Exhibits 1.45-1.49

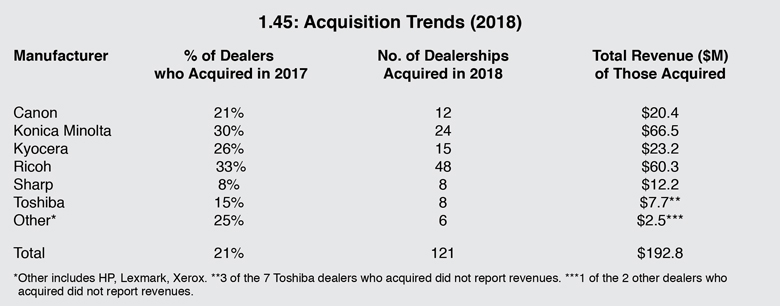

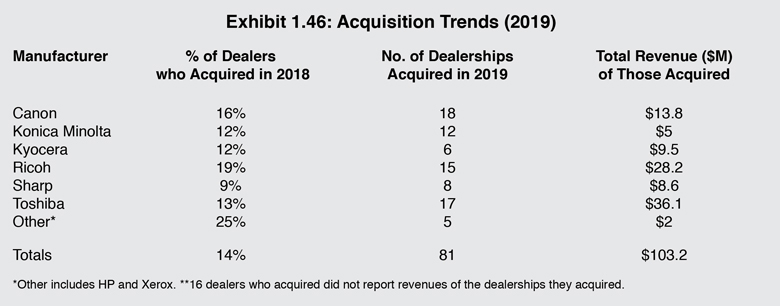

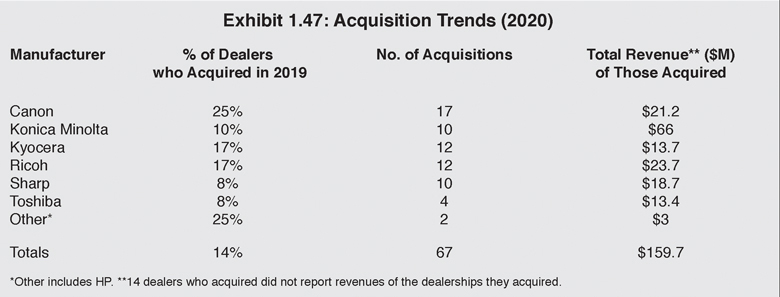

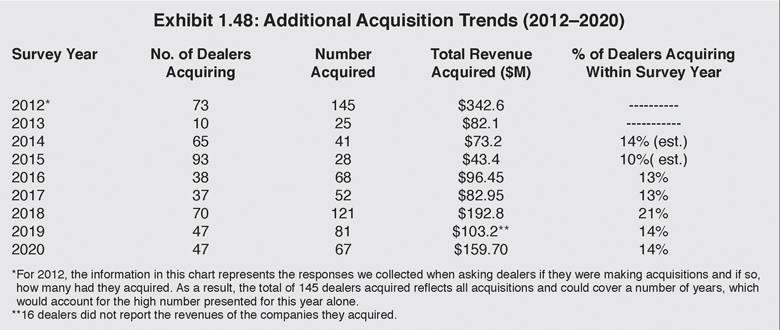

With such a significant number of dealers participating in our survey this year, one might surmise that the number of acquisitions reported would be trending upward. Not exactly, particularly when one looks at the Survey results from the past two years—2018 and 2019. The number of acquisitions reported in our Survey is on the decline. In 2018, 21% of the dealers participating in the Survey reported 121 acquisitions. Last year, 14% of the dealers who contributed to the Survey reported 81 acquisitions. The number of acquisitions reported by respondents in this year’s Survey percentage-wise was the same as last year (14%) of dealers (47) in our universe of 342 respondents (Exhibit 1.49). While the number of companies acquired was 67, 14 fewer than last year.

Most acquisitions were of smaller companies, with the average value of the acquired companies $3.01 million, up from $1.6 million a year ago. Respondents did not report the revenue for 14 of the acquired companies, so $3.01 million reflects the revenues of 53 of the 67 acquired companies.

Why does our Survey show acquisitions trending downward?

We believe what’s happening on the acquisitions front has more to do with quality than quantity. Dealers, even the private-equity-backed companies, have become more prudent in their purchasing, no matter how much due diligence they have done in the past. Another factor slowing the rate of acquisitions is that many of the more successful small and mid-sized dealers targeted by larger dealers and private-equity firms are not for sale.

Private-equity money has been instrumental in reshaping the independent office dealer channel. Over the past few years, we have watched as private-equity money has reshaped the dealer landscape. Flex Technology Group, Marco, UBEO, and Visual Edge have been acquiring at a fast and furious pace. That trend has obviously slowed down to a trickle in 2020. Although let’s put an asterisk next to Visual Edge as that organization, as of press time, has not made an acquisition since November of 2018, as it struggles to get its financial house in order. Each of these organizations will continue to have a presence in this space for the foreseeable future and will compete for prime acquisition targets. Meanwhile, mid-sized and larger, well-funded dealers had been expanding their regional footprints through acquisition. Of late, we have seen Kelley Imaging Systems in Kent, Washington, and Gordon Flesch Company in Fitchburg, Wisconsin, take a more aggressive approach to acquisitions as they expand their footprints. Even in the midst of the pandemic, Gordon Flesch Company was able to close on two acquisitions.

Last year, 50% of Survey respondents reported acquisitions were in their plans for the following year and beyond. This year, that percentage fell to 49% (167 dealers of our universe of 342 respondents). Again, we believe this slight decline can be attributed to a lack of suitable acquisition targets and competition from larger acquirers. Just as they have in the last two Surveys, Canon dealers were most interested in acquiring (66%), followed by Ricoh dealers (56%), Sharp dealers (53%), Konica Minolta dealers (49%), Toshiba dealers (44%), and Kyocera dealers (37%). We were not surprised to see that Toshiba dealers’ interest in making acquisitions doubled. Last year, only 22% said they were planning to acquire in the coming year. We attribute the uptick to 44% to the current climate, where more dealers may be interested in selling than prior to the pandemic, as well as a commitment from Toshiba America Business Solutions (TABS) to help its dealers grow through acquisition.

It is still to be determined how the COVID-19 pandemic will impact future acquisitions. Based on this year’s Survey, the number of dealers interested in is still significant. Still, we don’t expect to see a dramatic increase in the number of acquisitions reported in 2020 when we tally the responses for our 2021 Survey. As of September 2020, only 20 acquisitions had been reported for the year. Obviously, the pandemic has impacted acquisitions activity. Once we get through this pandemic, we expect the floodgates to open and see acquisitions accelerate as budgets free up and more dealers that may have been hesitant to sell their dealerships pre-pandemic, decide the time is right to exit the business.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.