Exhibits 2.1–2.11

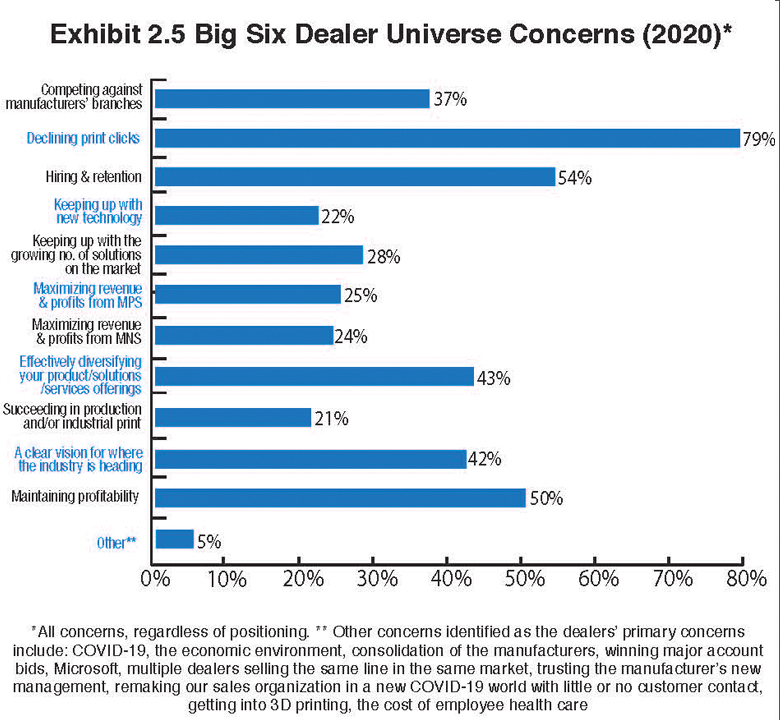

Historically, one of the more interesting findings from our Survey is dealer concerns. Last year, we expanded the number of concerns from 11 to 12 based on reader feedback. The 12th concern was “maintaining profitability.” As things have turned out, that has become a common concern. We asked the dealers to choose from the following 12 areas of concern:

· Competing against manufacturers’ branches

· Declining print clicks

· Hiring and retention

· Keeping up with new technology

· Keeping up with the growing number of solutions on the market

· Maximizing revenue and profits from MPS

· Maximizing revenue and profits from MNS

· Effectively diversifying your product/solutions/services offerings

· Succeeding in production and/or industrial print

· A clear vision for where the industry is heading

· Maintaining profitability

· Other

Two years ago, rather than ask dealers to identify their four top concerns as we had done in previous Surveys, we allowed them to identify an unlimited number of concerns. Since then, we have continued with that format. The number of concerns noted ranged from zero to eight concerns per dealer, with more than half of all respondents identifying more than four concerns. As a result, we have added additional charts to reflect the dealer concerns of each of the Big Six OEMs, as well as charts for the top three concerns, and a chart that identifies the concerns of the entire Survey universe.

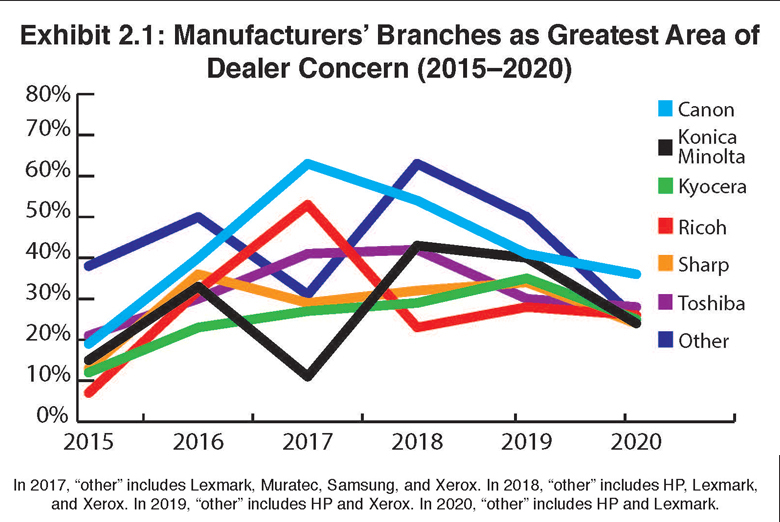

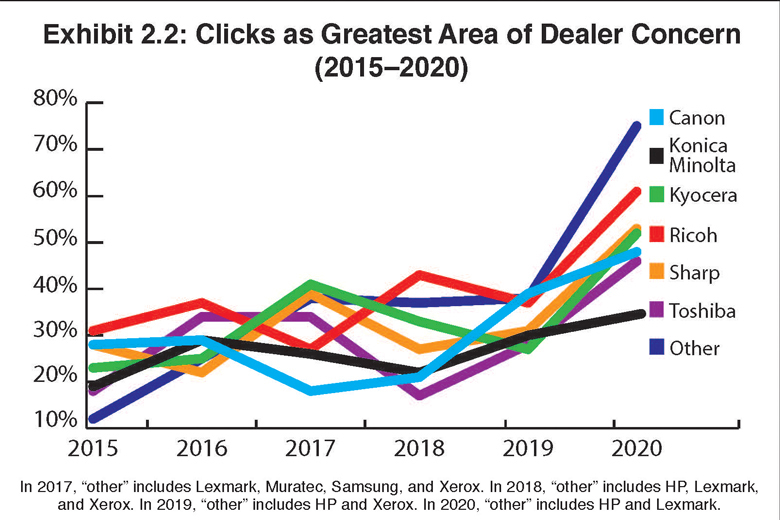

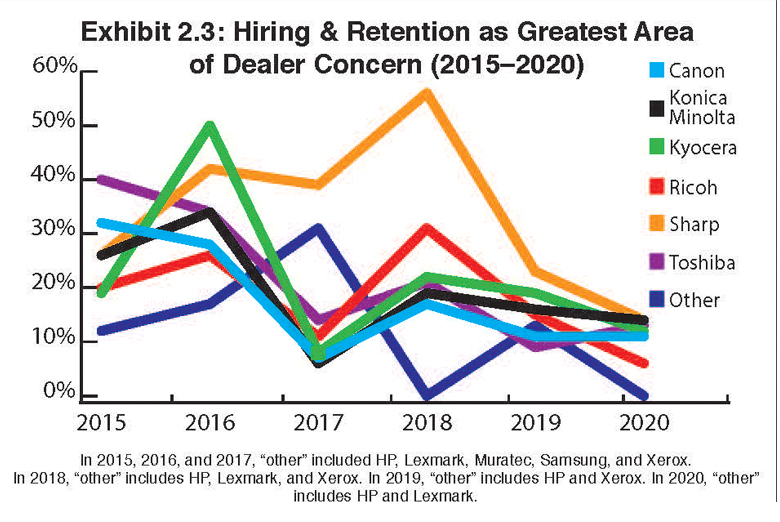

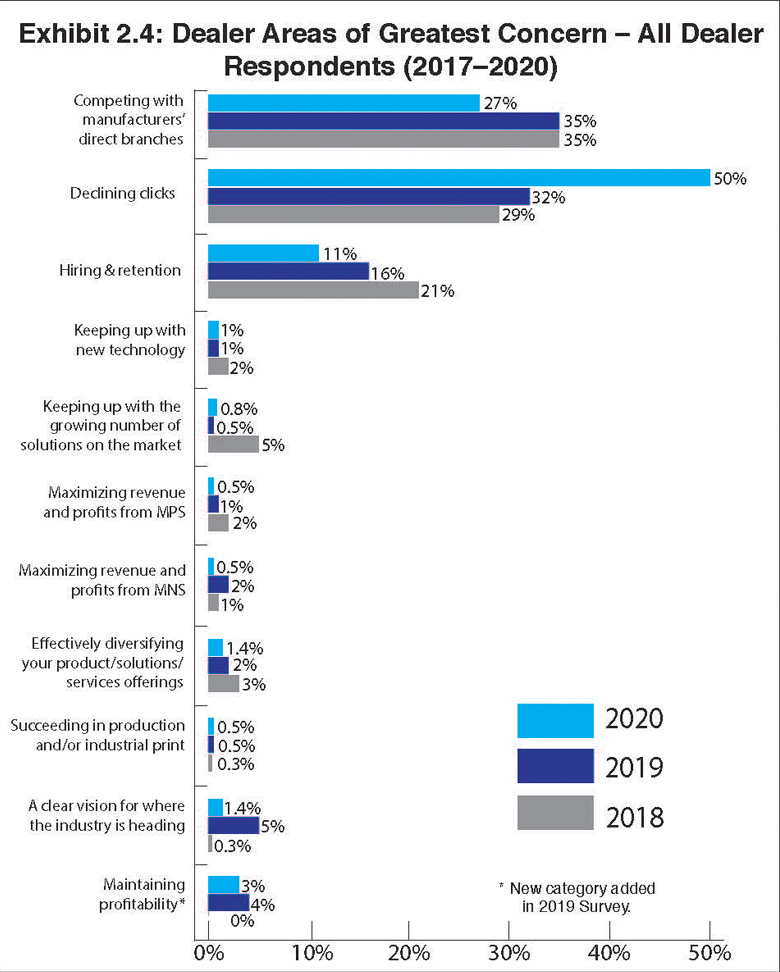

The pandemic has had a dramatic effect on this year’s results. The top three concerns remain the same, but the order has changed, with the No. 1 concern (Exhibit 2.4) being declining clicks at 50% compared to 32% in last year’s Survey. Manufacturers’ direct branches (27%) and hiring and retention (11%) followed. Concerns about direct branches and hiring and retention declined by 8% and 5%, respectively, from 2019.

The increase in dealers concerned about declining clicks is even more dramatic when we take into consideration all dealer concerns regardless of positioning (Exhibit 2.5). This year 79% of dealers identified it as a concern compared to 54% in last year’s Survey. Concern about hiring and retention increased from 50% in 2019 to 54% this year. That was followed by maintaining profitability, which increased by 4% in this year’s Survey to 50%.

Effectively diversifying your product/solutions/services offerings also experienced a notable increase as more dealers realized that with the dramatic decline in printing in 2020, it is time to get serious about diversifying beyond print. Last year, 29% of dealers were concerned about diversifying. This year that percentage grew to 43%. Concern about where the industry is heading was also exacerbated during the pandemic, as 42% of dealers identified this as a concern compared to 33% last year.

Maintaining profitability warrants further discussion, especially since for the second consecutive year, it has placed among the top three concerns regardless of positioning. We have been speaking to dealers throughout the pandemic and at its peak, we were hearing that business was down anywhere from 40% to 60% from the previous year. Contributing to concerns about maintaining profitability prior to the pandemic were trends such as declining clicks, tighter margins, the need to diversify, and realistically, most every other item on the list. When we add “other” concerns to this list—where most dealers cited “COVID-19” as a concern—it’s not surprising 50% of dealers are concerned with maintaining profitability.

We can take a glass-half-full approach to concerns about maintaining profitability and observe that the 50% who are not concerned—despite the downturn in business caused by the pandemic—are echoing Gloria Gaynor’s disco hit of 1978, “I Will Survive.” That’s the attitude!

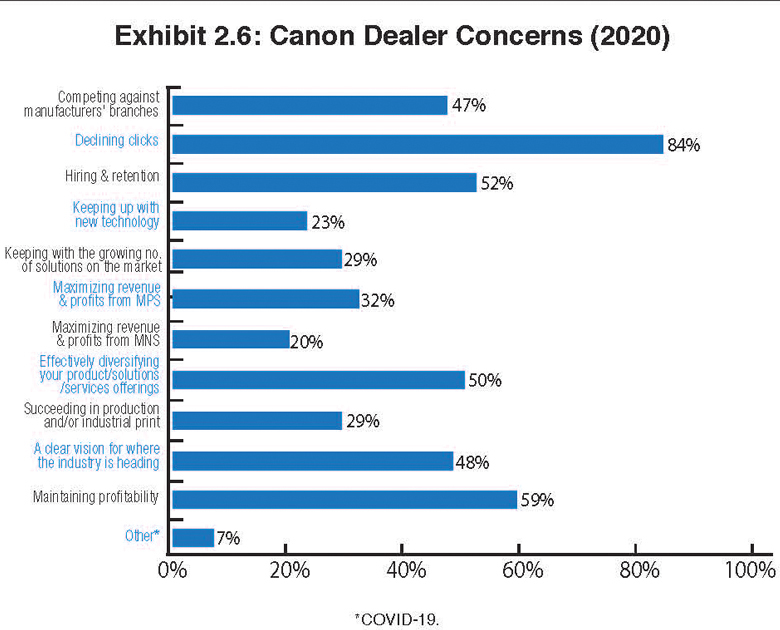

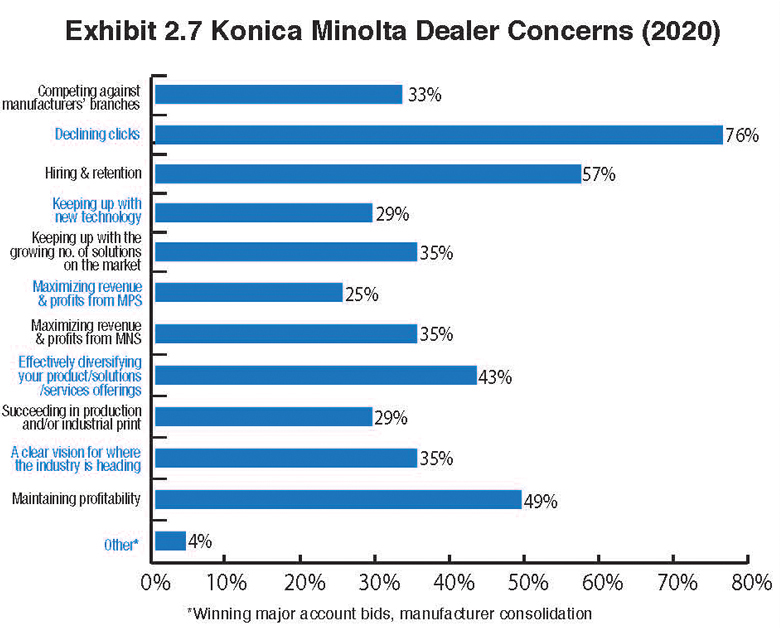

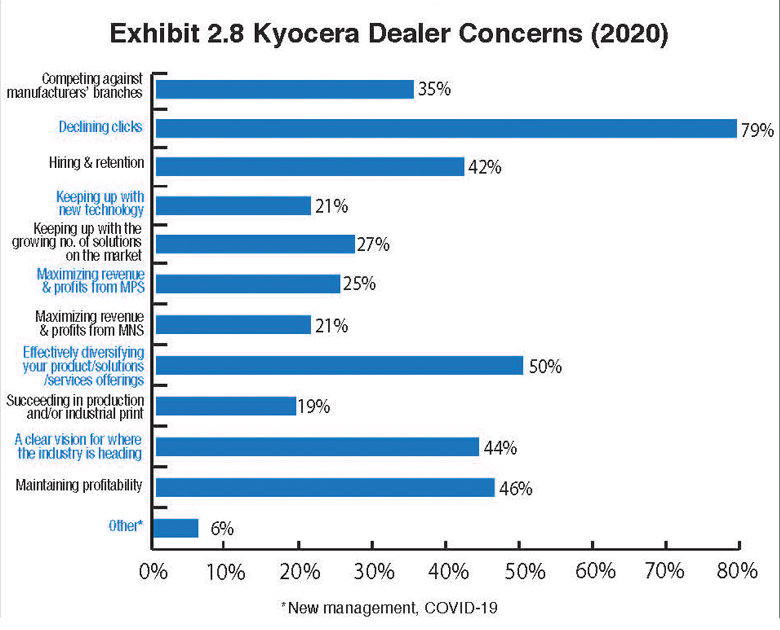

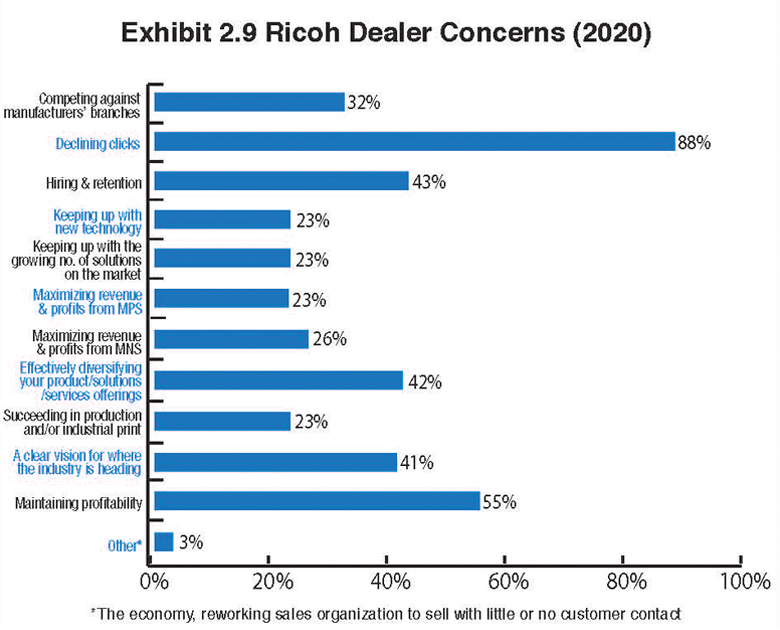

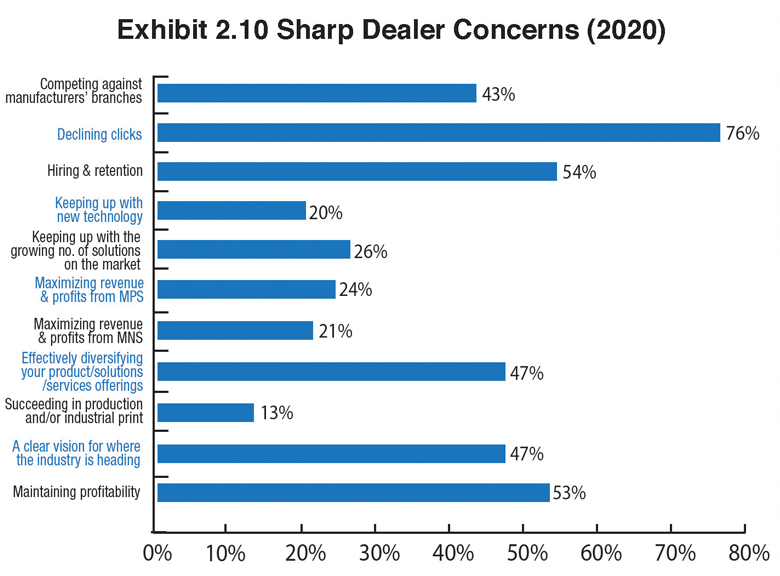

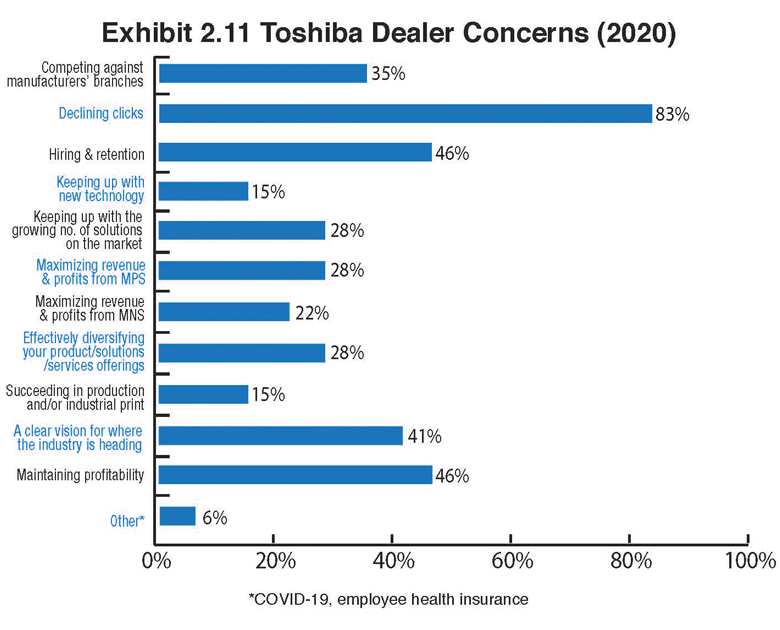

Examining the responses (Exhibits 2.6–2.11) reflecting the concerns of dealers affiliated with each of the Big Six OEMs, regardless of positioning when listing those concerns, there are some significant shifts year-over-year regarding dealer concerns. And yes, we believe the pandemic is responsible for these shifts.

Dealers representing Ricoh (88%) were most concerned about declining clicks, followed by dealers representing Canon (84%), and Toshiba (83%). Across the Big Six dealer universe, regardless of positioning, declining clicks was cited by 79% of respondents because they were living it, particularly during the first three months of the pandemic.

Concerns about competition from direct branches have declined for dealers representing three of the Big Six OEMs (Canon, Konica Minolta, Kyocera). Canon dealers were still most concerned about direct branches with 47%, an increase of 3% from last year, identifying this as a concern. There was a modest 1% increase year over year from Ricoh and Toshiba dealers who identified this as a concern, 32% and 35%, respectively.

One reason we are seeing a decline in this area is that manufacturers are doing their best to level the playing field between direct and their dealer channels, even if there are notable exceptions in certain markets. We do hear from dealers every now and then who lament about losing deals to branches that are practically giving the hardware away. But with the pandemic in full swing when we conducted this year’s Survey, dealers had more pressing concerns than competition from direct branches.

The Cannata Report, other analysts, and the OEMs have been encouraging their dealers to diversify beyond traditional office print technology for years now. All manufacturers are backing up this recommendation with products, solutions, and services that provide dealers with an opportunity to diversify. The challenge for dealers is having the financial resources and the patience to take on a new product offering, knowing that it’s going to take some time to build a book of business for that product, solution or service. Effectively diversifying your products/solutions/services has experienced double-digit growth as a concern among dealers representing four of the Big Six OEMs (Canon, Konica Minolta, Kyocera, Sharp) in this year’s Survey. Perhaps Ricoh and Toshiba dealers are doing just fine diversifying, which may explain why only 28% of Toshiba dealers identified this as a concern compared to 32% last year and 42% of Ricoh dealers identified this as a concern, a 7% increase from 2019.

Canon and Kyocera dealers were most concerned about diversifying (50%), followed by Konica Minolta (43%), and Sharp dealers (47%). There is no consistent diversification opportunity offered by these four OEMs to their dealer channels, but each offers more than just traditional office printing. We can easily point to Canon’s and Konica Minolta’s production and industrial print offerings, as well as Konica Minolta’s Workplace Hub initiative. Sharp has its Smart Office Suite, digital displays, and computers, a product category it was able to add thanks to its acquisition of Toshiba’s laptop business in 2018. Kyocera’s diversification opportunities are a little more difficult to pin down although one can make an argument for its high-speed inkjet production machine and its Hyland Software ECM offering.

Another viable diversification opportunity is managed network services, or managed IT, which is something most OEMs advocate. Across the Big Six dealer universe, this is a concern for 24% of dealers. Konica Minolta dealers (35%) and Ricoh dealers (26%) are most concerned about maximizing revenue and profits from MNS. Konica Minolta dealers have Konica Minolta’s All Covered organization as a managed services resource if they are looking to partner with a third party. But so do dealers that are aligned with other manufacturers as All Covered’s managed services capabilities are not limited to Konica Minolta dealers.

Hiring and retention was the biggest concern among Konica Minolta dealers (57%) compared to all the other dealers representing the other Big Six OEMs, as those percentages ranged from 42% to 54%. Konica Minolta dealers led here as well last year with 64% citing this as a concern. This concern primarily applies to sales, a position with a high turnover rate. As dealerships diversify their products, services, and solutions offerings, this is creating more hiring and retention challenges. First and foremost is training legacy reps to sell these new products, services, and solutions, and second is finding young talent with the mindset to sell.

The pandemic has created an interesting dynamic around hiring and retention as dealers have either furloughed or laid off employees. While many of those furloughed employees have returned, others have not. That’s because dealers have either decided that those employees were expendable because of a downturn in business or because there may be better talent available in the current labor market. That is what the copier industry recruiting firm Copier Careers has been seeing since April of this year. Based on our conversations with Copier Careers, retention could become an issue for certain dealers who were lax about communicating with their furloughed employees. This has created morale issues, which could mean these individuals are now more likely to talk to other prospective employers, whereas they might have been more loyal to their current employer in the past. For those who have been in the industry for some time and are of retirement age, this may be the spark that encourages them to retire sooner than planned.

We saw a significant decline in the number of dealers citing concerns categorized as “Other” in this year’s Survey. In 2019, with 344 respondents, that percentage rose to 14%, up from 3% in our 2018 Survey. This year, 5% of respondents cited “Other.” “Other” concerns identified by dealers include:

· COVID-19

· The economic environment

· Consolidation of manufacturers

· Winning major account bids

· Microsoft

· Multiple dealers selling the same line in the same area

· Trusting the manufacturer’s new management

· Remaking our sales organization in a new COVID-19 world with little or no customer contact

· Getting into 3D printing

· The cost of employee health care