Exhibits 1.5-1.8

Declining A3 clicks and wider acceptance of a hybrid workforce prompted by the COVID-19 pandemic have made A4 more viable than ever within corporate America and at small- to medium-sized businesses (SMBs). Another driver of A4 is MPS, and as you’ll see later in our Survey, nearly three quarters of dealers offer this service.

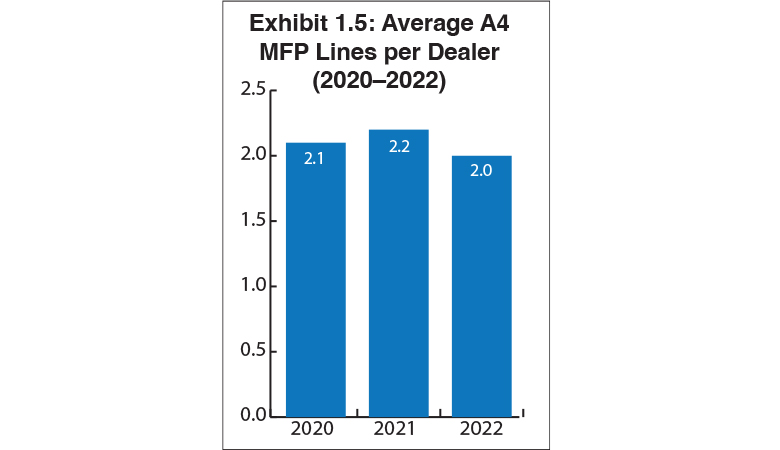

The average number of A4 lines carried per dealer (Exhibit 1.5) has been hovering between 1.9 and 2.2 since 2015, the year we first began tracking this segment. This year, the average number of lines is 2.0, down from 2.2 a year ago. Like last year, 12 A4 brands were identified by dealers in our Survey, including OKI Data, which exited the A4 market in March 2020. Only two dealers participating in our Survey are still selling OKI A4. In 2020, Toshiba introduced its first internally developed A4 device. It’s difficult to determine how many of the 51 Toshiba dealers participating in this year’s Survey who identified Toshiba as an A4 supplier are selling Toshiba-branded A4. That’s because in previous Surveys, Toshiba dealers were identifying Toshiba as their A4 supplier when the company did not have their own branded A4 device. Instead, Toshiba has relied on A4 partners such as Brother, HP, and Lexmark to meet their dealer’s A4 needs. That has not changed with each of those A4 OEMs well represented as A4 options among Toshiba dealers. Kyocera was also a popular A4 brand among Toshiba dealers.

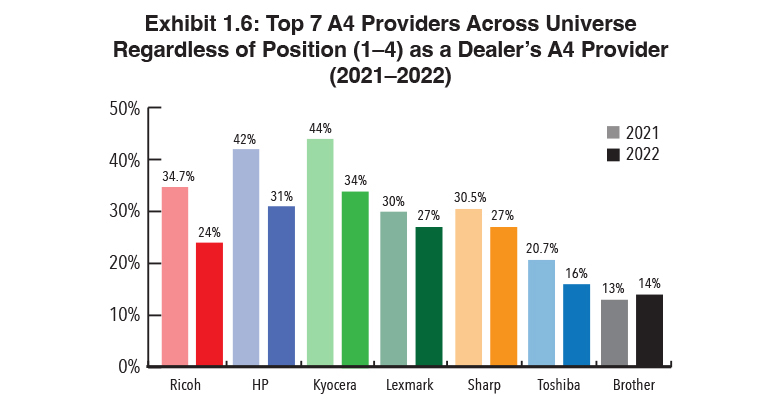

Four years ago, we first identified the Top Five A4 brands regardless of whether they were a Big Six manufacturer or a secondary manufacturer, and regardless of position as a dealer’s A4 provider. Two years ago, we increased that to the Top Seven A4 brands (Exhibit 1.6). This category has been fluid with the positions changing each year since. For the second consecutive year, Kyocera holds the top position at 34%, down from 44% a year ago. HP, which was in second position last year at 42%, remained in that position, but saw a decline to 31%. Most of the remaining positions were determined by the number of dealers from that manufacturer participating in the Survey, with the next five spots held by Lexmark and Sharp (tied at 27%), Ricoh (24%), Toshiba (16%), and Brother (14%). Not included in Exhibit 1.6, were Canon (13%), Konica Minolta (10%), Xerox (8%), Epson (6%), and OKI Data (0.5%). All of these percentages were down from a year ago and can be attributed to the 0.2% decline in average A4 lines per dealer. We still believe that Brother is a vendor to watch in the A4 space even though it has been relatively quiet in 2022 as far as new product introductions. Epson is another vendor we’ve been watching to see if it was going to make a move in the A4, as well as in the A3 space in our Survey. The pandemic has slowed down its momentum in signing new dealers; however, the company has an executive team that truly understands the independent dealer channel, and we wouldn’t be surprised if it has a larger piece of the A4 and A3 pies in future Surveys.

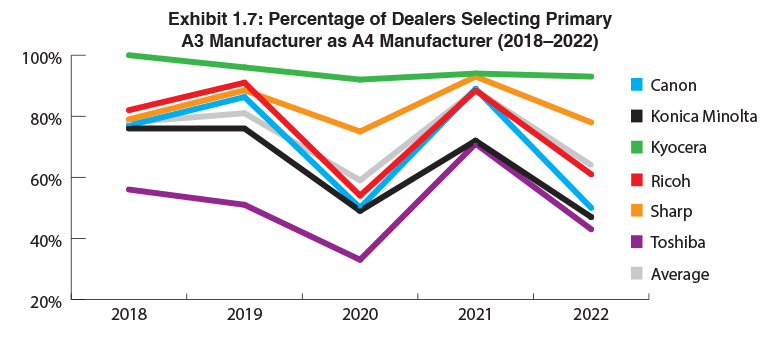

The percentage of dealers selecting their primary A3 manufacturer as an A4 manufacturer (Exhibit 1.7) once again found Kyocera dealers at the top of the heap with 93%, down from 94% last year. Sharp finished a distant second at 78% after soaring to 93% in last year’s Survey. This could be the result of Sharp addressing the chip shortage by shifting available chips from its A4 products to its A3 line. No doubt the chip shortage is creating havoc with all the OEMs, and each is getting creative to ensure they can meet at least some of the demand. For example, we recently learned that Toshiba, whose A4 product is also impacted by chip shortages, will be releasing new A4 products later this year that don’t rely on the difficult-to-source chips it was using in its first-generation A4 device.

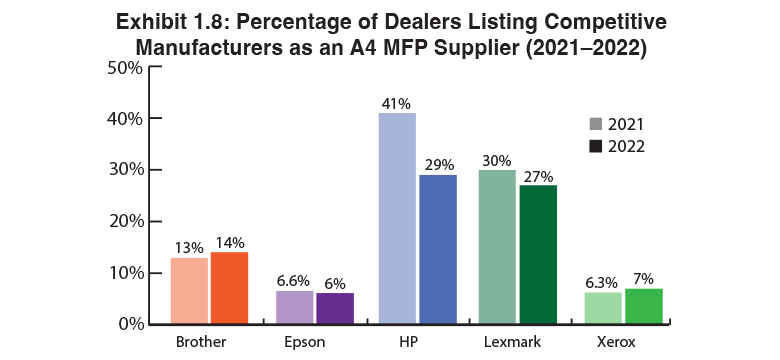

Exhibit 1.8 reveals the performance of A4 suppliers not among the Big Six. HP is sold by 29% of dealers participating in our Survey. Please note that this percentage has been adjusted from the percentage shown in Exhibit 1.6 since we are not factoring in the nine HP dealers who sell HP A4. HP experienced a 12% decline from the previous year, possibly because of some of the controversy around its Amplify program. It’s a program that is beneficial to many dealers, but it has also irked some dealers who are not so keen on providing HP with customer data. As a result, some dealers have stopped carrying the HP line, although not in significant enough numbers in our view to result in a 12% decline. As we note every year, this could be the result of a different pool of respondents in this year’s Survey. That would also explain the declining percentages of some of the other A4 OEMs in Exhibit 1.8. Lexmark is an interesting company to watch in the A4 space as it seems to be having its ups and downs in our Survey, from a low of 22% in 2020 to a high of 30% in 2021, and down to 27% this year. This could be increased competition from Brother (14%), an A4 manufacturer high on our watch list, or it could be a temporary bump in the road for this legacy A4 OEM. Considering its Lexmark Cloud Services initiative (read the accompanying article in this issue), Lexmark is doing its part to elevate its A4 product offerings and help its dealers future-proof their businesses.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.