Exhibit 1.44

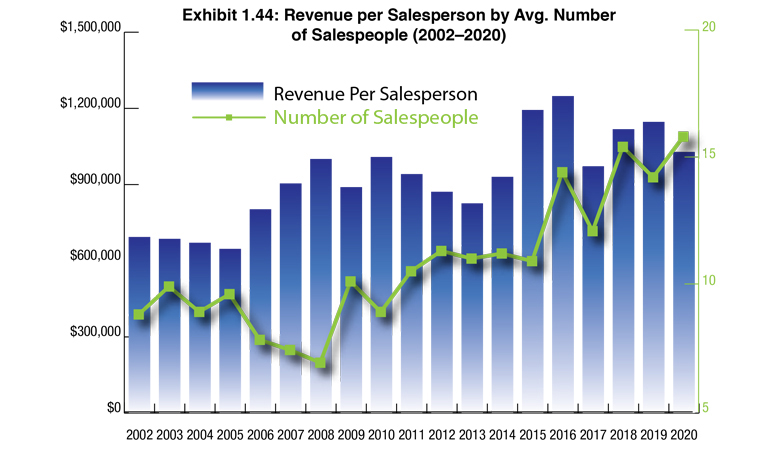

To better understand how revenue impacts productivity, we take total dealer revenue and divide it by the total number of salespeople (Exhibit 1.44). We do not distinguish revenues from other sources such as supplies and services. The increase in productivity in our Survey is consistent with the increase of average revenue per dealer, even with the price erosion that has been impacting the channel.

We also combine the “other” salespeople who are responsible for selling MPS and MNS with hardware salespeople. In more dealerships, hardware reps are tasked with selling MPS, and increasingly more reps are also responsible for MNS, although that is not usually the situation in larger dealerships with MNS divisions. This year, the average number of salespeople combining traditional sales reps with MPS and MNS reps was 15.8, up from 14.2 a year ago. If we were only to include traditional hardware sales reps, that figure, as we noted earlier, would be 12.7.

We continue to analyze this data differently than most surveys conducted by and for the independent dealer channel. Our intent is to present a simple way to measure sales productivity and the correlation between the size of a dealer and revenue. We are confident this method of analysis offers an accurate barometer.

Our method of analysis broaches the question of which analytical approach is more accurate or most appropriate for tracking productivity. By including “other” sales or support people as an option, we believe the data more accurately reflects the relationship of dealer sales to revenue.

Comparing our 2019 and 2018 results, the average number of salespeople rose from 14.2 in last year’s Survey to 15.8 in this year’s Survey (Exhibit 1.44). After two consecutive years of seeing revenue per salesperson exceed $1 million, that figure fell to $972,569 in 2017’s Survey. Last year, that figure broke the $1 million mark again, and was over the $1 million mark again this year at $1,029,162.

We continue to hear that hardware placements are trending downward, and if that is truly happening, sales reps seem to be finding other ways to increase the revenue they are bringing in for their dealerships. We’re skeptical that new technologies are currently driving those increases. Could it be that MPS and MNS revenues are responsible? Possibly with MPS, but we keep hearing anecdotally how dealers are struggling to make money with MNS, even if our Survey suggests otherwise. If we had to make an educated guess, it would be that A3 hardware placements have yet to fall completely off the rails. However, sales reps should still start preparing themselves for a future where more customers figure out they no longer need A3 or as many A3 devices as they had in the past.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.