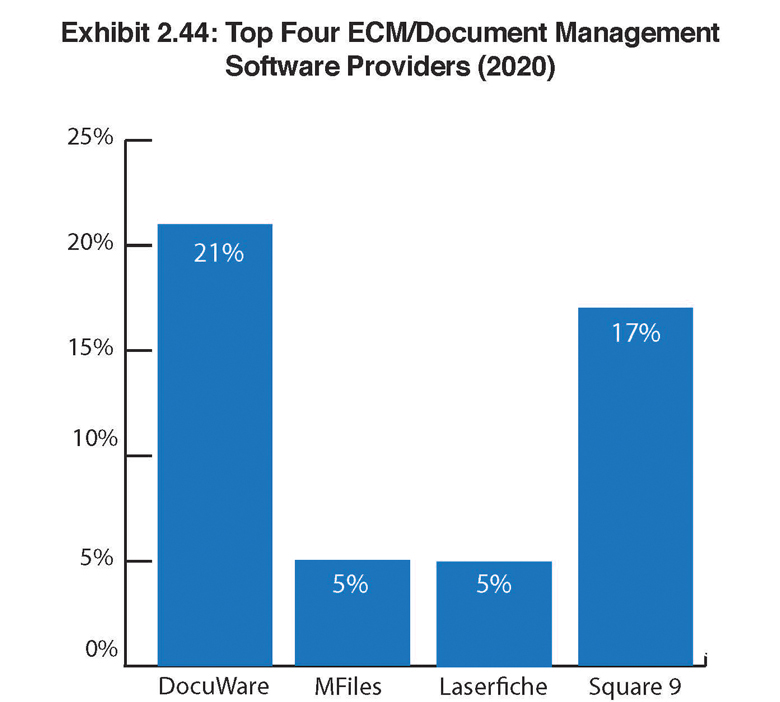

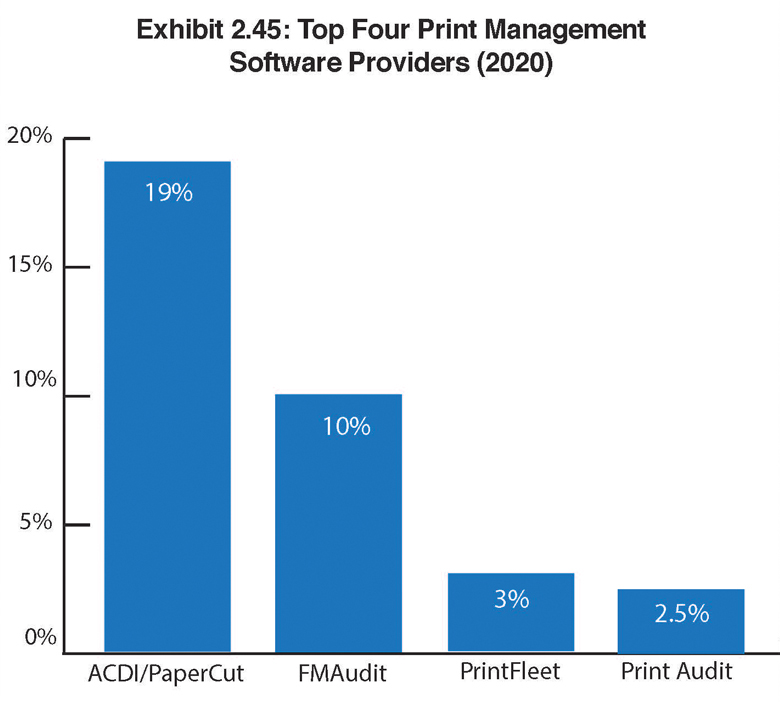

Exhibits 2.44-2.45

This is the seventh year that we have asked dealers to identify the companies—excluding the hardware manufacturers and leasing companies—that provide them with software and support that allows them to compete the most effectively.

We are continuing with the format we initiated last year, asking dealers to identify the ECM/Document management provider that provides the best pre- and post-sales support, as well as the print management provider that offers the same.

Software is an interesting category to track because there are so many types of software available to dealers, and consequently, a wealth of software providers, including their own OEMs. That reality was reflected across our Survey results in the document management/ECM and print management categories.

Another point of clarification in the software category is that some dealers or the individuals tasked with filling out our Survey aren’t that knowledgeable about these software categories and or identify a company whose software doesn’t offer either of these capabilities.

We ask dealers to identify third-party software providers that provide the best pre- and post- sales support rather than OEMs, but OEMs still receive a significant share of love from their dealers in the software rankings. We also saw 26% of dealers identify their OEM as the top document management/ECM provider. Similarly, 16% of dealers identified their OEM as their top print management provider.

In the ECM/document management category, two companies stood out from the rest in terms of the percentage of dealers identifying them as the best provider—DocuWare (21%) and Square 9 (17%). Their closest competitors were tied at 5%. Note that the percentages we are reporting this year only include dealers that sell ECM/document management solutions rather than the entire universe of dealers participating in our Survey.

In the print management category, ACDI/PaperCut was the runaway winner, with 19% of dealers selecting them, followed by FMAudit at 10%, PrintFleet at 3%, and Print Audit at 2.5%. Twenty percent of respondents did not respond to this question. Even if the individual filling out the Survey is unable to answer this question, there are still dealers that are not taking advantage of print management solutions or document management/ECM. If they are not, the former is essential for anyone placing printing hardware, while the latter should be viewed as a prime diversification opportunity.

We are still curious to see what impact, if any, consolidation will have on the software segment of the industry. Up until this year, ECi had aggressively been growing its software portfolio through acquisition. Last year’s acquisition of PrintFleet complemented its previous acquisitions in the print management space of FMAudit and e-automate. Notable acquisitions by OEMs of software companies during the past three years include Konica Minolta’s acquisition of ERP provider MWA and Ricoh’s acquisition of DocuWare. As we expect to see on the dealer front, we would not be surprised to see more acquisitions in the software space post-pandemic.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.