This is the sixth year that we have asked dealers to identify the companies—excluding the hardware manufacturers and leasing companies—that provide them with the software and support that allow them to compete the most effectively.

This year, we experimented with a different format, asking dealers to identify the ECM/Document management provider that provides the best pre- and post-sales support, as well as the print management provider that offers the same. We decided on this format because those are two of the most popular software categories that dealers sell or use in their organizations. We also examined sales management software, production print software, and ERP systems, but did not receive enough of a response—even from 344 participants—to get an accurate read on those software categories.

Software is an interesting category to track because there are so many types of software available to dealers, and consequently, so many players. Even as we tried to compartmentalize the software into specific categories, there were still 58 different software providers identified between the two. That’s even higher than the 50 different software providers cited in last year’s Survey.

Twenty-nine providers only received one vote, while only eight companies scored in the double digits. This wealth of software options, including software from their OEMs, and the diversity in the responses, underscores the challenge dealers have navigating the many software options as noted in the dealers’ Greatest Concerns section of our survey.

It will be interesting to see what impact, if any, consolidation will have on the software segment of the industry. ECi continues to grow its software portfolio through acquisition, having acquired PrintFleet earlier this year. That acquisition complements its previous acquisitions in the print management space of FMAudit and e-automate. Notable acquisitions by OEMs of software companies during the past two years include Kyocera’s acquisition of end-to-end solutions provider DataBank, Konica Minolta’s acquisition of ERP provider MWA, and Ricoh’s acquisition of DocuWare. Add to that, software provider Kofax’s acquisition of Nuance in late 2018. We expect to see further consolidation in the software space.

A software company acquiring another software company doesn’t raise the same issues as when an OEM acquires a software company. When an OEM does it, there’s a concern as to how that acquired company will play with dealers representing competitive OEMs. Will a dealer be interested in taking on a product sold by an OEM they don’t represent, and will that dealer’s existing OEM partner have an issue with it? Dealers are protective of their territory (customer base) and that attitude could pose a problem for OEMs looking to grow the software companies they acquire.

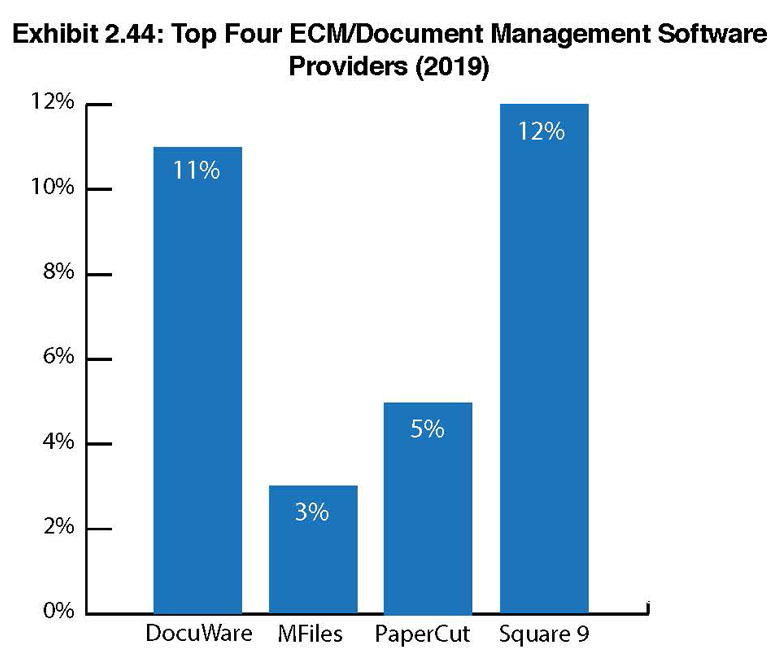

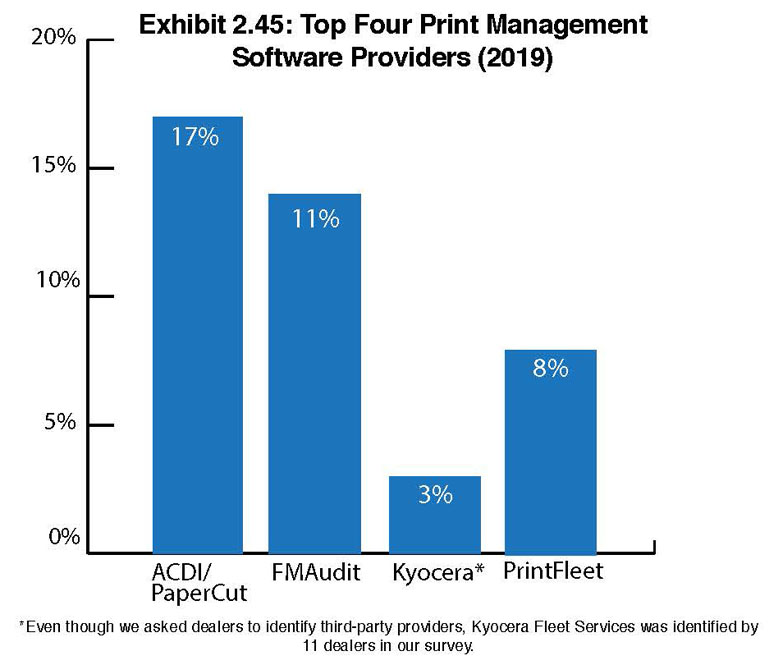

Exhibit 2.44 reveals the top four software ECM/document management providers—Square 9 (12%), Docuware (11%), ACDI/PaperCut (5%), and MFiles (3%). All four of these companies scored in the double digits. Exhibit 2.45 reveals the top four print management providers—ACDI/PaperCut (17%), FMAudit (14%), PrintFleet (8%), and Kyocera (3%). Note ACDI/PaperCut’s inclusion in both categories.

We ask dealers to identify third-party software providers that provide the best pre- and post-sales support rather than OEMs, but as we continue to see, OEMs still receive a significant share of love from their dealers in the software rankings. If we were to eliminate Kyocera Fleet Services from the top four print management providers because of these criteria, PrintAudit would have captured the fourth spot with 2%. We would be remiss if we didn’t note that some dealers participating in our Survey have a difficult time discerning between ECM/document management, print management, and other software categories. That said, we are seriously considering keeping things simple and returning to our original format in our 2020 Survey.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.