Last year, 50% of Big Six dealers said they offered managed network services (MNS). In this year’s Survey, that percentage declined to 46%. We don’t feel this drop is anything to be alarmed about. MNS is alive and well in the channel and offered by most larger dealers and a growing number of mid-sized dealers. After all, if you’re selling products that connect to the network, why not take over that customer’s network too?

If only it were that easy. Some customers would much rather manage their own networks, and some dealers prefer not to take on that responsibility.

Managing a customer’s network represents a feasible business opportunity and enhances a dealer’s product and services offerings. And as more new product offerings come to market (think smart office and meeting room systems) there are more reasons to manage the customer’s network than ever before. And you better believe the OEMs recognize this. Security is another reason to offer MNS. That has to be the greatest sales talk track of the century right now and a prominent component of every MNS offering.

Two years ago, we predicted within the next five years 50% of dealers will be offering MNS. We see no reason to change that prediction despite this year’s Survey results. As acquisitions increase throughout the channel, the smaller dealers that were not offering MNS prior to acquisition will now be part of a larger organization that has this capability. Think of Marco and all the companies it has acquired, including a significant number that did not offer MNS prior to the acquisition.

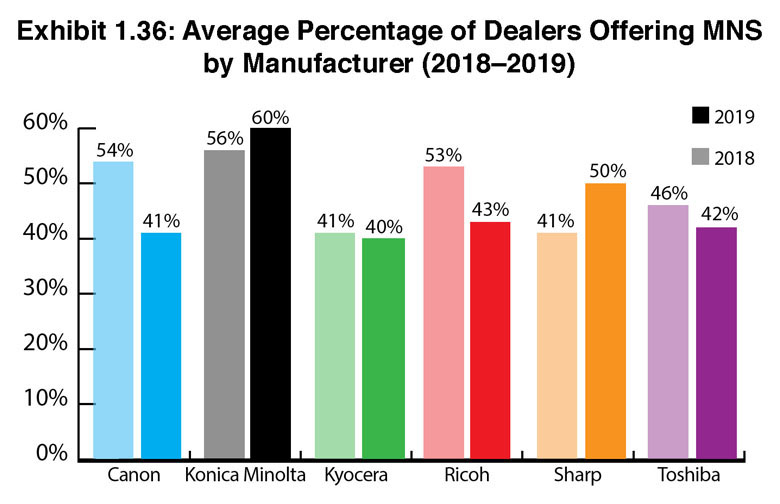

When one examines MNS engagement by dealers representing the Big Six OEMs (Exhibit 1.36), we find Konica Minolta dealers leading the way at 60%, a 4% increase from last year’s Survey. No doubt the Konica Minolta/All Covered connection helps here. A surprising second in terms of MNS engagement in this year’s Survey is Sharp at 50%, a 9% increase from last year’s Survey. With its Smart Office and the addition of a computer line acquired from Toshiba, Sharp seems to be giving its dealers an incentive to move into MNS. Fewer Canon and Ricoh dealers reported they were offering MNS this year compared to last year. Canon saw the number of dealers offering MNS drop from 54% to 41%, and the number of Ricoh dealers offering MNS fell from 53% last year to 43% this year. Again, no reason to panic. We attribute the drop to a different group of Survey respondents, as well as a significant increase of Ricoh dealers participating in our Survey, rather than dealers from these two groups exiting the MNS business. As these OEMs introduce new products and provide additional incentives and encouragement for their dealers to engage in MNS, we expect these percentages will climb upwards in future Surveys.

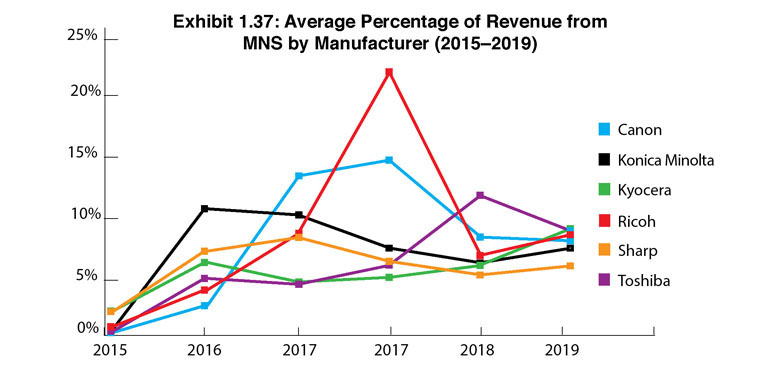

As we noted last year, we remain skeptical of the average percentage of revenue from MNS reported by manufacturer (Exhibit 1.37). Those percentages seem to be higher than we think they should be based on our conversations with dealers and organizations that track MNS revenue derived from dealers’ actual financial reports. (Despite this, we continue to adhere to the honor system with our Survey respondents.)

The average percentage of revenue derived from MNS for all Big Six dealers was 8.14%. The top three by manufacturer were Ricoh (9.2%), Kyocera (9%), and Konica Minolta (8.7%). The bottom three were Toshiba (8.2%), Sharp (7.6%), and Canon (6.1%). The percentages seem high for Kyocera and Toshiba, and on the low side for Canon. However, we’re only noting the percentages reported to us. Worth mentioning, as with MPS, is that not every dealer breaks out the percentage of MNS revenue from their overall revenues. Although considering most big dealers do, we don’t believe this had a significant impact on the final percentages. What had a slight impact on the percentages, however, was the six dealers who reported they just started offering MNS and were unable to provide revenue percentages because it is too soon to know.

Please note that 56% (85) of the 153 dealers offering MNS reported revenues of less than 5%, with 15% (23) reporting average revenues derived from MNS of 1% or less.

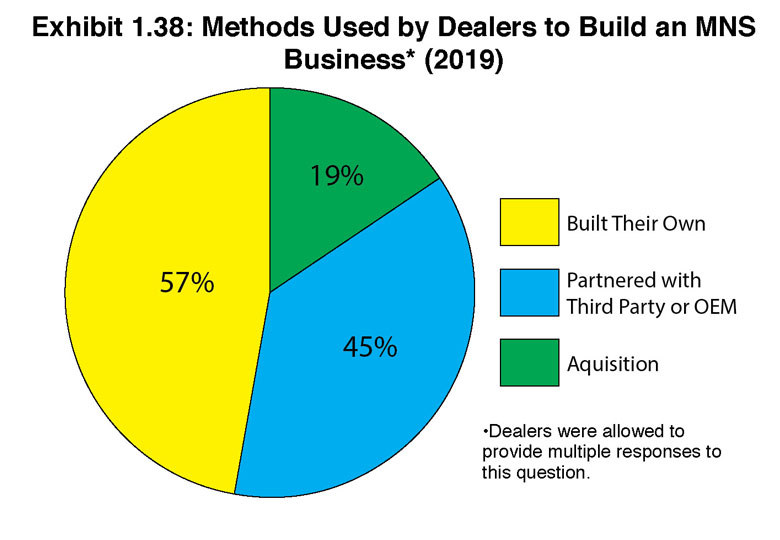

There are three primary ways a dealer can build an MNS business, and as our Survey reveals (Exhibit 1.38), the least popular way to do so is through acquisition, with 19% of respondents using this strategy. (Please note some dealers identified multiple strategies for building their MNS business, so the cumulative percentages do not equal 100%.) That figure is up 2% from last year. Even though we’re seeing private equity firms acquiring IT companies, as well as some larger dealers, the challenge has been integrating two disparate cultures–a sales-driven, commodity-based copier culture with that of a looser, IT-oriented culture. Sometimes dealers aren’t acquiring a base of business as much as they are the talent to provide MNS. If they can’t hang onto that talent, there”‘s not much value in that acquisition. That may be why 57% of dealers in this year’s Survey said they built their own MNS business or partnered with a third party or OEM (45%). Those percentages are a dramatic increase from 55% that built their own and 47% that partnered in last year’s Survey.

That radical change begs the question, why? While we do think one cause is due to the different pool of Survey respondents compared to last year, we believe it is much more than that. We believe partnering with a third party such as Continuum, GreatAmerica’s Collabrance, and Konica Minolta’s All Covered has become more acceptable, even if dealers are simply using the third party to provide around-the-clock help-desk support. The discrepancy between the 55% last year and 85% this year that said they built their own is more perplexing. We attribute this to an increase in the number of dealerships that created a separate MNS department within their company, even it only entailed hiring one or two people to get this segment of the business off the ground.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.