Exhibits 1.26-1.27

For the past three years, we tracked dealers with revenues of $7.5 million or greater, calling it, the “$7.5 Million-Plus Club.” Prior to 2017, we tracked dealers with revenues of $5 million and higher. In the early years of our Survey, average dealer revenues hovered around $7 to $8 million. Today, average revenues are in the $16-million range. When average revenues were $7 to $8 million, we believed a dealer with revenues of $5 million and above possessed sufficient resources to add new products and services and grow through acquisition. In 2017, we felt that $5 million figure was no longer realistic. For this year’s Survey and going forward, we believe a more realistic figure to achieve growth is $10 million or more in average yearly revenues.

This does not mean a dealer with less than $10 million in yearly revenues can’t expand or acquire, but it is more difficult today than it was five years ago. The number of dealers with revenues under $10 million that are being acquired or are considered acquisition targets support our contention. Dealers in this revenue range are either serving small local markets or a niche, and are comfortable with their existing size, or are thinking about exiting the business. Though this contention may be a generalization, when we look at the average yearly revenues of those dealerships that have been acquired over the past five years, the majority of dealerships had yearly revenues of less than $10 million. We expect the pandemic to accelerate this trend in 2021.

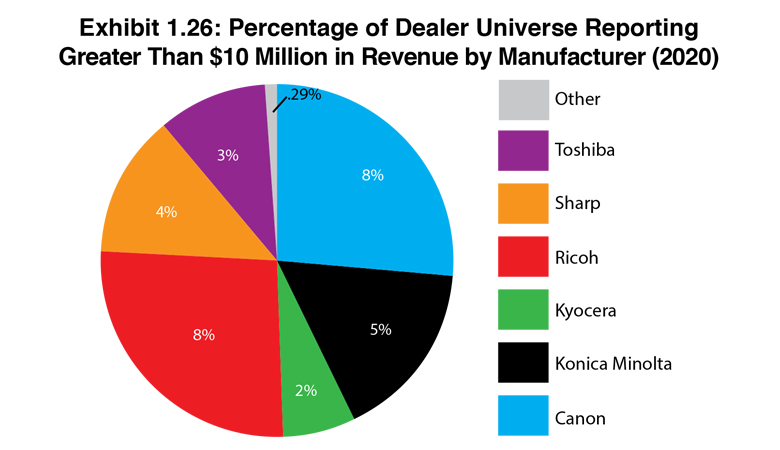

Exhibit 1.26 shows the percentage of our dealer universe reporting revenues greater than $10 million by manufacturer, while Exhibit 1.27 indicates the percentage and average revenue of dealers in the $10 Million-Plus Club by manufacturer. Fully 105 dealers, or 30% of all respondents, reported revenue of $10 million-plus. They accounted for 80% of all revenue of our dealer respondents. The remaining 237 dealers were responsible for $866,015,000. That yields to an average of $3,654,072.

It is not surprising to see Konica Minolta, Canon, and Ricoh dealers rank in the top three, respectively, in terms of highest average revenue (Exhibit 1.27). The average revenues for dealers representing the Big Six in the $10 Million-Plus Club is $38.75, up from the $36 million of last year’s $7.5 Million-Plus Club.

Diversification will be instrumental in helping dealers grow once we come out on the other side of this pandemic. Each of the Big Six companies have been diversifying their product offerings beyond traditional office print and as you will see later in the section on Greatest Growth Opportunities, dealers view some of these new offerings as catalysts for future growth.

However, the current economic environment could impact future membership in the $10 Million-Plus Club as some dealers are projecting revenue declines of 20% to 40%, or higher for 2020.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.