 54% of Survey respondents. Concern about hiring and retention increased from 58% in 2021 to 65% this year. The third leading concern for the third consecutive year was maintaining profitability at 56%, which after a challenging 2020, has improved for many dealers in our Survey.

Effectively diversifying your product/solutions/services offerings has become a pressing need for an increasing number of dealers with 40% identifying this as a concern. We were expecting more dealers to cite this as a concern with fewer options to choose from in our list of concerns, even though 25% identified this as their greatest concern (Exhibit 2.4). Instead, this concern fell by 2% compared to last year. Perhaps dealers are embracing this opportunity rather than fearing it.

For the fourth consecutive year, maintaining profitability ranked among the top three concerns regardless of positioning, rising to 56% from 49% a year ago. If you go back to the revenue portion in Part 1 of our Survey, you’ll see that revenues have rebounded quicker than we expected them to. With backorders much worse this year than last year, it will be interesting to see in next year’s Survey what impact products that can’t be delivered will have on a dealer’s profitability. Even though we only track the direction of dealer revenues in our Survey, next year, we will track profitability because even if a dealer reports revenues are up, that doesn’t mean the dealership was profitable.

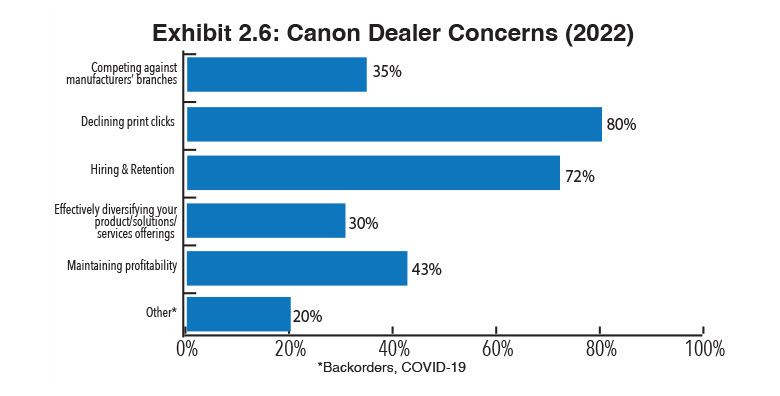

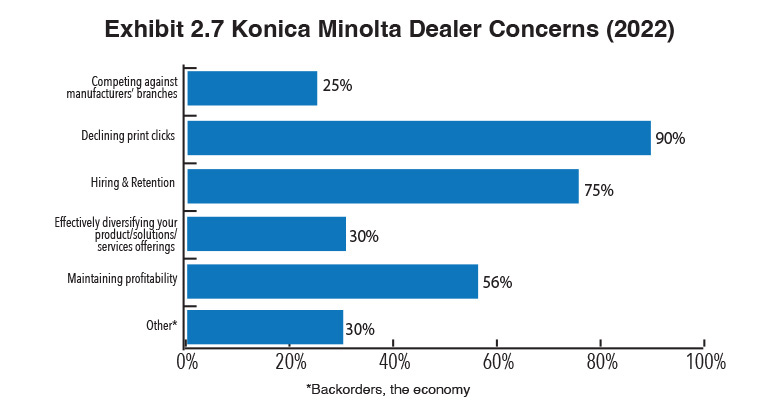

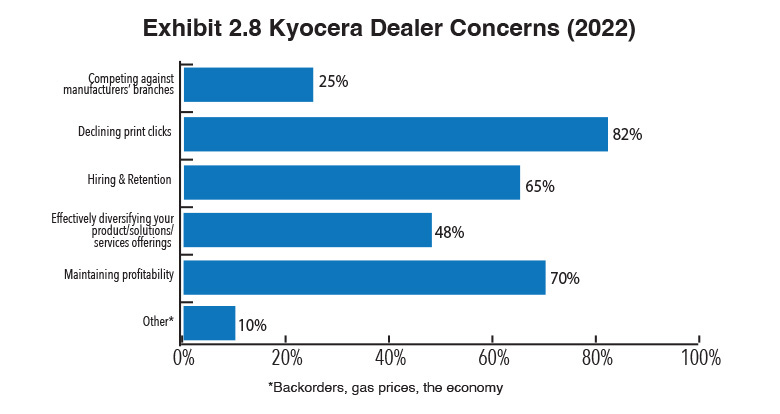

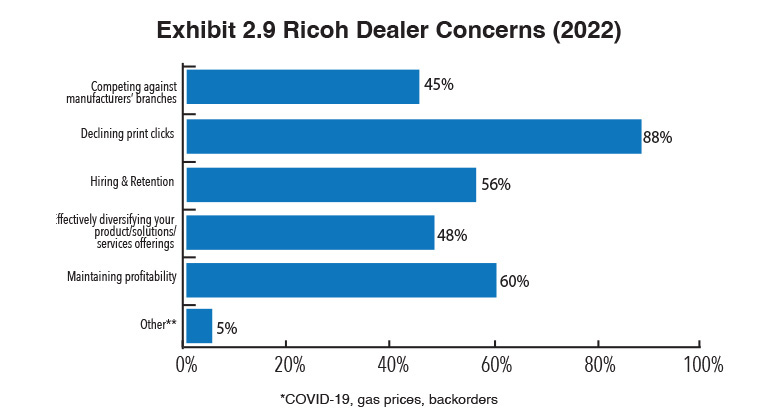

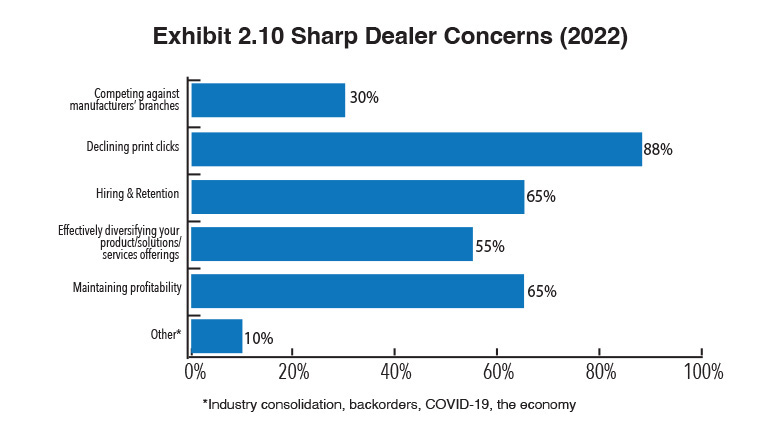

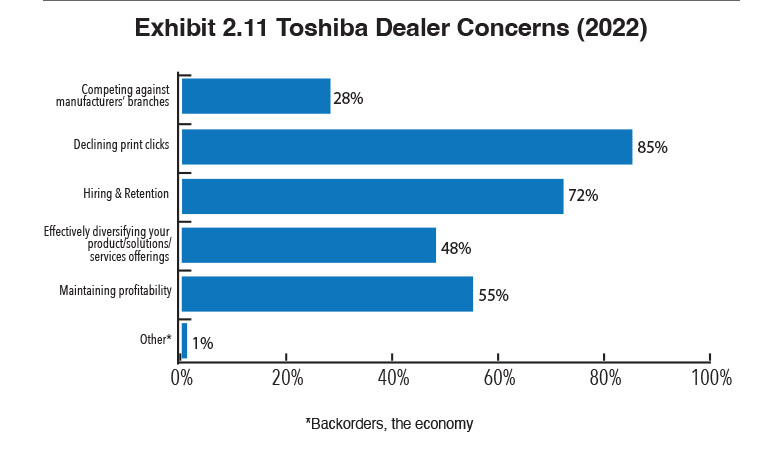

Examining the responses (Exhibits 2.6–2.11), reflecting the concerns of dealers affiliated with each of the Big Six OEMs, regardless of positioning when listing those concerns, declining clicks remains the leading concern. Konica Minolta dealers (90%) were most concerned about declining clicks, followed by dealers representing Ricoh (88%), Sharp (88%), Toshiba (85%), and Kyocera 82%). Last year, Sharp dealers (70%) were least concerned about declining clicks.

This year, with fewer options to choose from, the percentage of dealers representing the Big Six OEMs

were more concerned about diversifying compared to previous Surveys. Dealers representing Sharp (55%) were most concerned about diversifying, followed by dealers representing Kyocera and Ricoh (48% each). Dealers are fully aware of the need to diversify or at least the hype around diversification. All they need to do is attend an OEM dealer meeting or BTA conference, or read one of the industry trade publications to learn the who, what, where, and when about diversification. It’s inescapable. Still, there are a significant number of holdouts who have no intention of diversifying and are perfectly content to continue selling traditional imaging equipment. There are plenty of naysayers who say this business model is not sustainable, but here we are in 2020 and you don’t have to look too far to find a dealer who is still doing just fine selling what they’ve always sold. As Mad magazine’s Alfred E. Neuman would say, “What, me worry?”

For those dealers concerned about diversifying, much of the worries are related to the cost of diversification and the time spent training sales reps and service technicians. Unfortunately, it’s impossible to diversify without making some financial sacrifices at the beginning. The independent dealer channel is filled with those that have turned these investments into success. Just look at Impact Networking’s managed IT business or what Atlantic, Tomorrow’s Office and RJ Young have done in the production and industrial print segment.

Looking at hiring and retention as a concern across dealers representing the Big Six OEMs, we saw a pronounced uptick in the percentage of dealers who identified this as a concern. Again, we attribute the upward swing to dealers having fewer options to select from in our Survey. No matter, this is an ongoing concern and like diversification a hot topic in breakout sessions, webinars, and the industry trades. Dealers representing Konica Minolta (75%) were most concerned about hiring and retention followed by Canon dealers (72%), and Kyocera and Sharp dealers (65% each). No doubt, this industry has a problem here and can certainly do a better job of recruiting young people who have no previous ties, such as family members already in the business. Some of this is perception of the industry, and it’s easy to understand why the prospect of working in one that’s still copier-centric does not sound all that appealing to outsiders, no matter how sophisticated the technology has become.

We always receive interesting comments among the “Other” concerns identified by dealers. Rather than identify all of them, including some of the more off-the-wall comments, we are only identifying the most commonly cited concerns in this category:

- Backorders/supply chain

- Gas prices

- The economy

- COVID-19

- Industry consolidation

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.