Exhibit 1.15-1.16

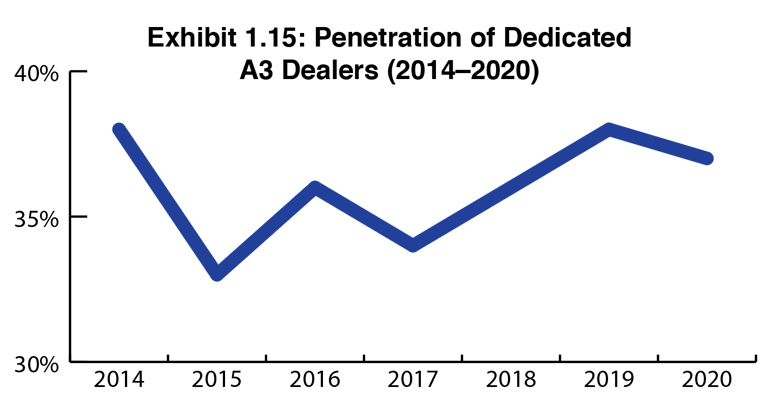

The number of dedicated dealers participating in our Survey over the past three years has been consistent. In 2018, the percentage of dedicated dealers was 36%. Last year, the percentage increased by 2% to 38%. This year, we saw a slight decline to 37%. We attribute this consistency to more single-line A3 dealers who have been participating in our Survey in recent years.

As has historically been the case with dedicated dealers, the lower the revenues, the more likely they are to be dedicated. We found 26.9% of the dedicated dealers in our Survey reporting revenues of $5 million or less—the exact same percentage as last year. For the record, 47% of dedicated Sharp dealers participating in our Survey had revenues of $5 million or less. A distant second were Toshiba dealers with 34% who reported revenues of $5 million or less, followed by Kyocera dealers at 29%.

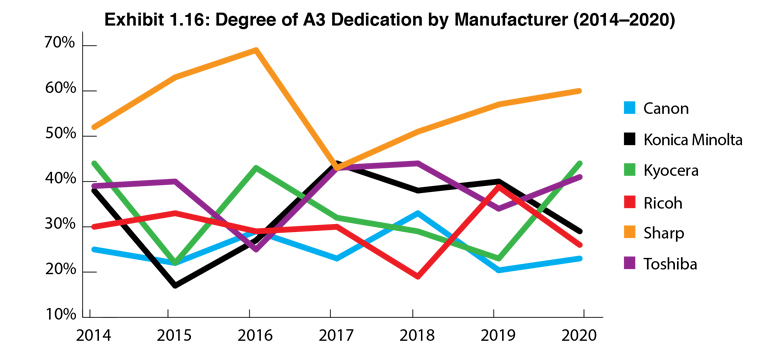

Sharp continues to lead in the percentage of A3 dedicated dealers (60%) in this year’s Survey in which we had 72 Sharp dealers respond with 43 of those dedicated. Kyocera (44%) supplanted Konica Minolta (29%) with the second highest percentage of dedicated dealers in our Survey, followed by Toshiba (41%). Konica Minolta fell out of the top three with an 11% drop from our previous Survey. Konica Minolta partners with some of the largest dealers in the industry, but also has a significant base of smaller, dedicated dealers, even though only 11 Konica Minolta dealers with revenues of $5 million or less participated in this year’s Survey.

Rounding out the Big Six dedicated dealer universe, were Ricoh (26%) and Canon (23%). Canon had the fewest number of dedicated dealers (10), as well as the fewest number of dedicated dealers with revenues less than $5 million (5). Canon may argue quality over quantity and considering that its 44 dealers participating in the Survey reported total revenues of $1.5+ billion, that’s a contention we would have difficulty arguing against.

Last year, we speculated about the impact of HP’s entry into the A3 space and how that will affect the percentage of dedicated A3 dealers. HP executives have been telling us that they are pleased with the number of dealers that they have been signing up globally to carry the company’s A3 line, and our Survey supports that contention here in the U.S. We started to see that traction in last year’s Survey, as 17% of dealers reported they were carrying HP A3 products. This percentage was up from 12% the year before. In this year’s Survey, the percentage of dealers carrying HP A3 has grown to 18.4% (Exhibit 1.12). It is time to take HP seriously as an A3 provider.

Among dealers representing the Big Six, Canon had the most dealers 17 of 44 (39%) carrying HP A3. That’s an increase of 14% from last year. The number of Ricoh dealers carrying HP A3 increased by 8% from 24% in 2019 to 32% this year (22 of 69 dealers). Rounding out the Big Six were Toshiba with 10 of 54 dealers (18.5%), Konica Minolta with 7 of 51 dealers (14%), Kyocera with 5 of 48 dealers (10%), and Sharp with 5 of 72 dealers (7%).

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.