Exhibits 1.49-1.54

We don’t believe we need to remind dealers again about the necessity of diversifying beyond traditional A3 technology. Most seem to be doing fine on their own. However, we are happy to help educate the channel about diversification opportunities that can complement their existing offerings and share how other dealers are achieving success with new products and services. We have been doing that consistently in our print and online editorial coverage, and through conversations with dealers and OEMs. Coincidentally, diversification opportunities represent opportunities for growth.

Ever since 2015, we have asked dealers to identify their greatest growth opportunities, allowing them to provide multiple responses to better reflect their visions for growth. Up until this year, dealers were asked to identify up to four growth opportunities among the following selections: digital signage, ECM/document management, MPS, MNS, production print/wide format/industrial print, security/cybersecurity, and other. In this year’s Survey, we asked dealers to rank their greatest growth opportunities from a list of eight in order of preference. The eight categories include:

- MPS

- MNS

- Production Print

- ECM/Document Management

- Digital Signage

- Cybersecurity/Security

- Smart Office

- Other

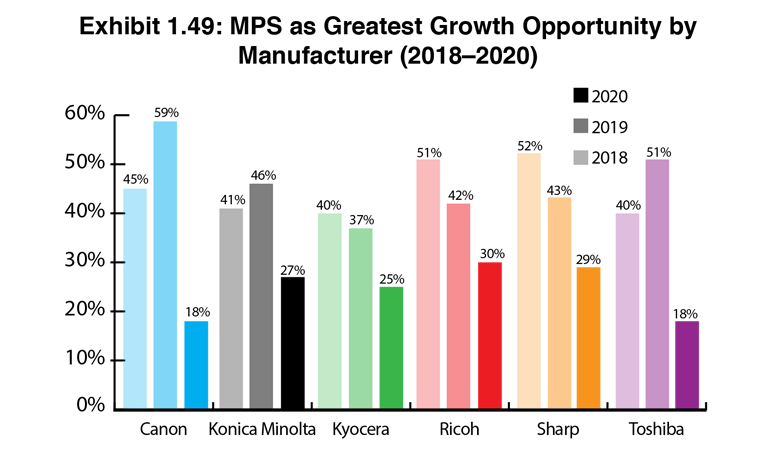

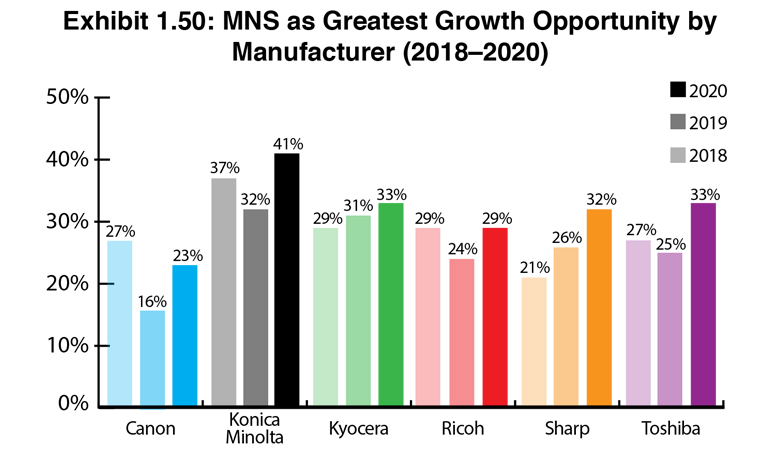

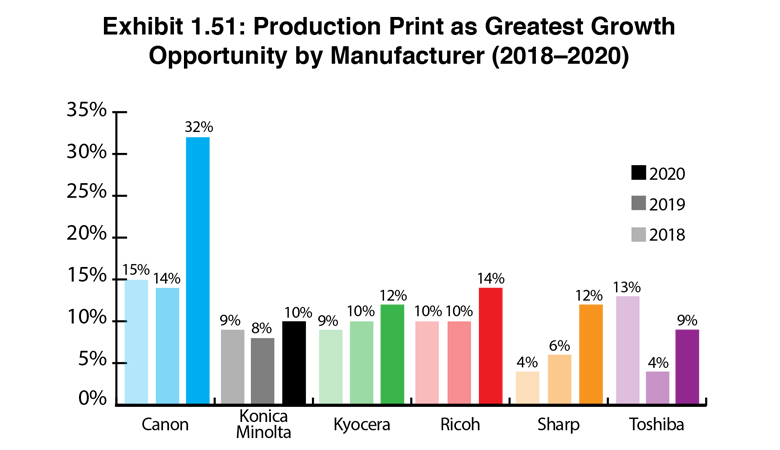

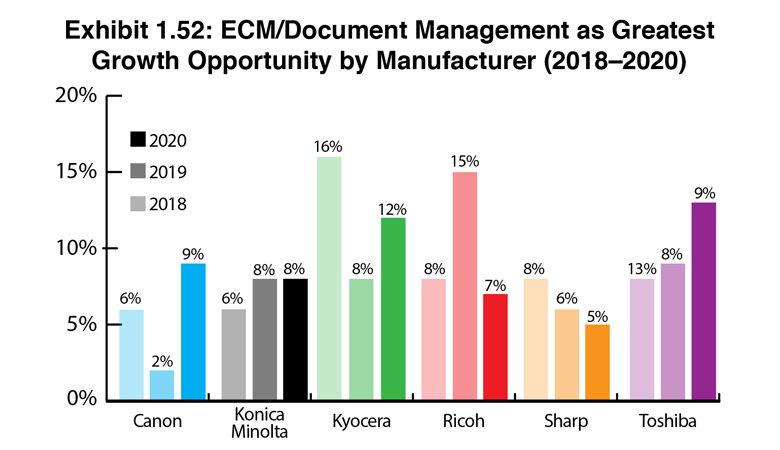

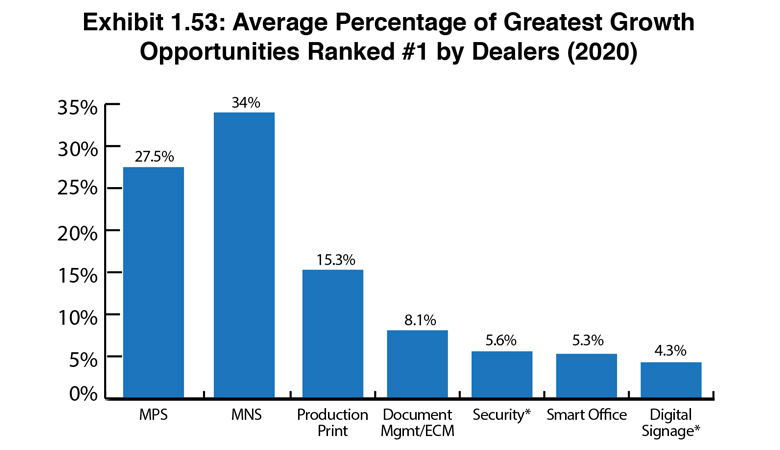

Exhibits 1.49 to 1.53 show the percentage of dealers, representing each of the Big Six OEMs, who identified MNS, MPS, Production Print, and ECM/document management as their No. 1 growth opportunity.

In our past Surveys, MPS ranked as the No. 1 growth opportunity for most dealers. However, MNS has supplanted it as the top opportunity (Exhibit 1.54). Note that 41% of Konica Minolta dealers identified MNS as their leading growth opportunity. What is most interesting to us with the MNS percentages is that 33% of Kyocera and Toshiba dealers, and 32% of Sharp dealers identified MNS as a growth opportunity. Those percentages have grown compared to last year, perhaps buoyed by a realization that during the pandemic, MNS was one of the business segments least affected. Regardless, we wouldn’t have expected those dealers to rank ahead of Ricoh (29%) and Canon (23%) dealers in identifying MNS as their top growth opportunity due to the number of smaller dealers representing those manufacturers participating in the survey, many of which do not currently offer MNS.

MPS remains a strong growth opportunity across the dealer universe despite its maturity, and despite the impact of the pandemic where office workers were not printing as they had before (Exhibit 1.50). Many dealers still see MPS as an opportunity for growth and when done right, can protect against losses from declining print volumes and any possible decline in hardware placements.

If there were any surprises in this section of the Survey, it was the percentage of dealers from OEMs not strong in production print who identified it as their No. 1 growth opportunity (Exhibit 1.52). Look at the percentage of Kyocera, Sharp, and Toshiba dealers that selected production print. Could this be an inflection point in the dealer channel for production print? To be honest, these percentages may reflect the dealer’s definition of production print. We do not consider light-production machines production print, and we understand that some dealers might be confused as to the difference. Rather than debate definitions of production print, for now, we will interpret these percentages to mean that dealers are looking to move upstream from many of the traditional A3 products they are currently selling.

When reviewing the percentage of dealers identifying ECM/document management as their top growth opportunity, the percentages remain relatively low, although the percentages rise significantly when examining the dealers who identified this as a growth opportunity (63%) in Exhibit 1.55. We believe that Kyocera’s acquisition of Databank and its partnership with Hyland Software is the reason why 69% of Kyocera dealers identified ECM/Document Management as one of their top four growth opportunities. Ricoh’s acquisition of DocuWare last year may also explain why 59% of Ricoh dealers placed ECM/Document Management in their top four growth opportunities.

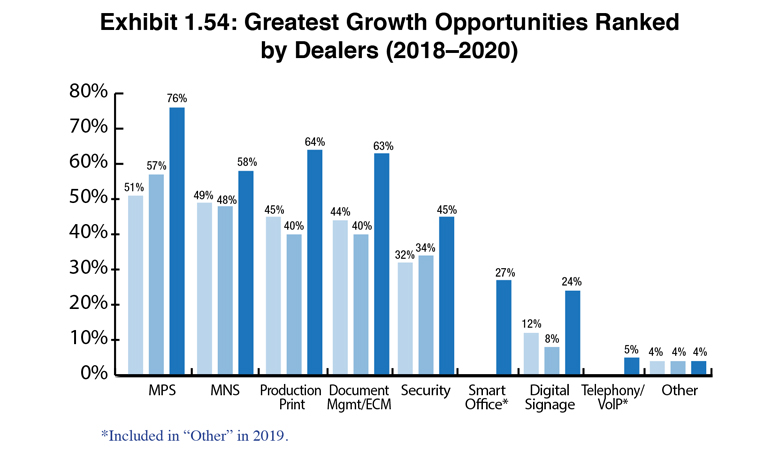

Exhibit 1.54 reveals how these four categories as well as security, smart office, and digital signage ranked in this year’s Survey as a No. 1 growth opportunity.

If we were only to look at the percentage of dealers that selected Security/Cybersecurity, Digital Signage, and Smart Office as their No. 1 growth opportunity, we would only be getting half of the story. A better indicator is the percentage of dealers that identified those as one of their top four growth opportunities (Exhibit 1.55). Security/cybersecurity rates at 45% among the entire dealer universe, while 53% of Konica Minolta dealers rank it as one of the four leading growth opportunities. With all the emphasis across the industry on security and the media reports about security breaches, it should not come as a surprise that dealers view this as a significant growth opportunity.

Because of the way the growth opportunities question in the Survey was structured this year, none of the dealers participating identified “Other” as their leading growth opportunity. Historically, most opportunities in the “Other” category receive a single vote. This year was different as 15 dealers (5%) in the universe of 320 responding to this question cited telephony/VoIP. Vendors such as RingbyName and Monster VoIP are actively courting the independent dealer channel, and we believe this is a legitimate diversification/growth opportunity for dealers. Expect to see this in the list of options in the growth opportunities question in our 2021 Survey.

Exhibit 1.55 reveals the percentage of dealers who selected each of those growth opportunities as one of their top four growth opportunities across the universe of 322 dealers. (20 dealers did not respond to this question.)

Last year, the growth opportunities ranked in the following order: MPS (57%), MNS (48%), production print (40%), ECM/document management (40%), and security (34%), digital signage (8%), and other (4%). In this year’s Survey, MPS still ranks No. 1 (76%), while production print (64%) has moved ahead of MNS (58%) into second place. ECM/document management (63%), MNS (58%), security (45%), smart office (27%), and digital signage (24%) round out the remaining growth opportunities—all with healthy percentages. Last year, smart office and VoIP was in the “Other” category.

What’s notable in the smart office category is that for Ricoh and Sharp dealers, whose manufacturers are actively promoting their smart office solutions, only a small percentage of dealers (3% for Ricoh and 7% for Sharp) cited smart office as a No. 1 growth opportunity. However, when smart office is considered one of the dealer’s top four growth opportunities, those percentages grow to 25% for Ricoh and 54% for Sharp. Those percentages seem to indicate that Ricoh’s and Sharp’s initiatives around the smart office are resonating with dealers. We should also mention Konica Minolta and its “Office of the Future” initiative, which may not be as clearly defined as Ricoh’s or Sharp’s. Only 2% of Konica Minolta dealers identified this area as their top growth opportunity, while 18% place it in their top four.

We can make a similar case around digital signage where Sharp and Toshiba have strong offerings in this category. Only 6% of Sharp dealers identified digital signage as their top growth opportunity, with 32% of Sharp dealers identifying it as one of their top four growth opportunities. Fully 9% of Toshiba dealers selected this as their No. 1 growth opportunity and 31% among their top four growth opportunities. For Sharp and Toshiba, if one-third of their dealers see merit in digital signage as a growth opportunity, things are moving in the right direction.

Overall, the results across each of these seven categories, excluding “Other,” continue to indicate that dealers are looking to offset the decline in clicks with services and solutions.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.