Service is a critical component of any dealer operation and a huge contributor to maintaining customers. That’s why we examine the makeup of a dealership’s service and technical operations, focusing on break-fix techs and technical specialists for MPS and MNS.

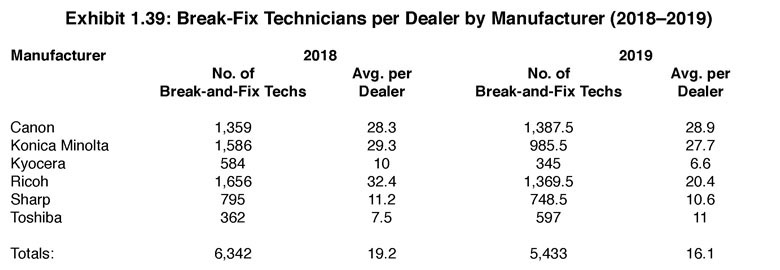

We determined the number of service technicians per dealer by asking how many break-fix technicians they employed and how many “other” technicians are on staff to service MPS and MNS clients.

Over the past few years of conducting this Survey, what we’ve discovered is that with the emergence of MPS and MNS, and changing job requirements, it has become challenging to identify a long-term employment trend for technical personnel.

Going back to 1985, the first year of our Survey, dealers employed techs with a ratio of 1 to 40, where one tech was responsible for servicing 40 copiers in the field. Back then, analog copiers were much less reliable than today’s digital copiers, resulting in many more service calls.

As reliability has become less of an issue and remote maintenance becomes more widely used, we’ve been seeing a decline in the number of traditional break-fix technicians employed by dealerships. Although last year, we saw that number trend upward in our 2018 Survey largely because of the participation of three larger dealerships that had not participated in the previous year’s Survey. This year, things seemed to have leveled out with the increased number of respondents and without the participation of one of the industry’s largest dealerships, which was acquired earlier this year. This year’s Survey finds the average number of break-fix technicians per dealer is 16.1, down from 19.2 a year ago, but more in line with the average of 15 in our 2017 Survey.

What we are finding is that some dealerships are using the same break-fix techs to handle MPS and MNS. That’s less likely to happen with larger dealerships who have their own MNS departments. Those dealerships are more likely to employ dedicated MNS personnel.

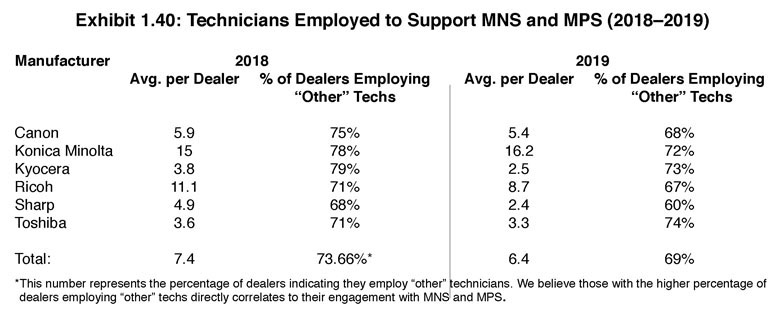

Exhibit 1.40 highlights the average number of technicians to support MNS and MPS. The average number of dealers employed by dealers fell from 7.4 in 2018 to 6.4 in 2019. Again, some of these techs are doing double duty as MNS and MPS techs and as traditional break-fix techs. We suspect much of the technical support staff employed by dealers possess IT certifications, which provides them and the dealership greater credibility for handling more IT-related issues.

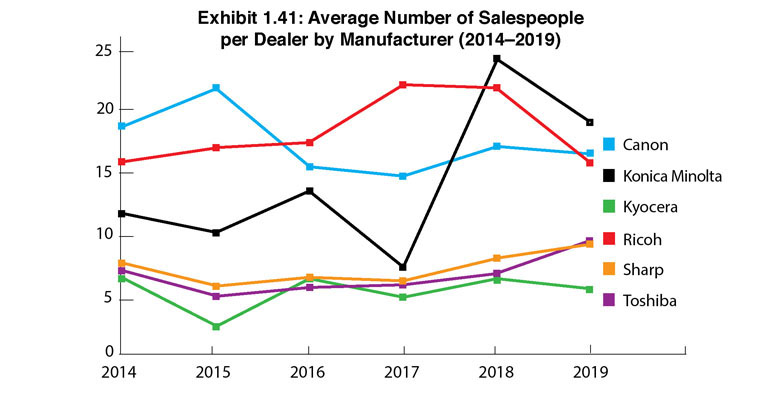

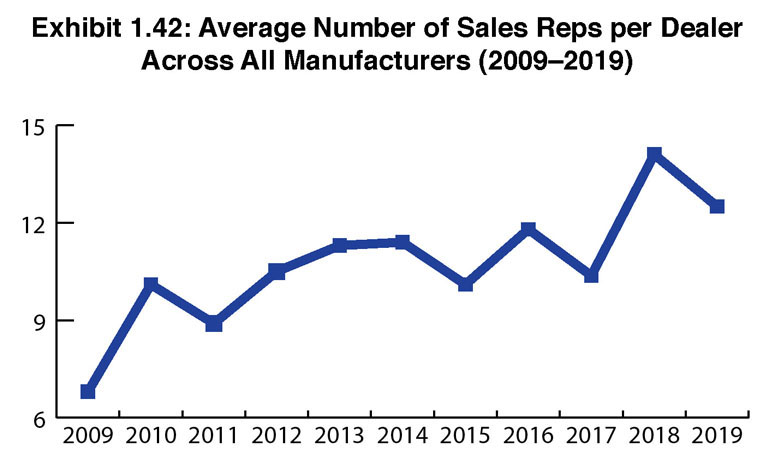

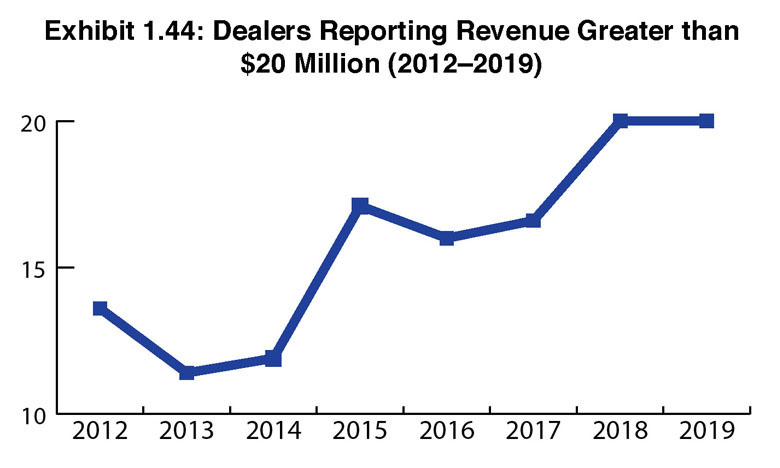

Looking at the sales side of the business, Exhibit 1.42 details the historical average number of sales reps per dealer across all manufacturers. We began showing this data in 2009, a tough time for the industry which was in the midst of an economic downturn. We saw a sharp spike in the average number of sales reps from 2009 to 2010, uneven numbers in subsequent years, then a significant spike from 10.37 in 2017 to 14.1 in 2018, and a decrease to 12.7 this year. These fluctuations can be attributed to various factors, but let’s be honest, sales is a high-turnover profession and even the most successful dealerships tend to have a revolving door in their sales departments. It’s no wonder that hiring and retention is one of a dealer’s biggest challenges as reported in a separate section of our Survey. That, probably more than anything else, explains the peaks and valleys in our charts related to the average number of sales reps employed by dealerships.

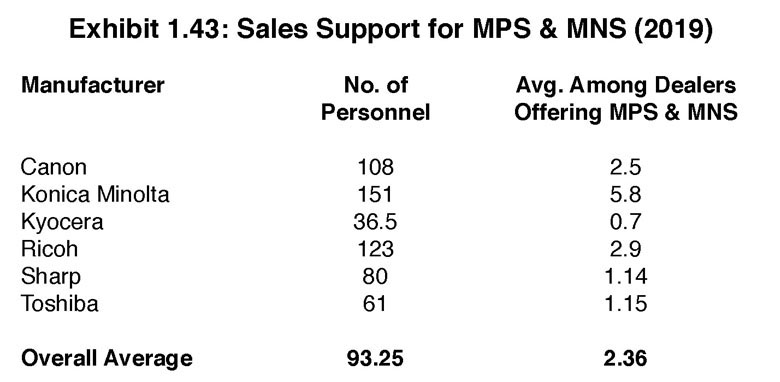

In 2016, we began examining staff employed by dealerships to provide sales support for MPS and for MNS. Last year, the number of sales support staff for MPS was 1.1, down from 1.26 in 2017. As MPS has matured and become more commoditized, virtually anyone on a dealer’s sales force can sell it, and the need for a sales specialist in MPS is no longer necessary in many dealerships.

MNS, on the other hand, can be considered a more complicated sale, and not one the average down-the-street sales rep is equipped to sell. However, results across dealers of our Big Six manufacturers have varied the previous two years when it comes to employing staff to provide sales support for MNS. The average among dealers employing MNS sales support staff was 1.80 in 2017 and 1.70 in 2018.

The presence of third parties to assist dealers with their MNS offerings, including GreatAmerica’s Collabrance, Continuum, and Konica Minolta’s All Covered, has helped dealers overcome some of the challenges associated with entering the MNS business or providing enhanced capabilities and round the clock help desk support. However, as some dealers have discovered, these third-party organizations aren’t always the panacea for a successful MNS offering, or they may not always be a good fit for some dealerships’ business models as they look to gain a foothold in MNS. We’ve spoken with quite a few dealers over the years that praise these third-party organizations, as well as dealers that have found that partnering with them didn’t work out as planned. Different strokes, you might say.

We are trying something different this year, and that is combining the separate charts from previous years that detailed the staff employed sales support for MPS and MNS into one chart (Exhibit 1.43). Our reasoning is the low numbers of MPS staff employed by dealerships and because some dealerships include MPS under their MNS offerings. We may revisit this decision when creating next year’s Survey, but for now, let’s look at the results. The average number of MPS and MNS sales support staff is 2.3, still relatively low. If you only looked at the number of MNS sales support staff employed by dealerships in our 2018 Survey, that number was a modest 1.7. For the record, Konica Minolta dealers employ the highest number of sales support staff in these two areas, 5.8 in our combined 2019 Survey versus 2.2 for MPS sales support staff and 3.26 for MNS sales support staff in last year’s Survey (a combined 5.46 in 2018).

As dealers look to offset erosion in the channel as print volumes spiral downward, MNS remains a high growth opportunity. It is complementary to what a dealer is already providing customers. The challenge is how to get into that business, and once you’re in, how to do it right. We believe MNS is an area that will continue to grow.

Access Related Content

Visit the www.thecannatareport.com. To become a subscriber, visit www.thecannatareport.com/register or contact cjcannata@cannatareport.com directly. Bulk subscription rates are also available.