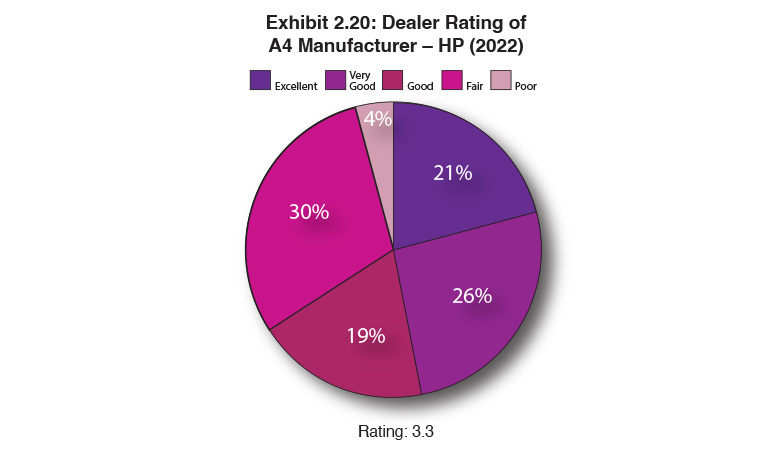

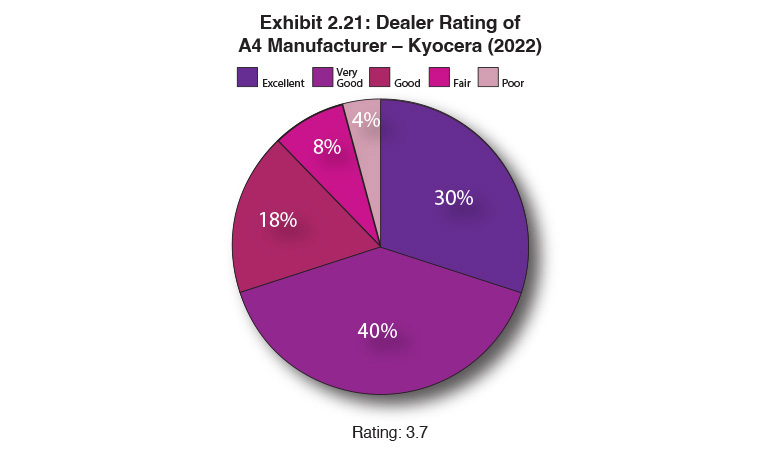

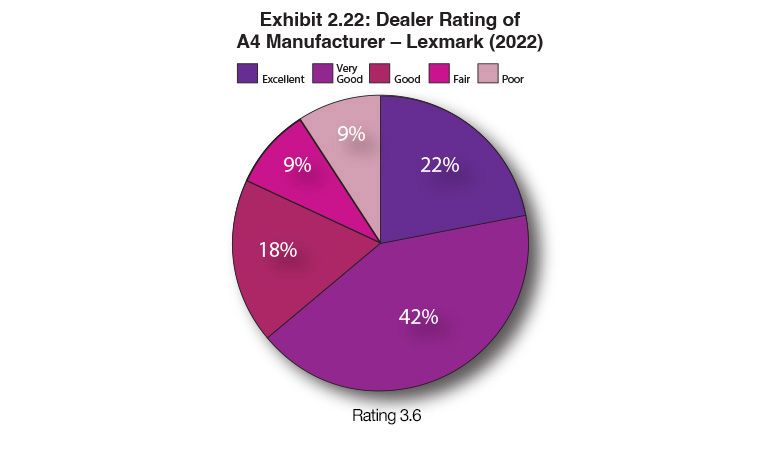

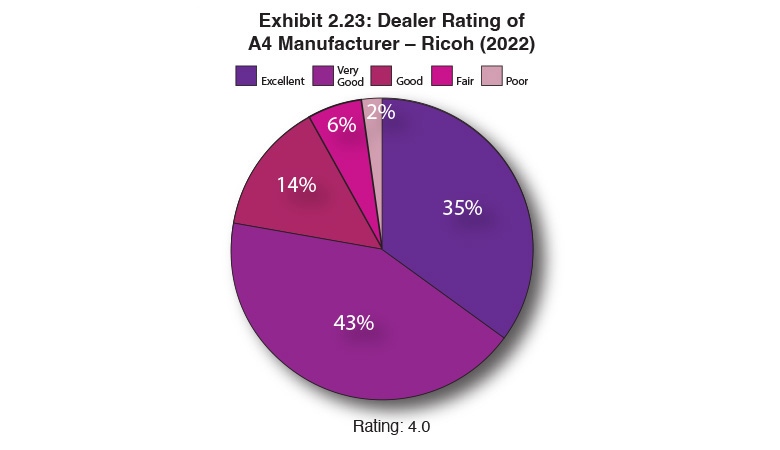

Exhibits 2.20-2.25

This has not been a good Survey year based on dealer ratings of their A4 providers. Except for Lexmark whose rating remained the same as last year, everyone’s ratings declined from our previous Survey. One might surmise that with the proliferation of hybrid work and the decline of traditional office print, this is a great time to be an A4 provider. Unfortunately, backorders and supply chain issues are taking their toll as some OEMs are shifting their available resources, including hard-to-source chips to higher margin A3 products. As a result, there are not as many A4 products available as there were before last fall.

Because not every Big Six OEM has a strong A4 offering, many dealers source A4 products from another vendor. Brother, Epson, HP, Lexmark, and Xerox are five manufacturers that dealers use to fill out their A4 offerings. Fifty-seven percent of respondents selected one of these other companies as an A4 provider and 26% of one of these companies as their primary A4 provider. Despite seeing Kyocera’s rating slip in the Survey, 22% of dealers still identified Kyocera as their primary A4 supplier. No other Big Six OEM even comes close to that percentage.

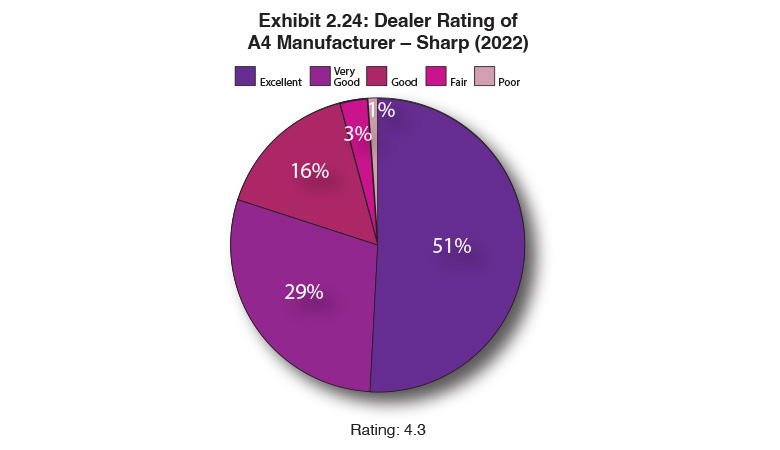

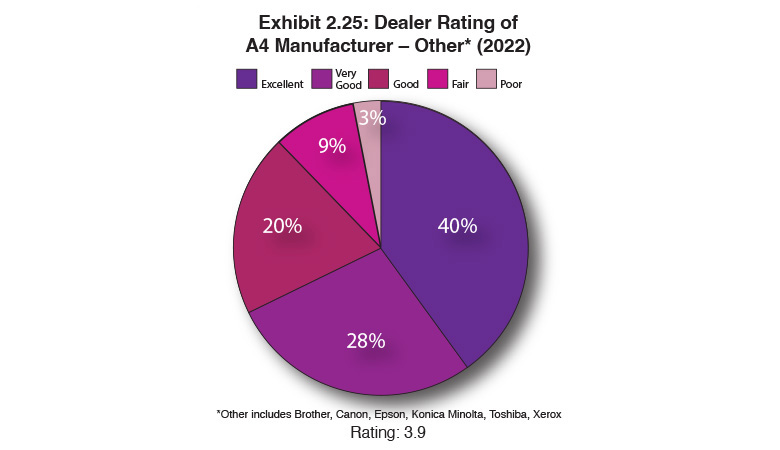

Exhibits 2.20 to 2.24 show the ratings of the A4 vendors with 30 or more dealers selecting them as their primary A4 provider. The OEMs that met this criterion included HP, Lexmark, Kyocera, Ricoh, and Sharp. Combined, those five OEMs represent 75% of primary A4 suppliers. Exhibit 2.25 depicts the ratings of other A4 providers cited by fewer than 30 dealers.

After seeing Lexmark’s ratings decline in our previous two Surveys, the company maintained the status quo this year, receiving a rating of 3.6. Ratings were down for everyone else, with HP receiving the lowest rating (3.3), down from 3.8 a year ago. Some of the controversy, real or imagined, around HP’s Amplify program could have had an impact on the company’s ratings. However, HP—like the Japanese OEMs—has also been plagued by supply chain problems. For the second consecutive year, Sharp received the highest rating (4.3), down from 4.5 in last year’s Survey. This is one of the manufacturers that has also temporarily shifted its focus away from A4 to A3, which could explain the modest hit to its rating. On the plus side, Sharp has been applauded by many of its dealers for its openness and communication about the challenges it is facing and the measures the company is taking to mitigate backorder problems.

The comments below provide additional insights into the ratings, including those companies that were identified by fewer than 30 dealers as their primary A4 supplier.

Brother

Excellent: “They have tons of products.”

Excellent: “Solid TCO.”

Very Good: “Great value and availability of inventory is better than our other A4 suppliers.”

Very Good: “Brother is a good company with a solid team to help you win some deals. The product is a little cheap and the warranty program has a few issues.”

Good: “Quality product but need to keep up with the times in product development.”

Canon

Excellent: “Brand awareness.”

Very Good: “Good product, lack of availability, no support.”

Very Good: “Great products and good reps.”

Good: “Inventory restraints.”

Fair: “Lack of support.”

Epson

Very Good: “Good communication.”

Good: “A4 is a growing side of our business but that is not where we need to diversify.”

Good: “Low revenue and high competition so we focus on the higher end.”

Fair: “Consumer-centric manufacturer mindset, distribution partner—TD/Synnex—provides better pricing and support than dealing directly with Epson.”

HP

Excellent: “Vast product line and outstanding reseller support.”

Very Good: “HP has been very competitive with discount pricing for bulk orders.”

Good: “HP has always been difficult to deal with. Now, they have supply chain issues too.”

Fair: “Product availability is an issue and difficult to do business with—complicated.”

Fair: “HP still doesn’t understand the dealer channel.”

Konica Minolta

Excellent: “Great equipment, great support.”

Excellent: “Product quality and dealer support.”

Good: “Konica Minolta can’t get equipment into the country for the last 18 months. Their ‘use the dealer as our warehouse’ theory allows for great stock prices, but no inventory bit them in the ass and we are all suffering.”

Fair: “Backorders are horrible and communication not great.”

Poor: “Difficult to do business with.”

Kyocera

Excellent: “They understand the future growth of A4 over A3.”

Very Good: “Great product reliability. Genuinely good people who have made great strides over the last year to improve communication with dealers.”

Very Good: “Very helpful during supply-chain problems.”

Good: “Need a better handle on the supply chain.”

Good: “Shortages of A4 make rating impossible.”

Lexmark

Excellent: “Lexmark provides great support.”

Very Good: “Lexmark BSD products are very reliable and have a good MSRP compared to dealer cost.”

Very Good: “What causes them to be below the excellent mark is product availability has been really bad. Their support outside of that is good.”

Good: “Kept us informed, however, no products to deliver.”

Fair: “Lexmark was completely absent during the pandemic—virtually nonexistent.”

Ricoh

Excellent: “Beyond great products and great support.”

Excellent: “Reliable and professional to work with.”

Excellent: “Ricoh continues to produce high-quality, reliable products.”

Very Good: “Product is tough to come by, but they are trying.”

Good: “Dealing with inventory constraints.”

Sharp

Excellent: “Strategy for supply chain/chip issues. Overall strategic partner attitude.”

Excellent: “Sharp has had the ability to stay in front of the supply chain issues since the pandemic.”

Very Good: “Higher priced than competitors, but extremely more advanced than most all other products on the market.”

Good: “Low yield and slower turnaround time for supplies.”

Fair: “Older technology of own products, relabeled products under par.”

Toshiba

Excellent: “Great product line and very good corporate support.”

Excellent: “A leader in dealer support.”

Excellent: “Toshiba listens and does the best they can to address our concerns in a timely fashion. Stability of their personnel.”

Fair: “Not enough choices.”

Fair: “Not enough product available.”

Xerox

Excellent: “Operates more like a partner than a vendor.”

Good: “Me-too products, OK prices.”

Good: “They provide minimal human interaction and require us to go it alone.”

Fair: “Xerox is no longer a good partner. We have been transitioning to more Kyocera A4 products.”

Poor: “Costs are too high.”

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.