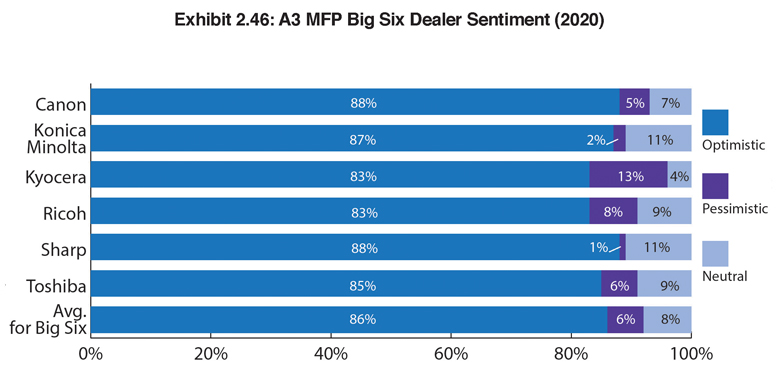

Exhibit 2.46

For the past three years, we tracked dealer optimism and pessimism in three areas—A3, A4, and production print. This year we decided to simplify things and just asked dealers how optimistic or pessimistic they were about the long-term viability of their businesses due to the business challenges caused by the COVID-19 pandemic. Their responses surprised us.

Not every dealer (6%) responded to this Survey question, and for accuracy, we did not include the responses of those dealers in our percentage calculations in Exhibit 2.46. We were shocked to find that 86% of dealers were optimistic about the long-term viability of their businesses. It’s become somewhat of a cliché to talk about the resilience and adaptability of the independent dealer channel, but if a global pandemic—and one that has decimated businesses across the United States—can’t keep these entrepreneurs down, we don’t know what can.

Canon and Sharp dealers were the most optimistic tied at (88%), followed by Konica Minolta dealers (87%). The least optimistic, and that’s stretching the definition of “least optimistic,” were Kyocera and Ricoh dealers, tied at 83%. By any measure, 83% is still a significant percentage of optimistic dealers.

Only 8% were neutral when asked this question, and 6% felt pessimistic about the long-term viability of their businesses. There is a good chance some of those pessimistic dealers will be among the dealers that will be selling their businesses within the next five years. Kyocera has the most pessimistic dealers (13%), followed by Ricoh (8%). There have been many personnel changes taking place at Kyocera during the past two years, and that could explain some of the pessimism. Change is hard, and couple that with a global pandemic, it should not be surprising that some dealers are pessimistic about their future. Sharp (1%) and Konica Minolta (2%) had the lowest percentage of pessimistic dealers.

We can’t predict what the future holds for the independent dealer channel, especially since the pandemic has yet to be eradicated and continues to impact the economy and will likely do so for some time. However, based on the independent dealer channel’s past history and the percentage of optimistic dealers in this year’s Survey, we have some clues.

Let’s just say, the independent dealer isn’t going anywhere. It will adapt by selling a wider variety of products, services, and solutions, and tweaking business models to better meet changing customer needs and customer environments. And that’s exactly what independent dealers have always done.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.