Exhibits 1.1-1.4

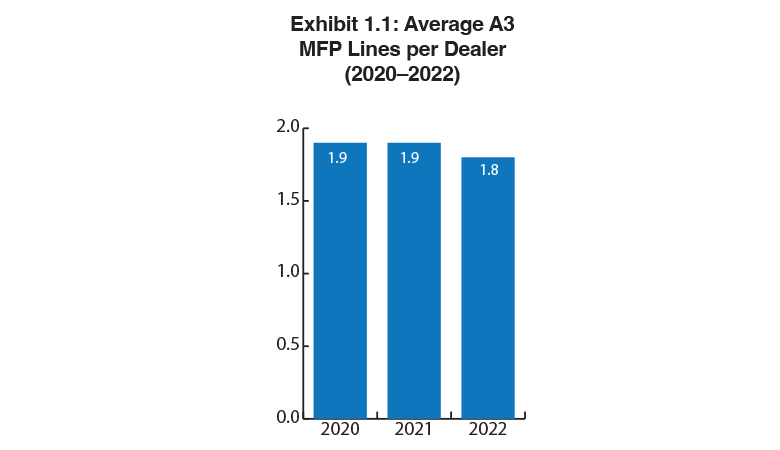

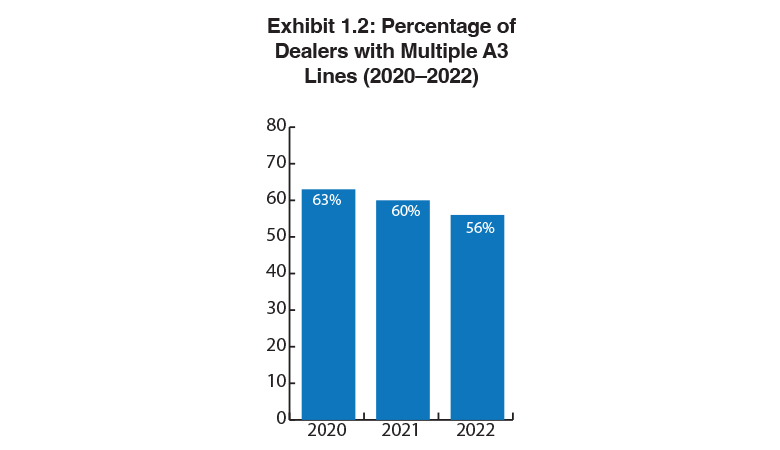

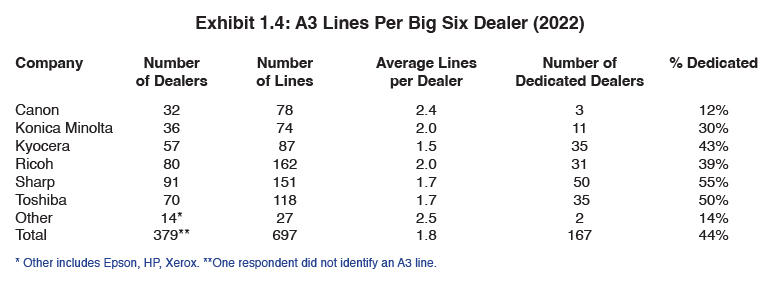

In this year’s Survey, 697 A3 MFP lines were reported across 379 respondents (one respondent did not identify an A3 provider). The average number of lines per dealer for the Big Six universe is 1.8, down from 1.9 a year ago (Exhibit 1.1). The decline can be attributed to a greater number of single-line dealers participating in our Survey.

For the past four years, the average number of lines per dealer has ranged between 1.9 and 2.0. We’d have to go back to 2017 when the average number of lines was identical to this year. We would have thought that consolidation resulting from acquisitions would have raised the number of MFP lines per dealer, but that doesn’t seem to have happened.

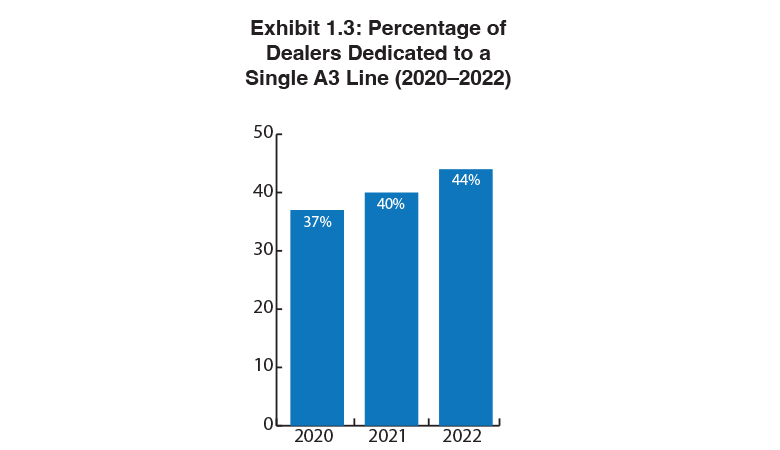

Rather, we attribute this year’s result to having more Survey respondents that are single-line dealers representing Kyocera, Sharp, and Toshiba. It will be interesting to see in future Surveys if this trend continues. The number of dedicated A3 dealers participating in the Survey has been on the rise since 2019, when 37% were carrying a single line. Last year, that percentage rose to 40%, while this year it hit 44% (Exhibit 1.3).

Although the Big Six OEMs comprising Canon, Konica Minolta, Kyocera, Ricoh, Sharp, and Toshiba have the lion’s share of the A3 market, HP remains a potential disruptor. Fully 14.2% of respondents sell HP A3 products. That’s down from 18.2% a year ago and could be the result of fallout from its Amplify program, which resulted in a few dealers dropping the line. More likely, the drop is the result of more dedicated dealers from other manufacturers participating in the Survey. Worth mentioning, however, is that nine dealers participating in this year’s Survey identified HP as their No. 1 A3 provider, up from five a year ago. All those HP dealers carry multiple A3 lines, which, in some instances may mean that HP has moved ahead of another OEM’s A3 line in the hearts and minds of those dealerships.

_________________________

To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available upon request and included in our media kit.