Exhibits 226-2.34

With companies such as Brother, Epson, HP, Lexmark, OKI Data, and Xerox offering A4 devices, dealers have an array of options to choose from beyond the Big Six OEMs. Because not all Big Six OEMs have a strong A4 offering, many dealers look beyond their primary A3 OEM to source A4 products. This year, 31% of dealers identified a company outside the Big Six as their primary A4 supplier compared to 30% in last year’s Survey. Those dealers who opt for a company outside their primary A3 manufacturer to meet their A4 needs do so either because their A3 OEM doesn’t offer its own A4 devices (Toshiba’s ratings in our Survey notwithstanding), or they feel that a vendor focused on A4 has a stronger offering than their A3 OEM.

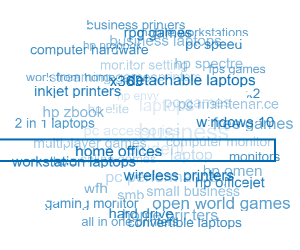

Our ratings of A4 manufacturers include the Big Six, as well as Lexmark and HP. The “Other” category in the ratings (Exhibit 2.34) includes Brother, Epson, OKI Data, and Xerox. After not being identified as a primary A4 supplier in our 2017 Survey, Brother reemerged in 2018. On September 1, 2020, OKI Data announced it would no longer be providing A4 products and printers to the North, Central, and South American markets as of March 31, 2021. Because of that announcement, we expect OKI Data to fall out of our Survey as an A4 provider within the next two years. This year, only three dealers identified OKI Data as its primary A4 supplier. Overall, 26 dealers identified either Brother, Epson, OKI Data, or Xerox as their primary A4 provider. That’s up from 10 dealers in our 2019 Survey and reflects the upward A4 mobility of Brother in the channel. Sixteen dealers identified Brother as their primary supplier, including seven Toshiba dealers. Toshiba’s entry into the A4 space with its own homegrown A4 products this year could impact Brother’s momentum as an A4 provider, although there is a strong possibility it could step in and fulfill the A4 needs of dealers that were partnering with OKI Data.

One variation we’ve been noting in our Survey the past few years is how dealers rate their A3 and A4 suppliers. The Big Six don’t typically receive as high grades in the A4 category as they do in A3. The average rating for the Big Six was 4.3, up from 4.2 last year, and 4.0 in our 2018 Survey. The average A3 rating among the Big Six is 4.5 so the gap is closing. That’s still better than the other A4 providers (Brother, Epson, OKI Data, Xerox) whose average rating was 3.8.

Overall, this year’s ratings were mostly consistent with last year. Konica Minolta improved the most, receiving a rating of 4.6 compared to 4.1 a year ago. Konica Minolta had the highest percentage of “Excellent” ratings (72%) of all A4 providers in the Survey. Is Konica Minolta making better A4 products or is the company providing dealers with better programs for its A4 devices? Check out the comments below to get a better idea as to why dealers rated Konica Minolta so highly as an A4 provider.

Another manufacturer whose A4 ratings improved was Kyocera, which saw its rating increase from 3.8 in 2019 to 4.2 this year. Only 48% of dealers gave Kyocera an “Excellent” rating, the lowest among the Big Six OEMs. Surprisingly, Toshiba received a 4.1 rating in A4 and had the second highest percentage of dealers rating the company “Excellent” as an A4 provider. That’s an impressive accomplishment, especially considering up until September of this year, Toshiba was not manufacturing its own A4 devices. Clearly, Toshiba dealers were impressed by the A4 devices rebadged by Toshiba, as well as its programs that help dealers sell those products.

Let’s look at some representative comments from dealers about their A4 providers.

Brother

Very Good: “Product and manufacturer support is great.”

Very Good: “Great response and technical support, and replacement/exchange.”

Good: “New to the dealer channel, still learning but willing to learn.”

Canon

Excellent: “Improved and cost-effective line over the past year.”

Excellent: “Great A4 products. Really show their commitment to the A4 space.”

Good: “Need a greater focus on these products to take over the HP world.”

Epson

Excellent: “Cost effective cloud-based solutions and new technology driving equipment and CPP lower.”

Excellent: “The products!”

Very Good: “Epson is working hard to get into the business market and is providing good support to dealers in that area. Their machines are reliable, and have low service and supply costs.”

HP

Excellent: “Innovative in bringing the latest technology to the forefront and sharing this with their dealers.”

Excellent: “Very willing to adapt and help dealers grow. Continues to develop new products. Also opens doors for other offerings.”

Good: “They lack an understanding of the dealer channel.”

Konica Minolta

Excellent: “Strong thorough A4 offering. Strong support as well.”

Very Good: “Reliable machines, few backorders, extremely supportive.”

Very Good: “I believe they produce the best A4 box on the market and have good cost of operation for after sale support.”

Kyocera

Excellent: “Great solutions portfolio.”

Excellent: “Easy to do business with, excellent communication.”

Good: “Fair product, could use smaller footprint, better TCO and lower cost.”

Lexmark

Excellent: “Very professional and easy to interact with. They do their best to understand dealer needs and try to adapt to and serve those needs.”

Very Good: “Lexmark’s BSD [Business Solution Dealer] program gives our sales reps the ability to sell a low cost printer solution to compete with HP.”

Good: “Their service on the back end has gone down.”

OKI Data

Very Good: “Great partnership. Responsive to dealer needs.”

Good: “Consumable issues.”

Fair: “Their support.”

Ricoh

Excellent: “Outstanding equipment quality; durability of equipment; very good inventory to support our sales; excellent technical support.”

Very Good: “Needs a little improvement on product quality.”

Fair: “High CPC.”

Sharp

Excellent: “Sharp is our exclusive brand and it’s because they are so strong in the technology sector with integrations alongside other software developers.”

Very Good: “Product is improving, but they are not there yet.”

Good: “Limited models available from Sharp.”

Toshiba

Excellent: “Plenty of options to choose from.”

Excellent: “Great support, valued partnership.”

Fair: “Not an [A4] OEM.”

Xerox

Very Good: “Supportive.”

Fair: “Poor profit margin.”

Fair: “Confusing programs, constantly changing personnel, costly supplies.”

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.