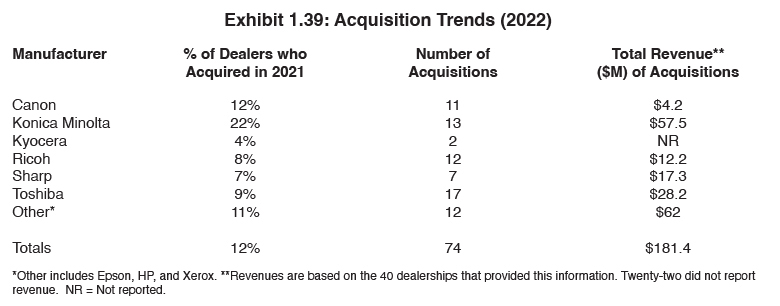

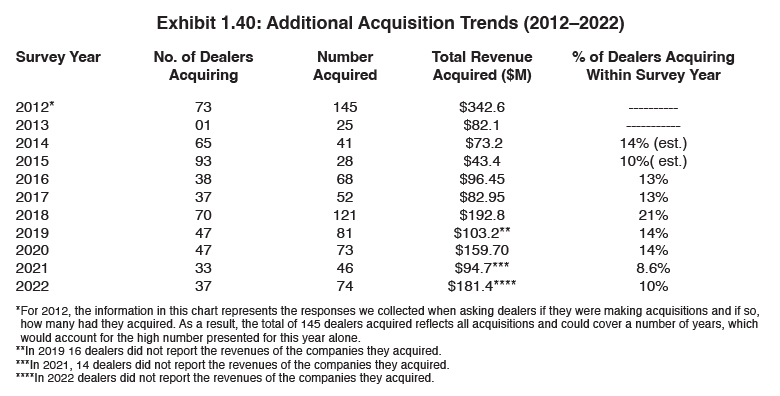

Exhibits 1.39-1.40

After seeing the number of acquisitions dip considerably in 2020 compared to the previous year, acquisitions picked up again in 2021. In last year’s Survey, 9% of dealers (33) reported 46 acquisitions, whereas in the previous year 14% of the dealers participating in the Survey reported 73 acquisitions. This year, we saw a rebound as 12% of dealers reported making 74 acquisitions. As we’ve mentioned in previous Survey analyses, some dealers prefer to keep their acquisitions private and do not report them in our Survey.

Most acquisitions were of smaller companies, with the average value of the acquired companies at $3.5 million, a modest increase from the $3.2 million (2021) and $3 million (2020) reported in our previous two Surveys. Most of the companies being acquired, whether they be independent dealers or MSPs, continue to fit the historical profile of acquired dealers—companies with less than $5 million in annual revenues. In this Survey’s results, 37 dealers made 74 acquisitions, however, respondents only shared revenue for 52 of those acquisitions. As a result, the $3.5 million figure noted above is based on 52 acquisitions, not 74.

It’s likely that the pandemic accelerated the decision of some business owners to sell in 2021, but pandemic or no pandemic, many dealer owners are on the north side of 60 and if they don’t have a succession plan, the only other option is selling, provided they can find a buyer. We’ve written reams about what makes an attractive acquisition target and what doesn’t, and we wouldn’t be surprised to see some of those smaller dealers that are looking to sell discover that their business isn’t all that appealing to most buyers.

Private-equity money is still a factor in reshaping the independent office dealer channel, and we’ve seen a couple of significant acquisitions in the first six months of 2022—UBEO’s acquisition of Centric Business Systems in January and Flex Technology Group’s acquisition of Standard Office Systems in June. We expect those two companies, along with DEX Imaging and Marco to continue to grow their presence nationwide backed by private-equity dollars. Meanwhile, Visual Edge’s offshoot, Visual Edge IT, is focused on acquiring IT companies. That’s not to say that they won’t still be acquiring legacy copier dealers, but based on an interview in The Cannata Report earlier this year with Visual Edge’s David Ramos, it’s unlikely the company will entertain making an offer for a legacy copier dealership that doesn’t have some sort of IT offering as well.

Mid-sized and larger independent dealers aren’t being left out of the acquisitions game either as we’ve seen Kelley Connect in Kent, Washington; Gordon Flesch Company in Fitchburg, Wisconsin; Impact Networking in Chicago, Illinois; and RJ Young in Nashville, Tennessee, expanding their footprints through acquisition.

This year, 42% of respondents reported they are considering a future acquisition, down 1% from last year’s Survey. Last year, 49% of Survey respondents reported they were looking to acquire in the future. The dealers who seem most interested in acquiring represent Canon and Ricoh (56% each), Konica Minolta (46%), and Toshiba and Sharp (38% each), with just 29% of Kyocera dealers considering acquiring.

No doubt, the independent dealer channel continues to contract, and we expect to see the larger entities continue to get bigger through acquisition and organically. Some of us who watch the industry closely have been wondering when the first acquisition of one of the private-equity-owned entities will happen. If it does, we surmise the acquirer will be another private-equity-owned entity within the document imaging space. If and when that happens, it will have a profound effect on the channel.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.