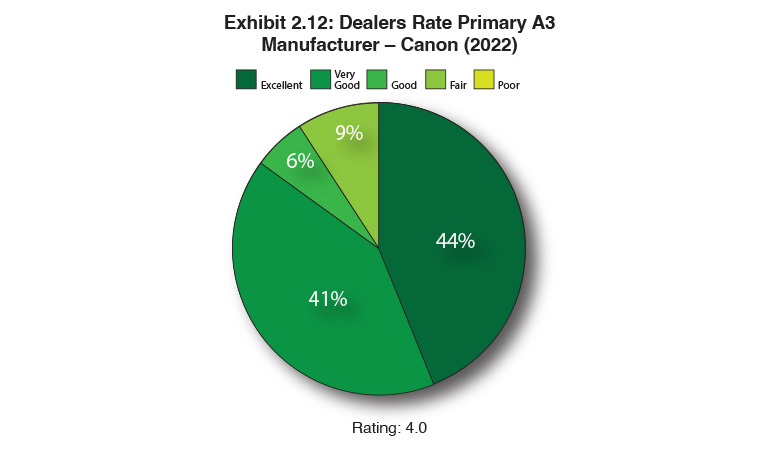

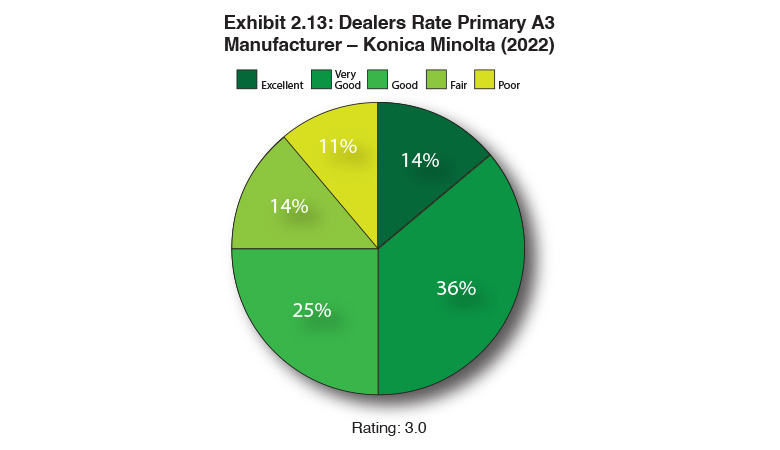

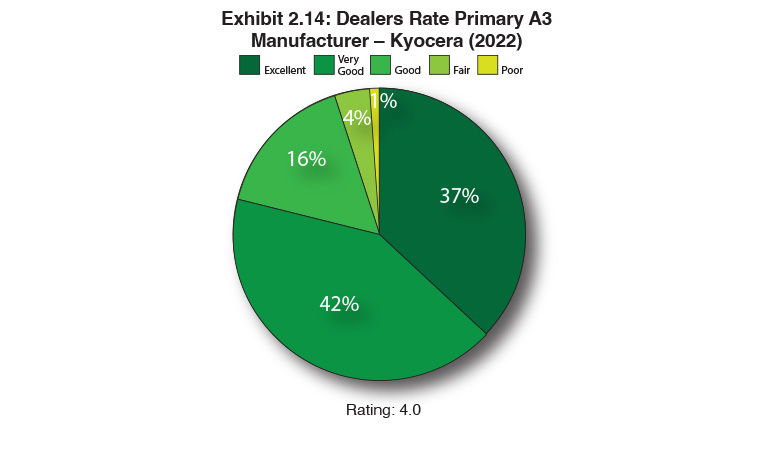

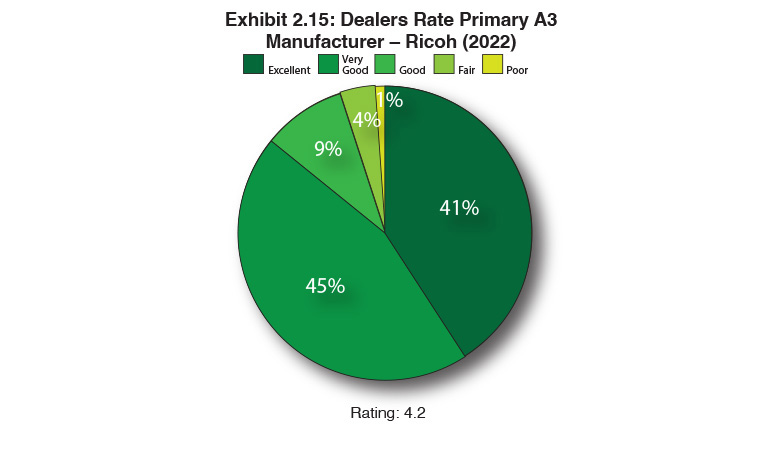

Exhibits 2.12-2.19

Each year, we ask dealers to rate their primary A3 MFP suppliers as “Excellent,” “Very Good,” “Good,” “Fair,” or “Poor.” Five points are then awarded for “Excellent,” four points for “Very Good,” three points for “Good,” two points for “Fair,” and one point for “Poor.” We then divide the total by the number of dealers participating from that manufacturer.

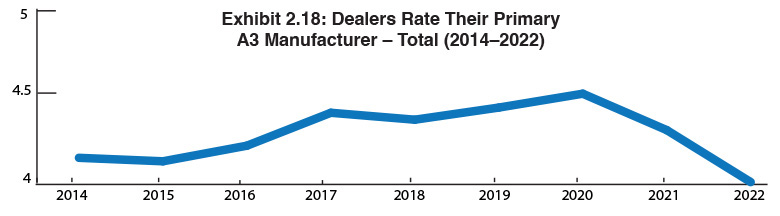

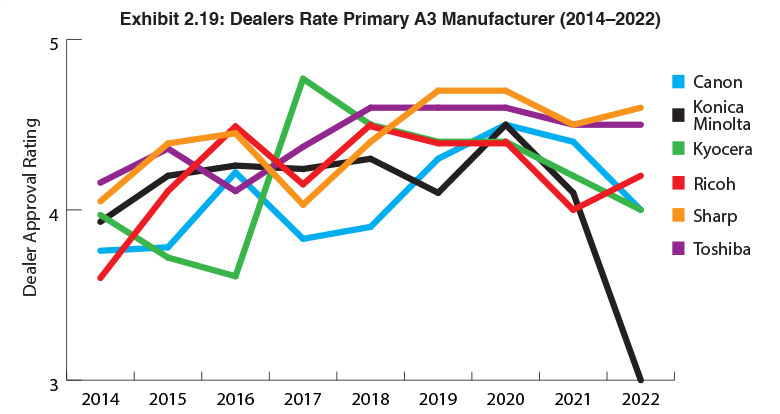

We attributed last year’s declining ratings to fallout from the pandemic and the emerging backorder situation. With backorders still raging, we were expecting to see lower ratings across the board for all OEMs this year. Even though the overall average declined from 4.3 to 4.0 (Exhibit 2.18), two OEMs experienced a modest increase, and one received the same rating as last year. As you will see in the representative comments that explain the reason for their ratings, backorders are an issue, even for the two OEMs with the highest ratings.

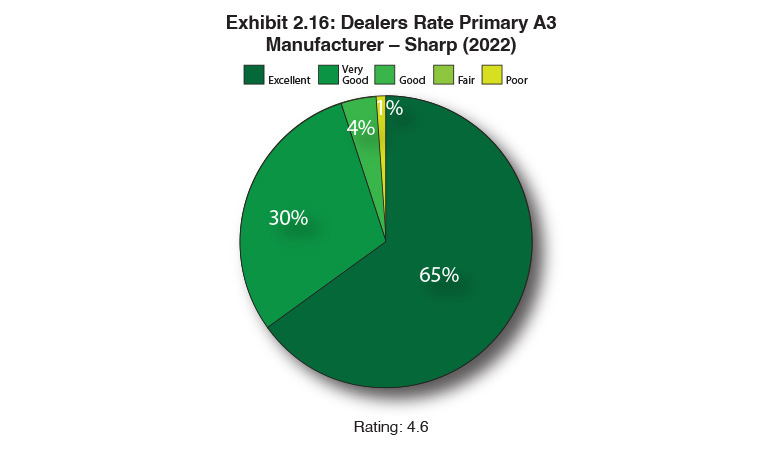

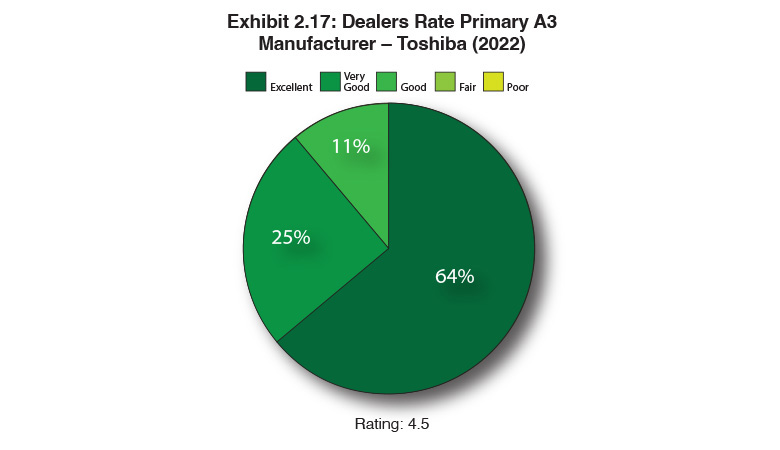

For the second consecutive year, the OEMs with the highest ratings in this year’s Survey were Sharp (4.6) and Toshiba (4.5). For the past three years, Sharp has been the highest ranked OEM with ratings of 4.7 (2020), 4.5 (2021), and 4.6 (2022), followed by Toshiba at 4.6 (2020) and 4.5 (2021 and 2022). No doubt, we believe the leadership at both companies is responsible for dealers’ high opinions of these companies, even during challenging times such as these. Ricoh, a company that had been seeing its ratings dip the past couple of years, experienced an uptick this year from 4.0 in 2021 to 4.2 in 2022. Communication is a key factor in how dealers rate their OEMs, and these three OEMs seem to be doing a better job than others in the opinion of our Survey respondents, especially during the last year and into this year.

It was not a surprise to see the dramatic decline in Konica Minolta’s rating based on what we have been hearing through the dealer grapevine. After receiving a 4.5 rating two years ago, its rating declined to 4.1 last year, and to 3.0 in our current Survey. Only 14% of its dealers rated Konica Minolta as Excellent, down from 41% a year ago. Three words explain the reason for this rating, the lowest an OEM has ever received in our Survey: supply chain issues. While all OEMs have been challenged by the supply chain, Konica Minolta seems to have had more issues than others, or perhaps their dealers are more vocal about sharing their opinions with us. Communication with Konica Minolta’s dealer channel seems to be another problem that dealers cite about the OEM, although we have found company executives to be candid with us about the challenges in interviews. Also, during the Konica Minolta dealer meeting, company executives addressed the supply chain at the beginning of the meeting, so in our opinion, Konica Minolta doesn’t seem to be avoiding the issue. However, it’s the Konica dealers that have the last word, and that word is sharply reflected in Konica Minolta’s rating this year.

Another factor that may impact a dealer’s rating is changes in upper management at the OEMs. That seems to have been a factor at Kyocera where Oscar Sanchez has stepped in and made some tough decisions that have taken dealers out of their comfort zones. Konica Minolta has had a change in leadership over the past two years, which could be another factor that impacted the company’s rating. That said, a change in leadership at Toshiba last year has not impacted this company’s rating, primarily because Larry White, the president, is highly respected among Toshiba dealers.

For the past four years, we have been presenting the common themes derived from the comments shared by dealers representing each of the Big Six OEMs to explain their ratings.

Canon

Excellent: “In a commoditized market, Canon still has the highest quality product and long-term parts support.”

Very Good: “Products are great; pricing and rebates since COVID have been one-sided, favoring the manufacturer.”

Very Good: “Canon has been around forever. I hate competing against the branch as they never sell with profit and many times sell under our dealer cost, which as you know is very frustrating.”

Good: “Need more and better communication on the supply chain.”

Fair: “Huge inventory issues, but the communication from manufacturer terrible, however Konica Minolta worst of all.”

Konica Minolta

Excellent: “They give us great product support for sales and service. Our rep stays in constant contact with us to find out if we need anything concerning equipment or supplies.”

Very Good: “I believe that KM is doing a good job of diversification, however the support I have received as a dealer has declined. Case in point, they just had their dealer conference and rolled out several new programs. I have not heard one word from my DSM about them. Corporate messaging is great, but it seems to stop there.”

Fair: “Hardware and toner supply chain issues and inability to accurately forecast ETAs.”

Fair: “Bad job with product availability compared to other manufacturers.”

Poor: “Horrible supply chain issues. I know everyone has issues, but theirs are deeper and broader.”

Kyocera

Excellent: “They have done a great job with the supply chain crisis.”

Very Good: “Still innovating and embracing solutions, handling supply chain issues pretty well.”

Very Good: “Great product reliability. Genuinely good people who have made great strides over the last year to improve communication with dealers.”

Good: “Makes a good product. Terrible to work with. Focused only on their profits and not that of their resale partners.”

Poor: “Kyocera no longer approaches our relationship from a customer-first perspective.”

Ricoh

Excellent: “Very dependable, great support, and multiple offerings to our customer base.”

Excellent: “Equipment and service support are the best. Ricoh’s dedication to the dealer channel is a top priority.”

Very Good: “A3 units are still attainable without long backorder issues.”

Very Good: “Ricoh has been pretty good at helping us through inventory shortages by reducing quotas, flexibility with credit terms, etc. They have been communicative and trying their best.”

Good: “We are a single-line dealer. The current backorder situation is totally unacceptable.”

Sharp

Excellent: “Sharp is strong, great products, they have inventory, and Mike Marusic has to be the most down-to-earth, easiest to get along with manufacturer CEO ever.”

Excellent: “Sharp has been a solid partner and was able to have inventory when other manufacturers did not!”

Very Good: “Sharp has navigated the supply chain waters with excellence.”

Very Good: “Sharp is doing well in keeping product available and developing the existing product in a timely manner comparatively.”

Good: “Very good product line up to 80 ppm. Not a player in high-end production.”

Toshiba

Excellent: “Toshiba continues to support independent dealers in a variety of ways, including partnering with a tech recruiting firm to help us hire sales, service, and admin professionals. The introduction of a Toshiba A4 MFP was especially helpful this past year.”

Excellent: “Was with Konica Minolta prior and they were terrible.”

Very Good: “Toshiba has the three P’s—great people, products, and pricing and has been a great partner for our company.”

Very Good: “Sales and service support is still very good, but it can be better. It’s a sign of the times but good times are ahead.”

Good: “Unfortunately, they did not plan well for shipping issues.”

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.