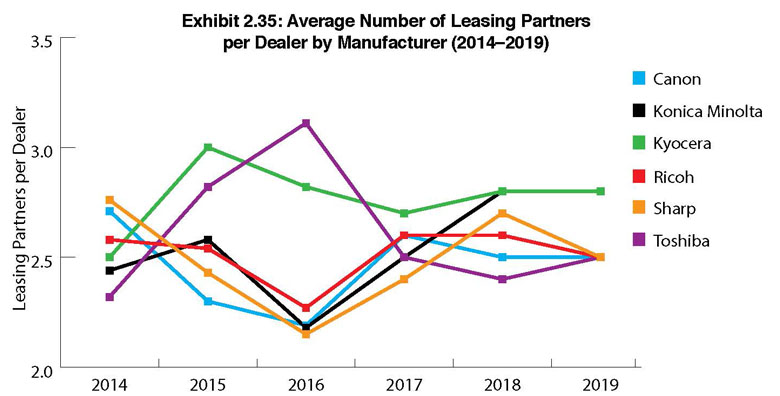

For the third consecutive year in our Survey, the average number of leasing partners among the Big Six dealer universe held steady at 2.6. Any way you cut it, more than two leasing partners are better than one as multiple partners provide dealers with options. Dealers identified 27 different leasing options in our Survey (dealers were asked to identify up to four leasing partners), including their own internal leasing and leasing from their OEM. Among the leasing companies identified are a few we are not familiar with, as well as the leading finance companies serving technology dealers and ones that maintain a consistent presence at industry events. It seems the more respondents our Survey has, the greater the diversity in the primary leasing partner.

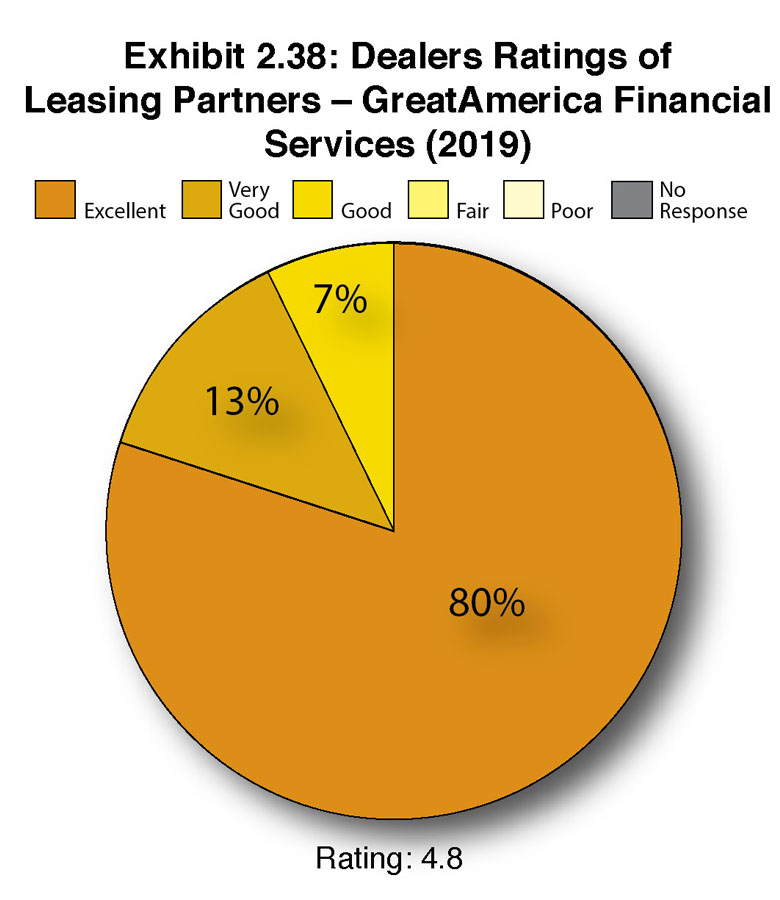

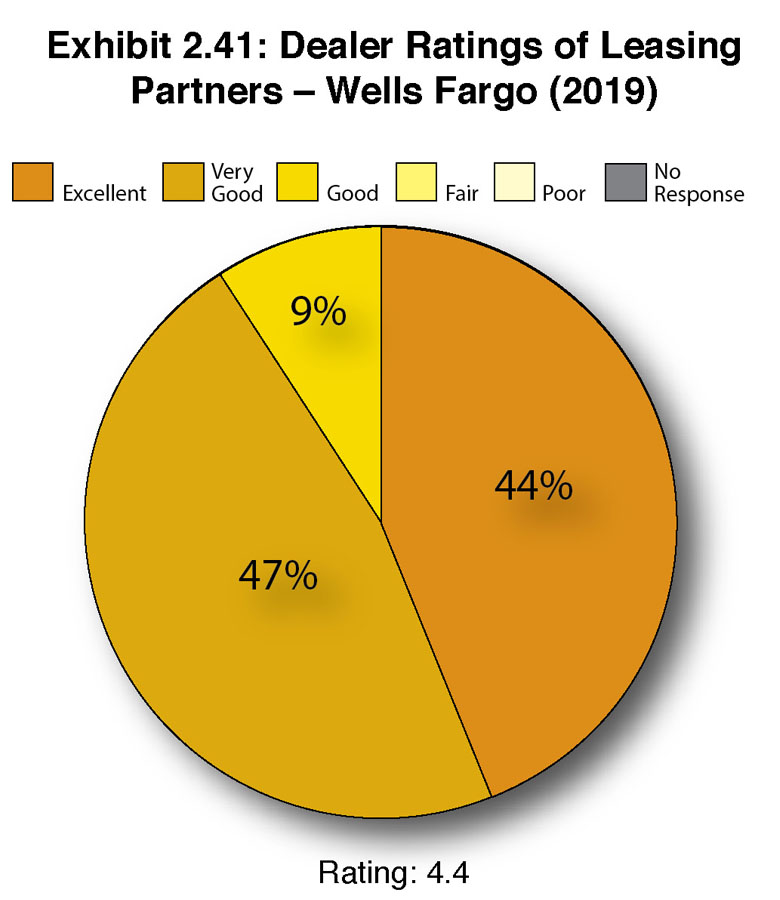

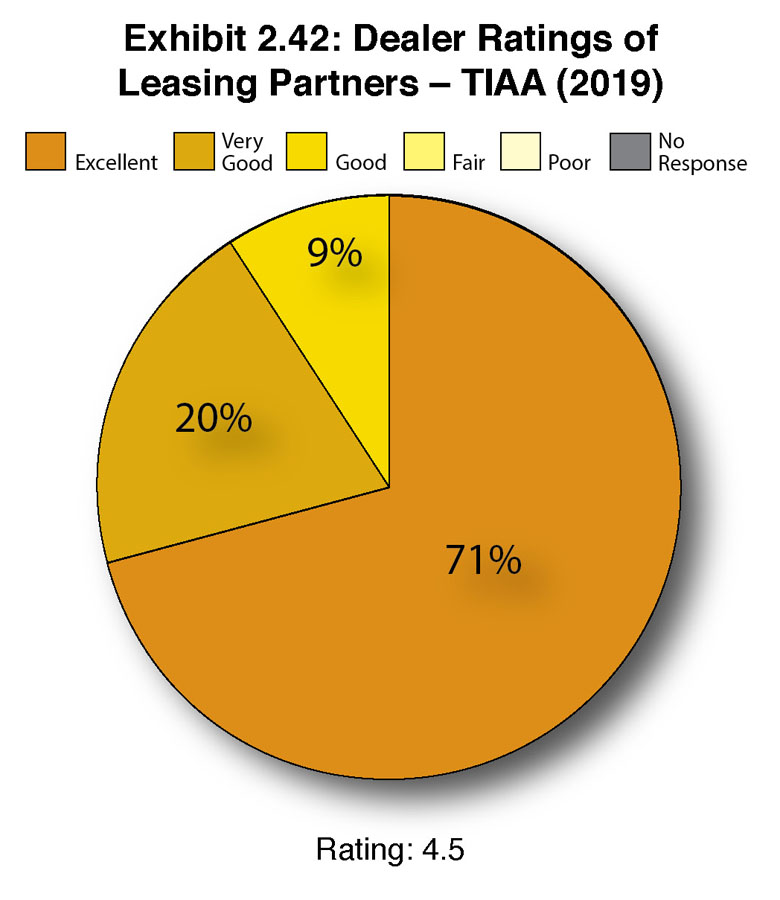

When tabulating dealers’ ratings of their leasing partners, we only include those companies that have been identified by 25 or more dealers as their primary leasing partner. In 2017, only three leasing companies reached that plateau—GreatAmerica Financial Services Corp., DLL, and U.S. Bank. Last year, that number climbed to five, as TIAA and Wells Fargo made the cut. The additions of Wells Fargo and TIAA are an indication of how presence at industry events can make a difference. We’d also like to note that the leasing company must have programs and rates that are favorable for dealers. The combination of maintaining a high profile, favorable programs and attractive rates have propelled Wells Fargo and TIAA into what we consider the elite group of leasing companies identified by 25 or more dealers. In 2017, neither one of these companies had 25 dealers identify them as a primary leasing partner. This year, Wells Fargo had 39 and TIAA had 37. Might we see the same traction by LEAF in future Surveys? This leasing company was identified by 18 dealers as their primary leasing partner, the only leasing company among those identified as a primary leasing partner that ranked in double digits outside the five identified by 25 or more dealers.

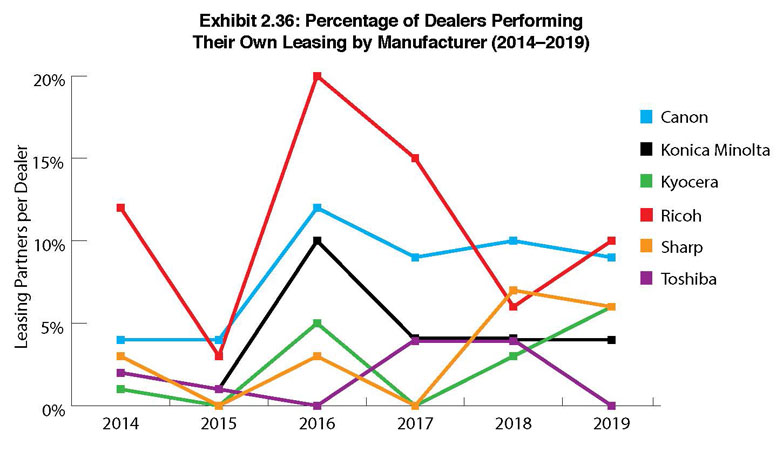

The number of dealers handling their own leasing experienced a modest increase from 5.66% in last year’s Survey to 5.83% this year. In 2015, 10% of respondents had an internal leasing program, with that number dropping to 8% in 2016. This downward trend is representative of a more solid economy as the economic downturn of 2009 forced dealers to get creative in their financing. An offshoot of that creativity resulted in dealers handling their leasing needs internally as it became more difficult to obtain financing in the leasing marketplace. At present, that doesn’t seem to be an issue for most dealers.

Another contributor to the slippage is the administrative costs associated with operating a leasing program. Some dealers that might have done so in the past have determined it’s not worth the expense or the headaches of managing it.

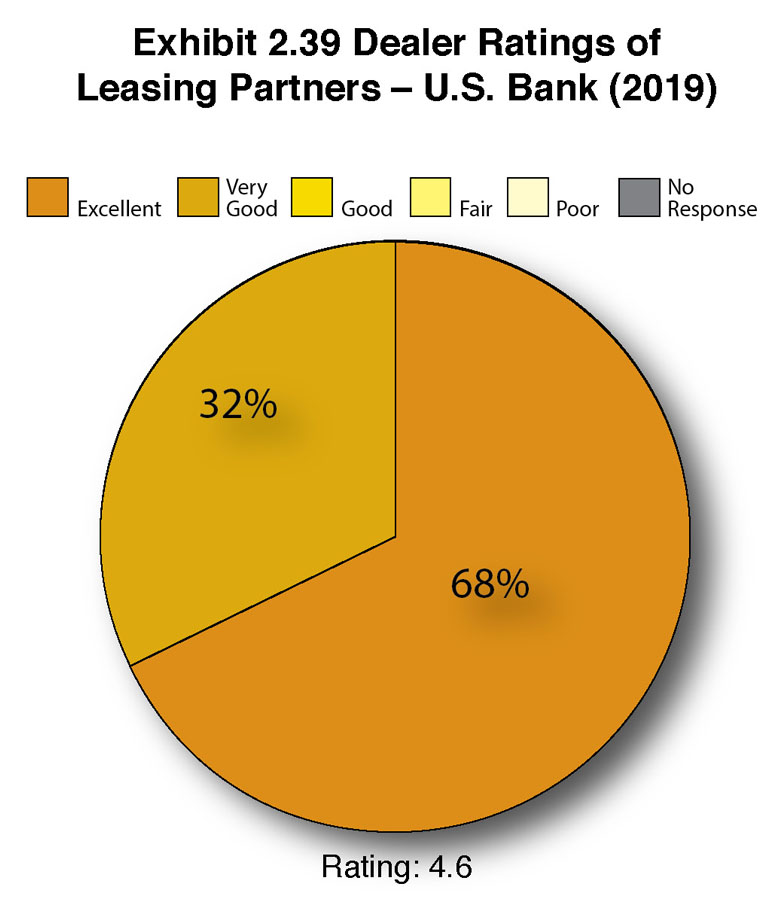

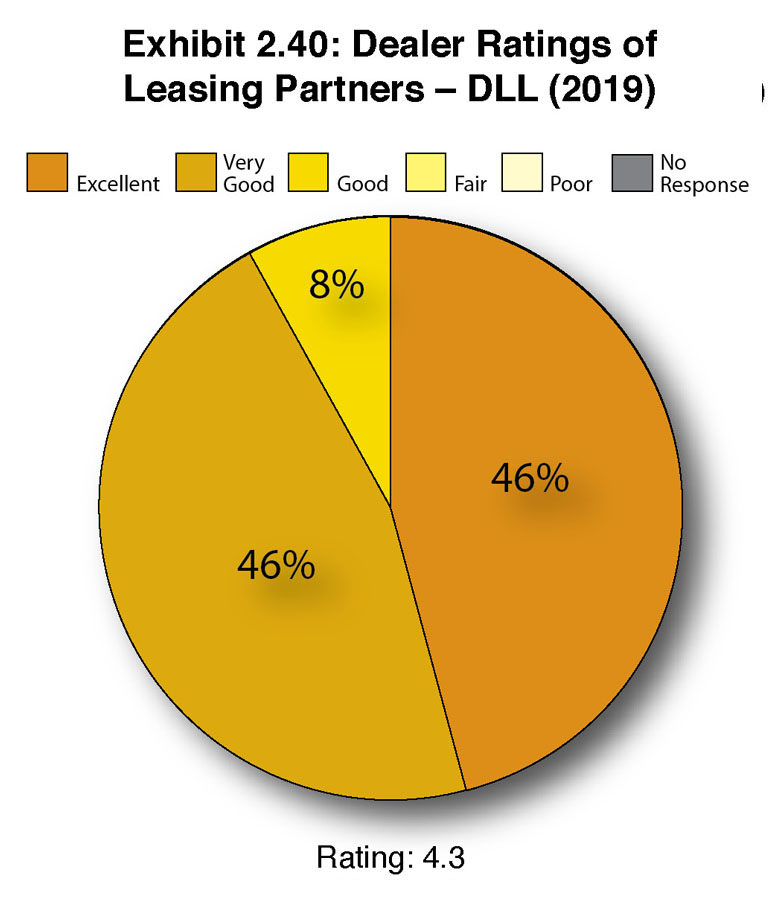

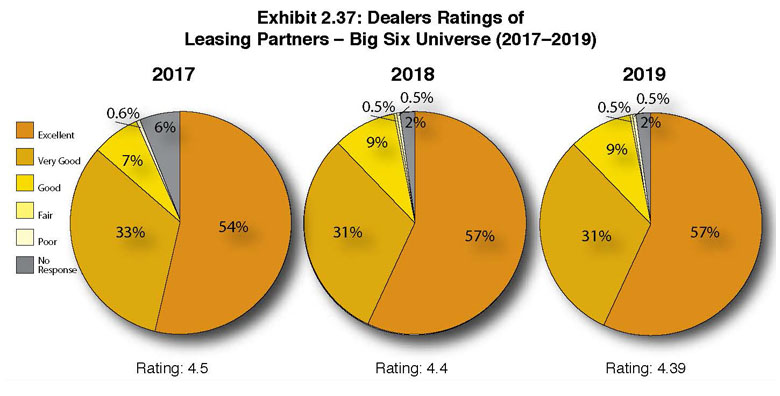

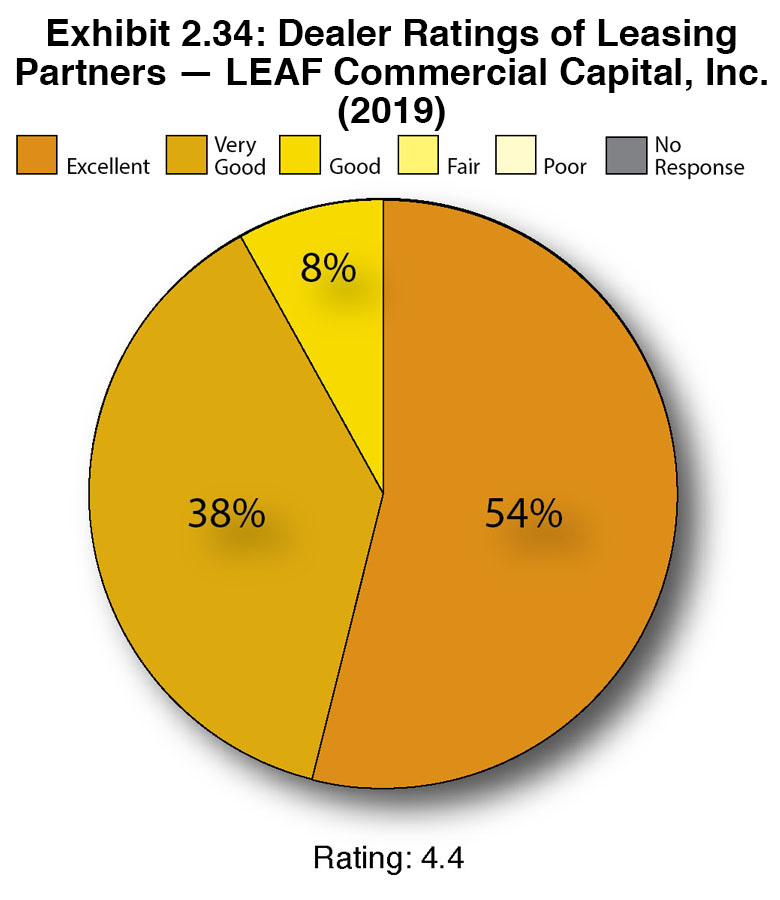

As we have done in our past Surveys, we asked participating dealers to rank their leasing partners as “Excellent,” “Very Good,” “Good,” “Fair,” and “Poor.” Examining how the Big Six dealer universe ranked their leasing partners in our current Survey, 63% were ranked as “Excellent,” a 6% increase over last year, and a 9% increase over 2017. Not a single leasing company received a “Fair” or “Poor” rating in this year’s Survey, a clear indicator that these companies continue to keep their dealer customers satisfied. With a five-point rating system (with 5.0 being the highest rating), the five leasing companies that were identified by 25 or more dealers as their primary leasing partners, all received scores above 4.00, averaging 4.52, an uptick from the 4.39 those five companies cumulatively scored on average in 2018.

While DLL and TIAA received identical ratings in this year’s Survey versus 2018, GreatAmerica Financial Services, U.S. Bank, and Wells Fargo all saw an increase, with Wells Fargo experiencing the biggest swing from 4.0 in 2018 to 4.4 this year.

Across the Big Six dealer universe, dealers seem generally satisfied with their leasing partners, which we attribute to favorable interest rates and more programs for services such as MPS and MNS, as well as emerging technology segments such as production print, digital signage, and security, for example. From our standpoint, the leasing companies do an excellent job of identifying trends and developing programs to accommodate new products and solutions.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.