Exhibits 2.12-2.19

Each year, we ask dealers to rate their primary A3 MFP suppliers as “Excellent,” “Very Good,” “Good,” “Fair,” or “Poor.” We then award five points for “Excellent,” four points for “Very Good,” three points for “Good,” two points for “Fair,” and one point for “Poor.” We then divide the total by the number of dealers participating from that manufacturer.

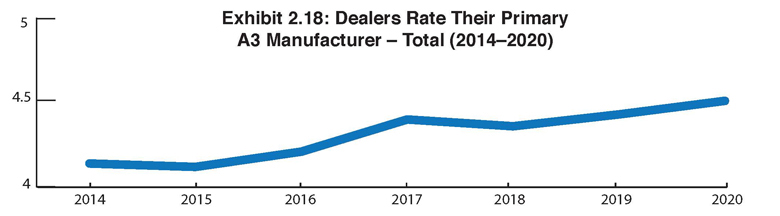

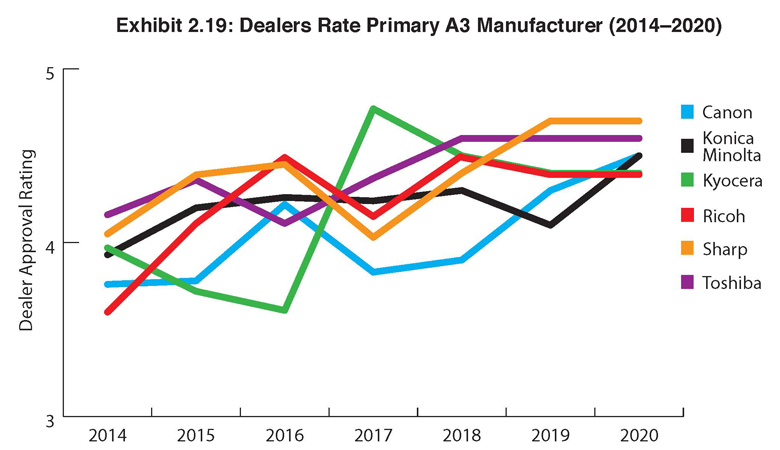

We haven’t seen much deviation in how dealers’ view their manufacturers since 2017. In fact, the ratings this year are the highest they have ever been, an average 4.5 out of a possible score of 5 across the Big Six dealer respondents (Exhibit 2.18). That’s up from 4.4 a year ago. Prior to 2017, those rankings were hovering around 4.2. For the first time ever in our Survey, not a single manufacturer received a “Poor” rating. Last year, Canon was the only manufacturer to receive a “Poor” rating. The company also saw its rating improve from 4.3 in last year’s Survey to 4.5 this year.

Konica Minolta, the OEM with the lowest rating in last year’s Survey (4.1), improved to 4.5 this year. We believe the company is doing a better job of engaging with its dealers, as well as building out its product offerings from A3 to production and industrial print. The rest of the OEMs—Kyocera, Ricoh, Sharp, Toshiba—had identical ratings to the previous year. Kyocera and Ricoh had the lowest ratings of the Big Six at 4.4, still a respectable rating. Overall, only two OEMs received a “Fair” rating, Ricoh and Sharp with one each. Sharp received the highest percentage of “Excellent” ratings from its dealers (72%), followed by Canon (66%), and Toshiba (65%). What these ratings tell us is that dealers are generally satisfied with their OEMs as 62% of dealers rate them as excellent.

This year, we are sharing the three most common themes derived from the comments shared by dealers representing each of the Big Six OEMs to explain their ratings. Not every dealer who participates in our Survey adds comments to explain their ratings, but as you will see, dealers have strong opinions and not all are positive, even when they give their provider an “Excellent” or a “Very Good” rating.

Canon

Very Good: “Canon continues to innovate. However, the OEM support level is declining.”

Excellent: “Unbelievable support, great pricing, low CPC across the board.”

Excellent: “They do it right and that includes equipment, support, and aggressive pricing.”

Konica Minolta

Good: “The products are good—not great—and they are late to market with new product.”

Very Good: “Great product lineup and overall favorable promotions and pricing. They are focused on their highest tier of dealers by volume, which is a very small/select group. If you don’t rank among the largest dealers then you are just along for the ride and are expected to be happy with whatever they decide.”

Excellent: “Long term relationship that has been open and honest. They are responsive to changes we need, good people we can depend on.”

Kyocera

Good: “In the past, I would have said excellent, however, new leadership has brought on changes. Whereas they were flexible in working with small local dealers, now they expect a one size fits all. Plus, it feels like they see their future in the large metro dealers/mega dealers.”

Very Good: “True partner, they listen and work toward a win-win.”

Excellent: “They have been a great partner for a long time. They step up when we need them and have the infrastructure to support us in the ways that we need support.”

Ricoh

Good: “Ricoh cannot figure out the MPS or A4 space. I believe it will be a hinderance for them and the dealer network they support. The quality of their support personnel is not what it once was.”

Very Good: “Longstanding great partnership, Jim Coriddi and Vince Roma are the reason for it. MFP line is getting old, they need to refresh.”

Excellent: “Ricoh has been a very valuable supplier, especially over these past few months with the COVID environment. They have set up numerous training programs around our specific needs, not theirs. The field support has been exceptional.”

Sharp

Very Good: “They do a great job supporting us. Very aggressive hardware pricing on formal RFPs. They could improve in providing lower pricing on aftermarket (supplies) support.”

Excellent: “Sharp has the most progressive leadership team and strategies of all five of our manufacturers. They’re constantly there for us to understand what they can be doing to support our business and further growth. Sharp has done an elite job during these challenging times to get creative with promotions to drive additional business. Elite leadership starting from the top with Mike all the way down to local support. We couldn’t be happier or speak more highly of Sharp!”

Excellent: “Customer retention is high because the company makes a great product. It’s nice selling a product that customers enjoy years after the sale.”

Toshiba

Very Good: “I would give Toshiba an Excellent grade if they would advertise!”

Excellent: “Knowledgeable field reps who can assist on deals that may be a bit beyond our comfort zone.”

Excellent: “Toshiba is big enough to be relevant and small enough to give the personalized attention that we need.”

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.