Exhibits 1.36-1.38

It’s too soon to call this a trend, but the greater the number of dealers who participate in our Survey, the lower the percentage that offer managed network services (MNS). We attribute that to the number of smaller dealerships with revenues under $5 million participating in the Survey.

In 2018, 50% of Big Six dealers said they offered MNS. That year, 330 dealers participated in the Survey. In 2019, the percentage of dealers offering MNS declined to 46% as 344 dealers participated. This year, we saw the percentage of dealers that offer MNS decline to 44%. We are not concerned, however, about the future of MNS in the channel. Most larger dealerships (those with revenues over $10 million) offer MNS. It’s a natural addition to a dealership’s services offerings, especially with so many devices connected to the network. Another factor that could impact the growth of MNS is the need to expand the network beyond the traditional workplace as more employees work remotely.

Managing a customer’s network is a viable business offering that broadens and enhances a dealer’s product and services offerings. With the introduction of new product offerings such as smart offices and smart meeting rooms, the ability to manage the customer’s network only takes on greater importance for dealers that plan to offer those services. The OEMs recognize this. Security is another good reason to offer MNS. Talk about door openers. What customer doesn’t want to make their network, data, and business more secure from outside threats? Dealers that offer MNS have an inside position on the security talk track.

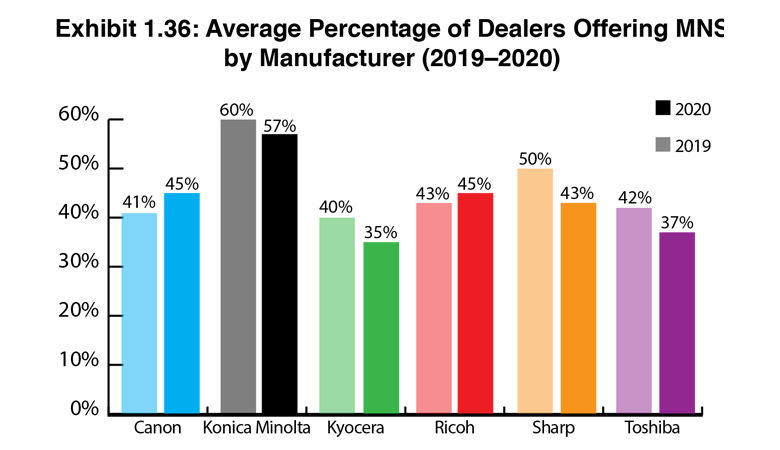

Tracking MNS engagement by dealers representing the Big Six OEMs, Konica Minolta dealers lead with 57%, a 3% decline from last year. One might think that Konica Minolta’s All Covered division is a factor for Konica Minolta dealers leading in this category, but our Survey results tell a different story. Fifteen of the 29 Konica Minolta dealers who offer MNS said they partner with a third-party provider or OEM, which more than likely is All Covered. We would think that number would be higher and that having access to All Covered’s managed services resources would be an incentive for more Konica Minolta dealers to offer managed services.

Ricoh and Canon rank second and third in MNS engagement in this year’s Survey each with 45%. Last year, 50% of Sharp dealers said they offered MNS. The remainder of the field finds Toshiba dealers at 37% and Kyocera dealers at 35%. The average number of dealers among the Big Six offering MNS currently stands at 44%. Three years ago, we predicted that in five years, 50% of dealers would be offering MNS. We attributed our projections to acquisitions of smaller dealers who would either be folded into larger entities or have access to their acquirers’ MNS offerings. This may not happen as rapidly as we projected because of the COVID-19 pandemic, which has slowed down acquisition activity. But, give it another year or two as we expect acquisitions to heat up once dealers and entities still interested in acquiring get on stronger financial footing and scoop up those dealerships finding themselves struggling post-pandemic.

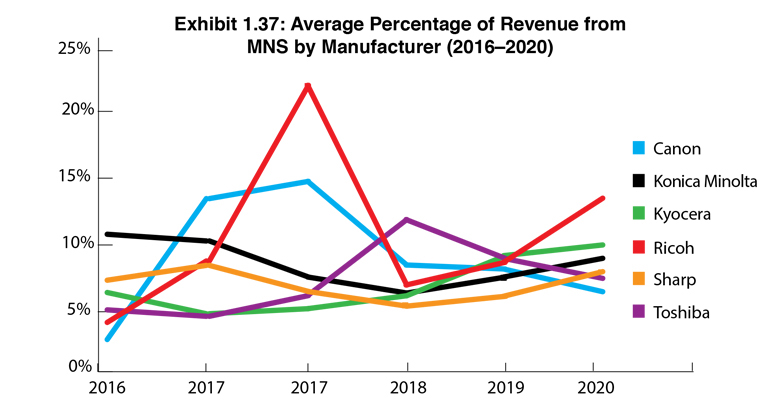

Our skepticism continues about the percentage of revenue from MNS reported by manufacturer (Exhibit 1.37). Those percentages are higher than we believe they should be, based on our conversations with dealers and organizations that track MNS revenue based on dealers’ actual financial reports. Despite this, we adhere to the honor system with our Survey respondents.

The average revenue percentage of revenue derived from MNS for all Big Six dealers was 9%, up from 8.14% in last year’s Survey. The top three by manufacturer were Konica Minolta (13.5%), Ricoh (10%), and Sharp (9%). The bottom three were Canon (8%), Kyocera (7.5%), and Toshiba (6.5%).

Not every dealer breaks out the percentage of MNS revenue from their overall revenues. Although considering that most big dealers do, and only a few did not reveal their revenues, we do not believe this had a significant impact on the final percentages. For the record, we did not factor in the dealers who did not report revenues when determining the average revenues attributed to MNS among the dealers representing the Big Six OEMs

Forty-four percent (65) of the 149 dealers offering MNS reported revenues of 5% or less, while 38% (57) reported average MNS revenues of 10% or higher. Here, we saw 4% (6) of dealers reporting average MNS revenues of more than 50%, with one dealer reporting 80%. If we were to eliminate those dealers with average MNS revenues of more than 50%, the average would fall to what we consider a more realistic 8.8%.

We also asked, for the first time, if MNS revenues were up, down, or the same compared to the previous year. Fully 62% of respondents reported revenues were up while 35% reported revenues were the same as the previous year, and only 3% saw a decline in their MNS revenues.

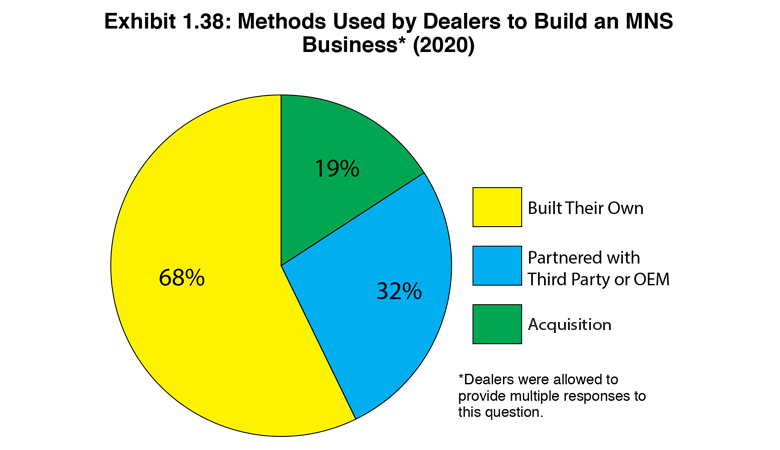

There are three primary ways a dealer can build a MNS business, and as our Survey reveals, the least popular way to do so is through acquisition, with 19% of respondents (Exhibit 1.38), an identical percentage as last year using this strategy. Some dealers identified multiple strategies for building their MNS business, so the cumulative percentages do not equal 100%.

Even though some of the private-equity firms are acquiring IT companies, as well as larger dealers, the challenge has been integrating two disparate cultures—a sales-driven, commodity-based copier culture with that of a looser, IT-oriented culture. What sometimes happens is dealers are not so much acquiring a base of business as they are the talent to provide MNS. If they can’t keep that talent, there isn’t much value in that acquisition. That may be why 68% of dealers in this year’s Survey said they built their own MNS business. That’s up from 11% a year ago. As dealerships have become more proficient at installing network devices, the confidence level in starting their own MNS business has likely accelerated as has access to IT professionals who are more likely to switch jobs for the right offer. The challenge for many dealers, which is one reason why we are surprised that so many dealers are building their own, is the cost of hiring this talent. It’s one thing to hire this talent, it’s another thing to grow this segment of the business from zero. Based on the percentage of revenues attributed to MNS across our dealer universe, apparently this is less of a problem than we originally surmised.

Another deviation in this year’s Survey compared to last year’s is that only 32% of respondents said they partnered with a third-party provider or an OEM. In last year’s Survey, that figure was 45%. We are aware that some of those partnerships do not work out over time, but a 13% swing from 2019 to 2020 is a good reason to scrutinize this trend, if indeed it is one, in future Surveys.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.