Exhibits 2.36-2.43

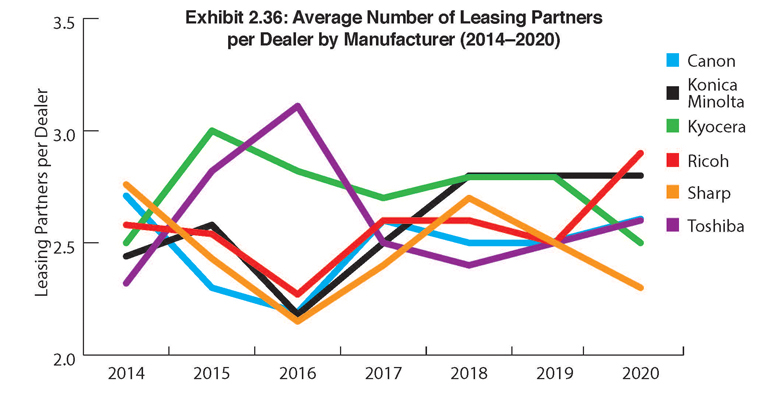

The average number of leasing partners among the Big Six dealer universe has not changed in our last three Surveys. It is holding steady at 2.6. A total of 29 different leasing options were identified by dealers (dealers could identify up to four leasing partners), including leasing from their OEM. That figure does not include the 12 dealers that provide their own leasing.

When tabulating dealers’ ratings of their leasing partners, we only include those companies that have been identified by 25 or more dealers as their primary leasing partner. This year, five leasing companies made the cut—DLL, GreatAmerica Financial Services Corp., LEAF Commercial Capital, U.S. Bank, and Wells Fargo. TIAA, which was identified by more than 25 dealers last year and was included in the charts in previous years, did not meet the threshold of required votes this year. Perhaps the news this spring that TIAA was exiting the office equipment leasing business played a part.

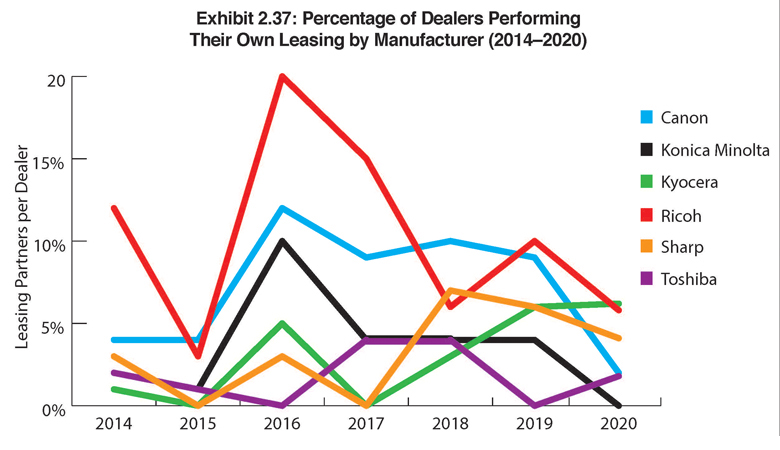

The number of dealers handling their own leasing declined from 5.8% last year to 3.3% this year. This percentage has been declining since 2015 when 10% of respondents had an internal leasing program. This downward trend is representative of a more solid economy as the economic downturn of 2009 forced dealers to get creative in their financing. An offshoot of that creativity resulted in dealers handling their leasing needs internally as it became more difficult to obtain financing in the leasing marketplace. At present, that doesn’t seem to be an issue for most dealers. And with the pandemic still an issue, there hasn’t been much need to reach for internal or external leasing compared to previous years.

Another contributor to the decline in dealers offering their own leasing programs is the administrative costs associated with operating a leasing program. Some dealers that might have done so in the past have determined it’s not worth the expense or the challenges of managing it.

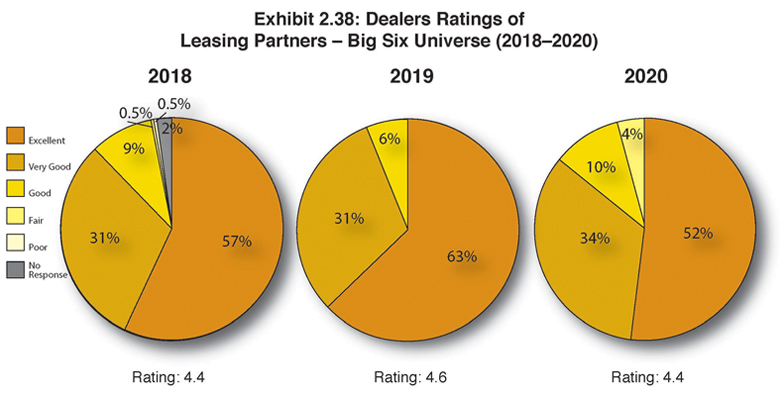

As we have done in our past Surveys, we asked participating dealers to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” and “Poor.” Examining how the Big Six dealer universe ranked their leasing partners in our current Survey, 52% were ranked as “Excellent,” an 11% decline from last year. Not a single leasing company received a “Poor” rating in this year’s Survey, an indication that these companies continue to satisfy the financial needs of their dealer customers. With a five-point rating system (with 5.0 being the highest rating), the five leasing companies that were identified by 25 or more dealers as their primary leasing partners, all received scores above 4.00, averaging 4.4, down from the 4.6 rating in last year’s Survey, which included TIAA, which received a 4.5 rating.

GreatAmerica Financial Services continues to capture the most favorable ratings in our Survey, scoring a 4.8 for the second consecutive year. No doubt the company’s full-court press at industry events, and its marketing, education, and social media initiatives, are a factor. DLL was the only leasing company to see its rating increase in this year’s Survey, rising from 4.3 in 2019 to 4.4 this year. LEAF Commercial Capital, U.S. Bank, and Wells Fargo all saw their ratings decline: LEAF Commercial Capital from 4.4 to 4.1; U.S. Bank from 4.6 to 4.5; and Wells Fargo from 4.4 to 4.1. What dealers are saying is that these companies are “Very Good” or better at what they do, but that there is room for improvement.

Overall, across the Big Six dealer universe, dealers are generally satisfied with their leasing partners, which we attribute to favorable interest rates and more programs for services such as MPS and MNS, as well as emerging technology segments such as production print, digital signage, and security, for example. Most leasing companies do an excellent job of identifying trends and developing programs to accommodate new products and solutions. As a result of the pandemic, we expect to see the leasing companies become even more creative in their financing options going forward.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.